Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

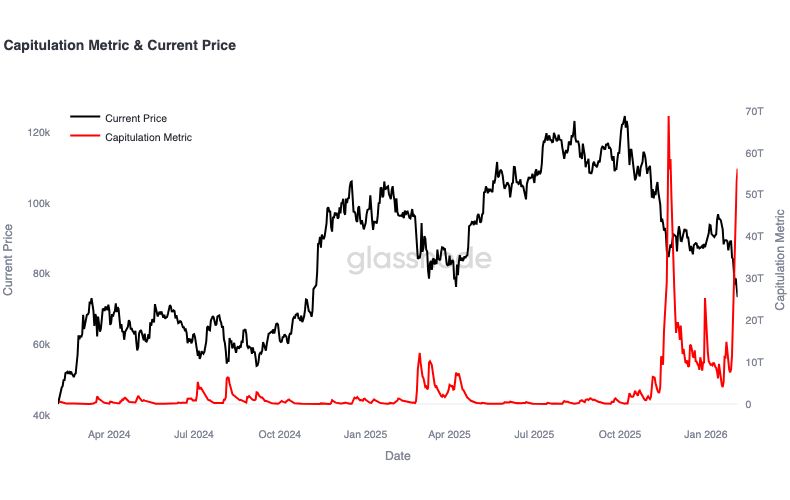

Glassnode: "The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling."

"These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning". Source: Glassnode

- Bitcoin is now down 41% since hitting $126,200 on the 6th of October.

- 4 consecutive red months is the longest bearish run since 2018. Source: Bitcoin archive

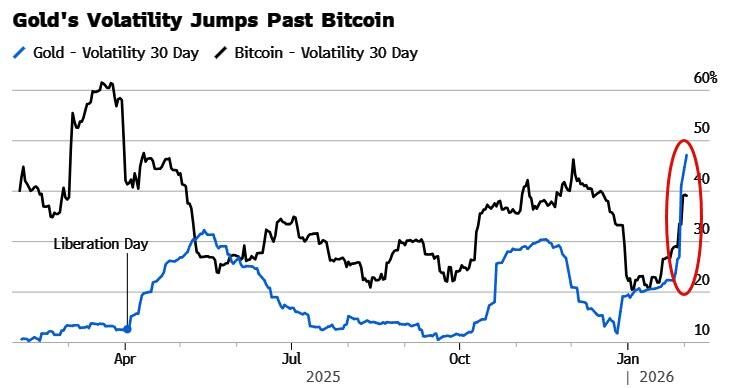

30-day realized vol in gold has climbed above 44%, the highest level since the 2008 financial crisis, according to data compiled by Bloomberg.

That surpasses the roughly 39% for Bitcoin, the original cryptocurrency often dubbed “digital gold.” Since Bitcoin’s creation 17 years ago, gold has only been more volatile on two occasions, most recently last May during a flare-up in trade tensions sparked by President Trump's tariff threats. Source: Bloomberg, www.zerohedge.com

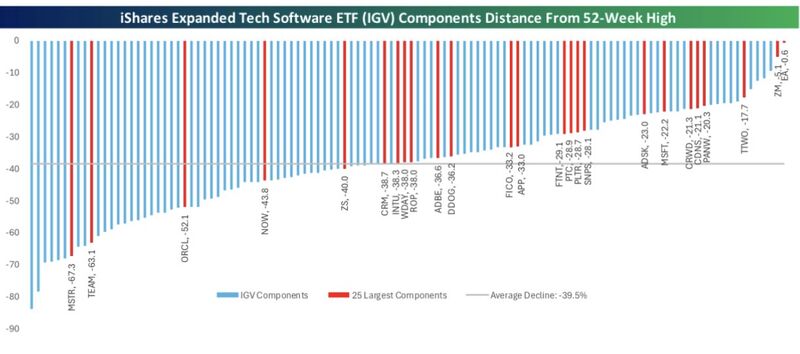

The average software stock is now in a 40% drawdown!

Absolute carnage in the space recently even with the broad market close to record highs. Source: Bespoke

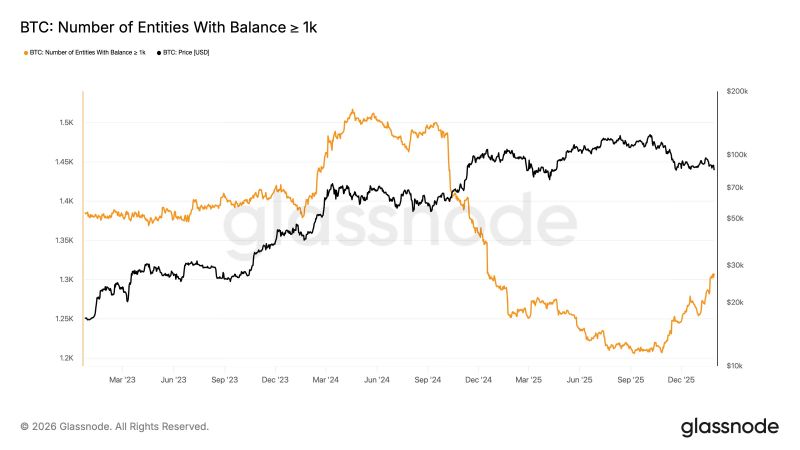

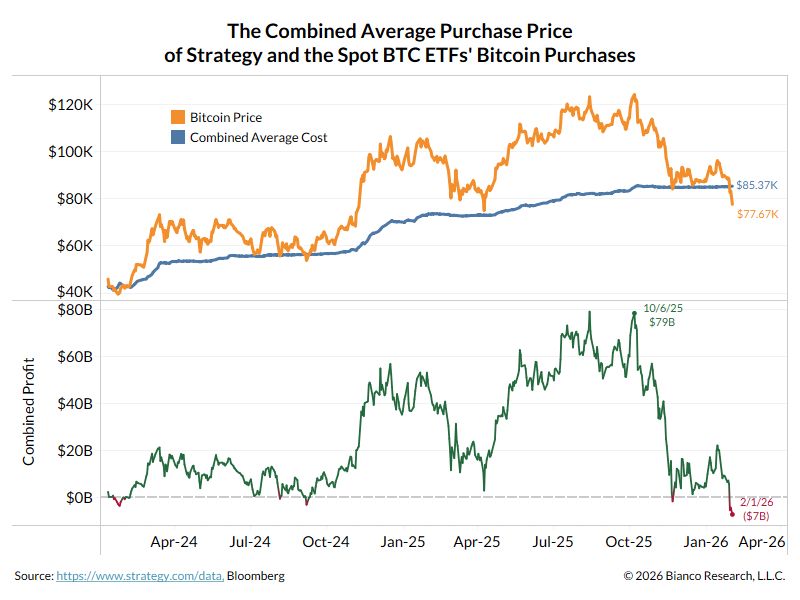

10% of the outstanding $BTC is held by $MSTR and the 11 Spot BTC ETFs.

These are the ways normies hold $BTC in regulated brokerage accounts. Collectively, the avg purchase price is $85.36K, meaning the average is now ~$8k underwater, with an unrealized loss of ~$7B. Source: Bianco Research

The unwinding of popular strategies such as the yen carry trade in traditional markets have been adding to the selling pressure on bitcoin.

The yen carry-trade strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns. According to Matt Maley, chief market strategist at Miller Tabak & Co, “Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline.” “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.” Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks