Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

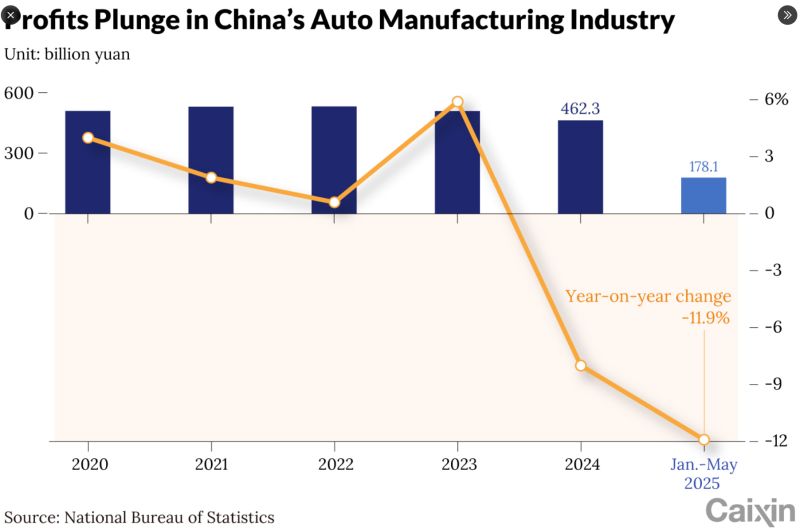

China's auto industryis a massive below-cost, state subsidized statecraft masking as trade

This is Beijing trying to put the world's auto producers out of business even as domestic carmakers teeter on the verge of collapse, but are propped up by state money. Source: zerohedge, Caixin

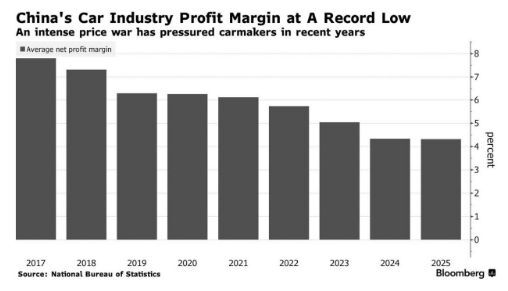

China's Car Industry Profit Margin has fallen to an all-time low

Source: Barchart

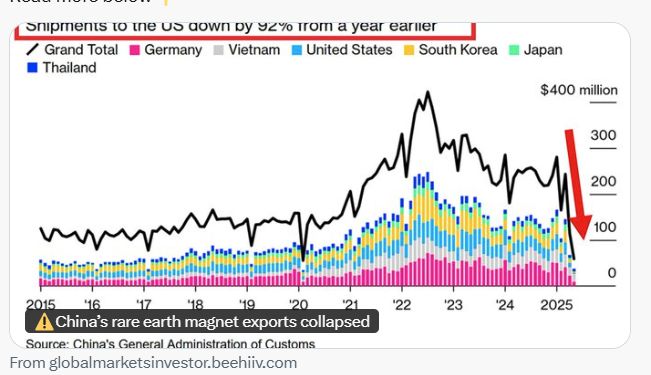

🚨China’s rare earth magnet exports COLLAPSED

Total shipments FELL 76% YoY in May, to 1,238 tons, the least since February 2020. Exports to the US FELL 92% YoY to 46 tons, and LESS than 1/10 of what was recorded in March. Source: Global Markets Investors

Global Statistics @Globalstats11

Top 10 Largest Car Producing Countries in 2024 1. China - 31,281,592 2. United States - 10,562,188 3. Japan - 8,234,681 4. India - 6,014,691 5. Mexico - 4,202,642 6. South Korea - 4,127,252 7. Germany - 4,069,222 8. Brazil - 2,549,595 9. Spain - 2,376,504 10. Thailand - 1,468,997 Source: International Organization of Motor Vehicle Manufacturer

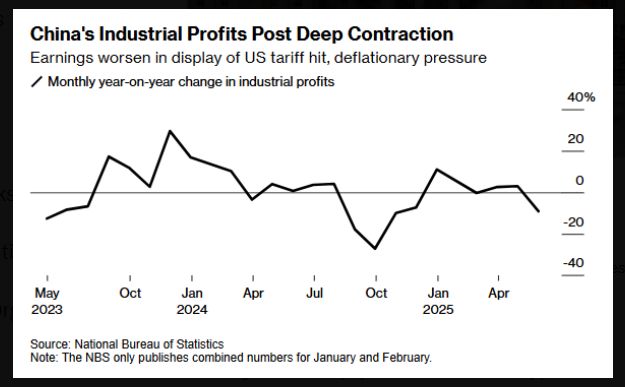

China’s industrial profits sink on US Tariffs, deflation woes - Bloomberg

China's industrial firms saw their profits drop the most since October, illustrating weakness in an economy strained by higher US tariffs and lingering deflationary pressure. Industrial profits fell 9.1% last month from a year earlier, according to data released Friday by the National Bureau of Statistics.

It seems that the EU finally realizes that their de-industrialization process has been going too far and put them at a huge competitive disadvantage vs. the US.

The European Union requires radical reforms through a new industrial strategy to ensure its competitiveness, to boost social equality and to meet climate targets, according to a keenly awaited report from economist and politician Mario Draghi. The proposals laid out in the report would require between 750 billion and 800 billion euros in additional investment each year, the European Commission estimates. Other areas of concern include supply chain security and defense spending, the report states. BOTTOM-LINE: This could mean more debt, more money printing, more inflation, higher nominal growth. Source: CNBC

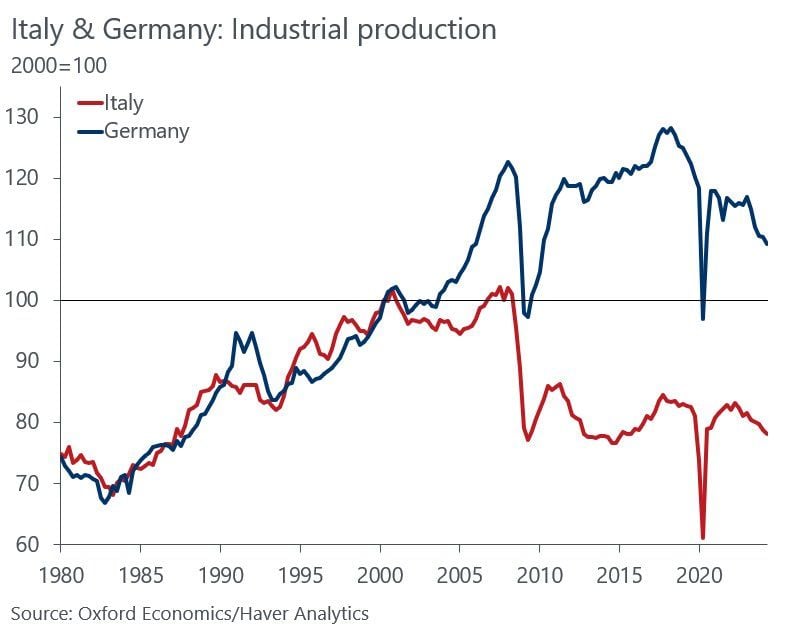

Two scary trends in Europe.

Interesting to see how the year of the Euro introduction coincides with Italian industrial production trend. Meanwhile, German deindustrialization has just brought its industrial production to 2006 level... Source: Chart @DanielKral1, Michel A.Arouet

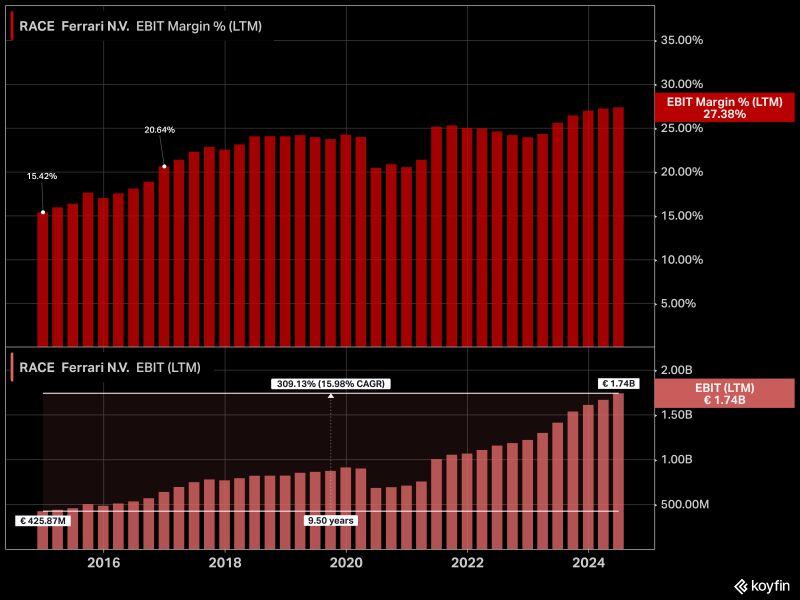

$RACE Since Ferrari IPO'd in 2015, operating margins at the luxury vehicle manufacturer have grown by almost 12%

Underlying operating income has grown at a 16% CAGR over the last decade. Source: Koyfin

Investing with intelligence

Our latest research, commentary and market outlooks