Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Sounds like a very interesting strategy...

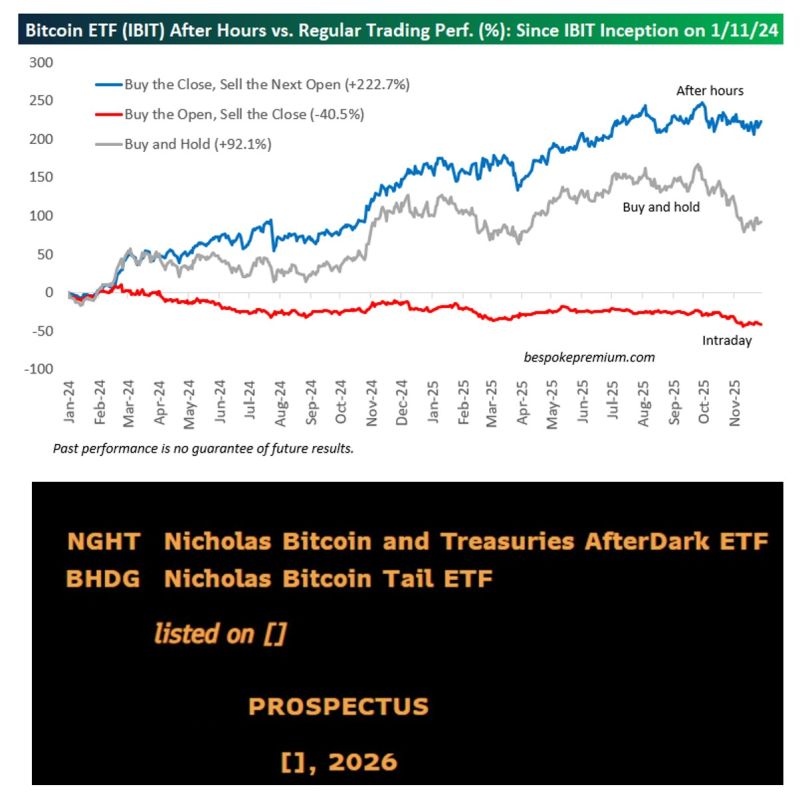

Bespoke shows how you can outperform $IBIT with a simple strategy: buy the (NYSE) close, sell the (NYSE) opening... Since the iShares Bitcoin ETF $IBIT began trading, had you only owned it after hours (buy the close, sell the next open), it's up 222%. Had you only owned intraday (buy the open, sell the close), it's down 40.5%. (Past performance is no guarantee of future results.) Results have been so impressive that Nicholas just file for an ETF that replicates this strategy: NICHOLAS BITCOIN AND TREASURIES AFTER DARK ETF (NGHT) will only hold bitcoin at night, buying it when the US market closes and selling it when it opens. Source: Bespoke, Eric Balchunas, Bloomberg

🚨Very interesting comment by Bull Theory @BullTheoryio on why Bitcoin always dumps at 10 a.m. when the U.S. market opens ?

Yesterday, Bitcoin erased 16 hours of gains in just 20 minutes after the US market opened. ‼️ Since early November, BTC has dumped most of the time after US market opens. The same thing happened in Q2 and Q3. 📌 @zerohedge has been calling this out repeatedly, and he thinks Jane Street is the most likely entity doing this. Bull Theory then highlighted that when you look at the chart, the pattern is too consistent to ignore: a clean wipe out within an hour of the market opening followed by slow recovery. That’s classic high-frequency execution. They add that it actually fit their profile: • Jane Street is one of the largest high-frequency trading firms in the world. • They have the speed and liquidity to move markets for a few minutes. They then assume (this is NOT verified) that what Jane Street does in a consistent manner is the following: 1. Dump BTC at the open. 2. Push the price into liquidity pockets. 3. Re-enter lower. 4. Repeat daily. And by doing this, they might have accumulated billions in $BTC. As of now, Jane Street holds $2.5B worth of BlackRock’s IBIT ETF, their 5th largest position. Does it mean that the dump in BTC isn't due to macro weakness but due to manipulation by one major entity??? What’s your take?

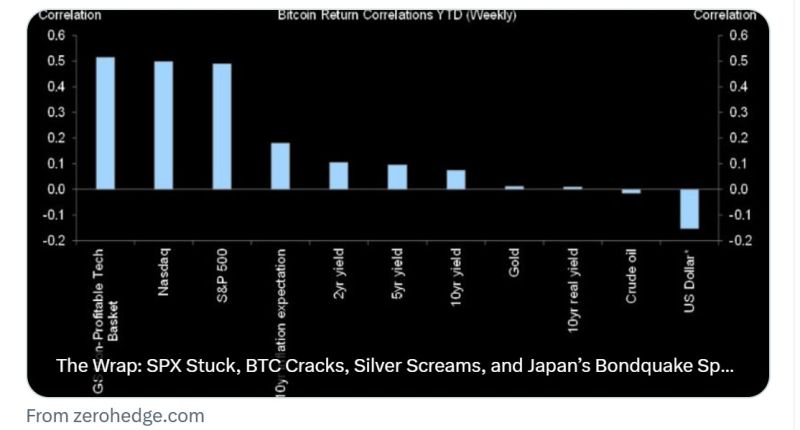

The Market Ear: "When you trade BTC, you're basically trading unprofitable tech, not a store of value, not dollar debasement".

As shown below, bitcoin has a high correlation with unprofitable tech stocks and the Nasdaq.

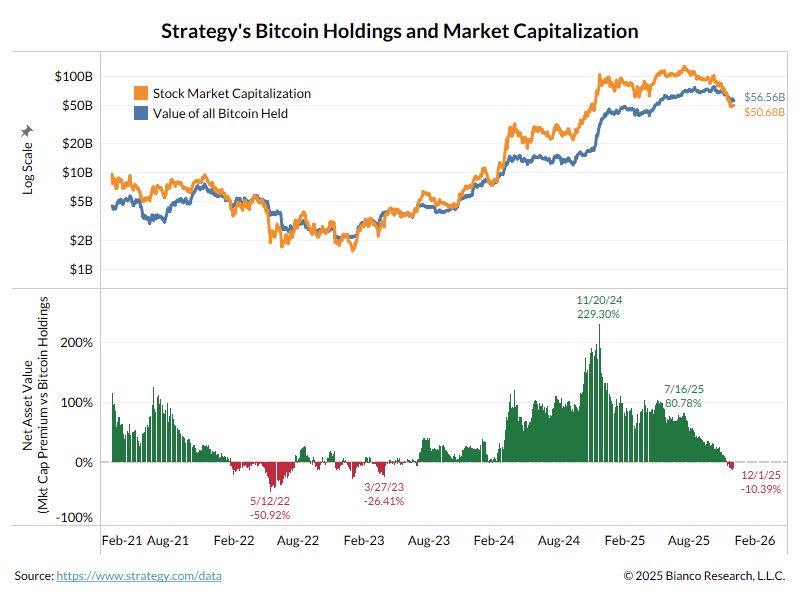

Stats about Strategy $MSTR's NAV by James Bianco Bianco Research L.L.C.:

* NEGATIVE (!) since Nov 12 * Lowest NAV since Mar 27, 2023 (SVB failure) * It reached -50.92% on May 12, 2022 (Terra/Luna collapse) * Consistently negative for 18 months (Jan 22 to Aug 23) The peak of 229% on November 20, 2024... this was the height of BTC excitement over Trump's win.

JPMorgan has taken a surprising leap back into Bitcoin – this time with a leveraged structured note tied directly to BlackRock’s iShares Bitcoin Trust (IBIT), the world’s largest BTC ETF.

The filing, made this week with U.S. regulators, arrives just days after the bank criticized MicroStrategy, faced boycott calls over alleged crypto debanking, and pushed MSCI to consider excluding Bitcoin-heavy companies from major indexes. Now, the same institution is rolling out a product built to ride Bitcoin’s next major cycle. JPMorgan Unveils IBIT-Linked Note Built Around the Halving Cycle The structured note mirrors Bitcoin’s well-known four-year pattern: weakness two years after a halving, followed by renewed strength heading into the next one. With the last halving in 2024, JPMorgan is effectively positioning investors for a potential dip in 2026 and a surge in 2028. According to the filing, if IBIT hits or exceeds a preset price by December 2026, the bank will call the note and pay a minimum 16% return. But if IBIT stays below that level, the note extends to 2028 and the payoff becomes far more aggressive. Investors would earn 1.5x whatever gains IBIT delivers by the end of that year, with no cap on upside. High Rewards, High Risk The note also includes partial downside protection. Investors recover their principal in 2028 as long as IBIT doesn’t fall more than 30%. But once that threshold breaks, losses mirror the decline. JPMorgan warns that holders could lose over 40%, or even their entire investment, if Bitcoin collapses during the period. A Sharp Reversal in Tone From JPMorgan The launch comes amid a rapid shift in messaging from the bank. JPMorgan now says crypto is evolving into a “tradable macro asset class” driven by institutional liquidity rather than retail speculation. Source: Trading View, Decrypt

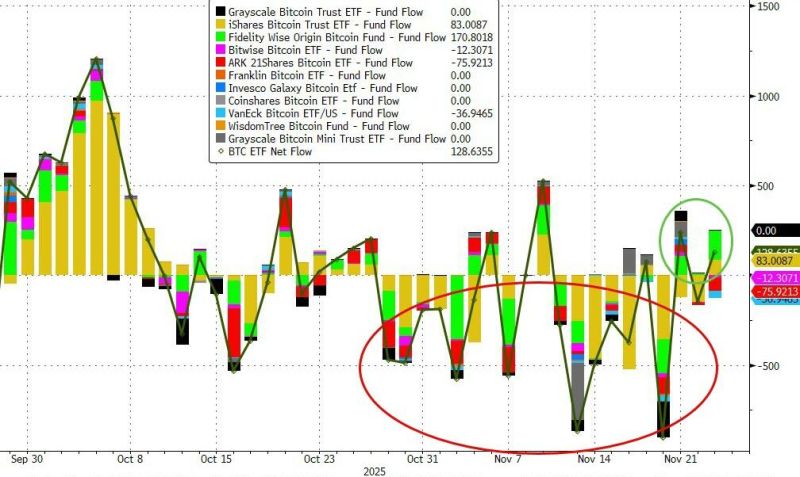

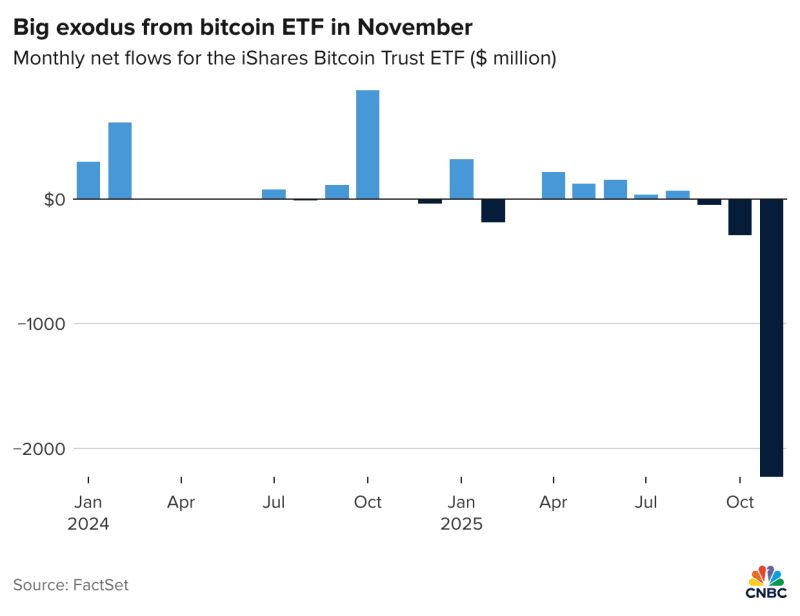

The iShares Bitcoin Trust ETF $IBIT has recorded $2.2 billion in outflows so far this month

Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks