Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

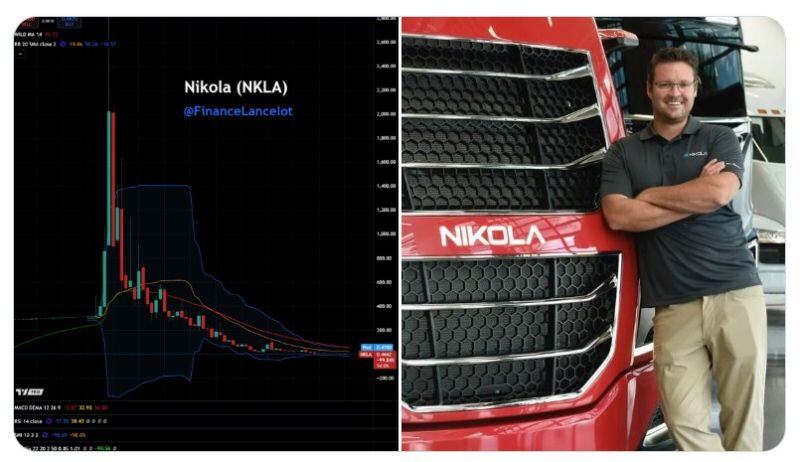

Nikola $NKLA officially files for bankruptcy.

From $2,828 to $0. What a ride... Source: Financelot @FinanceLancelot

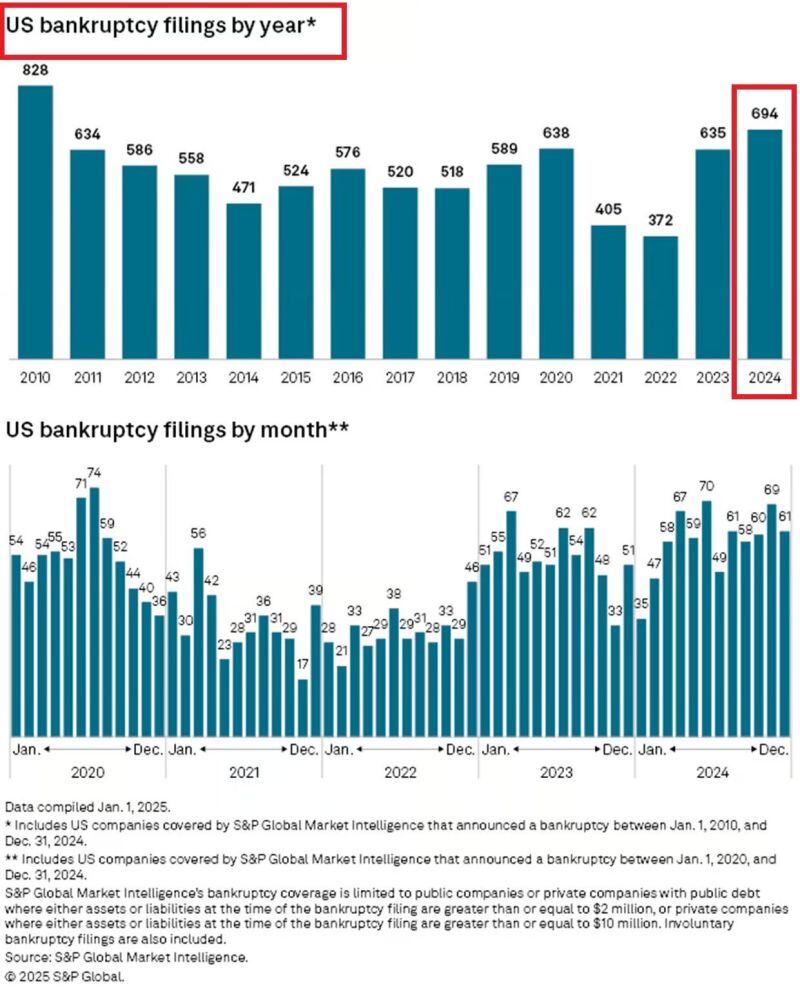

➡️ US large BANKRUPTCIES are accelerating:

There were 70 US bankruptcy filings in January, in line with the largest monthly number since the 2020 CRISIS. This comes after bankruptcies hit 694 in 2024, the most in 14 YEARS. Bankruptcies are rising as if there is a crisis. Source: Global Markets Investor

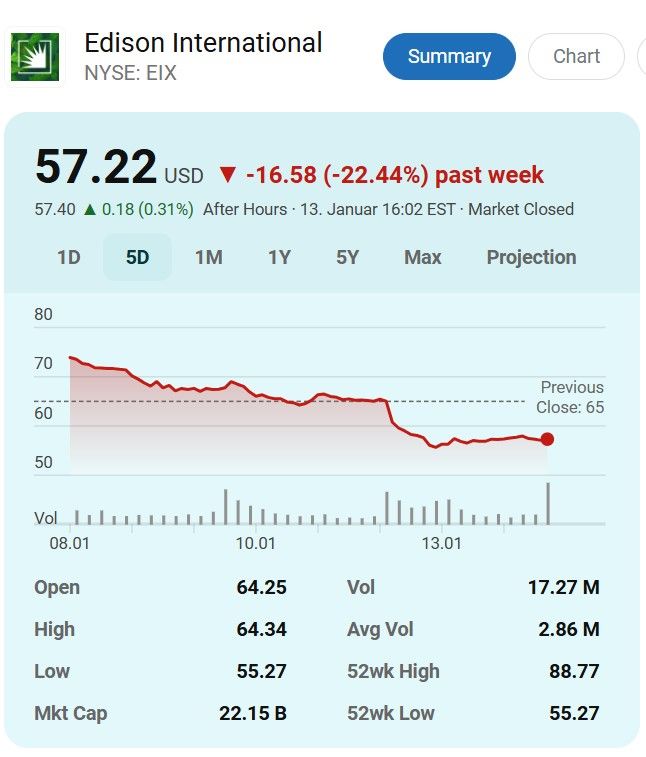

Did powerlines cause the Los Angeles wildfires?

Edison International stock, $EIX, the parent company of Southern CA Edison, is currently crashing. It's now down -30% since the fires began, erasing $10 BILLION of market cap. Could this be the next big bankruptcy? Source: The Kobeissi Letter

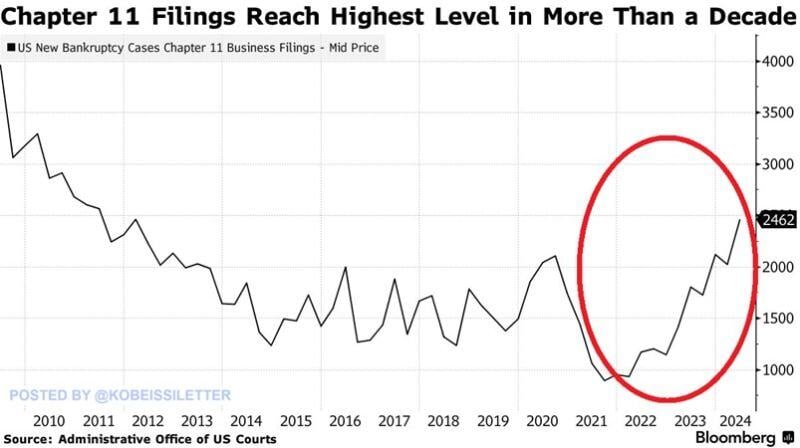

BREAKING: The number of US bankruptcies currently under Chapter 11 jumps to 2,462, the highest count in 13 years.

A Chapter 11 filing involves court-supervised reorganization and allows a company to stay in business and restructure its finances and operations. These bankruptcies have more than DOUBLED in just 2 years. This comes after many companies have struggled to make their debt payments as the Fed raised interest rates to the highest level in 23 years. Source: Bloomberg, The Kobeissi Letter

Interesting article by Financial Times:

Three in four audit reports failed to warn that companies risked going bankrupt in the year before their collapse. Here's how each of the Big Four performed: https://on.ft.com/3UFVHLG

In the last week - Commercial Real Estate Stress

- New York Community Bank (USA) - Aozora Bank (Japan) - and now: *Deutsche Pfandbriefbank, under pressure in Europe, more real estate cracks, banking concern, etc" Source: Bloomberg, Lawrence McDonald

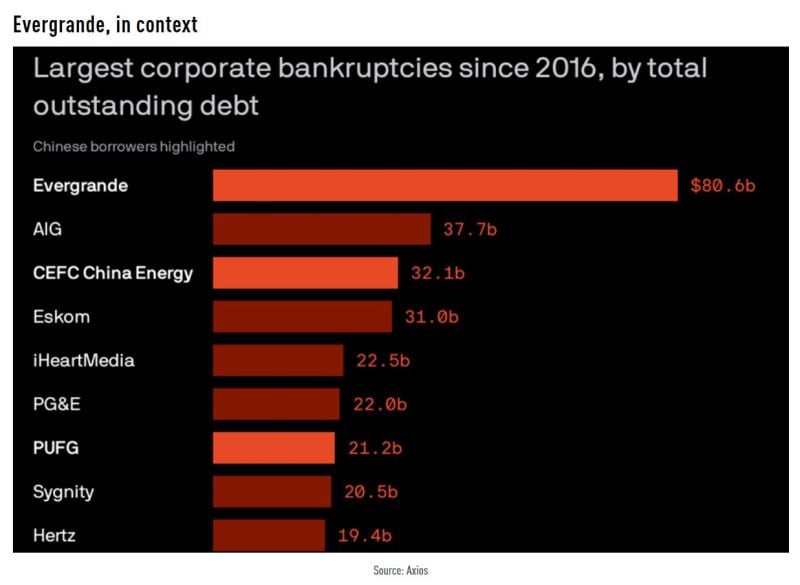

Evergrande, which has now been ordered to liquidate, has an astonishing $300 billion in liabilities.

That places it near the very top of the all-time list of corporate bankruptcies. A lot of Evergrande's liabilities are down payments that Chinese homebuyers made on apartments that remain unbuilt. But even just looking at the bonds and loans outstanding, the amount is greater than $80 billion. Source: TME, Axios

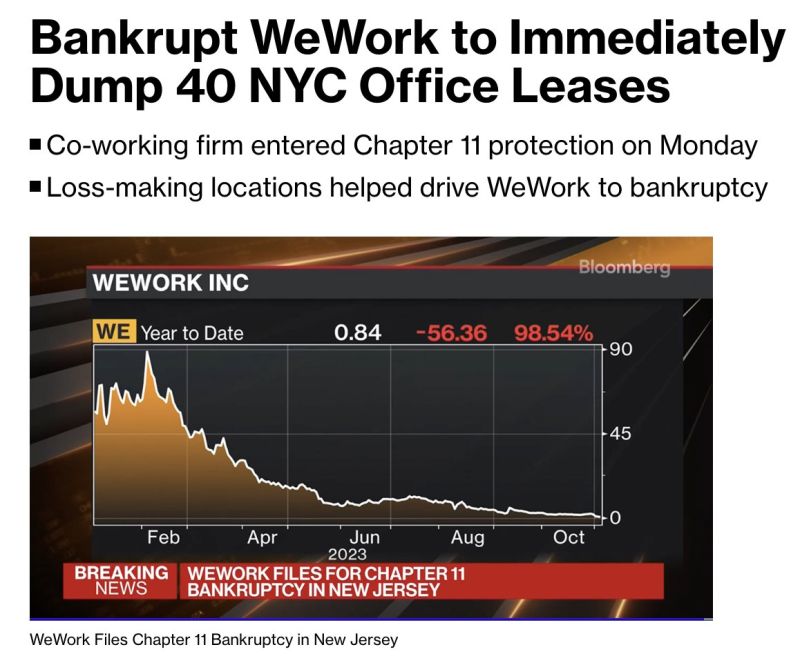

From The Kobeissi Letter -> Bankruptcy documents show that WeWork, $WE, will immediately break 40 office leases in New York City

Documents also show that WeWork plans to break leases on 70 properties in New York City. Note that 40 of these locations are completely empty. Once a $47 billion company, WeWork still has 700 locations world wide. Could this bankruptcy worsen the commercial real estate crisis?

Investing with intelligence

Our latest research, commentary and market outlooks