Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

*AMAZON $AMZN PREPARES FOR LAUNCH OF LOW-COST, TEMU-RIVAL DISCOUNT STORE $PDD

As initially reported back in June, Amazon is preparing for the launch of its new discount online storefront which will compete directly with Chinese e-Commerce rival 'Temu'. Strict "price caps" will be set for merchants, with shockingly low price limits, such as $8 for jewlery and $20 for sofas. Source: Stock Talk on X

After Alphabet $GOOG, it is now the turn of Amazon $AMZN to go nuclear...

It's investing $500 million across 3 new projects: • Building 4 SMRs (small modular reactors) with Energy Northwest • Exploring SMR development with Dominion Energy • Leading SMR developer X-Energy's funding round Source: Stocktwits

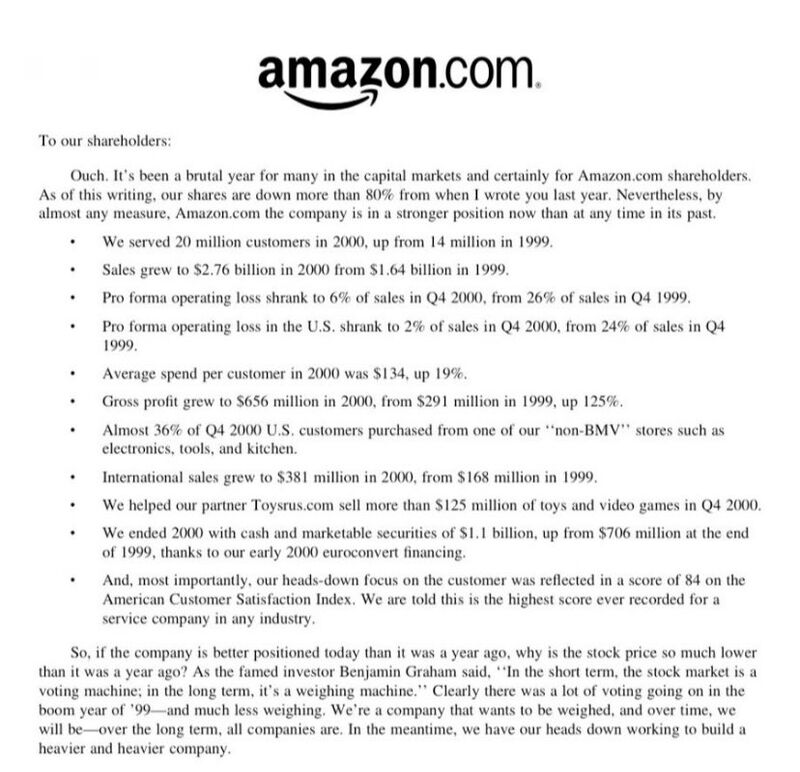

Jeff Bezos letter to shareholders when Amazon stock was down ~80%

Every investor should read this: (source: Matt Allen)

In case you missed it...

Intel & Amazon just Announced an Extended Multi Year Multi Billion Dollar Partnership. $INTC 📈 was up +10.85% in after hours Source: Trend Spider

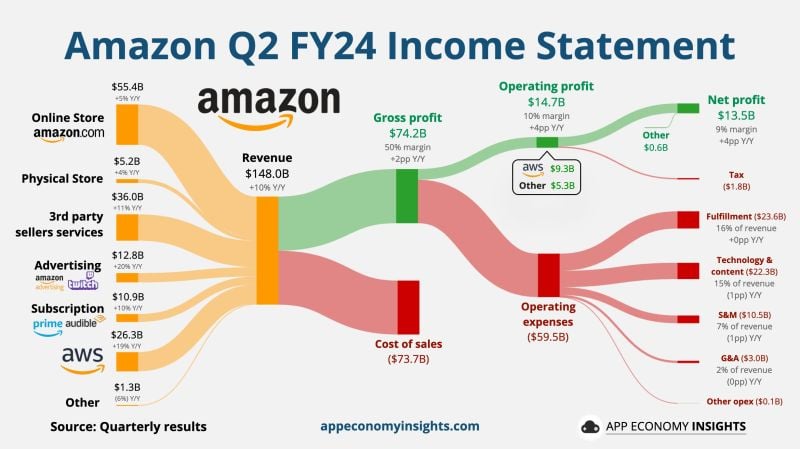

Amazon reported weaker-than-expected revenue for the second quarter on Thursday and issued a disappointing forecast for the current period.

The shares slid as much as 6% in extended trading. Here's how $AMZN Amazon did in Q2 FY24: • Revenue +10% Y/Y to $148B ($0.8B miss). • Operating margin 10% (+4pp Y/Y). • FCF $53B TTM. ☁️ AWS: • Revenue +19% Y/Y to $26.3B. • Operating margin 36% (+11pp Y/Y). Q3 FY24 Guidance: • Revenue ~$154-$158.5B ($158.3B expected).

Amazon enters elite $2tn club as AI optimism fuels rally.

Amazon up ~27% this year, driven by improving growth trends as AI re-accelerates its cloud-computing business. The milestone puts Amazon into an exclusive club of comps worth $2tn or more: Alphabet crossed the level in April, while Nvidia, Microsoft, and Apple are all worth north of $3tn. (via BBG)

Amazon Web Services launched in 2006.

Sales that year were $21 million. Today, it’s $21 million in LESS THAN TWO HOURS... Source: Jon Erlichman

Investing with intelligence

Our latest research, commentary and market outlooks