Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

US BANKS UNDER PRESSURE

With Powell stating that there won’t be significant rate cuts next year and the yield curve un- inverting along with BTFP going away banks were hammered yesterday as most of them have BILLIONS worth of unrealized LOSSES in BONDS. Source: The Coastal Journal

‼️ BREAKING: This doesn't sound like a great mark of confidence...

The Bank of England will hide the identities of any pension funds, insurers or hedge funds bailed out under a new financial stability tool to prevent crisis contagion... Source: Radar @RadarHits - Bloomberg

🥉 Swiss bank UBS smashes third-quarter expectations with $1.4 billion in profit (vs. $667.5 million expected)

👉 Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included: - Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year. - Return on tangible equity hit 7.3%, compared with 5.9% over the second quarter. - CET 1 capital ratio, a measure of bank solvency, was 14.3%, down from 14.9% in the second quarter. The lender said it expects to complete its planned $1 billion share buyback program in the fourth quarter and intends to continue repurchases in 2025. 💪 UBS Sees Uninterrupted Client Momentum: Switzerland's largest bank reports strong transactional activity in its core business and expects to achieve its objective of $100 billion in net new assets by the end of the year. Source: CNBC

Shorts estimated to be $1.3 Billion underwater on silver. Which five banks are at risk??

"Silver prices have experienced a significant increase, rising over 6% to exceed $33.6 per ounce. This unexpected surge has put five U.S. banks at risk of substantial financial losses due to their large short positions in the metal. This amounts to approximately 707.9 million ounces, nearly equaling a year’s global silver production". Source: Yahoo Finance, @kshaughnessy2 on X

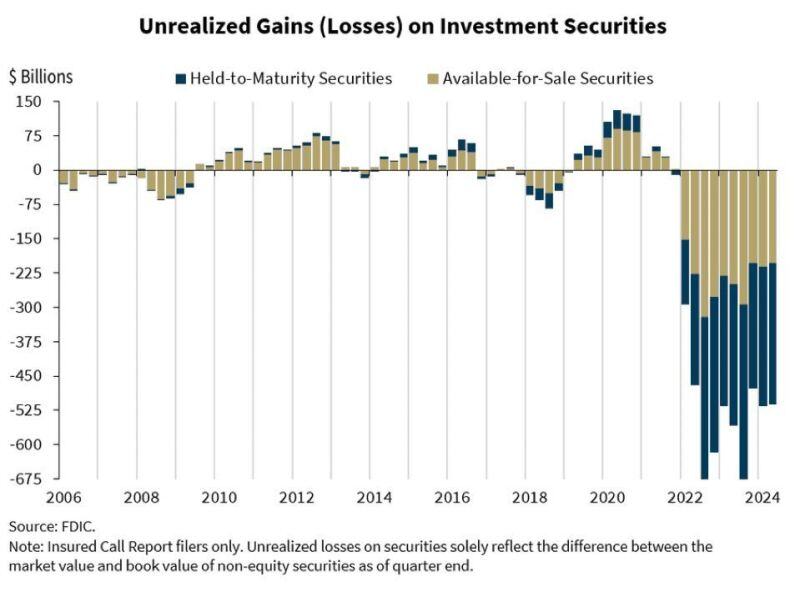

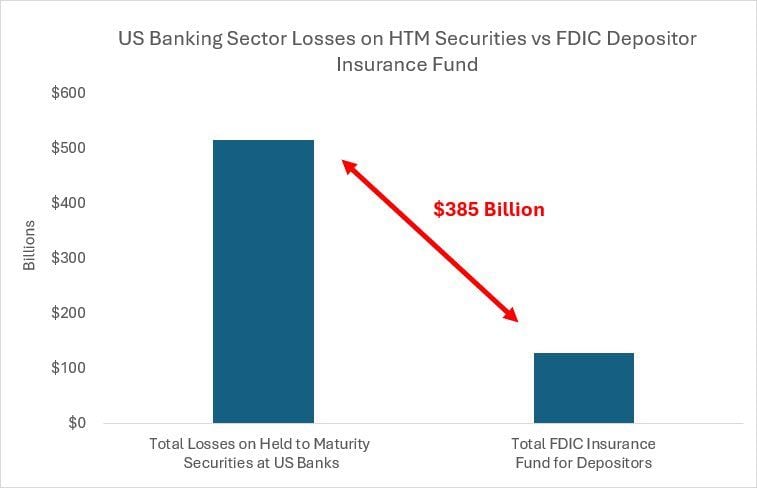

The scale of unrealized losses at U.S. banks is staggering, currently standing at $515 billion.

To put this in perspective, that's 7x higher than during the 2008 financial crisis. And the chart below helps to understand the scope of the problem... Source: Porter Stansberry @porterstansb on X

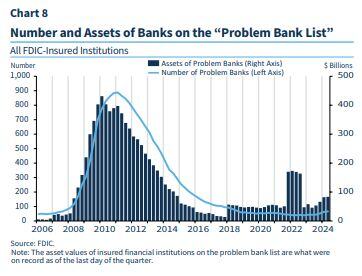

FDIC warns that 66 US banks face the possibility of insolvency after being added to its problem list

Source: Barchart, FDIC

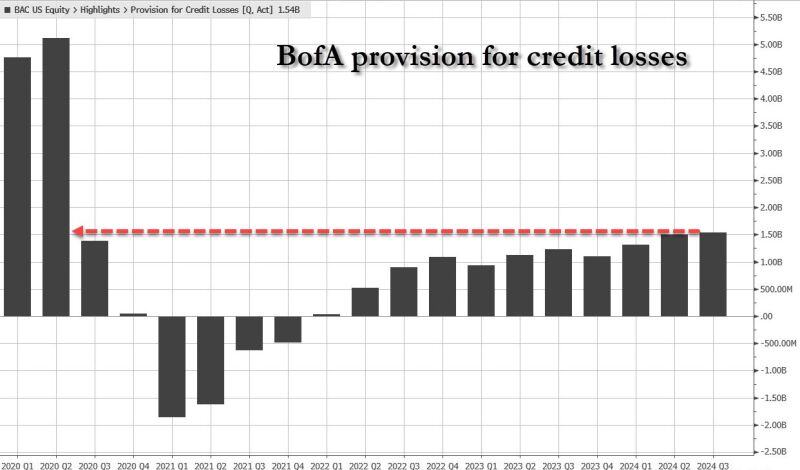

Why Buffett is dumping Bank of America $BAC stock:

Provision for credit losses highest since covid lockdown Source. zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks