Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The $1.19 Trillion Elephant in the Room

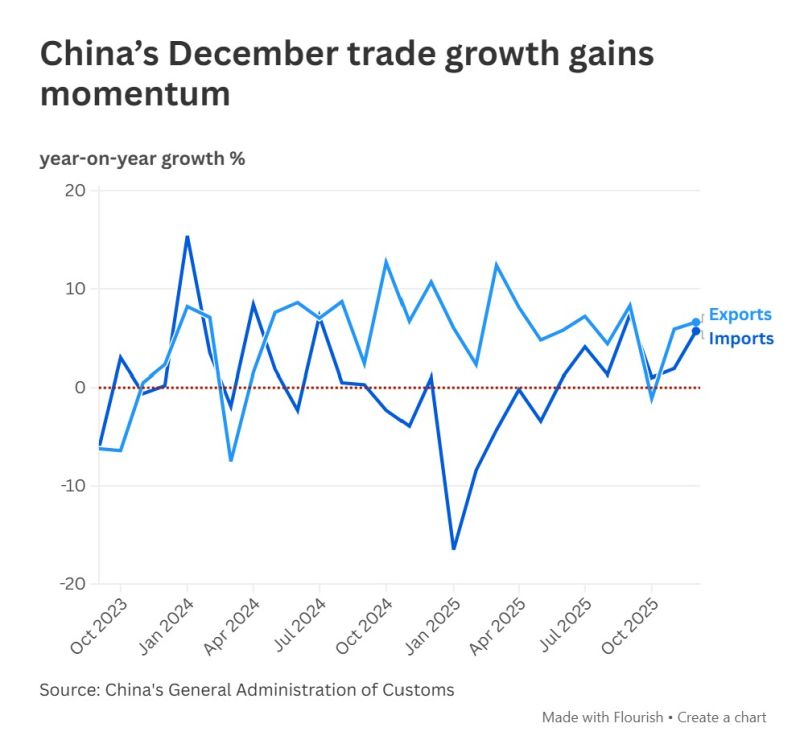

China’s December trade data just leaked, and it’s a masterclass in contradiction: ✅ The Good News: Exports beat expectations by 2x. Imports are at a 3-month high. The annual trade surplus hit a record high (up 20%). ❌ The Bad News: Trade with the U.S. is in freefall. Exports to the U.S. are down 30%. Imports from the U.S. are down 29%. What does this mean for 2026? - Diversification is king. China is filling the "U.S. gap" elsewhere. - Tariffs are working (but maybe not as intended). They are reducing bilateral trade, but China’s total global footprint is still growing. - Supply chains are shifting. Expect "China + 1" to move from a buzzword to a survival requirement. Source: CNBC

Chinese Households now have available cash totaling 160 TRILLION Yuan, the equivalent of more than $22 Trillion USD 🚨📈🤑🥳

Source: Barchart, Financial Times

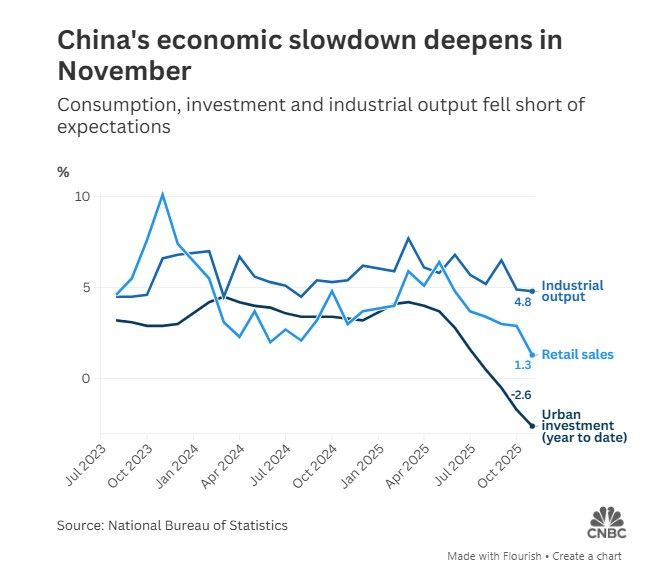

📢 China's Economic Slowdown Deepens in November 📉

China's economic performance in November fell short of expectations across key metrics, signaling a deepening slowdown as authorities grapple with weak demand, property sector decline, and supply-side constraints. Key data points: 🔴 Retail Sales: Rose 1.3% year-on-year (YoY), sharply missing the 2.8% forecast and slowing significantly from 2.9% in October. 🔴 Industrial Production: Climbed 4.8% YoY, missing the 5.0% forecast and marking its weakest growth since August 2024. 🔴 Fixed-Asset Investment (YTD): Contracted 2.6% over the January-November period (worse than the 2.3% forecast). This contraction deepened from the prior period (1.7% drop) and represents the sharpest slump since the 2020 pandemic outbreak. Source: CNBC

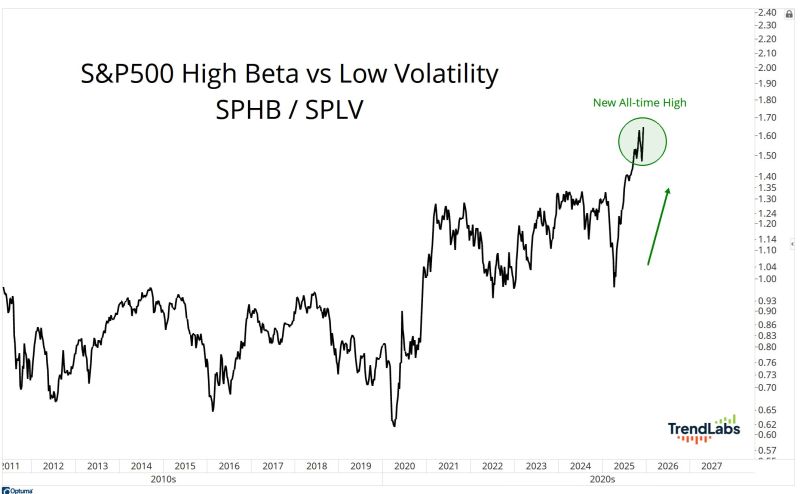

J-C Parets: When we talk about healthy sector rotation, this is exactly what that means.

High Beta is making new all-time highs, AND it's making new all-time highs relative to Low Volatility. That's not weak breadth. That's not deterioration. That's called a raging bull market.

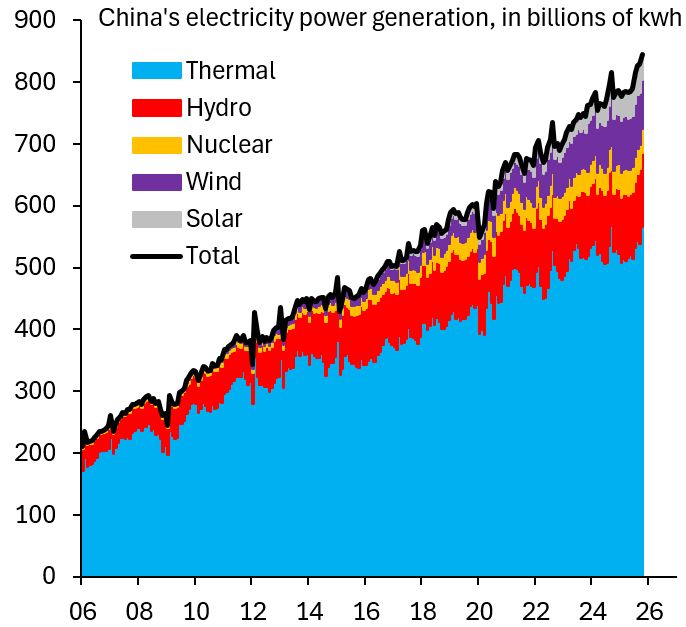

Lots of people are going on about cheap electricity in China and how this will allow it to win the AI race with the US.

Here's the thing about that electricity: it's from burning fossil fuels like coal - see chart below courtesy of Robin Brooks. Note however that China has massive plans to progressively replace fossil fuels by renewables and nuclear.

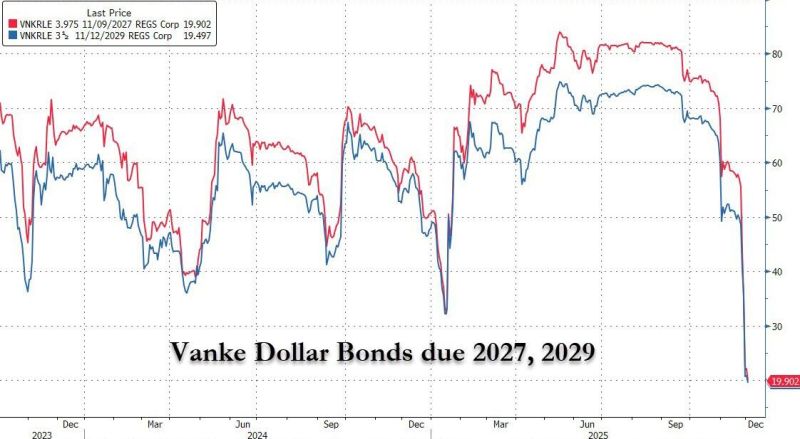

🔥 China’s Latest Property Shock: Vanke Just Broke the Last Illusion 🔥

Vanke, once viewed as China’s “safe” developer after Evergrande, just stunned markets. It’s asking for a 1-year delay on a ¥2B bond with zero upfront payment and even the interest pushed back a year. Creditors expected support. Instead, they got nothing. 📉 The fallout: ➡️ Bond crashed from near par to ¥27 ➡️USD notes collapsed to 20 cents ➡️Analysts warn this “shatters investor confidence” Vanke is now pledging core assets, being rejected for emergency loans, and facing warnings that its commitments are “unsustainable.” This isn’t one company’s problem — it’s the latest sign that China’s 5-year property downturn has no bottom. Home prices continue to fall, sales data is going missing, and global banks see years of decline ahead. And with China’s middle class holding most of its wealth in property, a deeper slump could be devastating. The crisis is no longer at the fringes. If Vanke is wobbling, the entire foundation is shaking. Source: zerohedge

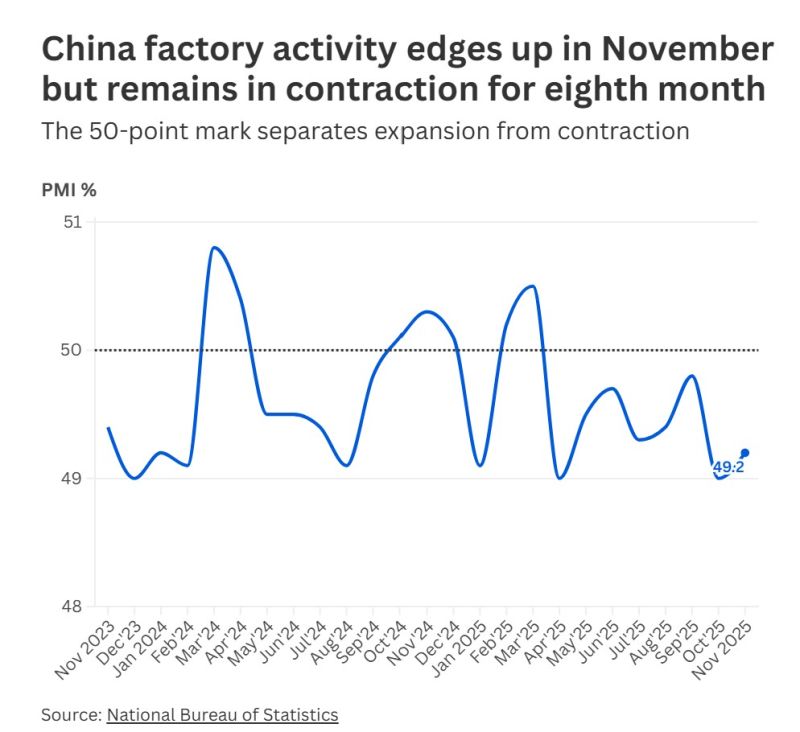

China’s factory activity edged higher in November but remained stuck in contraction for the eighth consecutive month

Services weakened as the boost from earlier holidays faded, according to official data released Sunday. The manufacturing purchasing managers’ index rose to 49.2, up 0.2 points from October, the National Bureau of Statistics said. The figures were in line with economists’ expectations in a Reuters poll, but remained below the 50-point mark that separates expansion from contraction. The non-manufacturing business activity index fell to 49.5, down 0.6 points from October, while the composite PMI output index eased to 49.7, indicating a slight pullback in both manufacturing and services activities. Supply and demand in manufacturing improved modestly, said Huo Lihui, chief statistician at the bureau’s Service Industry Survey Center, with the production index reaching the 50 threshold and new orders rising to 49.2. Source: CNBC

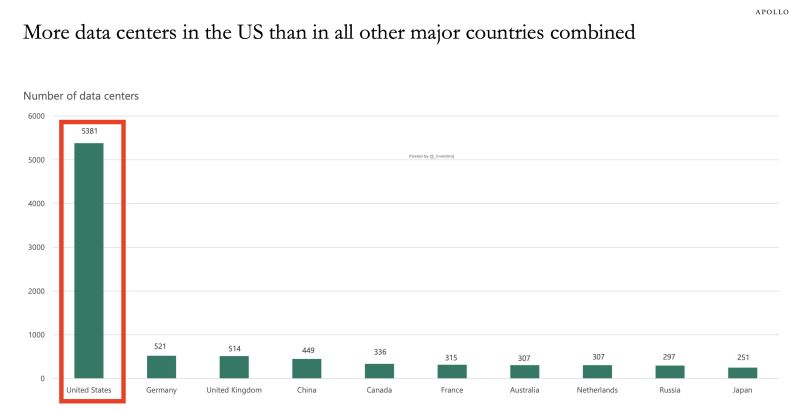

The US has 5,381 data centers — more than China (449) and every other major nation combined.

The American bet is simple: own the most compute, win the AI race. But China isn’t playing that game. Instead of chasing data center volume, China open-sourced frontier models (DeepSeek, Qwen, Baichuan) that run on cheap hardware. DeepSeek trained a frontier model for $5–6M (vs. tens of millions in the US). Inference costs are ~280x cheaper than ChatGPT. Modular data centers deploy in weeks, built around ultra-low-cost power. China isn’t scaling infrastructure. They’re scaling efficiency — and commoditizing intelligence. Meanwhile, the US is hitting a wall: the power grid. Data centers already use 6% of US electricity, headed to 11% by 2030. Spare grid capacity has fallen from 26% → 19%, on track for <15%. Some regions face 7-year waitlists just to connect new facilities. Ohio alone rejected 17 GW of new data center interconnection requests. You can build data centers. But can you power them? China can. By 2025, their installed capacity hits 3.99 TW (up 19% YoY). Renewables are nearly half of all generation. In the first five months of 2025 alone: 197 GW solar added 46 GW wind added By 2030, China is expected to have 400 GW of spare power capacity — over 3× global data center demand. The US built the most data centers. China built the power to scale whatever it wants. The real race isn’t about who has more compute today — it’s who can power their compute tomorrow. And on that dimension, China is pulling ahead. Source: StockMarket.news, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks