Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

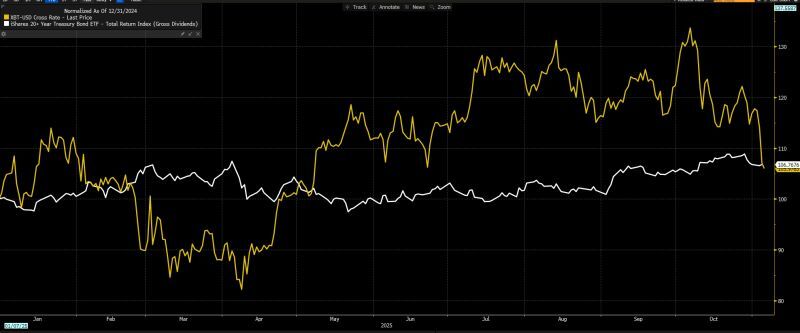

Bitcoin has now performed worse than US Treasuries in 2025

Source: Joe Weisenthal @TheStalwart

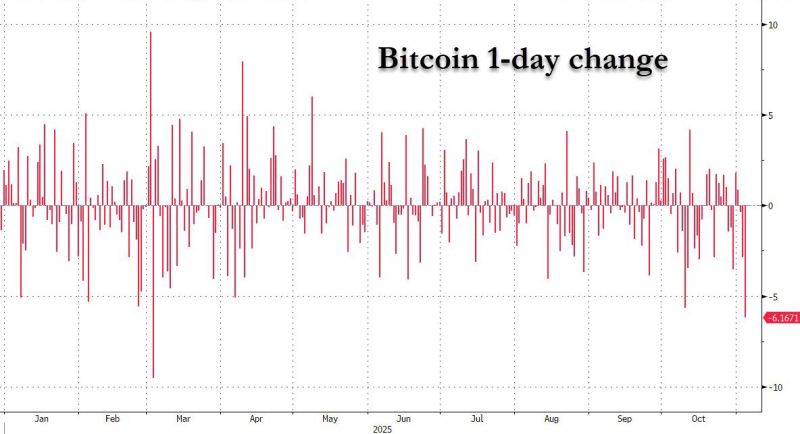

We need $BTC to announce a strategic partnership with OpenAI ASAP.

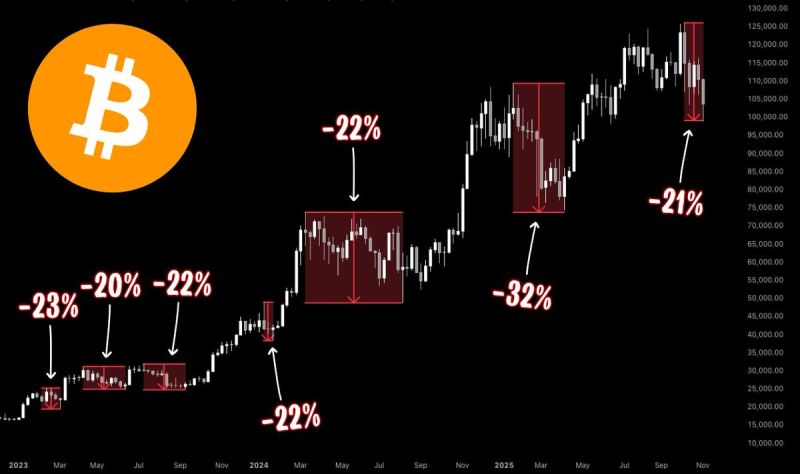

Source: Trend Spider

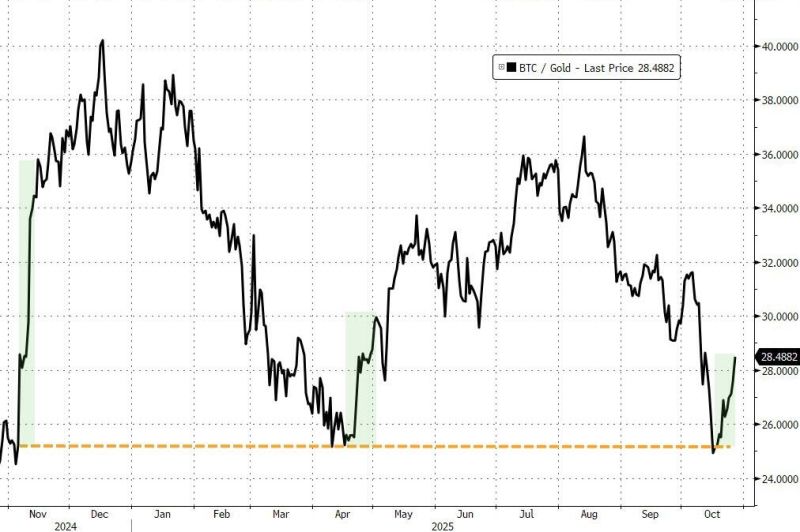

S&P Global Ratings has issued a credit rating to Michael Saylor’s Strategy, the first time for any Bitcoin treasury company 👀

Source: Bitcoin Magazine

S&P Global: "we are likely to continue to view capital as a weakness, because Strategy's bitcoin holdings are likely to grow materially"

So basically "the more Bitcoin they buy, the weaker their capital becomes.” If Strategy held U.S. Treasuries, S&P would call it “high-quality capital.” But if Strategy holds bitcoin, they mark it as negative equity. Incredible Source: @AdamBLiv

Investing with intelligence

Our latest research, commentary and market outlooks