Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China’s gross domestic product expanded by 4.8% in the third quarter from a year ago, a slowdown from 5.2% in the second quarter, and the weakest in a year.

👉 Fixed-asset investment, which includes real estate, unexpectedly FELL by 0.5% in the first nine months of the year (Analysts polled by Reuters had forecast a 0.1% growth). This drop is alarming. The last time China recorded a contraction in fixed-asset investment was in 2020 during the pandemic, according to data going back to 1992 from Wind Information. The single-month September FAI declined by 9.8% based on estimates !!! 👉 Industrial production grew by 6.5% year-on-year in September, faster than the 5% forecast and 5.2% growth in the prior month. 👉 Retail sales rose 3% in September from a year ago, matching analyst forecasts. Source: CNBC, Augur Infinity

China Sept. used home prices -0.64% m/m; drop faster than Aug.

China Sept. new home prices -0.41% m/m; drop faster than Aug. China's largest asset by a factor of 2 continues to disintegrate... Source: zerohedge, GS

China's deflationary vortex is getting worse:

*CHINA SEPT. CONSUMER PRICES FALL 0.3% Y/Y; EST. -0.2% *CHINA SEPT. PRODUCER PRICES FALL 2.3% Y/Y; EST. -2.3%

“If we lose this, we do not have a future at Ford,” says Jim Farley, CEO at Ford

China added 295,000 industrial robots last year. The US? 34,000. The UK? 2,500. Source: Zane Hengsperger @zanehengsperger

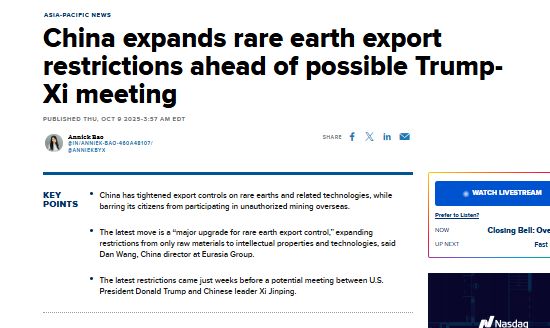

As pointed out by Wall St Mav, Rare earth metals are NOT rare. Plenty of sources around the world.

95% of the refineries and smelters that process raw ore are in China. Even if rare earths are mined in USA, it all needs to be shipped to China. Issue is that trying to build a smelter in the USA or Europe seems impossible these days. The environment litigation would take years. Hence the scarcity issue. Source: CNBC, Wall St Mav

AI’s energy demand is about to go vertical, and in many countries, the grids aren't ready.

China’s building 29 large nuclear reactors right now. The U.S. has none under construction. High costs, regulatory delays and market challenges hold us back, though advanced smaller reactors are emerging. Source: StockMarket.News

The effective US tariff rate on China (red)

The effective US tariff rate on China (red) based on imports and estimated duties paid - has stabilized near 43%, which is up from 17% before Trump 2.0 and up from 5% before Trump 1.0 before that. The effective tariff rate on everyone else (excluding Canada and Mexico) is 14%. Source: Robin Brooks on X

China controls close to 90% of the global rare earth market, and it has a track record of weaponizing exports when tensions rise.

Any new tariffs could invite retaliation, slower licensing, outright restrictions, or targeted disruptions that hit automakers, electronics, and magnet producers with higher costs and production delays. The ripple effects wouldn’t stop there, more expensive inputs could feed inflation and strain global supply chains. The G7 and the EU are weighing new ways to chip away at China’s rare earths dominance. Tariffs or taxes on Chinese exports are on the table along with price floors and subsidies to jump start mining and processing capacity outside Beijing’s reach. Source: StockMarket.news

Investing with intelligence

Our latest research, commentary and market outlooks