Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

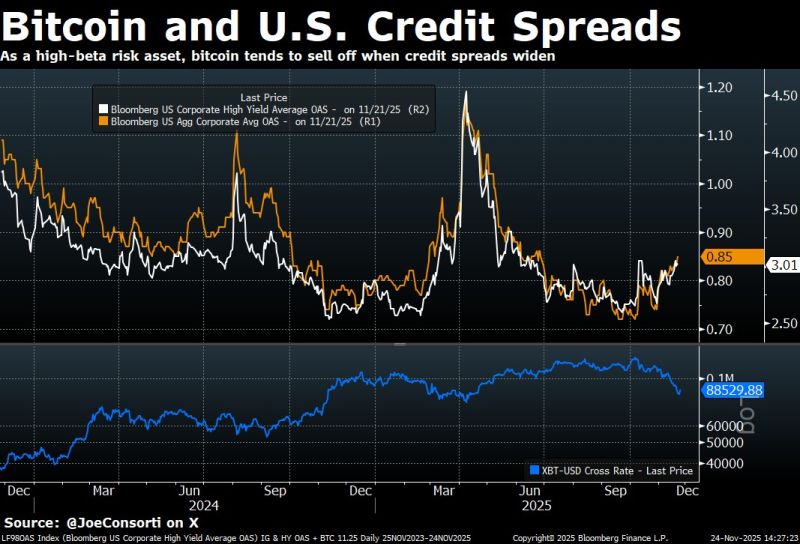

Bitcoin seems to be trading alongside credit spreads:

• Carry trade blowup → BTC -31% • Tariff tantrum → BTC -30% • October 6th through today → bitcoin $BTC -34% Source: Bloomberg, Joe Consorti

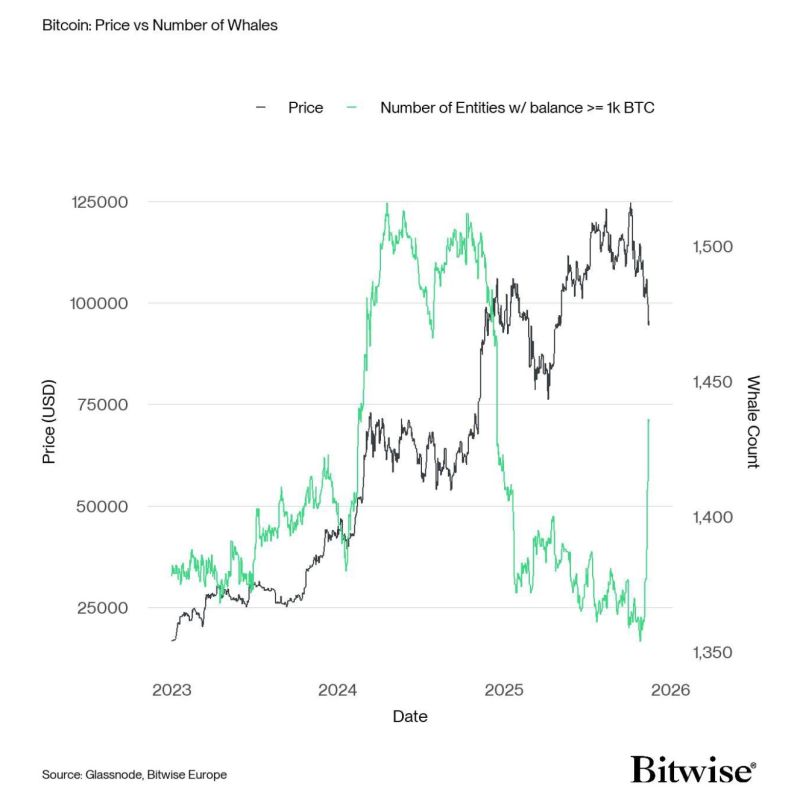

A great chart by Bitwise - 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐰𝐡𝐨 𝐲𝐨𝐮’𝐫𝐞 𝐬𝐞𝐥𝐥𝐢𝐧𝐠 𝐲𝐨𝐮𝐫 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐭𝐨

While retail panic-sold the dip, something very different was happening under the surface. The number of Bitcoin wallets holding 1,000+ BTC just went vertical. That’s ~$91 million per wallet. Translation? Short-term hands are handing their coins straight into the pockets of deep-pocketed, long-duration buyers. And yes — they know exactly what they’re doing. Markets have been jittery: • Rate-cut uncertainty 📉 • Overheated AI equity spending 🤖 • The classic “crypto cycle fear” 😬 Sentiment gauges? Extreme fear. Long-term capital? Completely unfazed. Case in point: Abu Dhabi’s sovereign wealth fund reportedly tripled its BTC exposure last quarter — now sitting near $500M. These aren’t tourists. They’re the ones who buy when everyone else hesitates. So if you’re selling your Bitcoin today… You might want to take a closer look at who’s on the other side of your trade. Now zoom out 👇 Global liquidity is sitting at record highs — and still expanding. Over 80% of major economies are easing or injecting capital again. Crypto regulation is finally becoming clearer. Historically, when: ✅ Liquidity rises + ✅ Policy clarity improves → Risk assets rally. → Crypto rallies the most. Will it happen again this time? Source: Bitwise, Tommy Rogulj @tommyrogulj

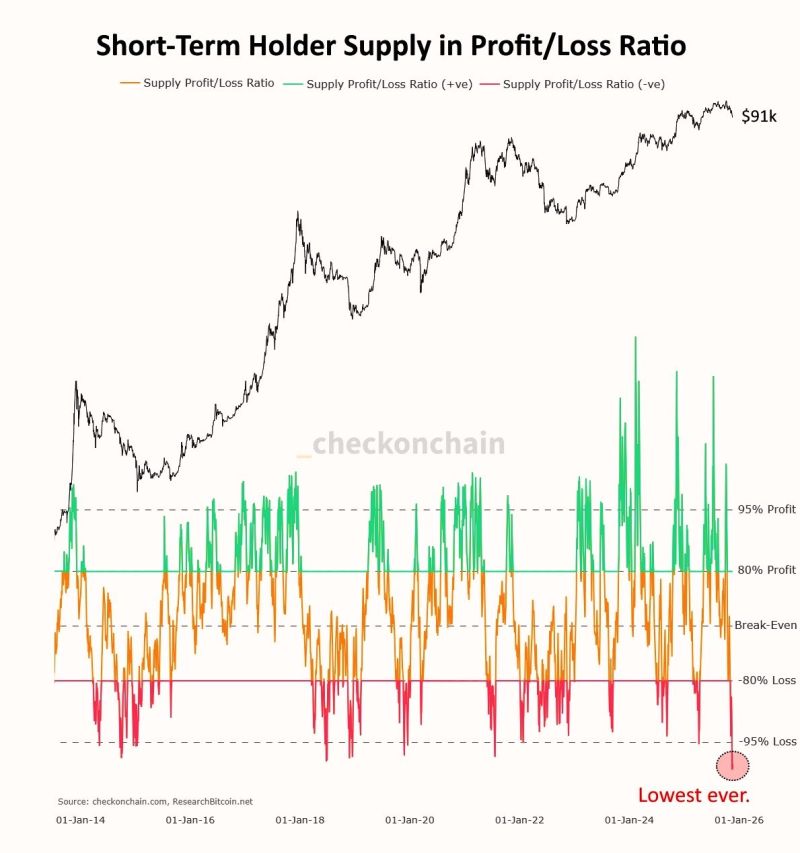

The short-term holder supply in profit/loss ratio is the lowest it’s ever been in the history of bitcoin.

Indeed, 95% of bitcoin $BTC held by short-term holders, those who bought less than 155 days ago, is underwater. Even with two 30% drawdowns this cycle, the speed and severity of the current drawdown have made it much more severe. Source: Joe Consorti, Frank @FrankAFetter

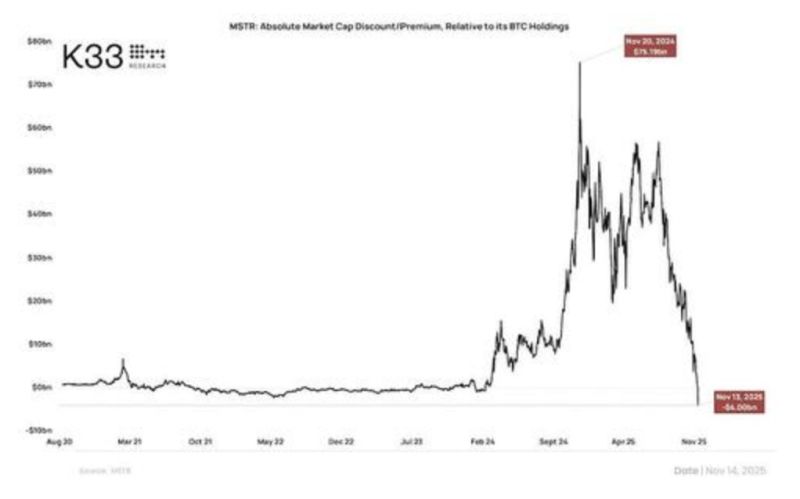

Is Michael Saylor's Strategy under attack?

Its mNAV is now negative - i.e the company's market cap is less than its BTC holdings.. Source: zerohedge

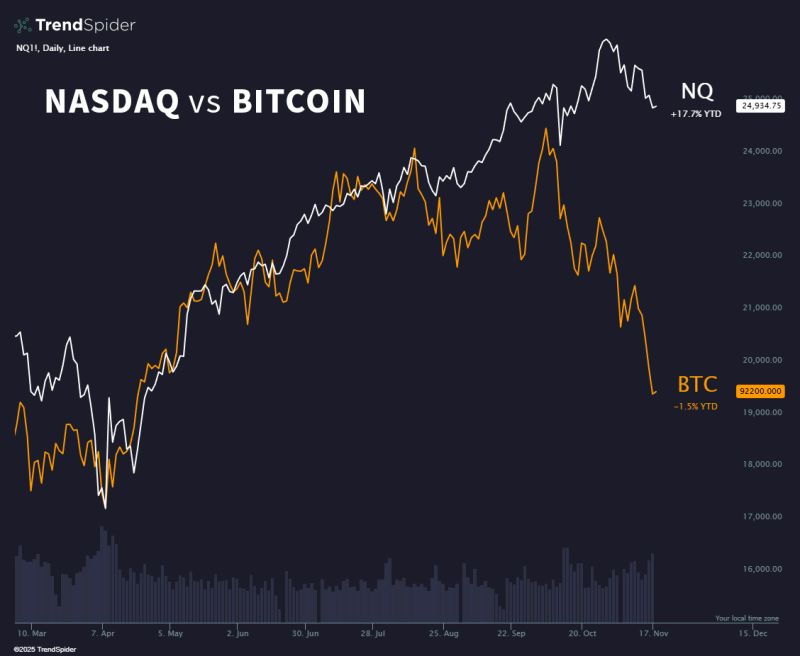

The spread between tech and Bitcoin is stretched to historic extremes.

Either $BTC reclaims ground, or $NQ has unfinished business on the downside. Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks