Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it...

According to NY Post, banking giant UBS is ramping up its threats to leave Switzerland and set up shop in the US — a radical response to Swiss regulators who have proposed onerous new capital requirements on the financial behemoth. Source : New York Post

Something to be worried about

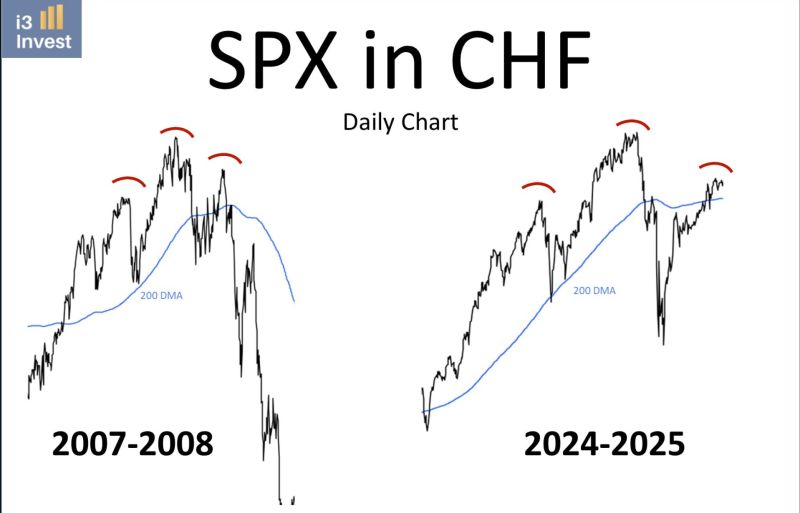

The chart of the S&P 500 expressed in a strong currency (Swiss franc) does not look the same as in Dollars. Source: i3 invest

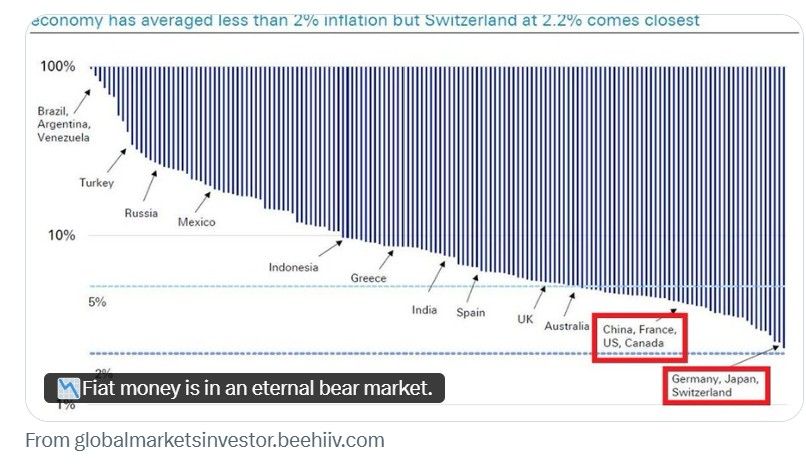

Currency debasement is not a bug — it’s a feature of the fiat system.

Since Bretton Woods collapsed in 1971, not one of 152 countries has kept average inflation below 2%. Even Switzerland averaged 2.2%. Source: Global Markets Investors

‼️ Why is Switzerland the most impacted by the new tariffs on gold imports?

🔴 The United States has recently imposed tariffs on gold imports, specifically targeting one-kilogram and 100-ounce gold bars, which are common forms for delivery in US futures markets. This policy shift was formalized in a July 31, 2025, US Customs and Border Protection ruling, reclassifying these gold bars under a customs code that is subject to tariffs—contrary to previous exemptions. ▶️The new tariff rate is as high as 39% on affected gold bar imports from certain countries, with hashtag#Switzerland—a major refining hub for London's larger 400-ounce gold bars—expected to be the most impacted. ▶️Traditionally, large gold bars (400-ounce format) are traded in hashtag#London, then shipped via Switzerland for recasting into the smaller kilo bars favored in the US, making the tariff particularly disruptive to established supply chains. ▶️The policy does not make clear whether London-origin 400-ounce bars, if sent directly, are currently subject to tariffs, but most industry analysis suggests that one-kilogram and 100-ounce bars, regardless of their original source, are now covered by the US tariff regime if imported into the United States. ⚠️ In summary, there are now substantial tariffs on gold bars (especially kilo and 100-ounce bars) imported into the US, even if they transit through London or Switzerland. The rule does not differentiate between bars exported directly from London or those refined elsewhere, as it is based on the classification of the bar itself at import

The trade-weighted tariff on swiss exports to the us is close to 20% - not 39%.

Indeed, as discussed in this article by NZZ, medicines and most gold imports are currently exempt from Trump's tariffs. Therefore, the 39% punitive tariff is likely to affect less than half of all Swiss goods exports to the United States. On a trade-weighted basis, the tariff rate for Switzerland would thus be around 20%. The main victims would be watch manufacturers and other companies in the mechanical engineering, electrical and metal industries. Link to the article: https://lnkd.in/esu_XvFM

The US has slapped tariffs on imports of one-kilo gold bars, in a move that threatens to upend the global bullion market and deal a fresh blow to Switzerland, the world’s largest refining hub.

The Customs Border Protection agency said one-kilo and 100 ounce gold bars should be classified under a customs code subject to levies, according to a so-called ruling letter dated July 31, which was seen by the Financial Times. Ruling letters are used by the US to clarify its trade policy. The CBP’s decision stands in sharp contrast with the industry’s previous expectations that these types of gold bars should be classified using a different customs code that is exempt from Trump’s countrywide tariffs. Here are some interesting comments by EndGame Macro on X 👇 : 🔴 This 39% tariff on 1 kilogram and 100 ounce gold bars from Switzerland is a calculated move with immediate market consequences. The July 31 U.S. Customs ruling reclassified these bars, the exact formats COMEX accepts for delivery into a tariffed category. That’s critical because Switzerland is the world’s largest gold refining hub, and a substantial share of the physical gold that underpins COMEX futures flows from there. ‼️ Within hours of the news, premiums for New York gold futures jumped above the spot price, signaling that deliverable supply into the U.S. market had abruptly tightened. Swiss refiners have already slowed or halted shipments, further compounding the squeeze. 👉 At its core, this is about LEVERAGE and STRATEGIC POSITIONING. The U.S. is applying pressure on Switzerland while giving domestic refiners a direct pricing advantage in kilo and 100 ounce formats. That could lock in a higher New York futures premium even if global spot prices hold steady. By effectively capping imports of these bar types, the move raises the stakes for COMEX short sellers, whose ability to source bars for delivery just got more complicated. Alternative routes such as shipping 400 ounce bars to London for recasting in the U.S., or rerouting through non Swiss refineries will take time, limiting throughput in the interim. 👉 The longer game may be less about tariffs for revenue and more about WEAPONIONZING the gold market, creating a controlled squeeze in the very bar formats that drive global futures pricing. It pressures the Swiss refining system, reasserts New York as the central arena for price discovery, and ensures that if gold is going to play a larger role in the future global monetary system, it will do so on U.S. terms. In a year when gold is already up on macroeconomic concerns, a politically engineered choke point like this can actively shift where and how the world’s benchmark gold price is set. Source: FT, EndGame Macro

With Trump's new Tariffs on Swiss watches, it will now be cheaper to fly to Hong Kong and buy a watch.

Source: Drew @aKellyBrand on X

Swiss urged to bring Fifa chief off bench in Donald Trump tariff row

According to the FT, Swiss political figures are calling for Fifa president Gianni Infantino to be enlisted to help sway Donald Trump, as the country reels from being saddled with the highest US tariff rate in Europe. The calls come as Switzerland’s president and economy minister failed in a last ditch bid to avert the implementation of 39 per cent tariffs, as they left Washington empty handed. President Karin Keller-Sutter and economy minister Guy Parmelin met with Marco Rubio on Wednesday afternoon but announced no change to the high tariff. The Swiss delegation was unable to secure a meeting with Trump. According to the FT article: "One member of Switzerland’s upper house as well as a former Swiss ambassador are among those arguing the world football chief could help secure vital access to the US president, with whom he has a long-standing rapport (...) National Councillor Roland Rino Büchel, also a member of the SVP, was among those arguing the Fifa president could act as an informal backchannel to the US president. Trump has previously referred to Infantino as “a friend of mine”, a “winner” and an “excellent guy”. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks