Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mom, can you come pick me up?

I'm scared. Source: Trend Spider

Bitcoin's weekly RSI is at its most oversold level since the April bottom, the end of last summer's 'chopsolidation', and the end of the last bear market.

Source: Joe Consorti @JoeConsorti

Bitcoin's 50-day moving average is a few days from crossing below the 200-day moving average.

Each cross marked a local bottom: • September '23 • September '24 • April '25 If BTC is still in a bull market, the local bottom is forming. Holding $100,000 remains crucial. Source: Joe Consorti, Bloomberg

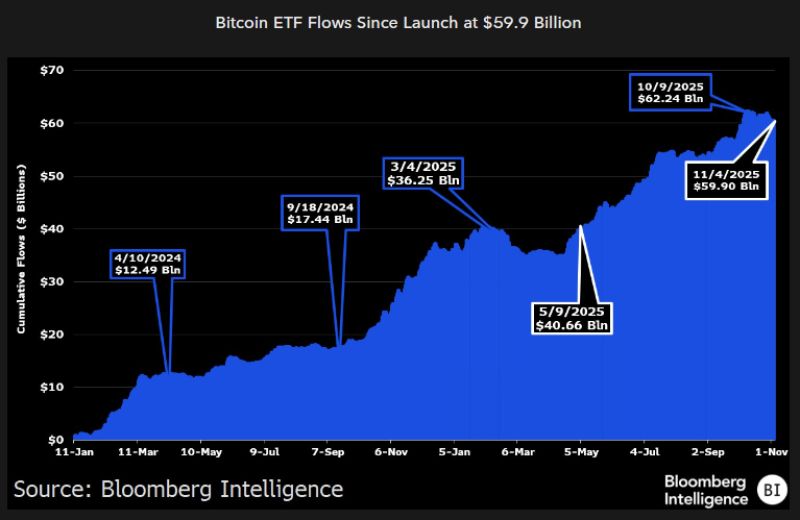

About $2.7b has come out of the bitcoin ETFs in the past month

New chart from @JSeyff puts it into context, and shows the two steps forward one step back pattern, it represents just 1.5% of total assets = 98.5% of aum hanging tough. Source: Eric Balchunas, Bloomberg Intelligence

Bitcoin sentiment is as bad as it was at the 2022 low.

Source: Glassnode, Joe Consorti

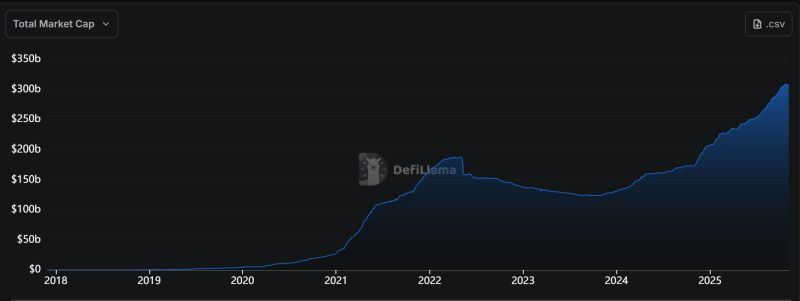

While everyone’s watching bitcoin… stablecoins quietly crossed $311 BILLION in circulation — processing more payments than Visa this year.

And nobody’s talking about it. Tether & Circle now hold $200B+ in U.S. Treasuries, earning $15B/year in interest — while moving $10 TRILLION across a system Wall Street can’t even see. Every stablecoin = a Treasury bond purchased. Every transaction = U.S. dollar dominance extended. Latin America runs on USD stables. The Middle East moves crisis liquidity through them. Corporates slash cross-border costs 70% — no banks, no permission, no friction. Welcome to the Eurodollar 2.0 era: faster, traceable, and Congress-approved. 📊 The numbers don’t lie: $1.5T Treasury demand by 2027 $50B+ in annual U.S. debt savings 55% growth in ten months 1-second settlement Meanwhile… China’s digital yuan? still not there. Where could we be heading by 2028? 💵 $2T in circulation? 🌍 25% of global remittances? 🏦 Trillions in tokenized assets? 🔗 A fully re-plumbed global financial system? The U.S. Dollar went digital — and didn’t even ask permission. Source: Shanaka Anslem Perera ⚡ @shanaka86 on X

Is bitcoin weakness signalling more downside ahead for the Nasdaq?

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks