Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

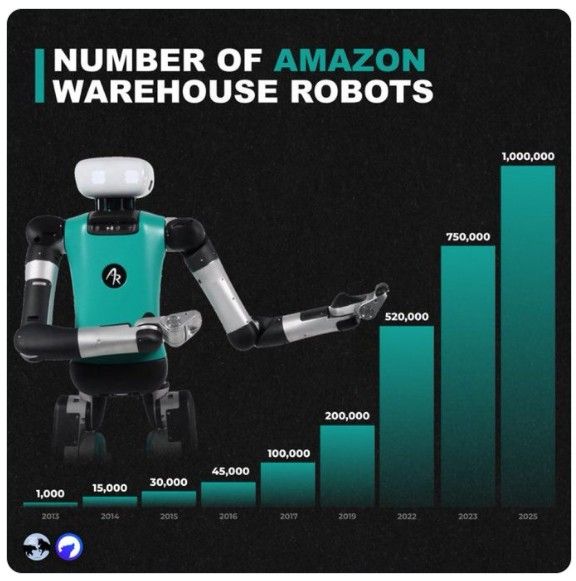

In the last 10 years, $AMZN fulfilment has 22x the number of packages handled per employee, while the number of employees per facility has gone down.

With AI, humanoids & more investment going into AI, this will only accelerate. $AMZN's retail margin might surprise investors. Source: Rihard Jarc on X, WSJ

Amazon $AMZN now has 1 Million robots deployed in its business operations

Source: Blossom @meetblossomapp

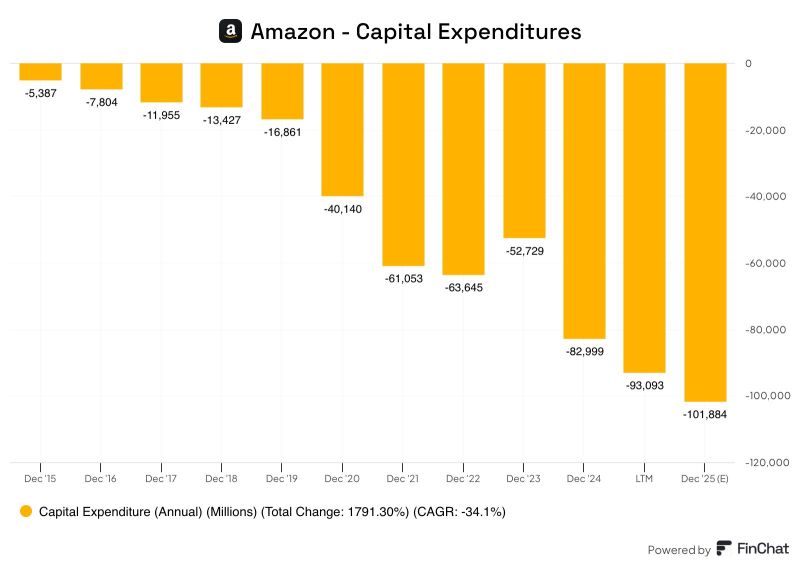

Amazon will be the first company ever to spend more than $100 billion on capital expenditures in a single year.

More than 50% of that CapEx will be spent on tech infrastructure. How much more runway does AWS have to grow? $AMZN Source: finchat

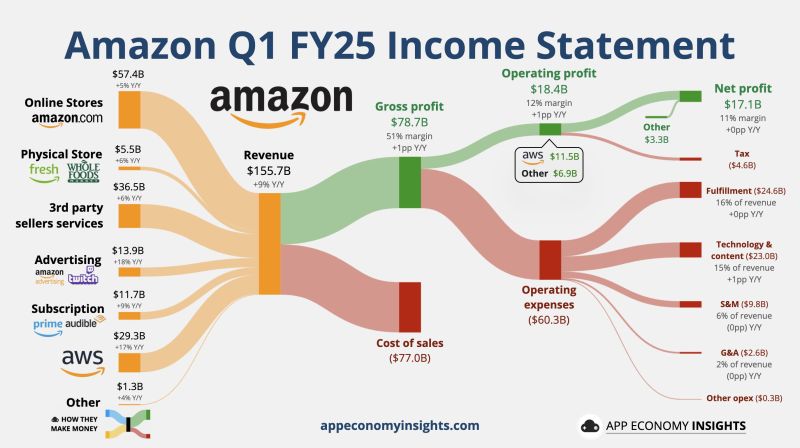

Amazon (AMZN) reported its first quarter earnings after the bell on Thursday beating on the top and bottom lines but offered lighter than anticipated guidance for its Q2 operating income.

The stock is down -4% after-hours ➡️ For the quarter, Amazon saw earnings per share (EPS) of $1.59 on revenue of $155.7 billion. Wall Street was anticipating EPS of $1.36 and revenue of $155.1 billion, according to Bloomberg consensus estimates. The company reported EPS of $0.98 and revenue of $143.3 billion in Q1 last year. AWS revenue came in at $29.2 billion versus expectations of $29.3 billion. ➡️ For the second quarter, Amazon said it anticipates operating income of between $13 billion and $17.5 billion. Analysts were expecting $17.8 billion. The company saw operating income of $14.7 billion in Q2 2024. ➡️ The company also said it anticipates a 10-basis point impact to its Q2 sales. ➡️ Amazon shares fell more than 4% following the report. ➡️ $AMZN Amazon Q1 FY25: • Revenue +9% Y/Y to $155.7B ($0.6B beat). • Operating margin 12% (+1pp Y/Y). • EPS $1.59 ($0.23 beat). • Q2 Guidance: ~$161.5B ($0.4B beat). ☁️ AWS: • Revenue +17% Y/Y to $29.3B. • Operating margin 39% (+2pp Y/Y). Source: App Economy Insights, Yahoo Finance

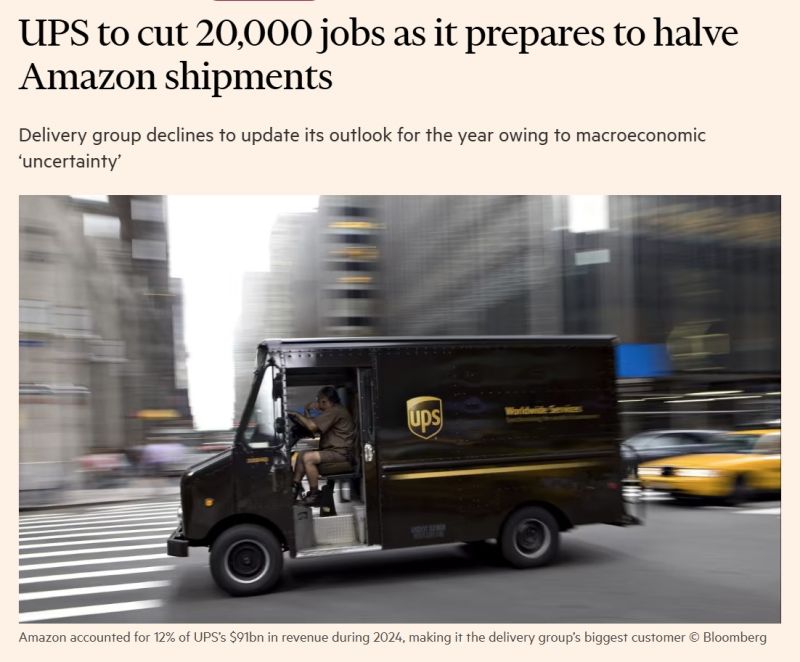

UPS has said it will cut 20,000 jobs this year and close more than 70 buildings

as the logistics group seeks to reduce costs and prepare for a halving in package volume from Amazon, its biggest customer. The job cuts will target workers responsible for delivering packages to customers and supporting UPS’s transportation and logistics services, and come after the group last year cut about 14,000 jobs, primarily in management roles. The latest reduction in headcount is part of UPS’s plan to boost efficiency and consolidate its US domestic network after it said in January it had reached an agreement in principle with its “largest customer” to lower its volume by the second half of 2026.

WELLS FARGO + COWEN FLAG AWS DATA CENTER LEASING PAUSE

Both banks say Amazon $AMZN AWS has hit pause on some colocation leasing deals—mainly international. Cowen notes hyperscale demand is cooling a bit, especially in Europe, with Amazon slightly pulling back on U.S. colocation activity too. Wells Fargo heard from multiple sources that AWS is stepping back from ongoing leasing talks, mirroring what’s been seen from Microsoft lately. Source: Wall St Engine

BREAKING: Amazon shareholders request the company explores adds Bitcoin to its treasury.

REMINDER: Microsoft shareholders are set to decide on the firm’s Bitcoin investment proposal this Tuesday, December 10. Source: Dennis Porter @Dennis_Porter, Bitcoin Archive @BTC_Archive

Investing with intelligence

Our latest research, commentary and market outlooks