Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

BREAKING: New York Community Bank stock, $NYCB, rises 20% after announcing $1 billion capital raise.

The stock is now up 125% from its low of the day seen just 2 hours ago. Completely normal behaviour for a bank with $100 billion+ in assets. Source: The Kobeissi Letter

Bloomberg reports that New York Community Bancorp plans to announce an equity investment of more than $1 billion

Led by Steven Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Partners, according to a spokesperson for the bank.

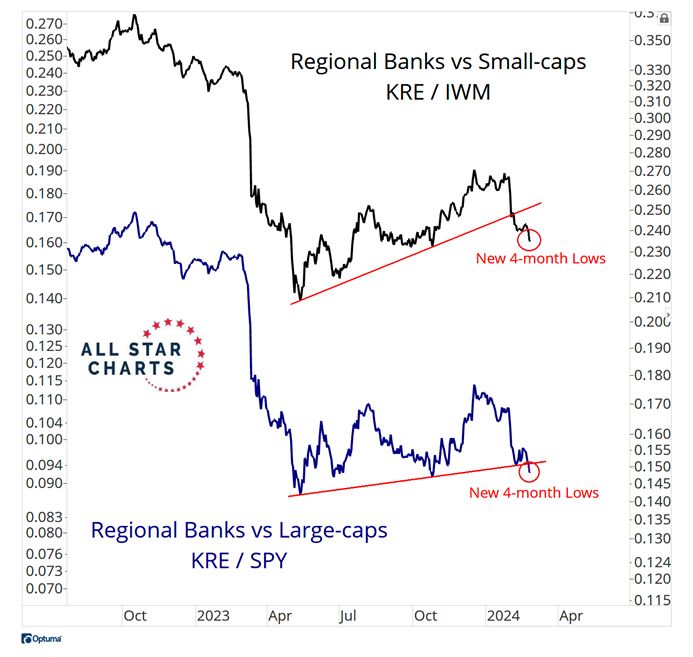

Regional banks don't look great compared to both large-caps and small-caps

source : all star chart

New York Community Bank $NYCB crashed 20% in after hours trading citing "material weakness in internal controls."

The weakness is reportedly related to loan review resulting from ineffective oversight and risk assessment. NYCB is the same bank that acquired the collapse Signature Bank during the regional bank crisis. This comes just weeks after the bank posted an unexpected $260 million loss in Q4 2023. The stock is now at its lowest level since 1997. Source: The Kobeissi Letter

JPMorgan CEO Jamie Dimon sells $150M of stock in nation’s largest bank for the first time

JPMorgan Chase chief Jamie Dimon cashed in about $150 million of his stock in the bank — the first time the head of the largest US lender has sold shares since taking charge in 2005. Dimon, one of the longest-serving chief executives on Wall Street, unloaded 821,778 shares of JPMorgan, according to an SEC filing Thursday. The selloff is part of a larger plan the bank revealed in an SEC filing in October to sell 1 million of the 8.6 million shares . Dimon and his family own. source : nypost

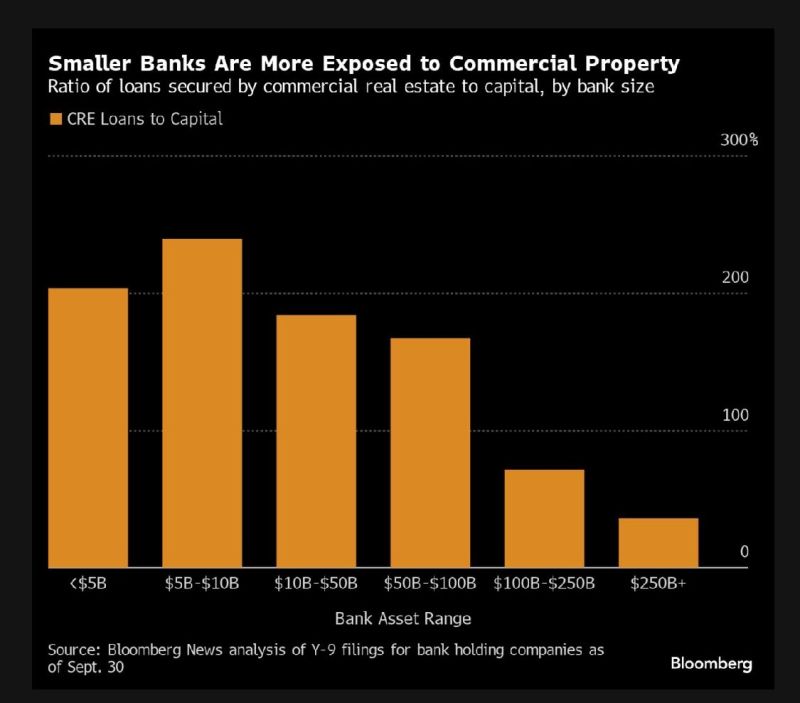

From The Markets article on US banks’ portfolios of commercial real estate:

“Bloomberg’s review found 22 banks with $10 billion to $100 billion of assets hold commercial property loans three times greater than their capital. Half of those firms had growth rates surpassing the thresholds laid out by regulators. The tally was even higher among banks with less than $10 billion of assets: 47 had outsize portfolios, of which 13 had swelled rapidly. The analysis excludes loans for nonresidential buildings that are occupied by their owners.” Source: Bloomberg

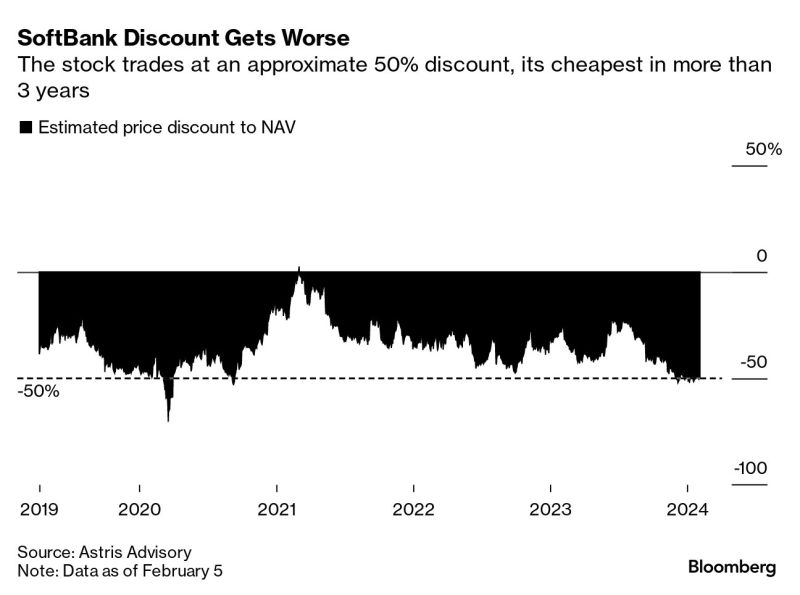

SoftBank Group shares jump more than 10% in Tokyo trading, heading for their strongest finish since July 2021.

An upbeat sales forecast from Arm Holdings bolstered sentiment. Question is whether the steep discount to its net asset value could narrow. Source: Bloomberg, Min-Jeong Lee

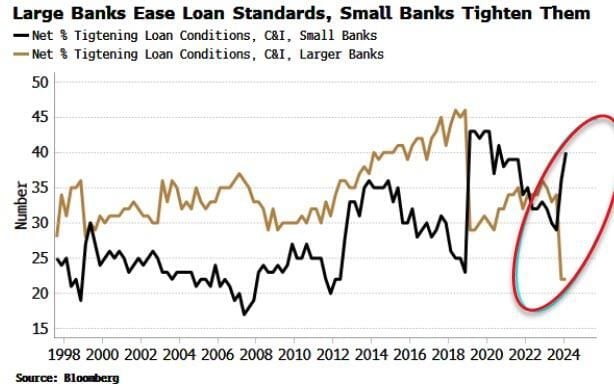

Large banks are easing lending standards while small banks tighten them Another sign of a K-shaped recovery, albeit in the financial sector

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks