Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

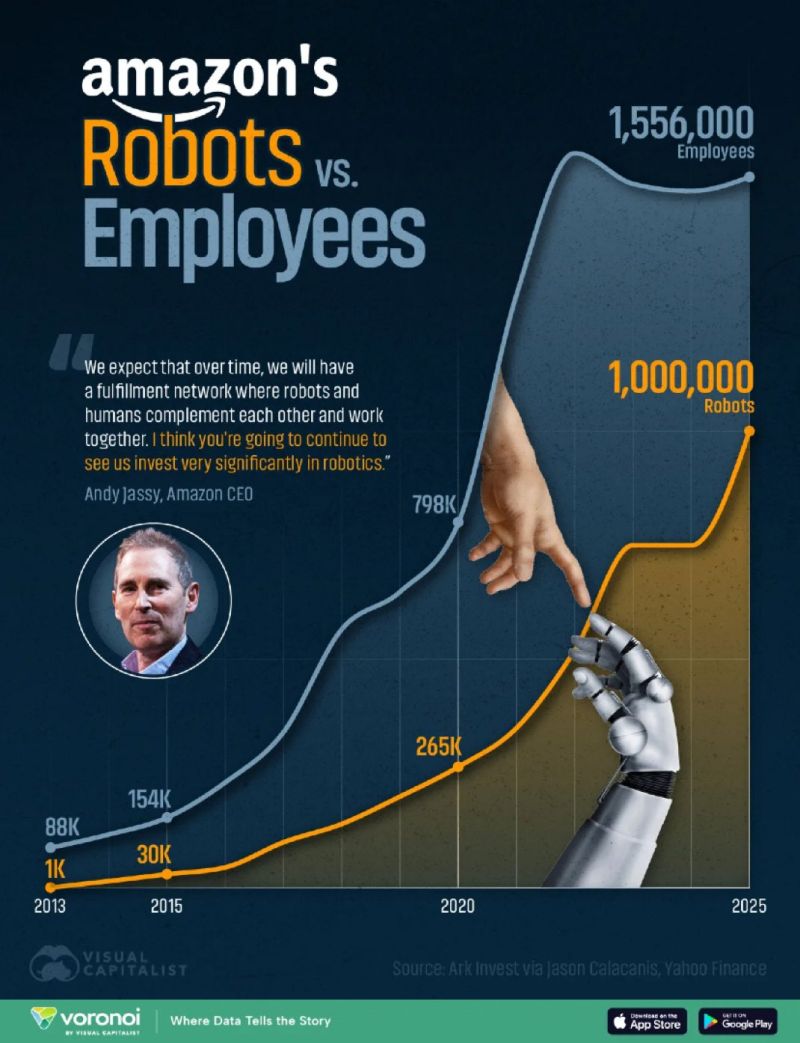

Amazon Is Hiring Robots While Cutting Human Jobs

Source: Visual Capitalist

To put things in perspective...

The Amazon $AMZN CAPEX estimates ($200B for 2026) aren’t even on the screen on the Bloomberg GF page yet… Source: Bloomberg, RBC

🚨 AI Power Shift Alert 🚨

Amazon is in talks to invest $10B+ in OpenAI, pushing its valuation north of $500B. But this isn’t just about capital. It’s about control of the AI stack. 🔹 OpenAI would use Amazon Trainium AI chips 🔹 Rent massive AWS data-center capacity 🔹 Deepen infrastructure dependence beyond Microsoft This comes right after OpenAI restructured its relationship with Microsoft, unlocking deals with rival cloud providers. 💡 What’s happening behind the scenes: OpenAI already committed $38B over 7 years to Amazon servers Has $1.5T (!) in long-term infrastructure deals with Nvidia, Oracle, AMD & Broadcom Nvidia alone plans up to $100B in a multi-year partnership 🤔 Investors are uneasy. Many of these deals are circular — suppliers invest in OpenAI, OpenAI buys their hardware, and sometimes takes equity in return. Meanwhile, rivals aren’t standing still: Anthropic has raised ~$26B from Amazon, Google, Microsoft & Nvidia Amazon alone has put $8B into Anthropic since 2023 ⚠️ Key limitation: Amazon still won’t get rights to OpenAI’s most advanced models — Microsoft keeps exclusivity until the early 2030s. 🛒 Bonus twist: Amazon and OpenAI are also discussing e-commerce integrations, as OpenAI expands beyond chat into platforms like Etsy, Shopify & Instacart. 📌 Big takeaway: The AI race is no longer about models. It’s about chips, clouds, capital, and distribution — and Big Tech is locking it all down fast.

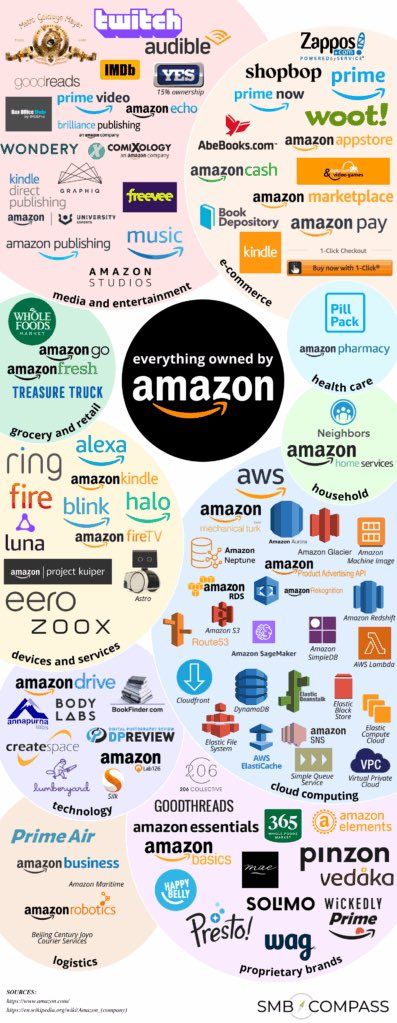

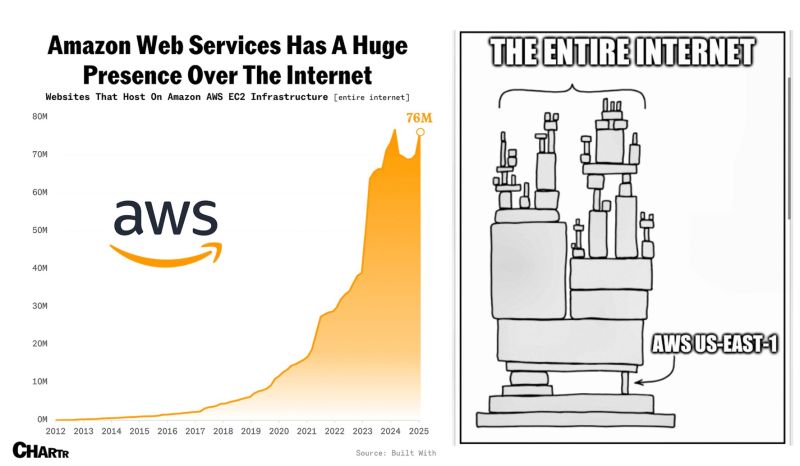

Amazon owns half the internet…

Prime, AWS, Twitch, Whole Foods, Ring, Zoox, Audible, Kindle, Alexa - the list never ends. Source: Dividend Talks on YouTube @DividendTalks

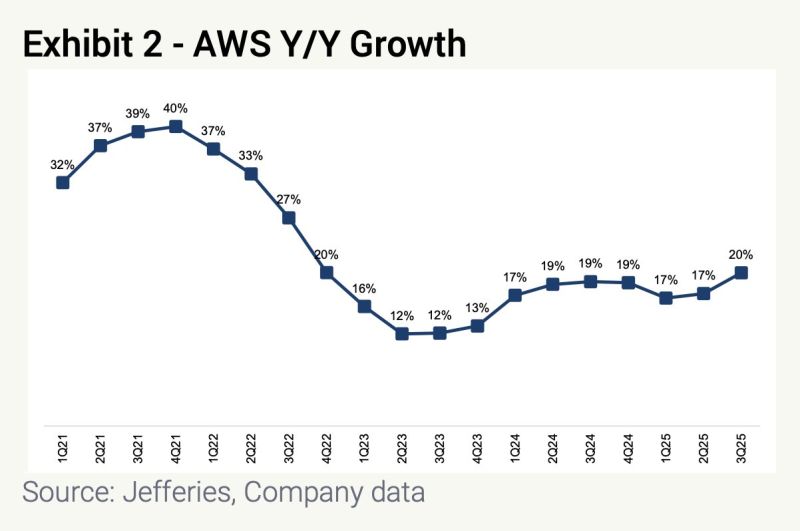

2006: AWS annual revenue was $21 million / 2025: $21 million every 1 hour, 22 min

Source: Jon Erlichman @JonErlichman

📈 The comeback of Amazon — in one chart!

🚀 AWS is back in growth mode. Demand for cloud computing is on fire, and Amazon Web Services is accelerating fast. 💡 According to CEO Andy Jassy, AWS’s power capacity is on track to double the levels seen in 2022 — and then double again by 2027. That’s not just a rebound — it’s a full-blown AI-fueled growth surge. 🔥 The message is clear: the AI trade still has momentum, and Amazon is positioning itself right at the center of it. Source: Jefferies, HolgerZ

76 Million websites are hosted on Amazon's $AMZN AWS EC2 Infrastructure

Source: Chartr, Elon Musk

Investing with intelligence

Our latest research, commentary and market outlooks