Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

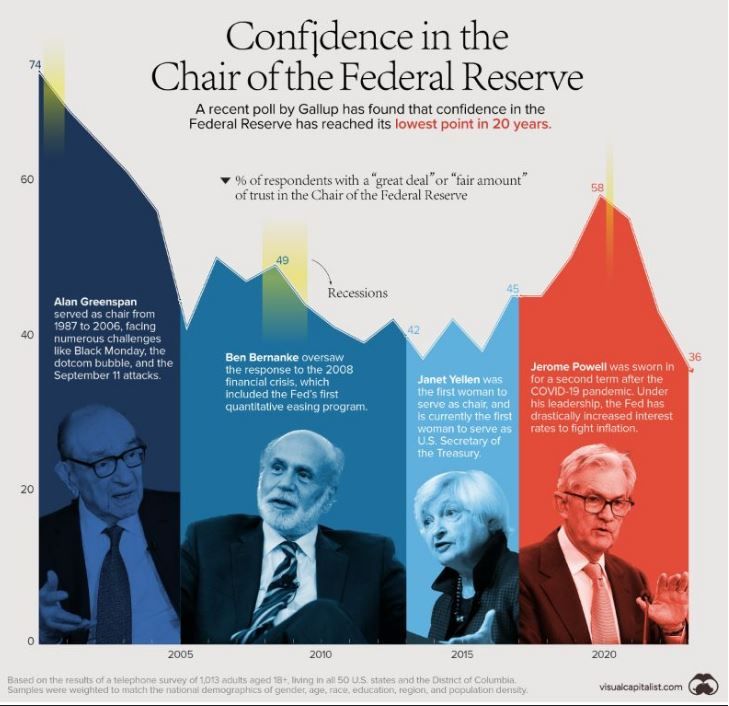

Ahead of Powell speech tomorrow...

Confidence in the Chair of the Federal Reserve has reached its lowest point in 20 years... By Visual capitalist

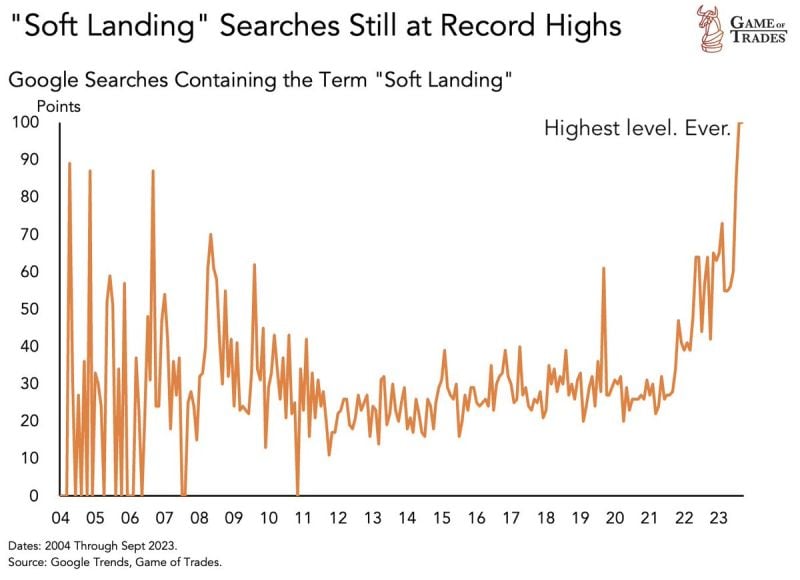

Soft landing?

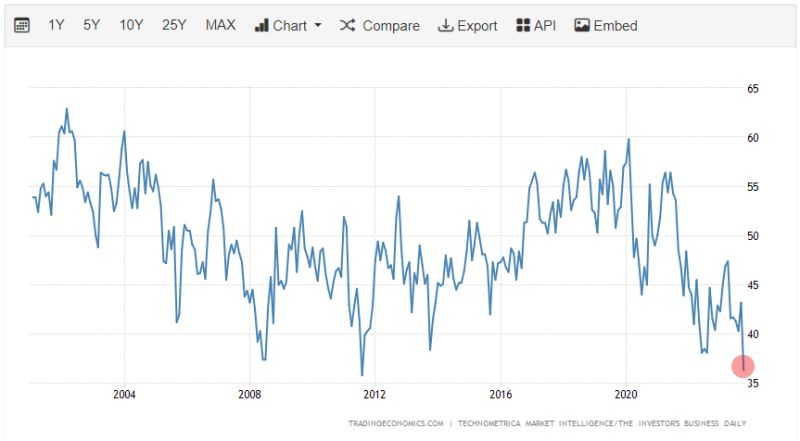

U.S. Economic Optimism Index plummeted to 36.3 in October, the lowest reading ever recorded. Source: Barchart

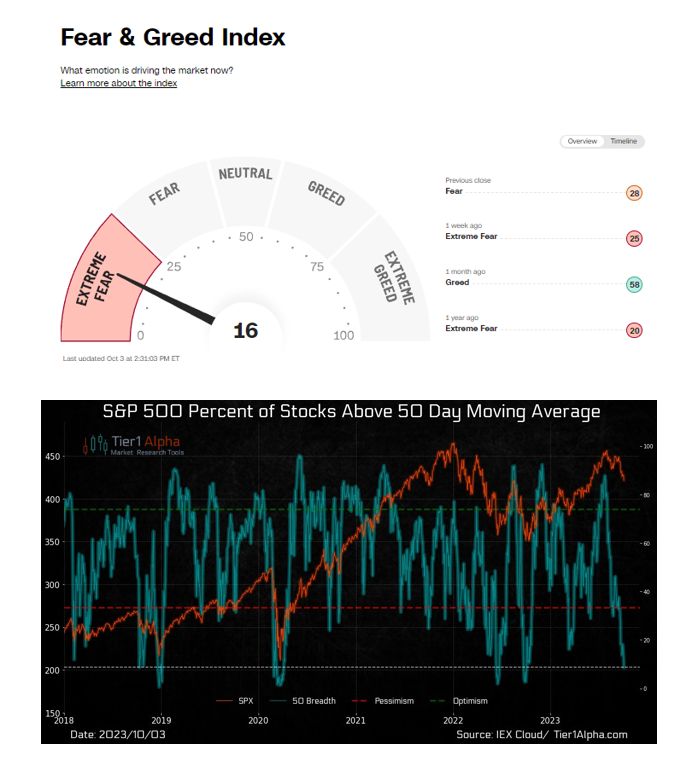

EXTREME FEAR ?

-> Stock Market Fear & Greed Index falls to 16, the most fearful its been in the last year. Meanwhile, only 8% of $SPX stocks are currently trading above their respective 50-day moving averages, representing a 2%ile move over the last decade... Source: barchart

“Soft Landing” is still the consensus. But consensus doesn’t have a good track record...

Source: Game of Tardes

Sentiment among consumers in Germany keeps deteriorating as persistently high inflation encourages people to save & blots out chances of a recovery before year-end

GfK German Consumer Sentiment Index drops to -26.5 in Oct from -25.6 in Sep. An indicator BELOW 0 signals YoY contraction in private consumption. Source: HolgerZ, Bloomberg

JACKSON HOLE: A RISK MANAGEMENT SPEECH

FACTS: The overall tone of Chair Powell’s Jackson Hole speech was relatively hawkish but not as hawkish as some feared on the back of recent strong data. It was also less hawkish than last year. The main message is that The Fed is definitely on hold but leaning on a more hawkish stance should data don’t show more progress in inflation / growth cooling down. OUR TAKE: The big event is now behind us, and we didn’t learn anything new. Powell believes that monetary policy is tight, but he opens the door to an even tighter one. With regards to macro data, they are going into the right direction but there is a risk of further upside, i.e interest rates path remains very data dependent which means that markets will now turn its attention to PCE inflation and US jobs data (next week). The Fed is likely to stay nervous as long as they see evidence of a serious break in job growth below the 200K pace. We are not there yet, which means that in the coming weeks, we will likely see macro volatility leading to market volatility. Our view remains that central bankers want first and foremost to avoid the big mistake (rather than targeting a pre-defined target). In the previous decade, central bankers wanted to avoid the deflation trap, hence the over-printing. This time, they want to avoid the risk of another round of inflation. Hence the temptation of over-tightening. MARKET REACTION: Rate-hike expectations initially moved lower but then reverted higher after investors actually read and listened to his speech. 2Y yields are back to July highs and equity markets are whipsawing.

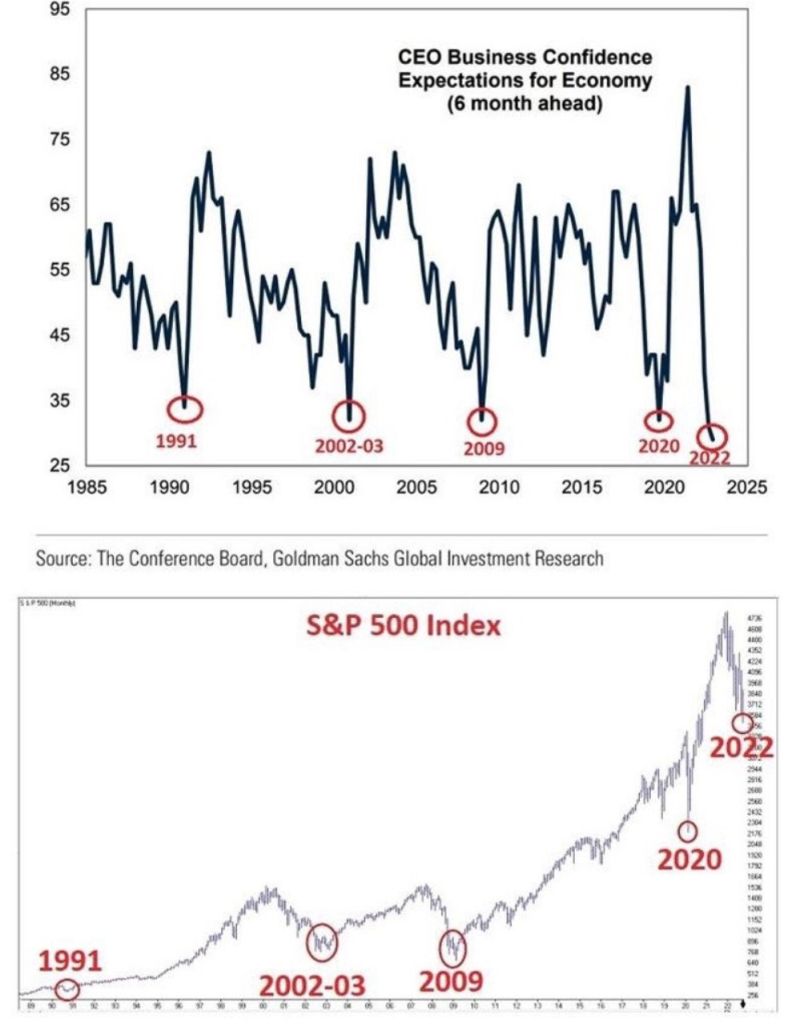

Think you're bad at timing the market? CEOs Business Confidence historically hits the lowest level at market bottoms...

Sounds like an effective contrarian indicator... Source: Brian Feroldi

Hedgeye about investors going nuts (do they?)

Source: Hedgeye

Investing with intelligence

Our latest research, commentary and market outlooks