Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Tariffs 2.0: how can Switzerland secure a better deal?

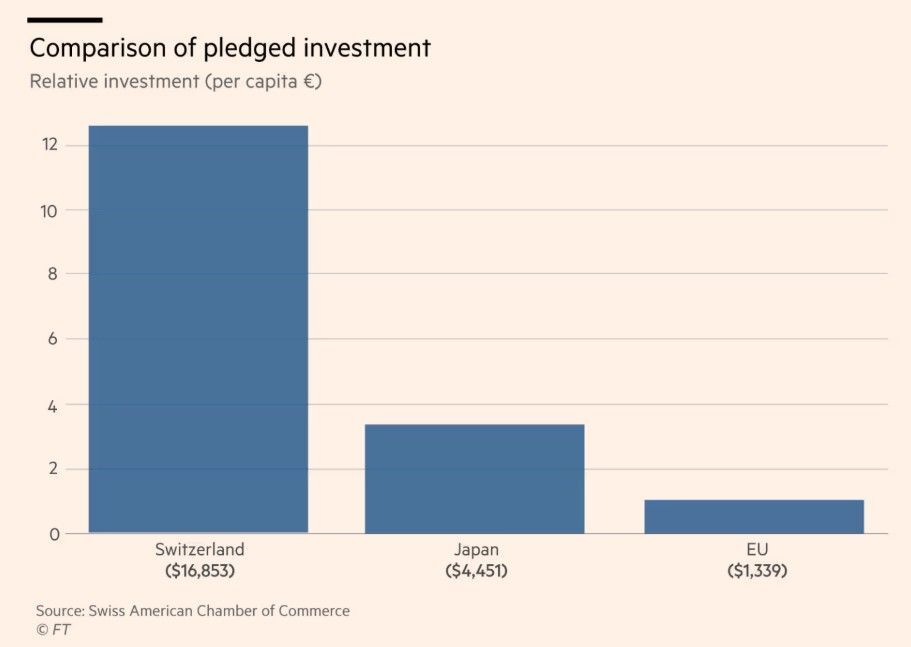

Switzerland said it was confident about securing an early trade deal as it was willing to pledge nearly $150bn in US-bound investment (which is huge on relative terms). “We have nine million people in Switzerland, yet our investment pledge per capita is much more than what Japan or the EU have pledged. If we talk about a $40bn trade deficit, one has to put that [in] perspective,” said Rahul Sahgal, chief executive of the Swiss-American Chamber of Commerce. Let’s also keep in mind that we are also a huge investor in the US, with Nestlé, Roche and Novartis employing thousands of Americans. Gold exports — often transiting through Switzerland for refining or trade — are largely responsible for the country’s trade imbalance with the US. Yet both gold and pharmaceutical products are exempt from Trump’s “reciprocal tariffs. Pharmaceutical sector could be the tipping point: Switzerland’s pharma sector sends about 60% of its exports to the US. Novartis and Roche’s US subsidiary Genentech were among the pharmaceutical companies that received letters from the Trump administration this week demanding that they lower drug prices. Swiss watchmaker Breitling’s CEO Georges Kern said his country was being “held hostage” by the pharmaceutical industry that had irritated Trump. Source: FT

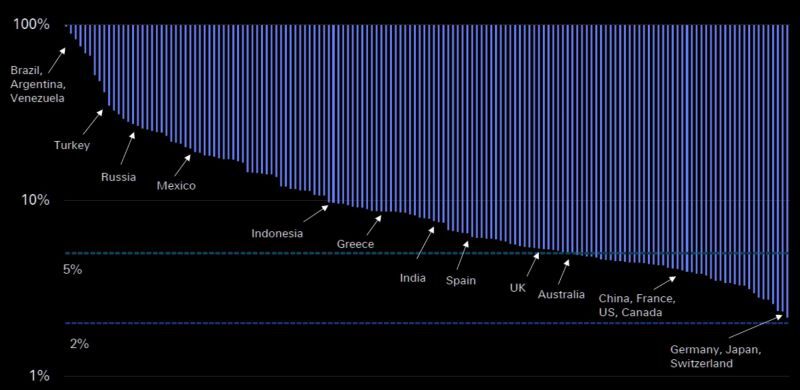

Average annual inflation of 152 economies since 1971 when Bretton Woods collapsed.

No economy has averaged less than 2% inflation but Switzerland at 2.2% comes closest. Source: The Market Ear

Tether, the issuer of the world’s largest stablecoin, has its own vault in Switzerland to hold an $8 billion stockpile of gold, with an eye to growing those stores.

The El Salvador-based crypto company now holds nearly 80 tons of gold, it said. The vast majority of that is owned by Tether directly, making it one of the largest gold holders in the world outside of banks and nation states. The private vault is based in Switzerland and is fully owned by the company. The exact location hasn’t been disclosed. Chief Executive Paolo Ardoino told Bloomberg that this decision was about ownership, scale, and cost. The company is based in El Salvador and is best known as the issuer of USDT, the world’s largest stablecoin. Tether now holds $159 billion worth of tokens in circulation, which are backed by various reserves, including US Treasuries and precious metals. Paolo made it clear that the move to physical gold storage is strategic and intended to reduce long-term costs. “If you have your own vault, eventually, with the size, it gets much cheaper to do custody,” he said. As of March 2025, Tether’s own reports show that nearly 5% of its total reserves are now held in precious metals, with the vast majority being gold. With the value of its bullion holdings now on par with UBS Group AG, one of the few major banks that discloses its precious metal reserves, Tether is pushing into a category usually reserved for nation states and central banks. Source: Binance, Bloomberg

The swissie has appreciated nearly 50% over the last 20 years.

A stronger CHF poses significant challenges for Swiss firms, particularly exporters, as it erodes their pricing power on the global stage. This could pressure corporate margins and economic growth in Switzerland. Note that the August 2011 high at 1.3125 is not too far away. What will the SNB do in case of breakout? Heavy use of its balance sheet (at the risk of being pointed out by Trump as a currency manipulator) and/or negative interest rates?

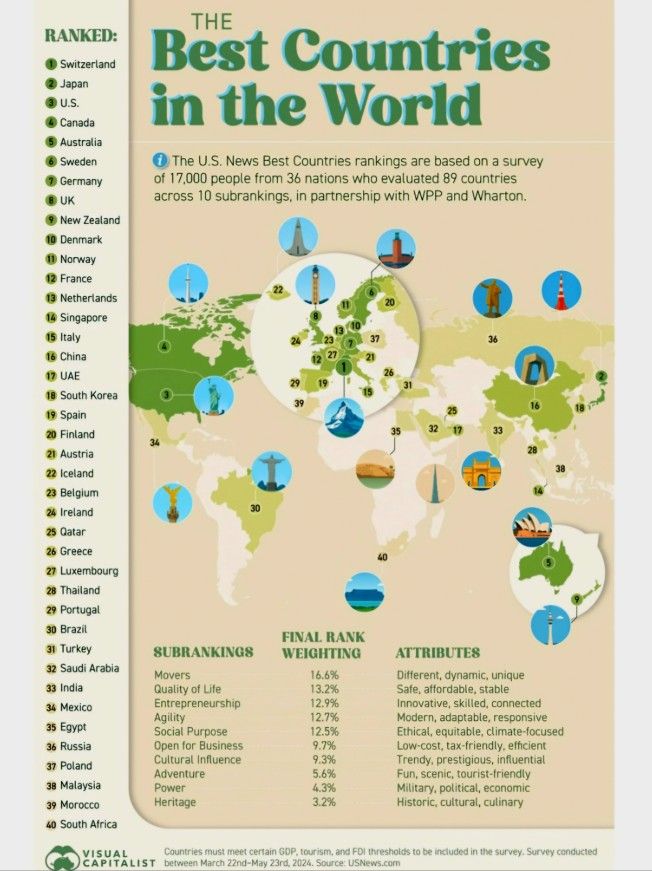

The Best Countries in The World (according to a survey conducted by US News in partnership with WPP and Wharton)

The U.S. News Best Countries rankings are based on a survey of 17,000 people from 36 nations who evaluated 89 countries across 10 subrankings, in partnership with WPP and Wharton. ATTRIBUTES Different, dynamic, unique Safe, affordable, stable Innovative, skilled, connected Modern, adaptable, responsive Ethical, equitable, climate-focused Low-cost, tax-friendly, efficient Trendy, prestigious, influential Fun, scenic, tourist-friendly Military, political, economic Historic, cultural, culinary Countries must meet certain GDP, tourism, and FOI thresholds to be included in the survey. Survey conducted between March 22nd-May 23rd, 2024. Source: USNews. com, Visual Capitalist

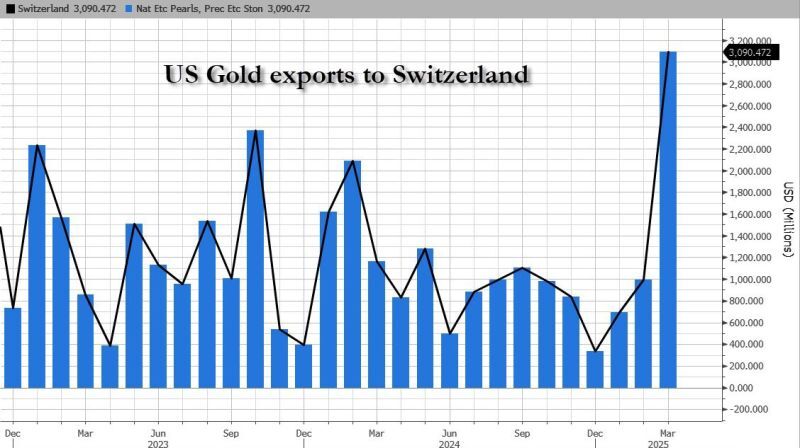

The Atlanta Fed was forced to adjust its entire tracker to exclude gold imports which were skewing GDP by 1.5%.

How long until the Atlanta Fed also excludes soaring physical gold EXPORTS TO Switzerland to reduce the surge in Q2 GDP??? Source: zerohedge

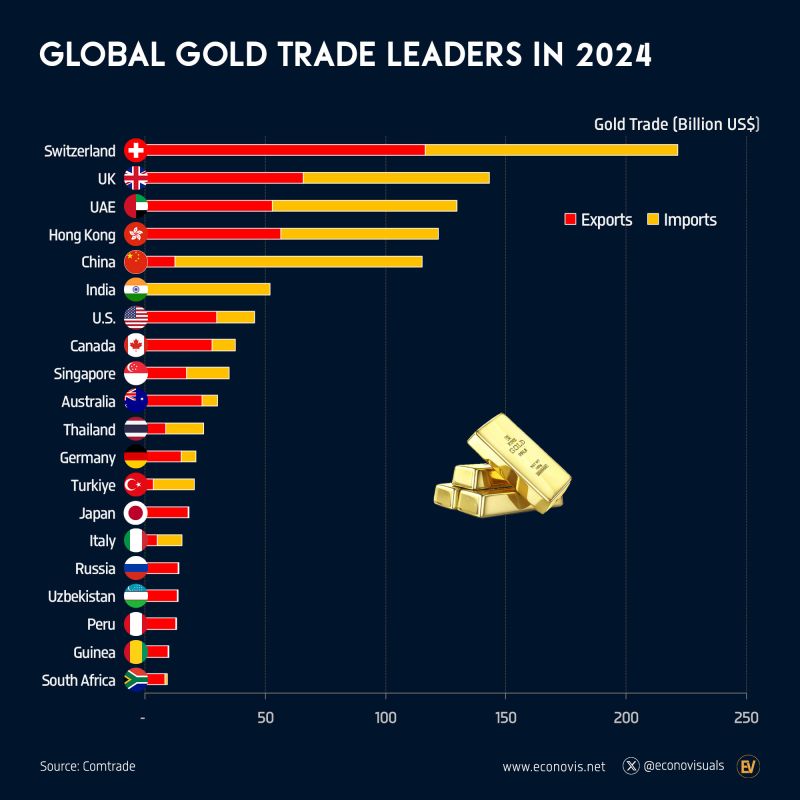

Global Gold Trade Leaders in 2024

In 2024, Switzerland ($116 billion), the United Kingdom ($66 billion), Hong Kong ($57 billion), and the United Arab Emirates ($53 billion) emerged as the world’s top gold exporters. These same economies also featured prominently among the top gold importers: Switzerland ($105 billion), the UK ($77 billion), Hong Kong ($65 billion), and the UAE ($77 billion). Meanwhile, China ($103 billion) and India ($52 billion) ranked as major gold importers but exported far less—$90 billion for China and $1 billion for India—making them the world’s largest net gold importers. Source: Econovis @econovisuals

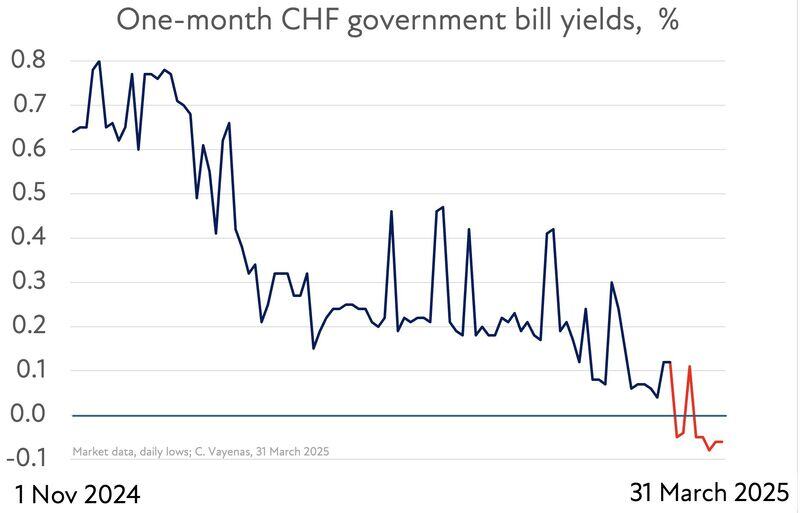

Negative interest rates have made a return in Switzerland, as noted by Costa Vayenas

Specifically, the one-month CHF government bill yield indicates a scenario where holders of Swiss francs are willing to pay the borrower instead of receiving interest. Source: C. Vayenas

Investing with intelligence

Our latest research, commentary and market outlooks