Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

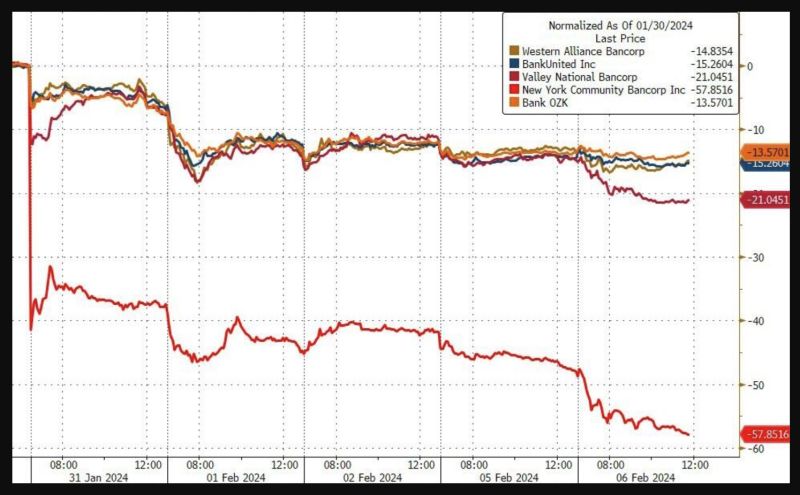

New York Community Bank stock, $NYCB, the bank that acquired the collapsed Signature Bank, crashes another 25% today.

The stock is now down a massive 61% in 2024 to its lowest level since June 2000. Currently, roughly 40% of NYCB's assets are not under FDIC insurance. The stock's decline accelerated after the bank posted an unexpected $260 million loss in Q4 2023. Is the regional bank crisis back? Is it NYCB just the first domino to fall? Source chart: www.zerohedge.com

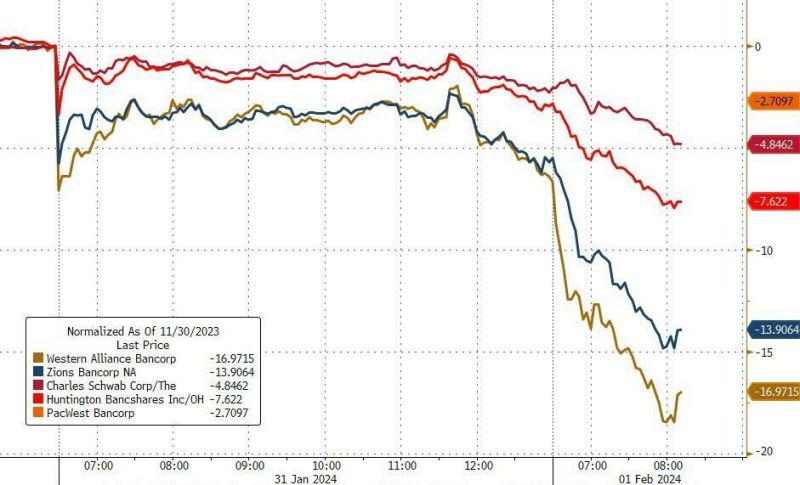

Multiple small us banks tumbled high-single and double digits.

There is a silver lining though -> the market quickly remembered that it was precisely the bank crisis last March that sparked a powerful Fed response (BTFP), and a violent rally, and we got the same thing today as stocks slingshot sharply higher closing 1.1% higher... Source: www.zerohedge.com

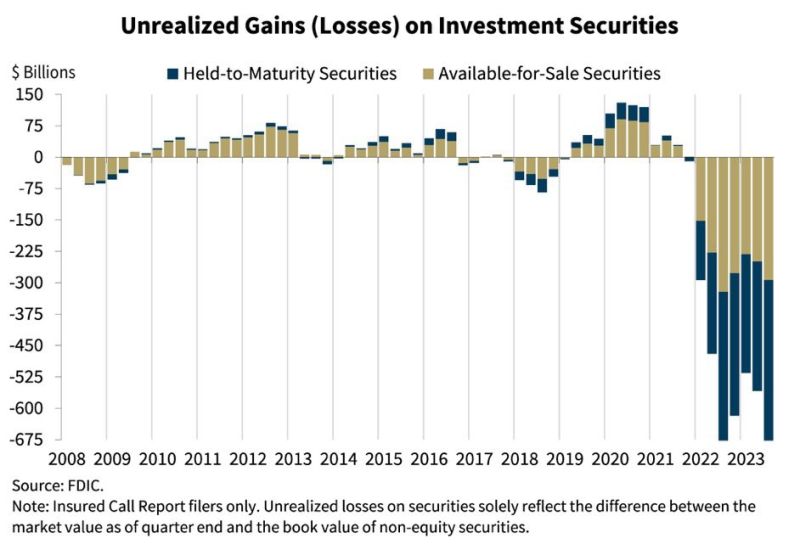

U.S. Banks are facing unrealized losses of roughly $685 billion (updated as of Q3).

This problem isn’t going away any time soon until the Federal Reserve begins cutting. New York Community Bancorp $NYCB might be the next victim. Source: Barchart

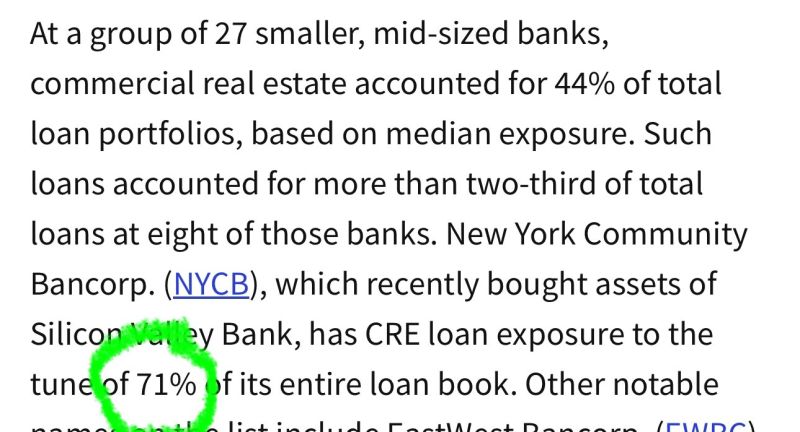

NEW YORK COMMUNITY BANK SHARES WERE DOWN AS MUCH AS 40% ON WEDNESDAY.

THE BANK POSTED A SURPRISE LOSS FOR THE FOURTH QUARTER AND ALSO CUT ITS DIVIDEND. THIS IS THE SAME BANK WHO BOUGHT SIGNATURE BANK LAST YEAR AFTER IT COLLAPSED. NOTE IT HAS COMMERCIAL REAL ESTATE (CRE) LOAN EXPOSURE TO THE TUNE OF 71% OF ITS ENTIRE LOAN BOOK.

This isn't a crypto or a meme stock. It's New York Community Bank $NYCB, which acquired failed Signature Bank assets last year, has fallen over over 40% today.

The price of shares in New York Community Bancorp - the regional bank that purchased deposits from Signature Bank last year - crashed today, below SVB crisis lows, after reporting a surprise loss for the fourth quarter and a cut to its dividend. As Bloomberg reports, the bank lowered its quarterly payout to shareholders to 5 cents. Analysts had predicted the dividend would remain at 17 cents. A worsening credit outlook contributed to the unexpected loss, as the company boosted its loan-loss provision more than expected. Source: www.zerohedge.com

Rabobank: "What happens when all of those regional US banks with balance sheets loaded with dubious commercial real estate loans can no longer pledge underwater securities at par?

The answer is more money printing, which explains the price action in the S&P500." Source: www.zerohedge.com, Bloomberg

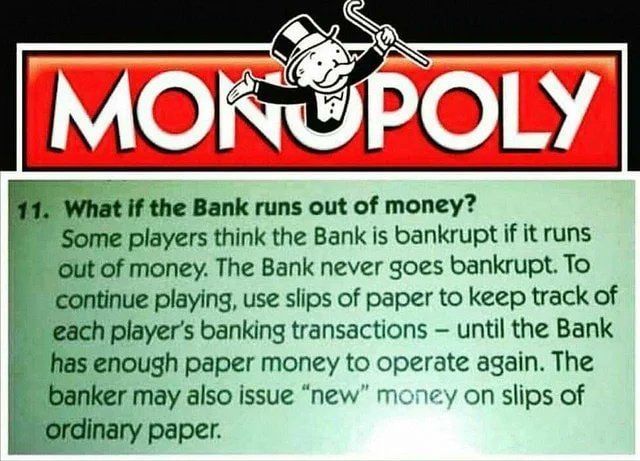

As a reminder. The bank never goes bankrupt and G7 countries will NOT default on their claims. Adjustment takes place through money debasement

There are 3 ways to invest at a time of FIAT currency: 1/ Spend 2/ Invest in risk assets 3/ Invest in store of values

Investing with intelligence

Our latest research, commentary and market outlooks