Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

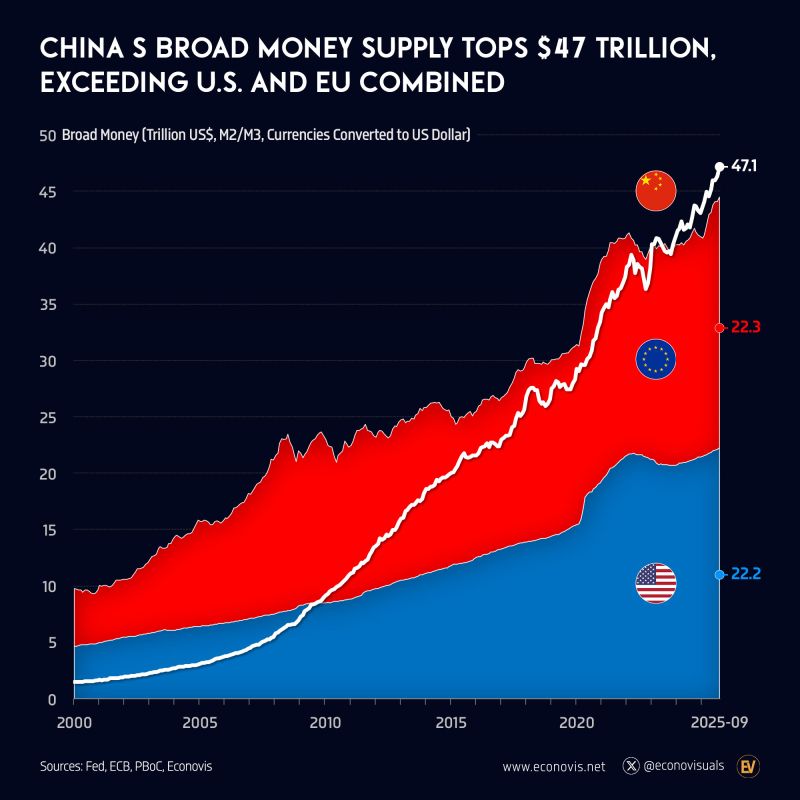

📈 China’s Broad Money Supply Surpasses Combined U.S. and EU Since 2023

China’s broad money supply (M2) reached $39.7 trillion in September 2023, surpassing for the first time the combined total of the United States and the European Union ($39.6 trillion). By September 2025, China’s M2 had expanded further to $47.1 trillion—5.9% higher than the combined $44.5 trillion of the U.S. ($22.2 trillion) and EU ($22.3 trillion). This reflects the continued rapid expansion of China’s financial system and credit base relative to Western economies. Source: Econovis

🚨 “China is going to win the AI race.” — Jensen Huang, CEO of NVIDIA

When the world’s most valuable tech CEO says the US might lose the AI race, people listen. At the FT’s Future of AI Summit, Huang didn’t hold back: ⚙️ China’s advantage → lower energy costs + looser regulations. ⚡ “Power is free” — local governments are literally subsidizing electricity for data centers (ByteDance, Alibaba, Tencent). 🇨🇳 Chinese firms are ramping up domestic AI chips — even if they’re less efficient than NVIDIA’s, they’re cheap to run. 🇺🇸 Meanwhile, the US faces export bans, fragmented AI rules, and what Huang calls “cynicism.” His message? “We need more optimism.” The irony: The US bans NVIDIA’s best chips from China to protect its lead. But by doing so, it might be accelerating China’s self-reliance. Huang’s warning hits hard: regulation, energy policy, and mindset could decide who truly leads in AI — not just who has the best chips. 💬 What do you think — is Huang right? Will policy and power matter more than chips and code in the next phase of the AI race? See the link to FT article >>> https://lnkd.in/eas5VKjj

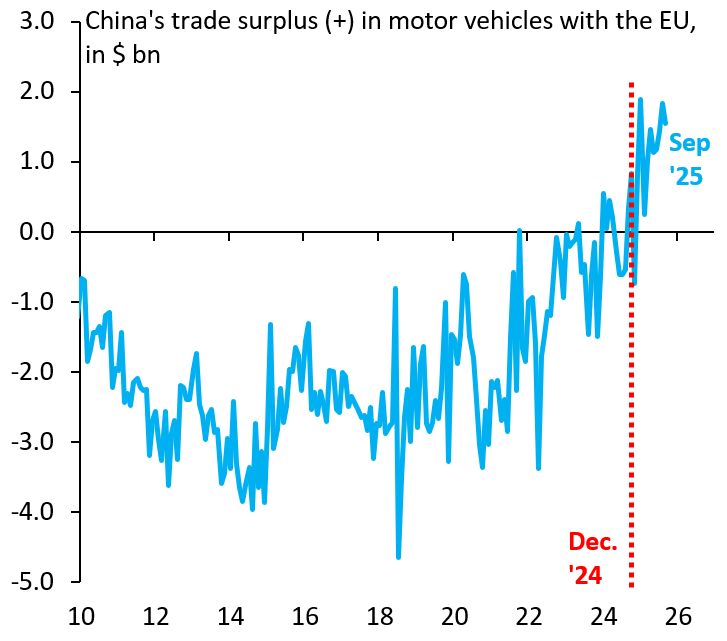

China now runs a trade surplus in cars with the EU after many years in which it ran a deficit.

Is a huge deflationary shock coming to the EU ? Maybe the ECB should recognize this and cut interest rates as aggressively as possible as a weaker Euro will help... Source: Robin Brooks

📉 China’s manufacturing slowdown deepens.

October’s PMI came in at 49.0 — hitting a 6-month low and missing expectations of 49.6 (Reuters poll). That’s down from 49.8 in September. 🇨🇳 China’s manufacturing sector has now been in contraction since April, underscoring persistent weakness in global demand and domestic investment. ⚙️ The country’s manufacturing activity has remained in contraction since April. Source: CNBC

🚨 Major Breakthrough in U.S.–China Trade Talks! 🚨

Over the weekend, Chinese and U.S. economic officials reached a framework deal set for final approval by President Donald Trump and President Xi Jinping — and it’s a big one. Here’s what’s on the table 👇 ✅ Pause on steeper U.S. tariffs that were set to hit Chinese imports. ✅ China delays its rare earth export controls for a year while it reconsiders policy. ✅ U.S. soybean sales to China resume — a major win for American farmers. U.S. Treasury Secretary Scott Bessent said the talks — held on the sidelines of the ASEAN Summit in Kuala Lumpur — effectively defused the threat of Trump’s 100% tariffs slated for November 1. This could mark a critical de-escalation in one of the world’s most consequential trade tensions. 🌏 📊 If finalized, this deal could reshape global supply chains, stabilize markets, and give both sides breathing room to rebuild trust.

China’s economy is hitting an imbalance wall. It keeps building, but people aren’t buying.

🧱 Investment eats up 42% of GDP — nearly double the global average. 🛒 Household spending? Just 37% — vs. 60% in most economies. The result: too many factories, not enough consumers. Property prices are still falling, savings rates are sky-high (20%+), and deflation has taken hold. Consumer prices are down, producer prices have been negative for years, and exports are doing all the heavy lifting — but even that’s cracking under U.S. tariffs. Instead of fixing the imbalance, Beijing is doubling down on the old playbook: more infrastructure, more state-led projects, little direct help for households. Economists say China needs a massive rebalancing — trillions in fiscal transfers to boost consumption and rebuild trust in the safety net. But that would mean loosening state control… and that’s not the direction things are heading. 📉 Without change, growth could slow to ~3% a year. 🧊 Deflation lingers. ⚙️ Factories hum, but consumers stay quiet. China’s still building the world’s factories — but it’s running out of people to sell to. Source: StockMarket.news

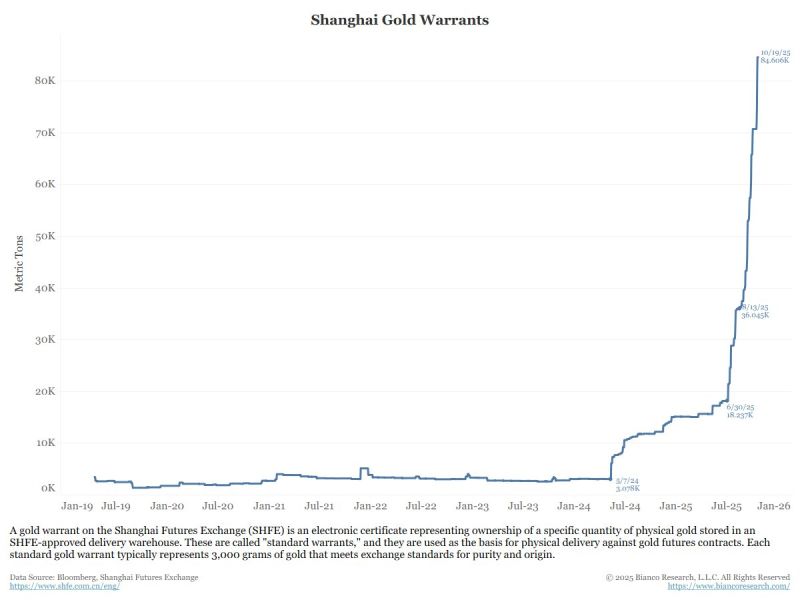

China is remonetizing gold

Gold Warrants on the Shanghai futures exchange are UP 25x since the beginning if the year. What is a Gold Warrant? A gold warrant on the Shanghai Futures Exchange (SHFE) is an electronic certificate representing ownership of a specific quantity of physical gold stored in an SHFE-approved delivery warehouse. They are used as the basis for physical delivery against gold futures contracts. Each standard gold warrant typically represents 3,000 grams of gold that meets exchange standards for purity and origin. Why are they surging? Shanghai gold warrants are surging due to a combination of record-breaking safe-haven demand, robust central bank gold purchases (notably by the People’s Bank of China), and intense price volatility driving investor and arbitrage activity. Source: Jim Bianco, @AndreasSteno

US-China: some "positive" comments by Trump on Fox News overnight

“I'm not looking to destroy China” “China’s President XI is a smart man who is open for a deal” TRUMP CONFIRMS HIS MEETING WITH XI IS STILL ON. HE SAYS THINGS COULD CHANGE QUICKLY.

Investing with intelligence

Our latest research, commentary and market outlooks