Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

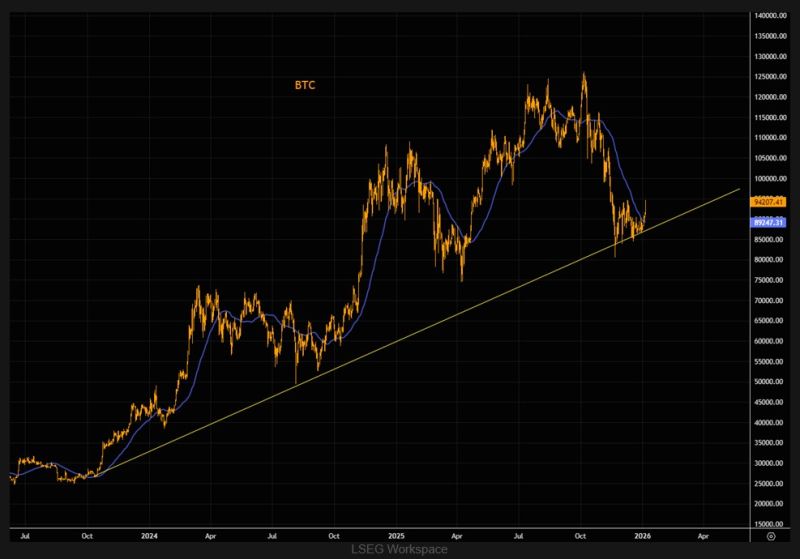

Bitcoin investors are now eyeing the $80,000 price level for support

- Rate cuts can't pump BTC. - Pro-crypto President can't pump BTC. - Weak dollar can't pump BTC. - Institutional adoption can't pump BTC. - Fed injecting liquidity can't pump BTC. - Stocks new ATH can't pump BTC. Is there anything that could pump BTC now? Which comes first? BTC $300k or a massive suck out of global liquidity??? Source: Zerohedge

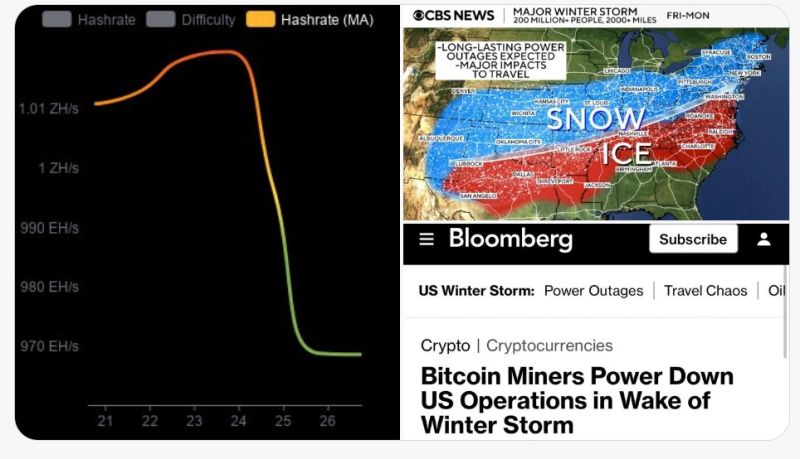

Bitcoin mining hashrate decreased -30% this week as a cold winter storm covered much of the United States.

Mining companies shut down voluntarily through demand-response programs, temporarily powering off machines to reduce electricity use and support the stressed power grids. Source: Documenting ₿itcoin 📄 @DocumentingBTC

Bitcoin dropped $2,500 in the last 5 hours and liquidated $400 million worth of longs.

More than $100 BILLION has been wiped out from the crypto market today. This is a low-liquidity Sunday evening dump. The real price action will come once the US market opens on Monday. Source. Bull Theory

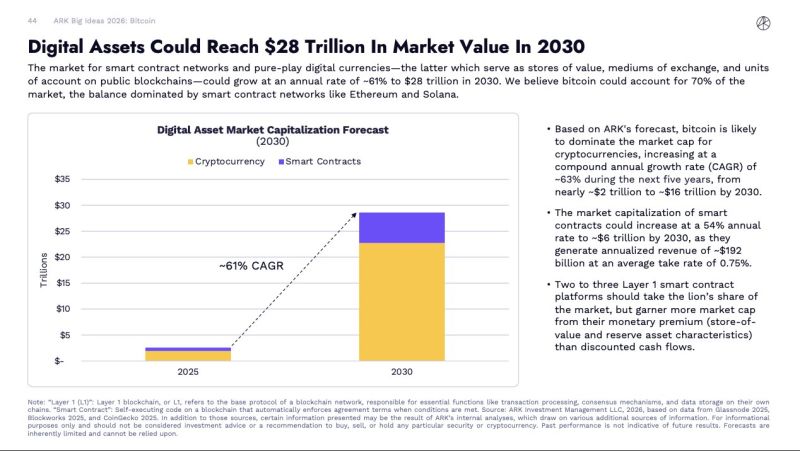

Cathie Wood's Ark invest predicts digitalassets could reach $28 trillion by 2030, with Bitcoin dominating at $16 trillion by 2030.

Source: Cointelegraph

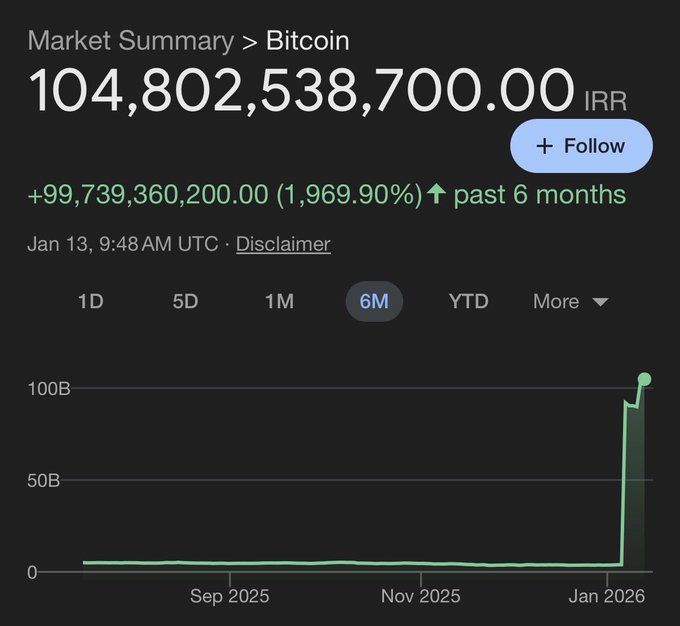

Bitcoin becomes King in Iran

As Iran’s currency collapses, Bitcoin is shifting from a theoretical hedge to a practical necessity. Hyperinflation in the rial is pushing citizens toward BTC as a store of value, while sanctions have made crypto an effective alternative to the traditional banking system. At the same time, Iran’s extremely cheap energy makes Bitcoin mining highly profitable, sustaining local supply that feeds sanction-bypassing channels. The combination of fiat collapse, sanctions, and energy arbitrage is driving a sharp surge in Bitcoin adoption and pricing relative to the rial. Source: Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks