Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

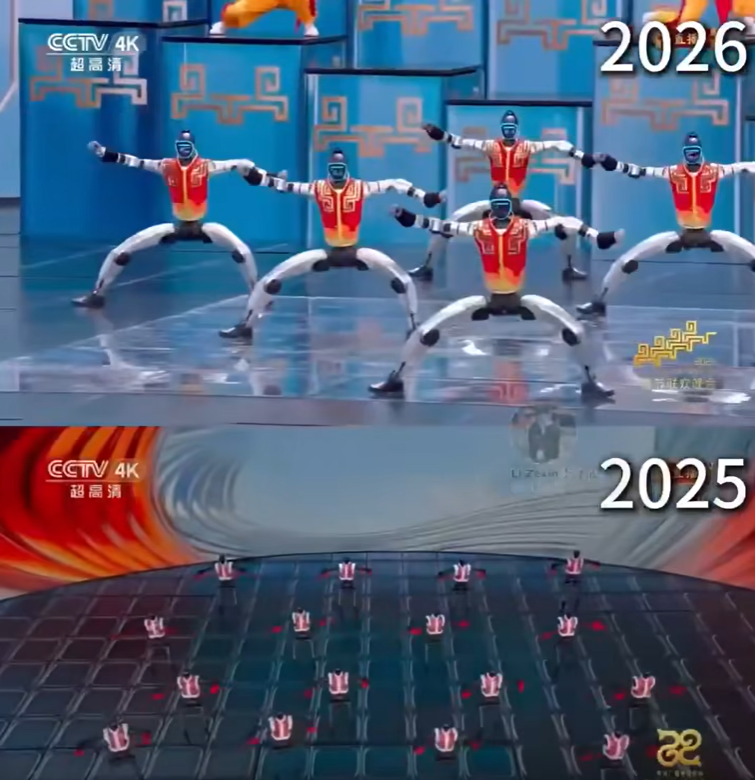

A mind-blowing robot kung fu show took place during China’s 2026 Spring Festival Gala (Lunar New Year Gala) on February 16.

It was entirely real not AI or CGI. Humanoid robots from Unitree Robotics performed synchronized martial arts routines with swords, poles, and nunchucks alongside children on live national television. Described as the world’s first fully autonomous humanoid robot kung fu performance, it highlighted major advances in balance, precision, and hardware within just 12 months. While commercialization still faces challenges like cost and reliability, the performance signals China’s rapid progress in humanoid robotics. Source: Evrim Kanbur (@WhileTravelling), Cyrus Janssen on X (@thecyrusjanssen)

AI in China isn’t just "catching up"—it’s sprinting

China’s AI market is surging, fueled by government support and rapid innovation. Tech giants and startups like Zhipu AI and MiniMax are launching advanced models for coding and multimodal tasks, pushing the STAR AI Index up. The focus has shifted to agentic workflows and AI that can handle speech, visuals, and music, signaling a move beyond simple chat. With Premier Li Qiang calling for AI integration across all industries, China is narrowing the U.S. AI gap fast, making the global AI race more intense than ever. Source: CNBC

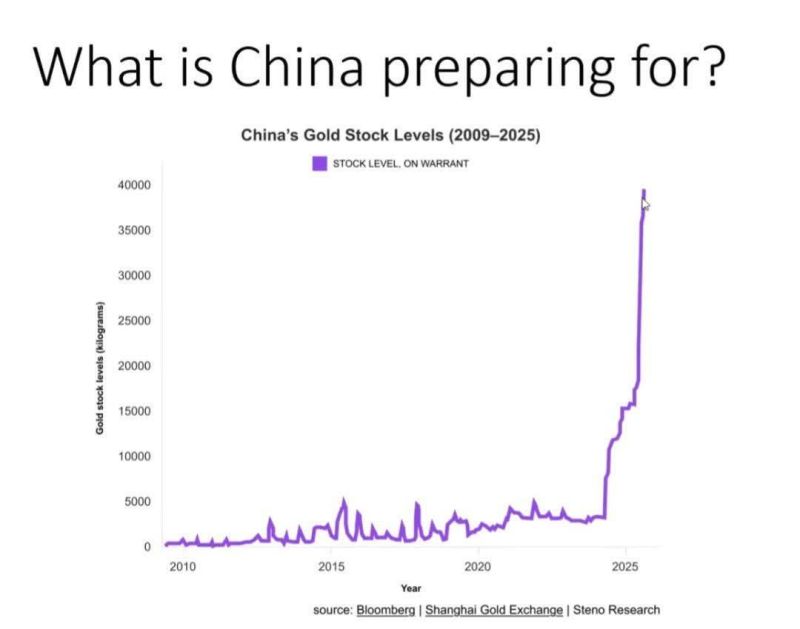

The Chinese leader told his people to hold gold. The people responded. Demand skyrocketed.

Now, the directive has shifted: Get USD off the books. The banks will respond. We aren't just talking about a policy change. We are talking about a fundamental shift in the global monetary order. Why does this matter? Liquidity is shifting: When the world's second-largest economy pivots away from the Dollar, the ripples hit every portfolio. Gold is the anchor: Central banks are returning to "real" assets as a hedge against geopolitical volatility. The Signal: When a superpower tells its financial institutions to de-risk from a specific currency, the "quiet part" is being said out loud. The world is de-dollarizing faster than most people realize. Source: Blomberg, Steno Research

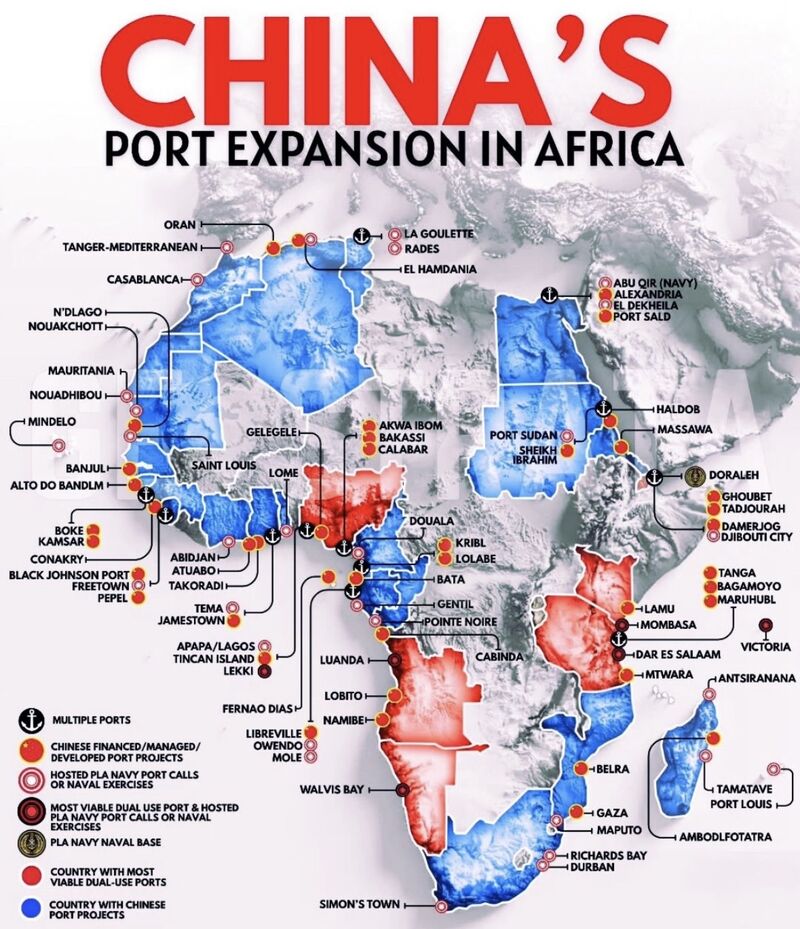

The map of global trade is being rewritten. 🌍⚓ And most people aren't looking at the right coordinates.

While the world discusses "influence," China is building infrastructure. Not just a few docks, but a literal nervous system for the African continent. Here is the reality of the "New Maritime Silk Road": 40+ African Ports: Financed, built, or operated by Chinese state-backed firms. Total Coastal Coverage: From the Atlantic to the Indian Ocean and the Red Sea. Dual-Use Potential: What starts as a commercial hub today can become a naval asset tomorrow. Beyond Djibouti: The PLA Navy’s reach is no longer confined to one base—it’s moving into the heart of global shipping lanes. Why this matters for the global economy: In 2026, Ports = Power. By controlling the gates, you control the flow of: ⚡ Energy 🌾 Food 📦 Commodities 🛡️ Security The Takeaway: China isn't just "surrounding" Africa. It is wiring itself into the very bedrock of global trade. When you own the infrastructure, you own the future of the supply chain. The board is being set. Are we playing the same game? Source: Jack Prandelli on X

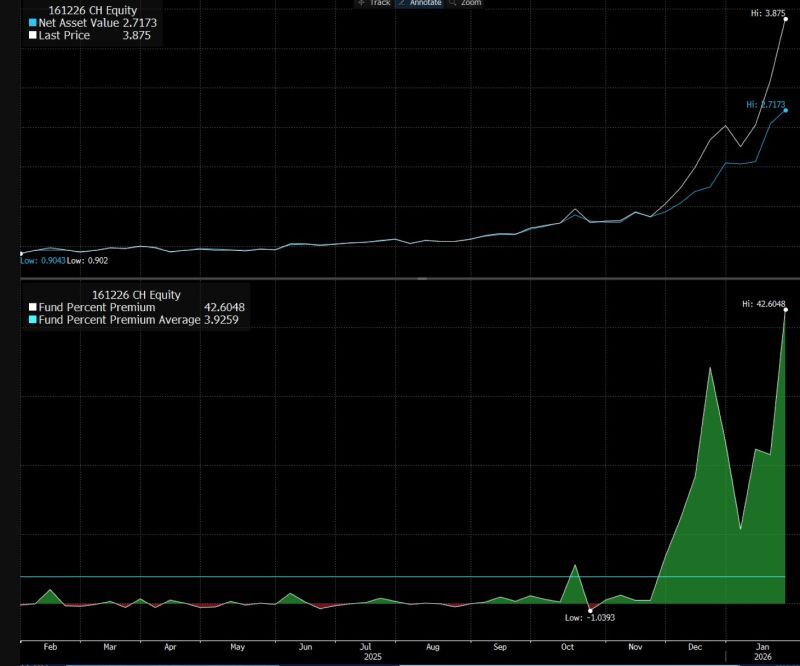

China only has one Silver fund and the demand is so rampant it had to shut off subscriptions so it's now at 42% premium

Source: Eric Balchunas @EricBalchunas Bloomberg

Chinese-financed infrastructure projects across Latin America

Source: Amazing Maps

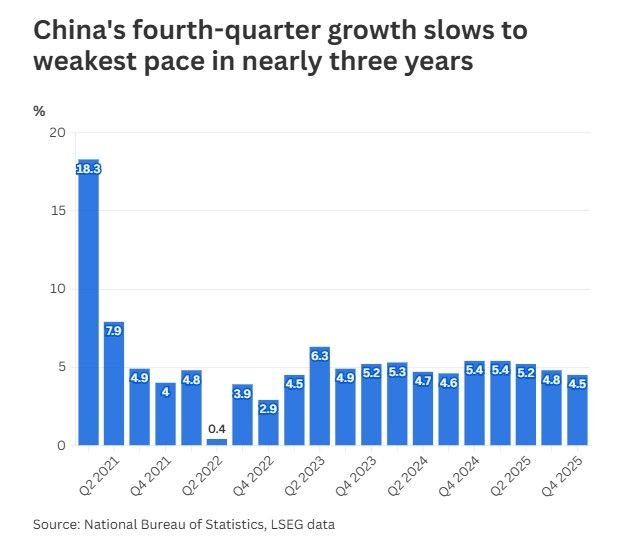

China’s GDP grew 4.5% in the October to December period, slowing from 4.8% in the third quarter, the weakest in nearly three years as consumption misses forecasts

Full-year economic output came in at 5%, meeting the official target of around 5%. Retail sales grew 0.9% in December from a year earlier, the slowest growth since late 2022. Industrial output climbed 5.2% in December, topping expectations for a 5% growth. Source: CNBC

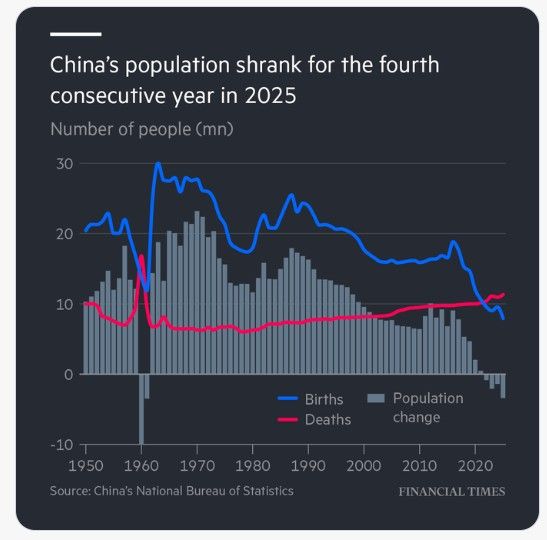

China last year registered the lowest number of births since records began

This marks the fourth consecutive year of population decline as policymakers grapple with a demographic crisis. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks