Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It looks like negative interest rates are returning to Switzerland...

Government bonds with maturities of up to 4 years are now yielding negative returns. Source: HolgerZ, Bloomberg

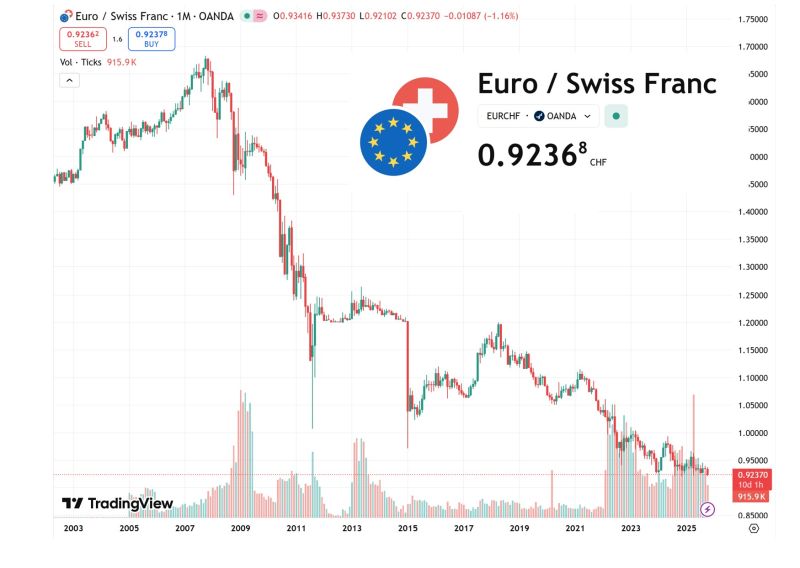

While the world watches the US Dollar and Yen with bated breath, the "Swissie" just hit its strongest level in over a decade.

Here is why the global markets are shaking: 🚀 The "Gold Nugget" Effect Investors are fleeing to safety. With Gold crossing $5,000/oz and political volatility rocking major powers, the Swiss Franc has become the ultimate "reliable" haven. It’s up 3% this year, following a massive 14% gain last year. 📉 The SNB's Impossible Choice A currency this strong is a double-edged sword. It keeps inflation low (currently at 0.1%), but it puts a massive squeeze on Swiss exporters. The Swiss National Bank (SNB) is now stuck between a rock and a hard place: Cut rates? They are already at 0%. Going negative again is a move they want to avoid. Intervene? Direct intervention risks the "currency manipulator" label and diplomatic friction. 🌍 The Bigger Picture When the "linchpin" of the global economy (the USD) feels erratic, capital doesn't just disappear—it migrates. We are seeing a fundamental shift in where the world stores The Lesson: In a world of volatility, stability is the most expensive luxury on the market. Source: FT

Although the Swiss Franc has been the strongest currency in the world, the purchasing power degradation in ‘real’/’hard’/gold terms over the last 20 years has been massive

Chart below shows Gold price in Swiss Francs – the “hardest” fiat currency in the world has lost 80%+ of its purchasing power !) Source: Goldman Sachs, zerohedge

🛑 In case you missed it... Swiss Inflation Just Hit ZERO! What will the SNB do ??? 🤯

Just days before their final 2025 rate decision, Switzerland threw the central bank (SNB) a curveball. Consumer prices came in UNCHANGED in November from a year ago. That's ZERO inflation. What does this mean for money managers and global markets? 📌 The Core Dilemma: Core inflation slid to its weakest in over four years. The SNB's 0.4% inflation forecast for this quarter is now officially dead in the water. 📌Negative Rates... Again? No yet. While the headline number is scary, it's unlikely the SNB will panic-cut rates back into negative territory next week. The market's real focus is the 2026 Inflation Forecast. Will the SNB slash its current 0.55% projection? That’s the real tell. 📌The Franc's Resilience: Despite the low inflation and fears of negative interest rates ahead, the CHF (Swiss Franc) is shrugging it off and staying strong. The SNB might wish for a weaker currency to "kindle" inflation via intervention, but we continue to think the Franc is UNLIKELY to weaken much and will rather remain strong. The Bottom Line: Low inflation is back in the spotlight for the safe haven currency. Watch the SNB's forward guidance, not just their rate decision Source: Bloomberg

We have a deal!

Among the $200B Swiss investment pledges, the US representative cites pharmaceuticals, the gold industry, and even the railway sector.

The Swiss National Bank is pursuing a steady monetary policy and leaving its key interest rate at 0%, which is reasonable given the current economic and political situation.

The Swiss economy is performing relatively well despite the US tariff shock, core inflation remains within a healthy range, and the ECB is also keeping key interest rates constant for the time being and is likely to continue to do so, meaning that the Swiss franc has hardly changed against the euro since the end of June. The hashtag#SNB mentions the great uncertainty surrounding the Swiss export sector, which is also the biggest question mark in our economic outlook for Switzerland at present. Should a significant deterioration manifest itself here, the SNB could come under greater pressure to lower interest rates below zero after all. The SNB's inflation forecasts also remain stable compared with the June forecast and are even rising slightly in the second quarter of 2028, which was forecast for the first time. Today's decision is therefore understandable across the board and should come as no surprise to the stock markets.

From the FT article "Switzerland’s US tech ‘whale’"

>>> https://lnkd.in/e5ctdeTq "Switzerland’s conservative Central Bank has quietly become one of the world’s biggest tech investors, amassing a stock portfolio that is equivalent in value to nearly a fifth of the national economy’s annual output. The Swiss National Bank has US equity holdings amounting to $167bn, spread across more than 2,300 positions, according to US Securities and Exchange Commission filings from June. More than $42bn is invested in just five companies, Amazon, Apple, Meta, Microsoft and Nvidia, making it a major Silicon Valley investor. Its stake in Apple alone is worth nearly $10bn and its stake in Nvidia is more than $11bn. Though not a sovereign wealth fund, the SNB’s $855bn balance sheet of assets, including its tech holdings, put it in a similar league as some of the world’s largest state investment vehicles, including those of Singapore and Qatar". Source: FT, IMD

Investing with intelligence

Our latest research, commentary and market outlooks