Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

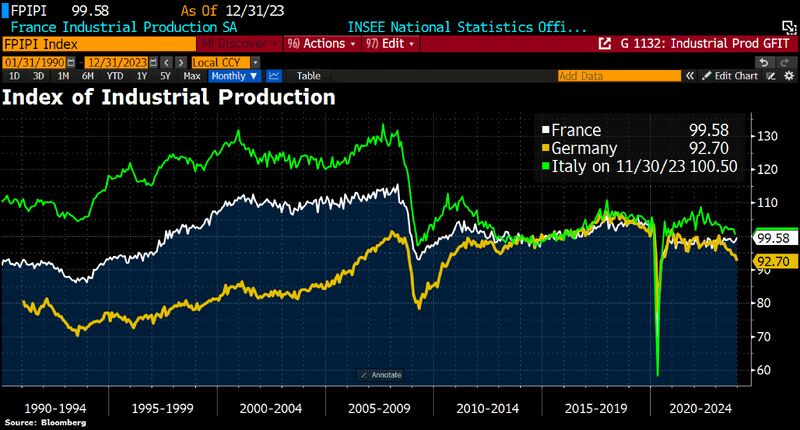

As highlighted by Michel A.Arouet on X: the German business model was based on:

1. Cheap energy from Russia 2. Cheap subcontractors in Eastern Europe 3. Steadily growing exports to China All three are gone by now, and not much has been done to change the trend. Source: Bloomberg, Michel A.Arouet

Deindustrialization continues unabated in Germany.

Industrial production fell by 2.5% in May to a level last seen in 2010 - except for covid –, meaning industrial activity is unlikely to contribute to GDP growth in Q2. The consensus forecast was for a 0.1% increase in May. Production in industry, excluding energy & construction, dropped 2.9%, mainly driven by lower activity at car & machinery producers. Construction output decreased 3.3%, while energy production increased 2.6%. Source: Bloomberg, HolgerZ

German business model was based on:

1. Cheap energy from Russia; 2 Cheap subcontractors in Eastern Europe; 3. Steadily growing exports to China. All three are gone by now Source: Michel A.Arouet, Bloomberg

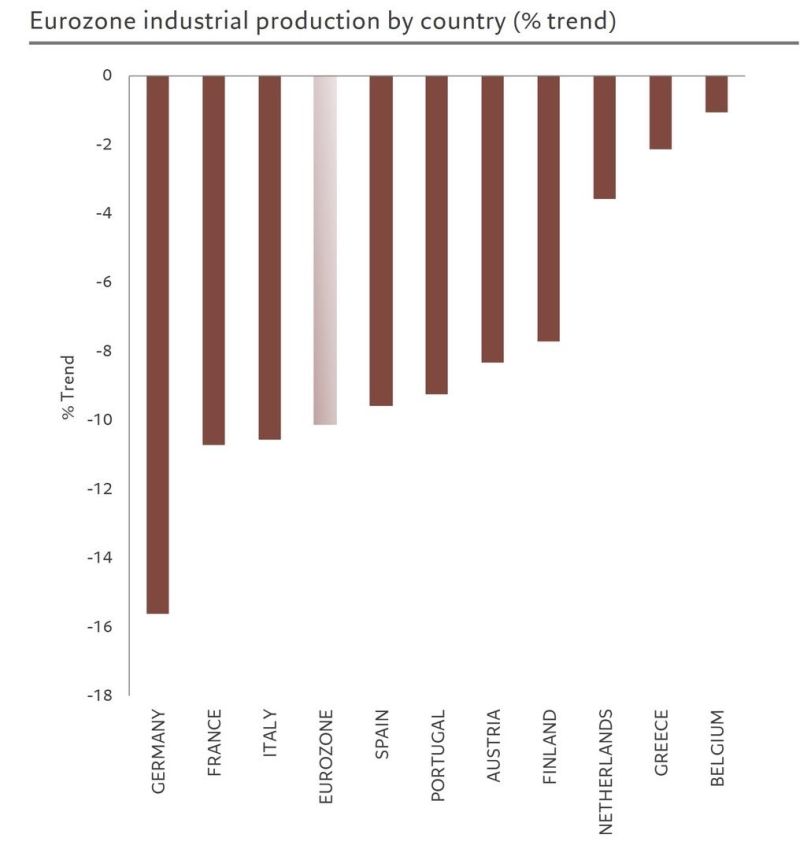

Everyone is aware of German deindustrialization by now, unfortunately industrial production in other major European countries is not looking much better.

Source: Michel A.Arouet, skhanniche

Deindustrialization in one chart:

Price for CO2 emission rights (Carbon Futures) hit lowest since Jul 21. Source: HolgerZ, Bloomberg

Construction spending has surged on late cycle government stimulus, helping to drive economic growth in the US

But it is coming at a cost as the US government is running an enormous deficit for a non-recessionary period $1.5 trillion for 2024 alone, down slightly from 2023 Source: Bloomberg, markets & Mayhem

Europe deindustrialization continues

German industrial production fell for 7th consecutive month in December, the longest decline in the history of the data series. The 1.6% MoM decline came as a huge downside surprise. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks