Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

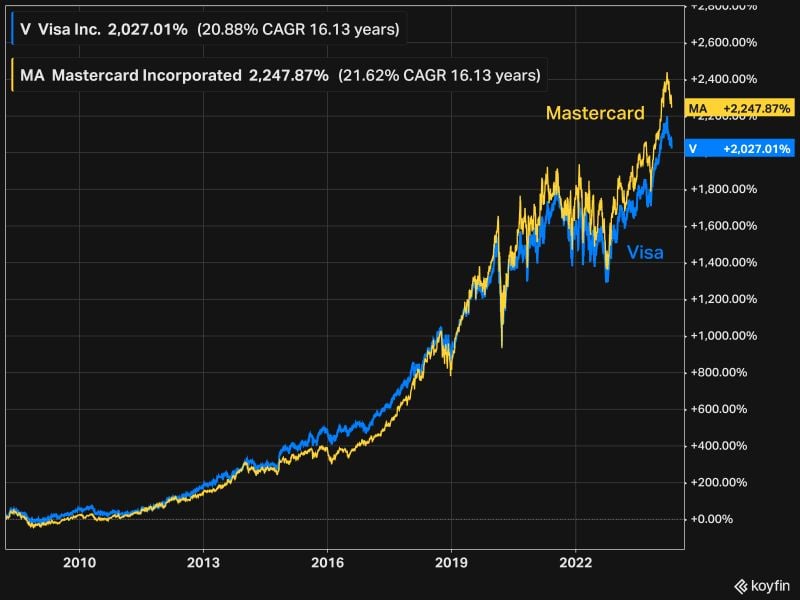

16 years of Mastercard vs Visa.

Both $MA (21.6%) and $V (20.9%) have remarkable CAGRs over that period. They have been pretty correlated throughout the period, taking over the world in unison. Source: Bloomberg, KoyfinCharts

European banks are apparently doing brilliant business in Russia…

In 2023, they paid 4 times more taxes to the Russian state than they did before the war in Ukraine... According to the FT, Deutsche Bank has increased its profits in Russia from €26mln before the war to €40mln in 2023, while Commerzbank has more than tripled its profits to €51mln. The German state holds a 15.8% stake in Commerzbank. Italian and Austrian banks are doing a killing as well… Western lenders have benefited from the imposition of sanctions on most of the Russian financial sector, which has denied access to the Swift international interbank payment system. That made international banks a financial lifeline between Moscow and the West. Source: FT, HolgerZ

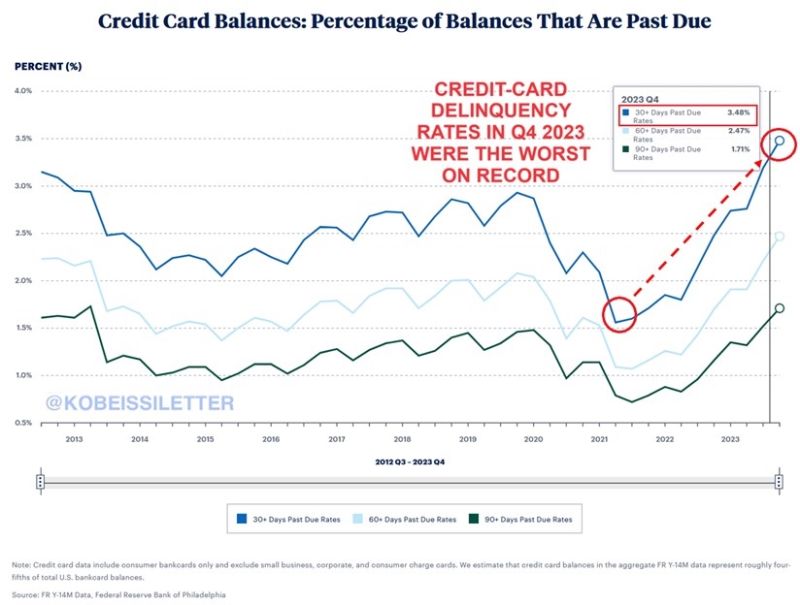

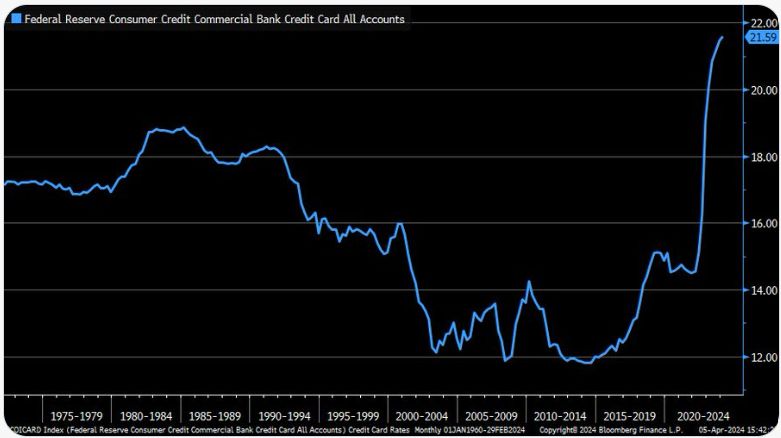

US credit card delinquency rates are now at their highest on record, according to the Philadelphia Fed.

In Q4 2023, more credit card balances were 30+ and 60+ days past due compared to any other period in history. The percentage of credit card balances at least 30 days past due is now ~3.5%. Meanwhile, total credit card debt has skyrocketed in recent months and is now at a record $1.3 trillion. The average credit card interest rate is also at record 28%, according to Forbes. Source: The Kobeissi Letter

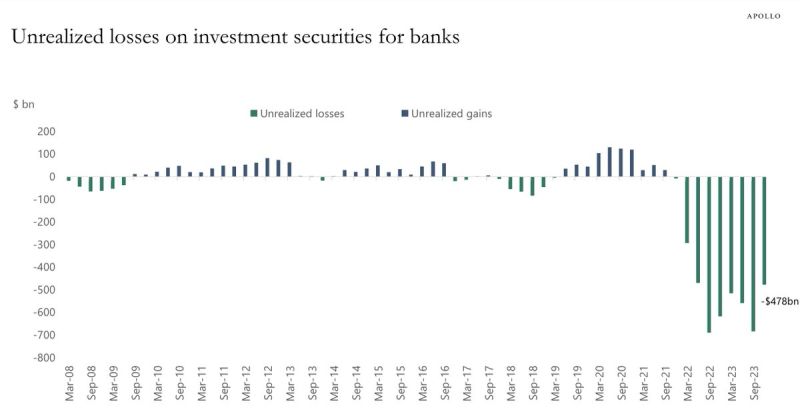

Just as everyone forgot, banks continue to carry alarming amount of unrealized losses.

In Q4 2023, unrealized losses on investment securities for banks hit $478 BILLION. This compares to over $100 billion of unrealized GAINS seen in 2020 when the Fed started cutting interest rates. Meanwhile, the Bank Term Funding Program has officially expired. This was the emergency loan program established during the regional bank crisis. Who will step in now? Source: The Kobeissi Letter

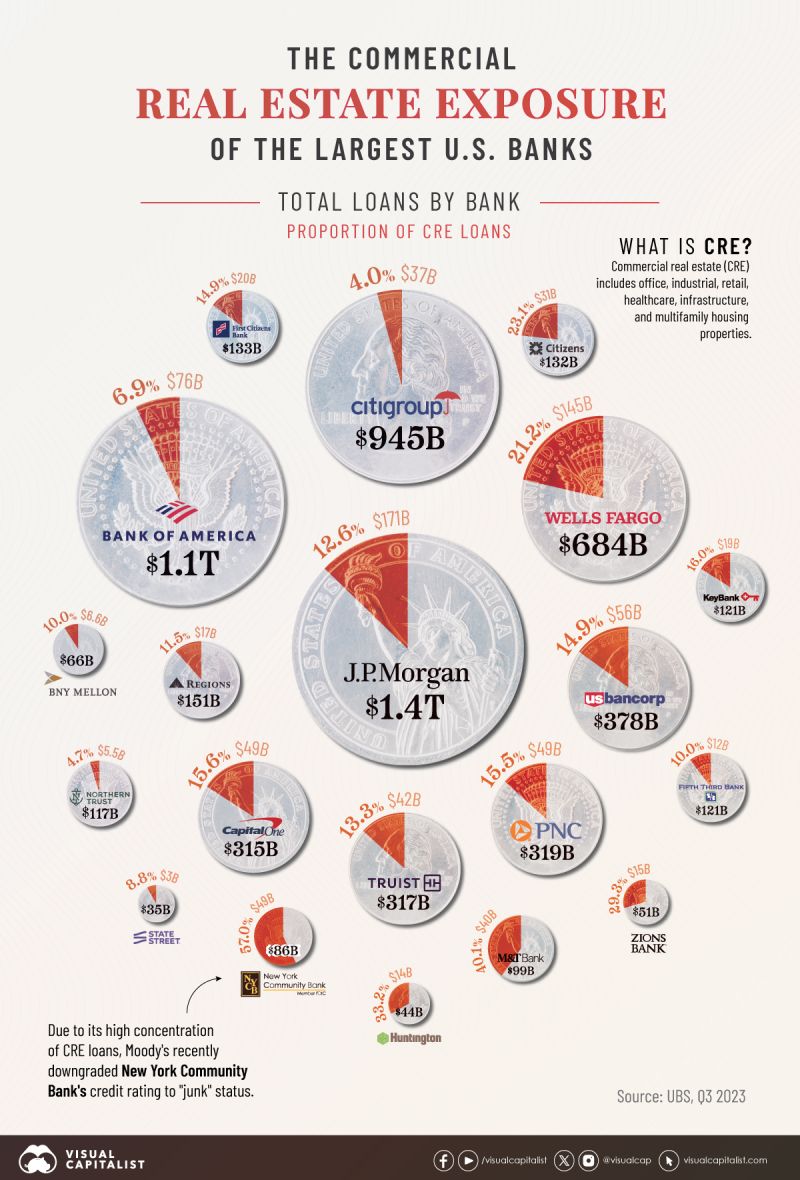

Major U.S. Banks, by Commercial Real Estate Exposure

This graphic shows the 20 largest U.S. banks by assets, and their exposure to commercial real estate as a percentage of total loans. source : visualcapitalist

Investing with intelligence

Our latest research, commentary and market outlooks