Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- bitcoin

- Asia

- markets

- technical analysis

- investing

- europe

- Crypto

- Commodities

- geopolitics

- tech

- performance

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- china

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- africa

- Market Outlook

- Flash

- Focus

Sentiment and overly bullish positioning remain short-term hurdles for the stock market

Too positive

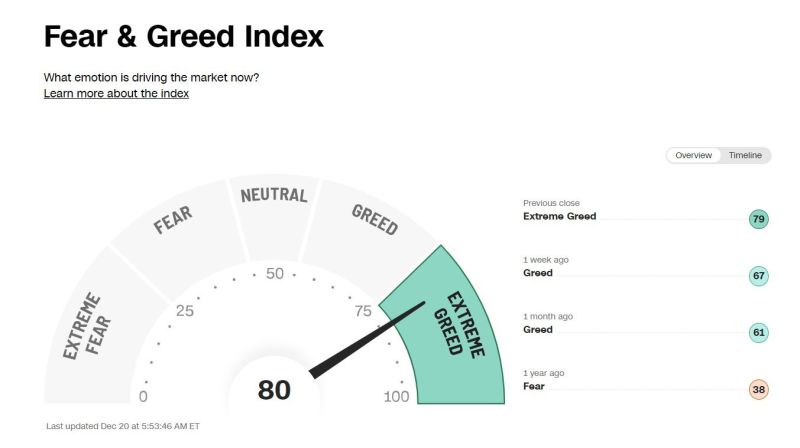

Yesterday's big correction took place just at the time the Fear & Greed Index hits 80, Extreme Greed, for the first time since July 27th

July 27th also happens to be the day when the S&P 500 topped and fell ~6% in 3 weeks. However, the decline was driven by a more hawkish than expected Fed outcome. Now, the rally is being driven by what appears to be a "Fed pivot." Source: The Kobeissi Letter

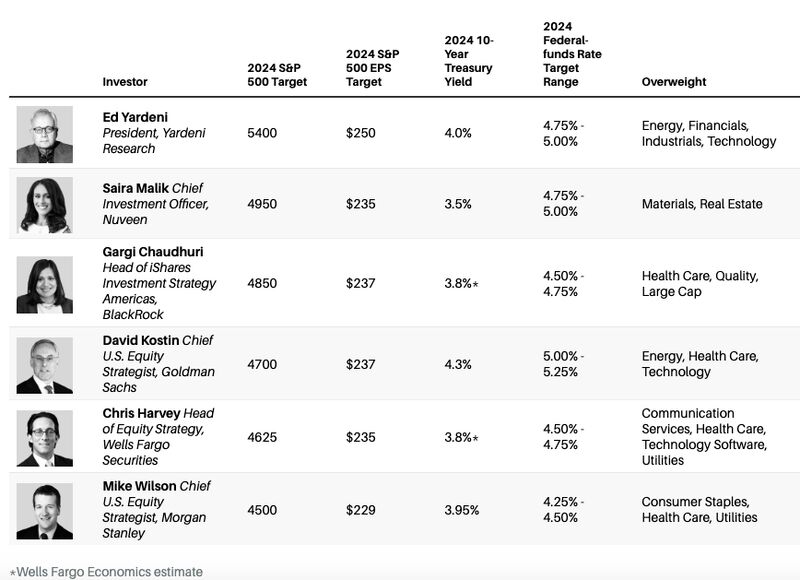

The average market strategist's 2024E S&P 500 target is 4837 with EPS of $237 for a return of 2.5% (excluding dividends) and a P/E of 20.4

Source: Julian Klymochko

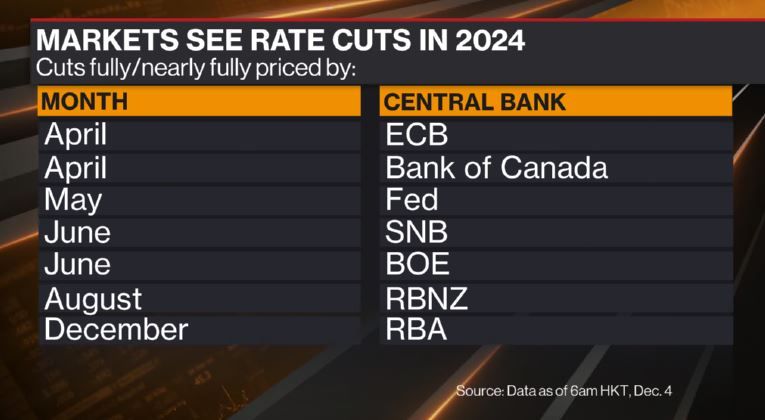

2024 is expected to be a year of interest rate cuts

Here's what's currently priced in markets of who does what when. Source: Bloomberg, David Ingles

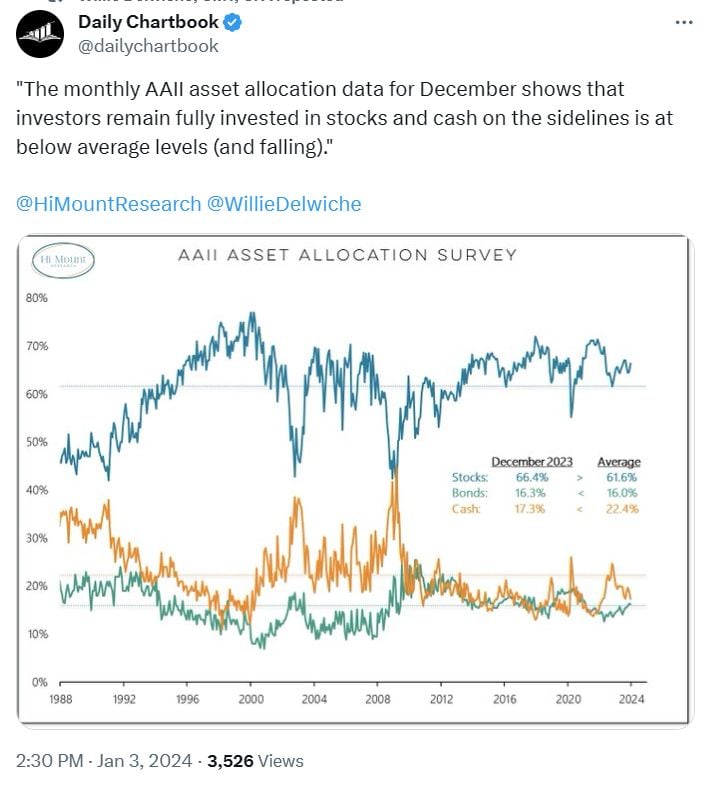

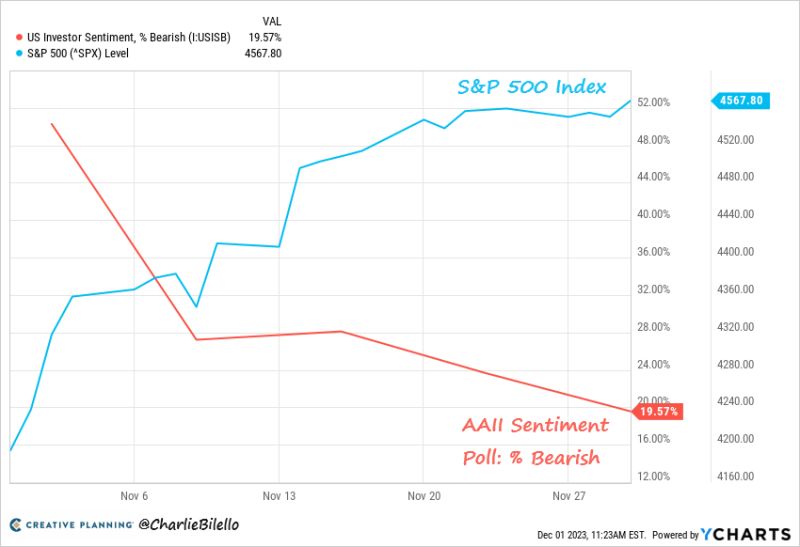

Sentiment is turning bullish. Bears in the AAII sentiment poll moved from over 50% to under 20% during November

This is the lowest bearish % since Jan 2018 (which followed 2017's record 12 straight up months). What changed? Prices. The S&P 500 gained 8.9% in November, one of its best months ever. $SPX Source: Charlie Bilello

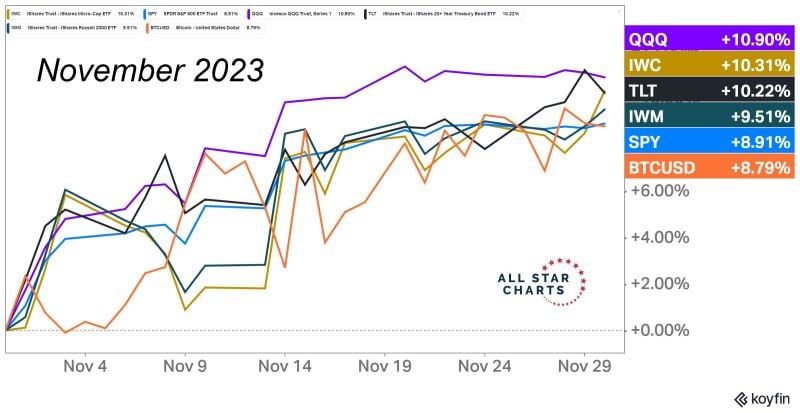

As of the end of October, investor's sentiment index was almost at maximum fear

But November turns out to instead be among one of the greatest months in stock market history. Source: J-C Parets

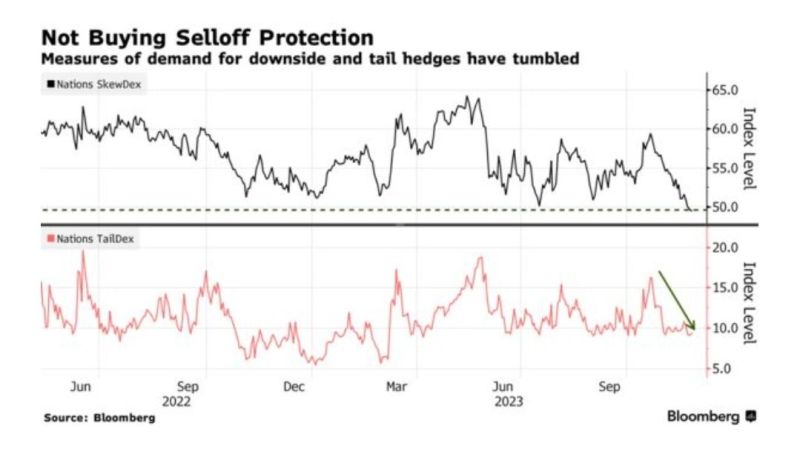

Hedging demand has fallen sharply with the cost to protect against a market selloff down by around 10%, or one-standard deviation, tumbling to the lowest ever in data starting in 2013

Demand for tail-risk hedges that pay out in an equity fall as precipitous as 30% has also dropped and is hovering around the lowest level since March.- Bloomberg

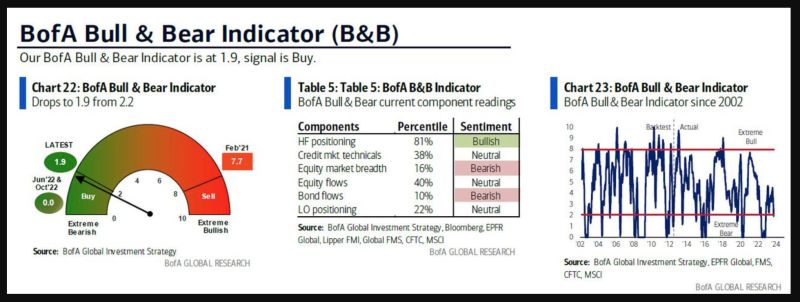

Wall Street biggest bear (BofA's Harnett) turns bullish as investors' sentiment turns extremely bearish (which is bullish from a contrarian perspective)

Indeed, with the S&P down in five of the past seven weeks, BofA's Bull & Bear Indicator just printed at 1.9 (extreme bearish), which according to Hartnett means that a contrarian buy signal for risk assets has been triggered.

Investing with intelligence

Our latest research, commentary and market outlooks