Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The FT reports that a secret meeting between US and China which took place in IMF basement paved way for tariff deal seen on both sides as a victory 👇

The first meeting to break the US-China trade deadlock was held almost three weeks ago in the basement of the IMF headquarters, arranged under cover of secrecy. "US Treasury secretary Scott Bessent, who was attending the IMF spring meetings in Washington, met China’s finance minister Lan Fo’an to discuss the near complete breakdown in trade between the world’s two biggest economies, according to people familiar with the matter. The previously unreported encounter was the first high-level meeting between US and Chinese officials since Donald Trump’s inauguration and the launch of his tariff war. The Treasury declined to comment on the secret meeting. The talks culminated this weekend in Geneva with Bessent and He Lifeng, China’s vice-premier, agreeing a ceasefire that would slash respective tariffs by 115 percentage points for 90 days". Link to FT article >>> https://lnkd.in/e_a7Rcix

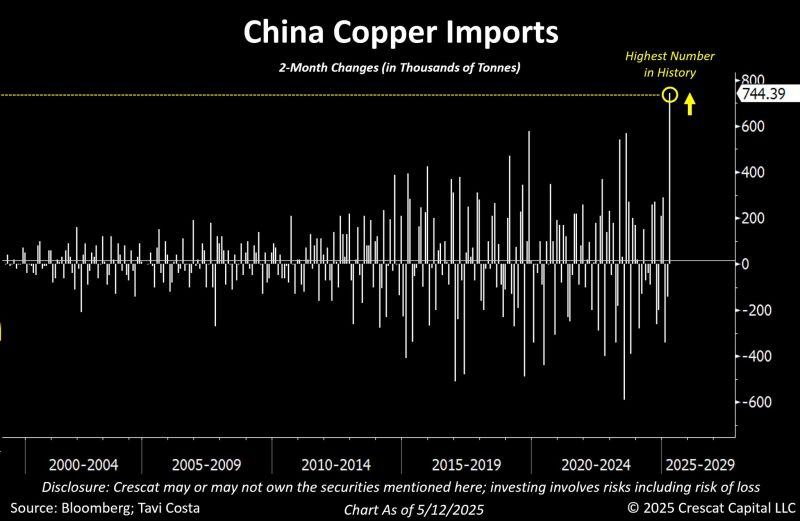

China has just reported its largest two-month copper imports in history.

The world remains firmly entrenched in a deglobalization trend. Even if we got a (temporary) US-China trade deal over the week-end, this foes not change the The push to secure strategic metals is just one manifestation of this broader shift unfolding in the markets. Source: Tavi Costa, Bloomberg

The US and China have agreed on a deal to help resolve the trade war raging between the world’s two largest economies, top Trump administration officials announced Sunday.

Details of the deal, struck during negotiations in Switzerland over the weekend, were not revealed, but officials teased that more information will be shared on Monday. Source: Karli Bonne on X

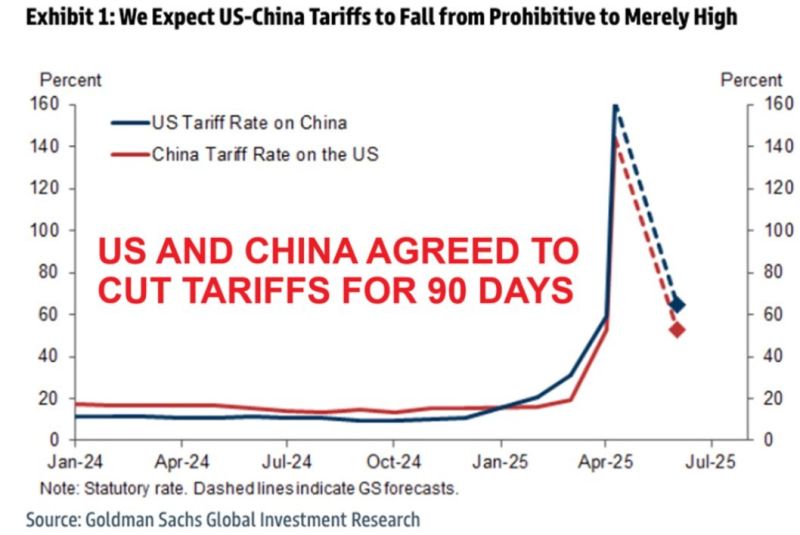

🔴 BREAKING: US and China agreed to LOWER tariffs on each other for 90 days until further agreement is reached.

▶️ US cuts tariffs on Chinese goods to 30% from 145% (a base 10% plus 20% fentanyl duty) from May 14th. ▶️ China cuts tariffs on American goods to 10% from 125%. ▶️ Reductions DO NOT include sectoral duties imposed on all US trading partners, and the tariffs applied on China during the first Trump administration remain in place. Treasury Secretary Scott Bessent said that neither side wants to decouple. As a reminder, in 2018, both sides also agreed to pause, but the US backed away from that, which led to more than 18 months of further tariffs and talks. It is a short-term relief at least. But just one headline may reverse everything again. Stay tuned. Source: Global Markets Investor

US-China Trade (temporary) deal summarized

(see below table by Mike Zaccardi, CFA, CMT, MBA. 👉 As highlighted by a CNBC article >>> The new U.S.-China deal to temporarily cut tariffs is better than expected, providing near-term relief for investors. Under the deal, so-called reciprocal tariffs will drop from over 100% to 10% on both sides. The Trump administration will keep 20% fentanyl-related tariffs on China in place, meaning America’s total duties on Chinese imports will stand at 30% while the 90-day pause is effective. 👉 In a note to clients on Monday, Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management, said the deal unveiled in Geneva was better than anticipated, but uncertainty remained. “The magnitude of this tariff reduction is larger than expected,” he said, although he noted that it would be difficult for Beijing and Washington to reach a more concrete trade arrangement in just three months. “The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process,” Hui said. “We are still waiting for further details on other terms of this agreement, for example, whether China would relax on rare earth export restrictions.” Source: CNBC

Breaking

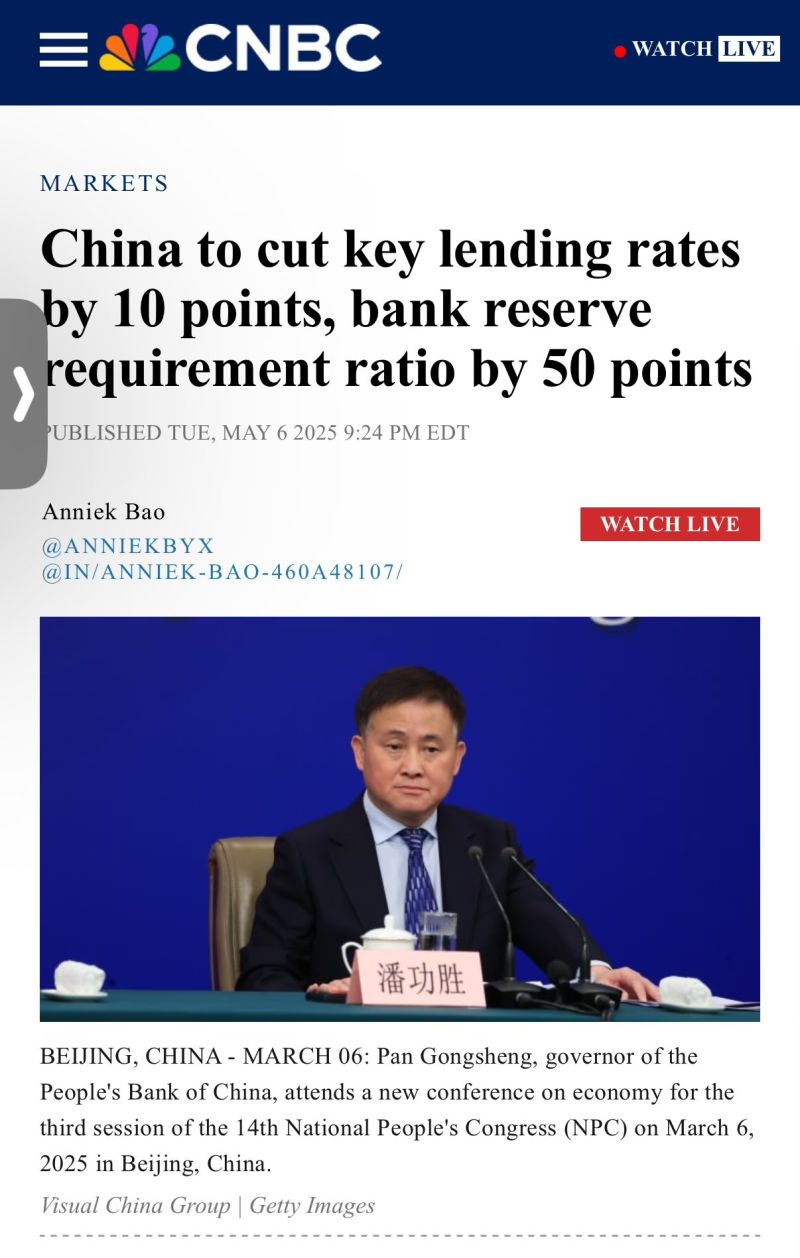

PBOC: TO LOWER RRR BY 50 BPS TO CUT POLICY RATE BY 10 BPS TO CUT STRUCTURAL MONETARY POLICY RATE BY 25 BPS TO CUT PERSONAL PROVIDENT FUND LOAN RATE BY 25 BPS. TO INCREASE THE CAPITAL MARKET SUPPORT TOOLS QUOTA TO 800B YUAN.

BREAKING: Treasury Secretary Scott Bessent says he will be meeting with Chinese officials in Switzerland to begin trade talks with China.

Bessent went on Fox News to break the news. "So, we will meet on Saturday and Sunday..."

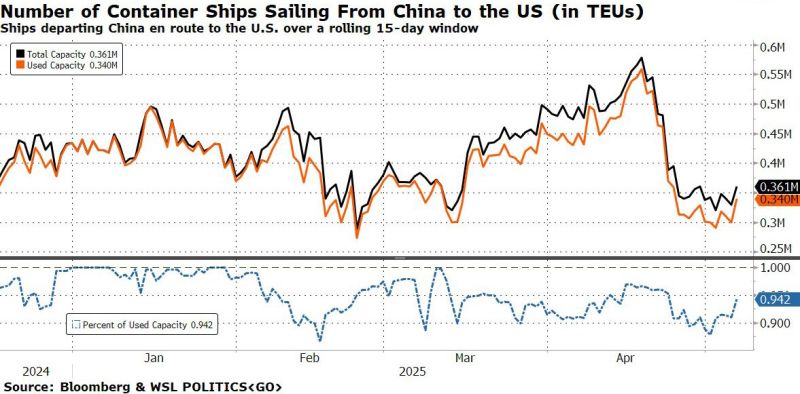

Ships sailing from China to US hits 2 week high.

But Long Beach was supposed to be a ghost port... @zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks