Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

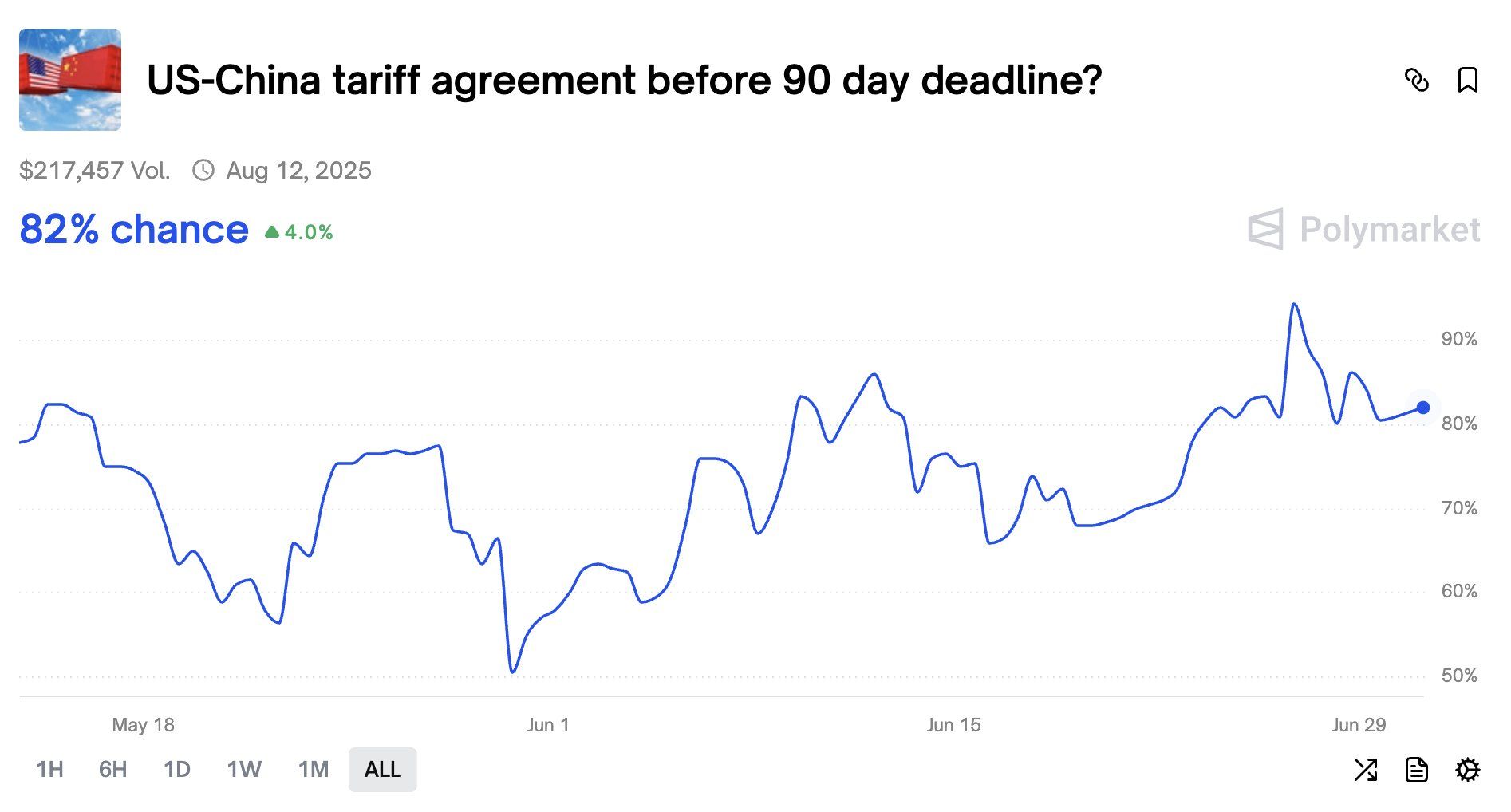

Beijing and Washington are expected to extend their tariff truce by another three months at trade talks in Stockholm beginning on Monday

During the expected 90-day extension, the U.S. and China will agree not to introduce new tariffs or take other actions that could further escalate the trade war, the report said. Source: Reuters

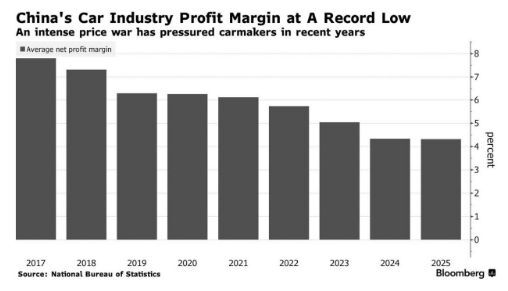

China's Car Industry Profit Margin has fallen to an all-time low

Source: Barchart

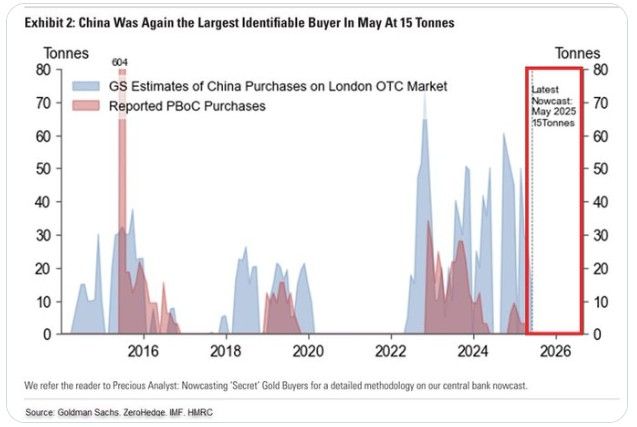

China continues to quietly acquire gold through the London market

China bought 15 tonnes of gold in May, according to Goldman Sachs estimates, 8 TIMES more than officially reported figures. Over the past year, China's monthly purchases have oscillated between 25-60 tonnes. Source: Global Markets Investors, Goldman Sachs

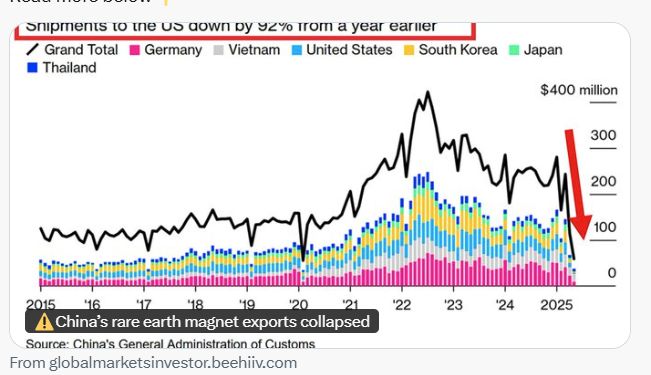

🚨China’s rare earth magnet exports COLLAPSED

Total shipments FELL 76% YoY in May, to 1,238 tons, the least since February 2020. Exports to the US FELL 92% YoY to 46 tons, and LESS than 1/10 of what was recorded in March. Source: Global Markets Investors

Deflation remains the name of the game in china

China’s producer prices plunged 3.6% in June from a year earlier, marking its largest decline in nearly two years, as a deepening price war rippled through the economy that’s already grappling with tepid consumer demand. The drop in producer prices, however, came worse than the expected 3.2% in a Reuters poll and marked its biggest fall since July 2023, according to LSEG data. The PPI has been mired in a multi-year deflationary streak since September 2022. The consumer price index edged 0.1% higher in June from a year ago, according to data from the National Bureau of Statistics Wednesday, returning to growth after four consecutive months of declines. Economists had forecast a flat reading compared to the same period a year earlier, according to a Reuters poll. Core CPI, stripping out food and energy prices, rose 0.7% from a year ago, the biggest increase in 14 months, according to NBS. China June Annual CPI +0.1% [Est. 0.0% Prev. -0.1%] Monthly CPI -0.1% [Est. 0.0% Prev. -0.2%] Annual PPI -3.6% [Est. -3.2% Prev. -3.3%] Monthly PPI -0.4% [Prev. -0.4%] Source: CNBC

‼️ New listing volume in Hong Kong Stock Exchange jumped around eight times to $14 billion in the first half of this year.

▶️ The frenzy came after years of lackluster IPO activity in the city. ▶️The renewed interest is fueled by a confluence of factors, including Beijing’s regulatory tailwinds, lackluster A-share listings and delisting fears in U.S. markets. https://lnkd.in/eK4PnfUQ Source: CNBC

ALERT: There’s only 8 days remaining until the tariff negotiation deadline

Betting markets are placing an 82% chance of US-China reaching an agreement before that deadline. Source: Bravos Research

US TREASURY SECRETARY BESSENT JUST SAID:

• US tariffs on China: 30% • China’s tariffs on US: 10%

Investing with intelligence

Our latest research, commentary and market outlooks