Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Nobody stays in a job for the perks.

People stick around when they have: 👉 Autonomy 👉 Trust 👉 Growth 👉 Fair pay 👉 Work-life balance Source: Corporate Rebels

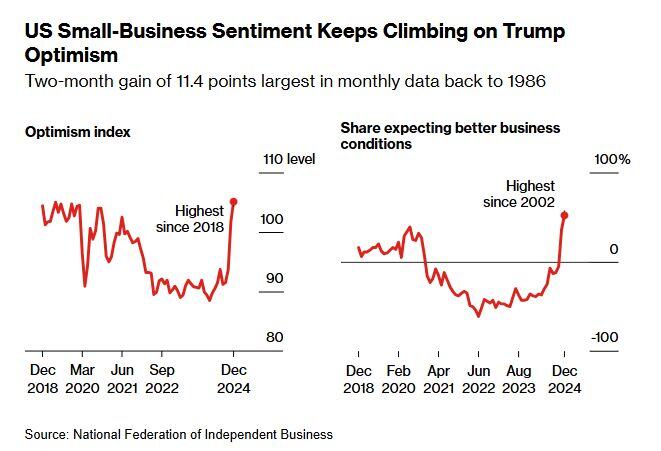

US Small-Business Optimism Hits Highest Since 2018 Post Election

- Bloomberg thru Christophe Barraud on X

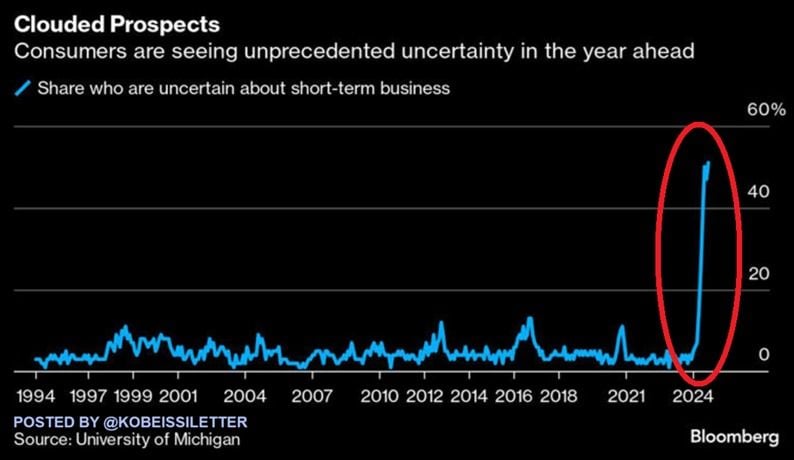

Americans have never been so worried about the year ahead:

The share of consumers uncertain about business conditions over the next year spiked to 51% in September, the most on record. The percentage has DOUBLED in 4 months. Over the last 30 years, the share of consumers concerned about short-term business prospects has never been so high. Americans have been hit by historically high costs of living, elevated borrowing costs, and the deteriorating job market. US households are struggling. Source: The Kobeissi Letter

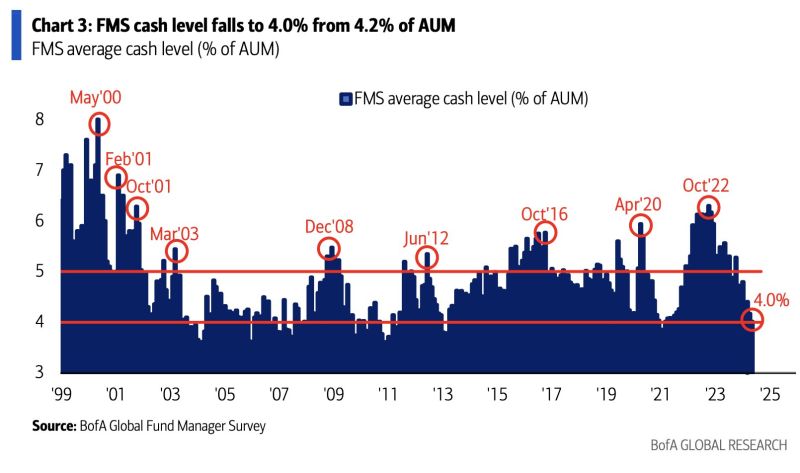

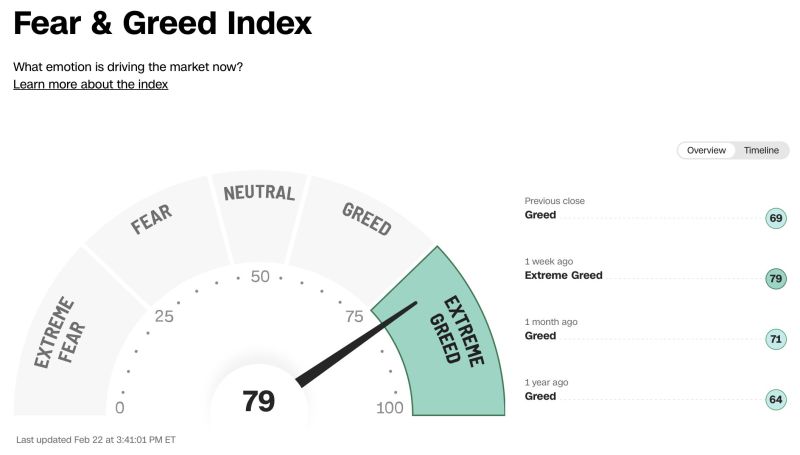

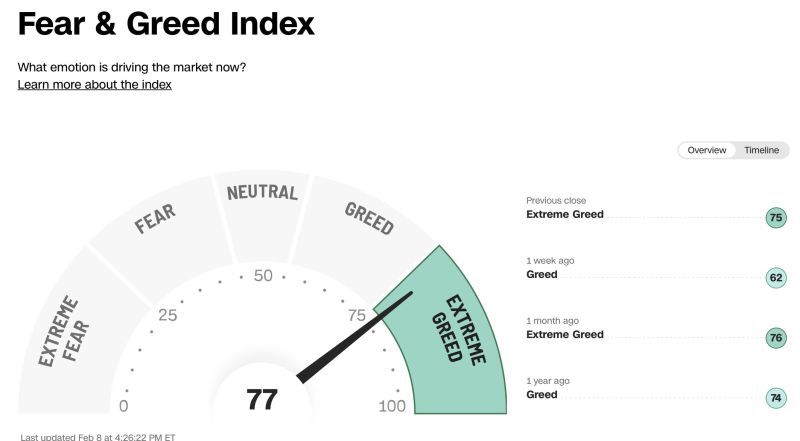

Are investors too complacent?

May Fund Manager Survey (FMS) sentiment is at the most bullish level since Nov’21, BofA says. The average cash level of FMS investors fell to 4.0% of AUM from 4.2%, the lowest level since Jun’21. Source: BofA, HolgerZ

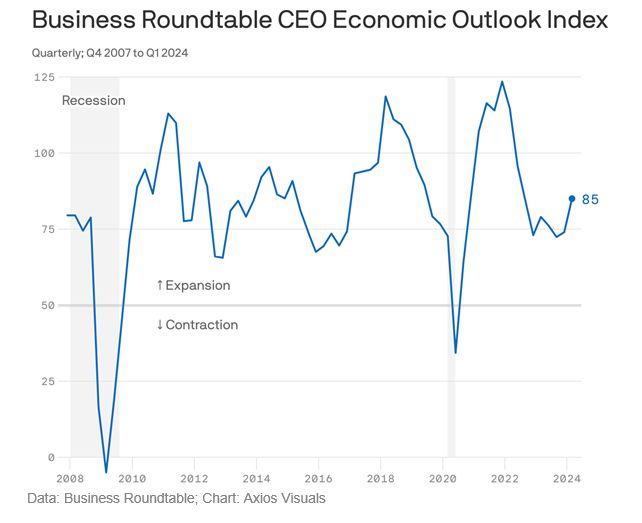

CEOs' economic outlook is surging

America's top executives are strikingly more confident about the economy, with expectations of stronger sales and capital investments. For the first time in two years, the Business Roundtable's quarterly gauge of CEO sentiment is above its historical average. By the numbers: The lobbying group's index jumped by 11 points in the first quarter to 85 — topping the long-running average by 2 points. source : axios

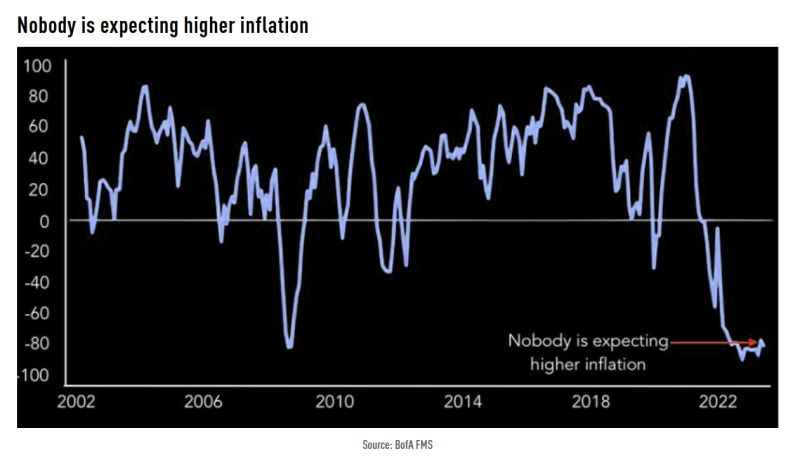

According to latest Fund Manager Survey by BofA, nobody is expecting higher inflation

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks