Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump said Wednesday that China’s President Xi Jinping was “extremely hard” to make a deal with

At a time when the White House has been suggesting the two leaders could talk this week amid a rise in trade tensions: “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!,” the U.S. president wrote on Truth Social. That post on the social media platform came after a senior White House official told CNBC on Monday that Trump and Xi were likely to speak this week. Chinese Foreign Minister Wang Yi told the new U.S. Ambassador David Perdue during a meeting Tuesday that the recent string of “negative measures” by the Trump administration were based on “groundless reasons,” and undermined China’s legitimate rights and interests, according to the official English readout. Source: CNBC

China's manufacturing activity plunges to lowest level since September 2022 📉

Source: Barchart, LESG

A Taiwanese official said Chinese air force and missile units that would take part in an invasion had improved to the point where they could 'switch from peacetime to war operations any time'.

Link >>>https://lnkd.in/epE_ri2X Source: FT

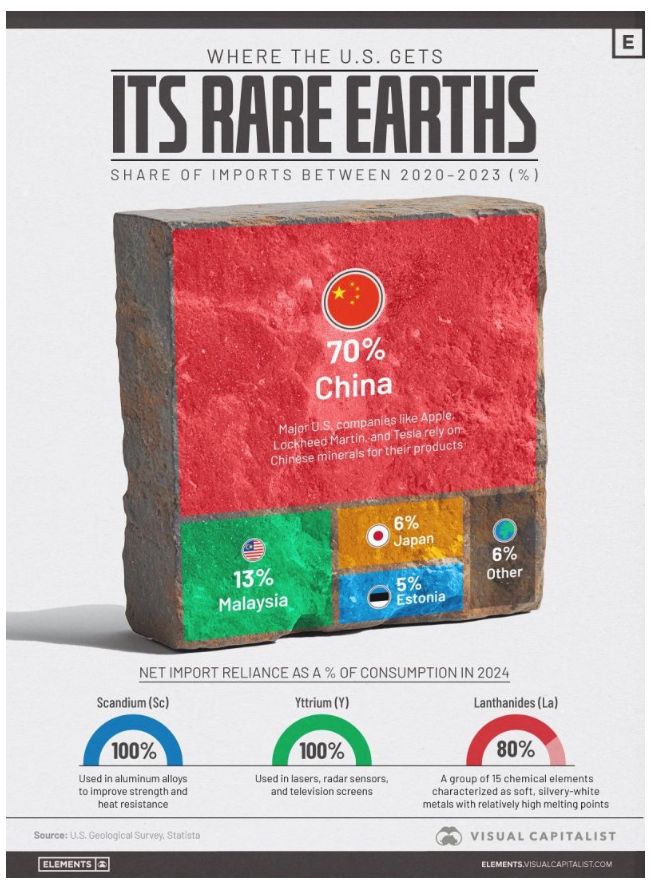

China's dominance in the global supply of rare earth elements (REEs) is a significant factor influencing various industries, from smartphones and electric vehicles to guided missiles and satellites.

Between 2020 and 2023, China supplied 70% of U.S. rare earth imports, establishing itself as the primary source. Following closely are Malaysia, Japan, and Estonia in the top four suppliers. Despite their name, rare earths are not scarce in the Earth's crust; the challenge lies in extracting them in concentrated amounts economically and sustainably. China plays a pivotal role in this scenario, producing approximately 90% of the world's refined rare earths. Its extensive capacity for separation and purification gives it a substantial influence over global supply chains. For instance, yttrium, crucial in radar systems, lasers, and television screens, saw 93% of its U.S. imports originating from China between 2020 and 2023. Other vital rare earths like Samarium, Gadolinium, Terbium, Dysprosium, Lutetium, and Scandium face similar supply concentration challenges. These elements are integral to military applications, electric motors, and cutting-edge electronics, with companies such as Lockheed Martin, Tesla, and Apple relying on them for their core products. Source: Elements

📢 CHINA SAYS U.S. DIALOGUE TO CONTINUE AS CHINA HINTS TRADE TALKS ARE ADVANCING - CNBC

The U.S. and China have agreed to maintain communication following a call between Chinese Vice Foreign Minister Ma Zhaoxu and U.S. Deputy Secretary of State Christopher Landau, according to a brief readout released by the Chinese Foreign Ministry on Friday. Both sides exchanged thoughts on crucial issues during the call on Thursday, the statement said, without elaborating. The U.S. Department of State issued a similar statement Thursday, briefly noting the consensus on the importance of the bilateral relationship and an agreement to keep open lines of communication. The statement came as Beijing and Washington continued to trade swipes at each other, despite the tariff de-escalation following a meeting between both sides in Switzerland earlier this month. Source: CNBC

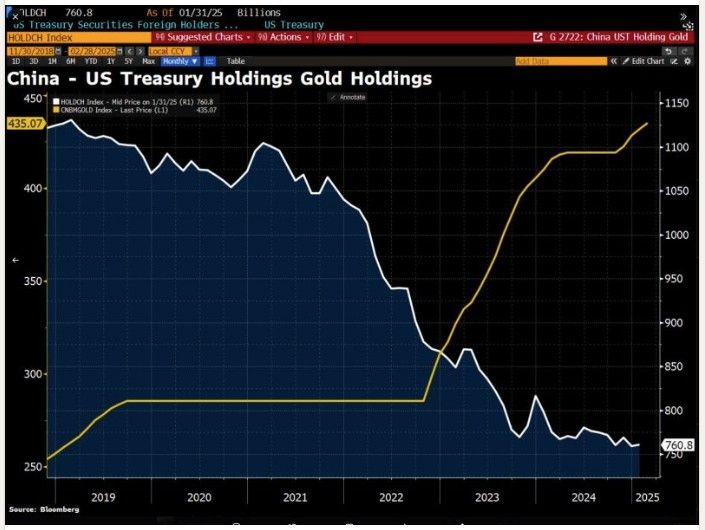

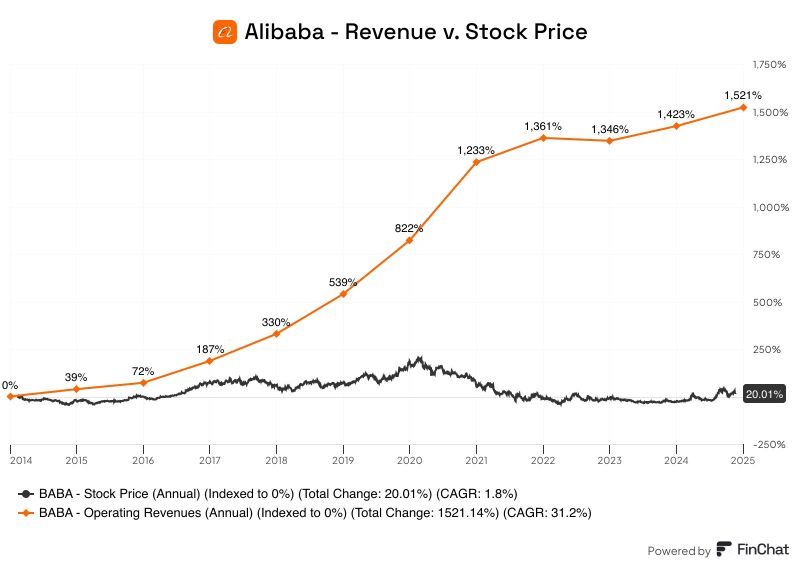

What a wild chart...

Alibaba Revenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_ioRevenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_io

Retail sales rose 5.1% from a year earlier in April, MISSING analysts’ estimates of 5.5% growth, according to a Reuters poll

Sales had grown by 5.9% in the previous month. Industrial output grew 6.1% year on year in April, STRONGER than analysts’ expectations for a 5.5% rise, while slowing down from the 7.7% jump in March. Fixed-asset investment for the first four months this year, which includes property and infrastructure investment, expanded 4.0% from a year earlier. ➡️ As mentioned by Mo El Erian on X, the latest Chinese macro numbers illustrate a familiar pattern in the country’s economy: government measures often succeed in boosting industrial production, but tend to be less effective at stimulating household consumption Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks