Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔥 Trade between the U.S. and China has collapsed to its lowest point in nearly 20 years.

👉 Imports from China just hit a 19-year low, and U.S. exports to China are sliding too. Tariffs, decoupling, and weaker demand are crushing the flow of goods. 👉 On paper, China’s GDP is still growing. But when your biggest trading partner is importing less than in 2006, that growth looks hollow. ➡️ It thus seems that China’s stock rally isn’t built on trade or fundamentals but rather being propped up by liquidity and policy support. Source: StockMarket.News @_Investinq

Chinese stocks are on 🔥

- Turnover nearly 2 trillion yuan in the morning session - CSI 300 within 1% of 2022 high - Technicals signaling short-term overheating. Meanwhile, HSBC lifts China index targets: "We lift our end-2025e target for SHCOMP to 4,000 (from 3,700), CSI300 to 4,600 (from 4,300), and SZCOMP 13,000 (from 11,500) given the abundant liquidity" Source: David Ingles, Bloomberg

Nvidia has asked some of its component suppliers to stop production related to its made-for-China H20 graphics processing units, as Beijing cracks down on the American chip darling.

The directive comes weeks after the Chinese government told local tech companies to stop buying the chips due to alleged security concerns, the report said, citing people with knowledge of the matter. Nvidia has reportedly asked Arizona-based Amkor Technology, which handles the advanced packaging of the company’s H20 chips, and South Korea’s Samsung Electronics, which supplies memory for them, to halt production. Samsung and Amkor did not immediately respond to CNBC’s request for comment. A separate report from Reuters, citing sources, said that Nvidia had asked Foxconn — officially known as Hon Hai — to suspend work related to the H20s. Foxconn did not immediately respond to a request for comment. Source: CNBC

Investors lost billions of dollars in July betting on a handful of small US-listed Chinese stocks that plunged in value shortly after being heavily promoted on social media.

Seven Nasdaq-listed microcap stocks — Concorde International, Ostin Technology, Top KingWin, Skyline Builders, Everbright Digital, Park Ha Biological Technology and Pheton Holdings — all dropped more than 80 per cent over a few trading sessions in recent weeks. The declines wiped a cumulative $3.7bn off their market value, according to price data analysed by predictive analytics firm InvestorLink. All seven stocks had surged before their sudden sell-offs, having been plugged to investors on WhatsApp groups and social media sites. Analysts and investors said the moves bore many of the hallmarks of pump and dump scams. There is no suggestion that any of the companies named were involved in the unusual share price moves. None of the seven responded to requests for comment. Source: FT

Chinese Stocks jump to highest prices in more than a decade

Source: Barchart

😨 China’s economy slowed across the board in July with factory activity and retail sales disappointing, suggesting the world’s No. 2 economy is losing traction

‼️ China Retail Sales rose 3.7% Y/Y in July, well below consensus of 4.6%. This is the weakest reading since November 2024. On a month-over-month basis, retail sales declined for a second consecutive month, by -0.1%. ‼️China Industrial Production rose 5.7% Y/Y in July, missing consensus of 5.9% and slowing from June's 6.8%. This marks the weakest pace of growth since January. The sequential M/M growth rate also slowed to 0.4%. 🔴 China Economic data👇 ▶️ July retail sales 3.7% y/y [Est.4.6%] ▶️July industrial growth 5.7% y/y [Est.5.9%] ▶️Jan-Jul fixed asset investment 1.6% y/y [Est.2.7%] ▶️ July Unemployment 5.2% [Prev. 5.1%] Note that while China's industrial production continues to run well above the pre-COVID trend, real retail sales have diverged further away from the pre-COVID trend. Source: Augur Infinity

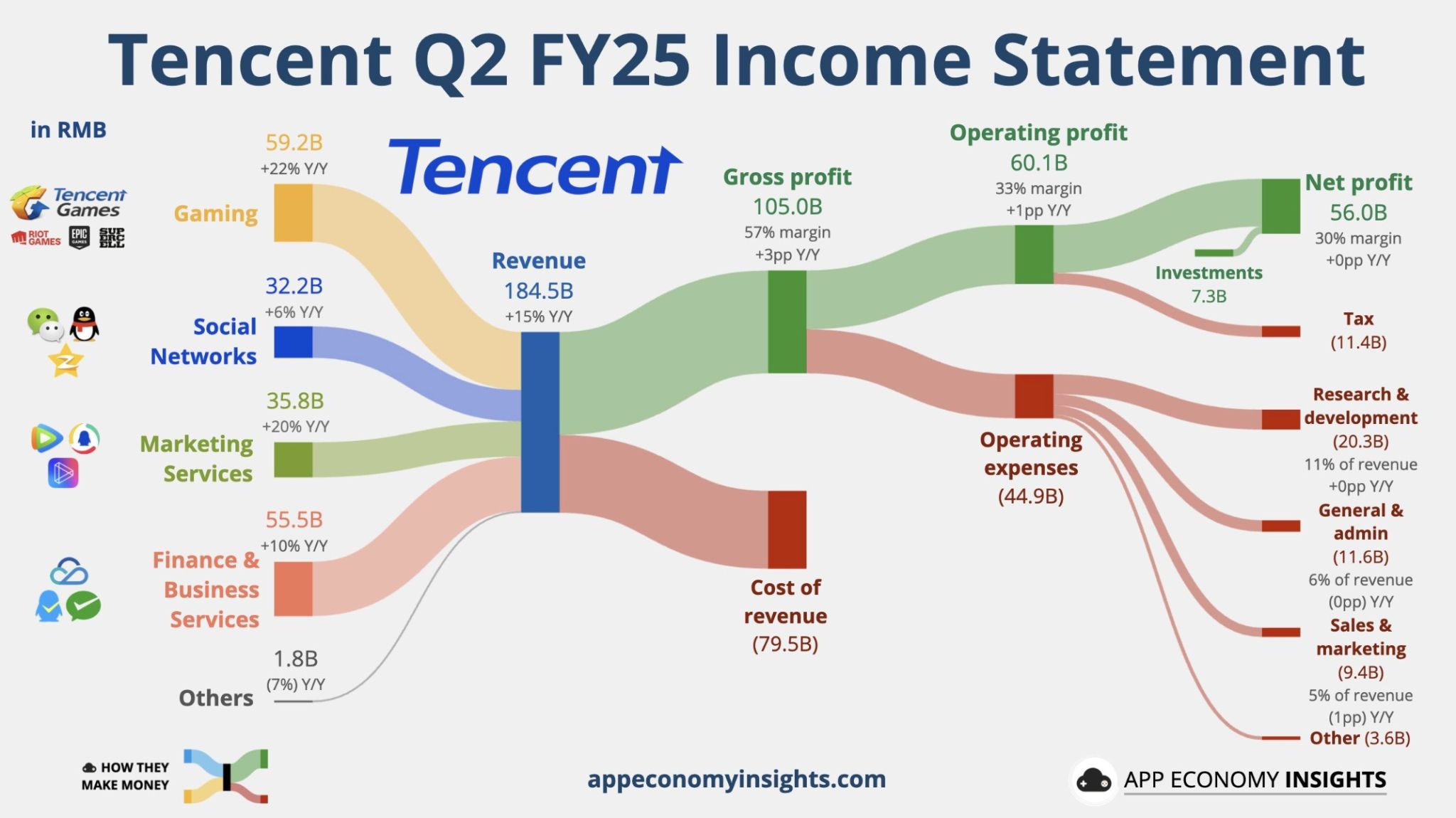

Tencent on Wednesday reported a 15% jump in second-quarter revenue as a strong performance in its gaming unit and AI investments boosted growth.

The ADR is up 7% today $TCEHY Tencent Q2 FY25: Revenue +15% Y/Y to RMB185B ($25.7B). Gaming +22% Social Networks +6% Marketing Services +20% Fintech & Business +10% Weixin/WeChat: 1.4B MAU (+3% Y/Y). Capex +119% to RMB19B ($2.7B). Source: App Economy Insights @EconomyApp

🔴 China state media says Nvidia H20 chips not safe for China

▶️ Nvidia's new tab H20 chips pose security concerns for China, a social media account affiliated with China's state media said on Sunday, after Beijing raised concerns over backdoor access in those chips. The H20 chips are also not technologically advanced or environmentally friendly, the account, Yuyuan Tantian, which is affiliated with state broadcaster CCTV, said in an article published on WeChat. ▶️ "When a type of chip is neither environmentally friendly, nor advanced, nor safe, as consumers, we certainly have the option not to buy it," the article concluded. ▶️ H20 artificial intelligence chips were developed by Nvidia for the Chinese market after the U.S. imposed export restrictions on advanced AI chips in late 2023. The administration of U.S. President Donald Trump banned their sales in April amid escalating trade tensions with China, but reversed the ban in July. ▶️ China's cyberspace watchdog said on July 31 that it had summoned Nvidia to a meeting, asking the U.S. chipmaker to explain whether its H20 chips had any backdoor security risks - a hidden method of bypassing normal authentication or security controls. Source: www.investing.com, Reuters

Investing with intelligence

Our latest research, commentary and market outlooks