Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

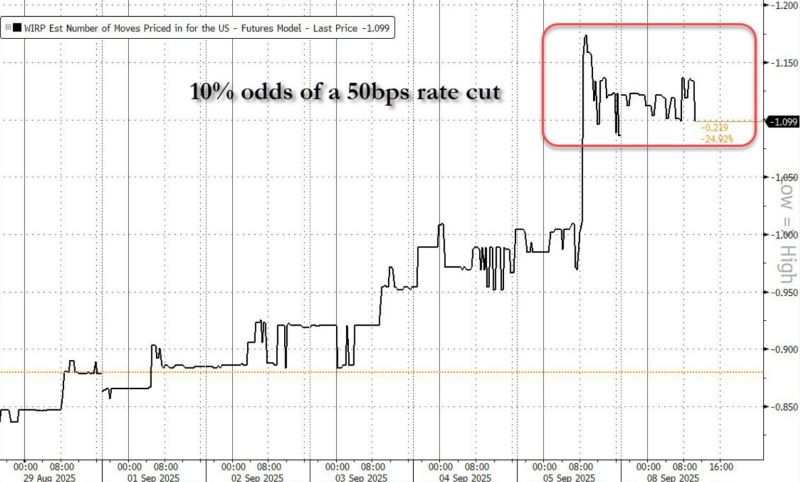

Odds of 50bps rate cut just hit 10%

Standard Chartered now predicts the Fed will cut TWICE at September FOMC. Source: zerohedge

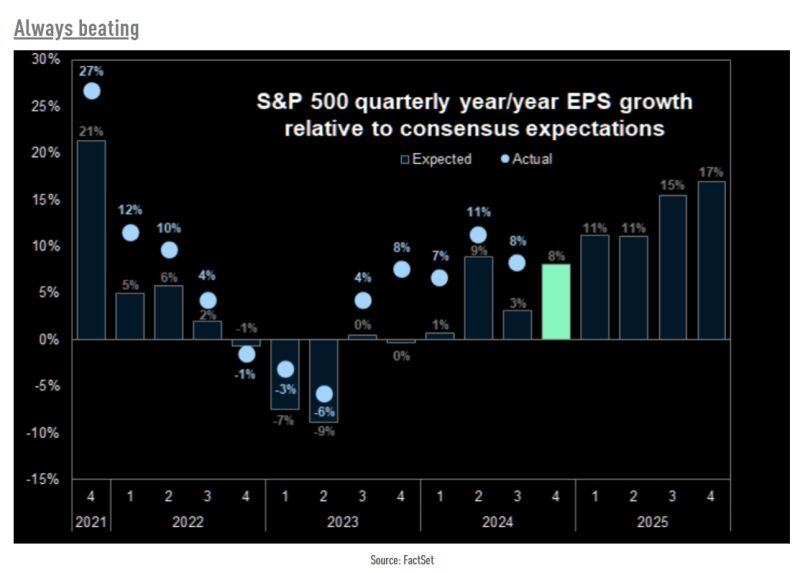

Actual S&P 500 earnings growth has exceeded expectations during the last few years.

Will it be the case again this quarter? Source: The Market Ear, Factset

In our H2 outlook, we highlighted 5 key themes expected to unfold before year-end. As we approach the final quarter, most are materializing, albeit with some notable uncertainties:

- Global economic growth is normalizing, but recent macro data, particularly in the US and Europe, signal an increased recession risk. While a soft-landing remains the core scenario, the likelihood of a hard landing has grown since H2 began. - The US labor market is showing signs of slowing, with a looming risk of a sudden and significant increase in unemployment. - The Fed is anticipated to make cuts. The question on everyone's mind is whether we will see a substantial jumbo rate cut (50bps) initially. - While sector and style rotation is underway, the defensive lean is proving to be more pronounced than initially anticipated. - Volatility is on the rise, with some moderation thus far (aside from August 3rd). The big question is whether we will experience real market stress leading up to the elections.

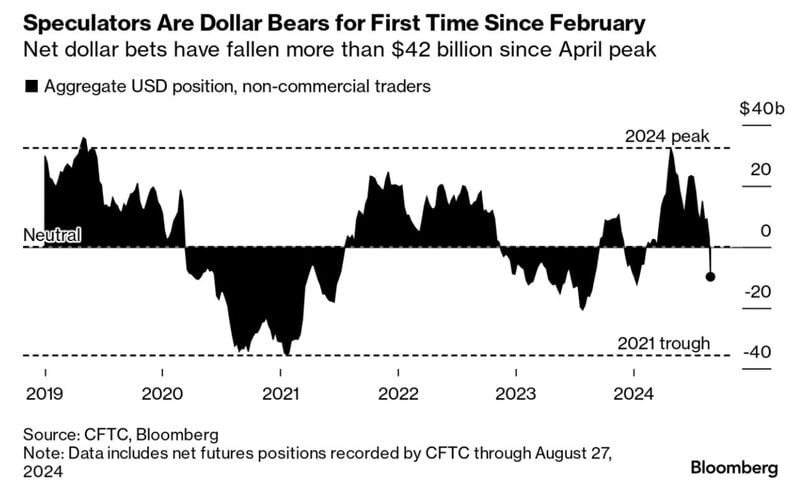

Speculators have turned Bearish on the U.S. Dollar for the first time since February 🚨

Source: Barchart, Bloomberg

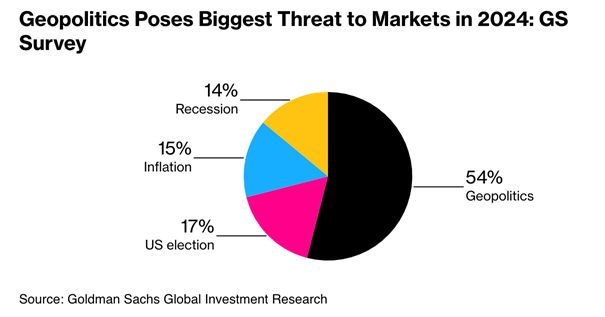

Goldman Client Survey Shows Geopolitics Is Biggest Risk in 2024 –

Source: Bloomberg

Credit Suisse raised its S&P 500 Year-End target to 4,700, becoming most Bullish Wall Street Bank

But as shown below, majority of Wall Street strategists have revised upwards their estimates for 2013. Source: TME, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks