Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Container bookings from China to the US are falling sharply ⚠️

Source: Markets & Mayhem, FT

China’s Huawei Technologies is preparing to test its newest and most powerful artificial intelligence (AI) processor

it hopes to replace some higher-end products of US chip giant Nvidia, the Wall Street Journal has reported. Huawei has approached some Chinese tech companies about testing the technical feasibility of the new chip, called the Ascend 910D, the United States newspaper reported Sunday, citing people familiar with the matter. This was part of our "10 surprises 2025": SURPRISE #6 FROM MAG7 TO LAG7 https://lnkd.in/eKXRsc58

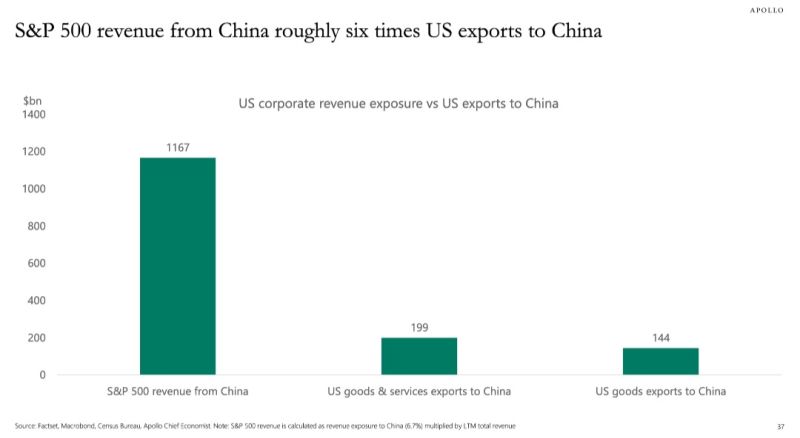

SP500 revenue from China are roughly six times US exports to China

From Torsten Slok, Apollo

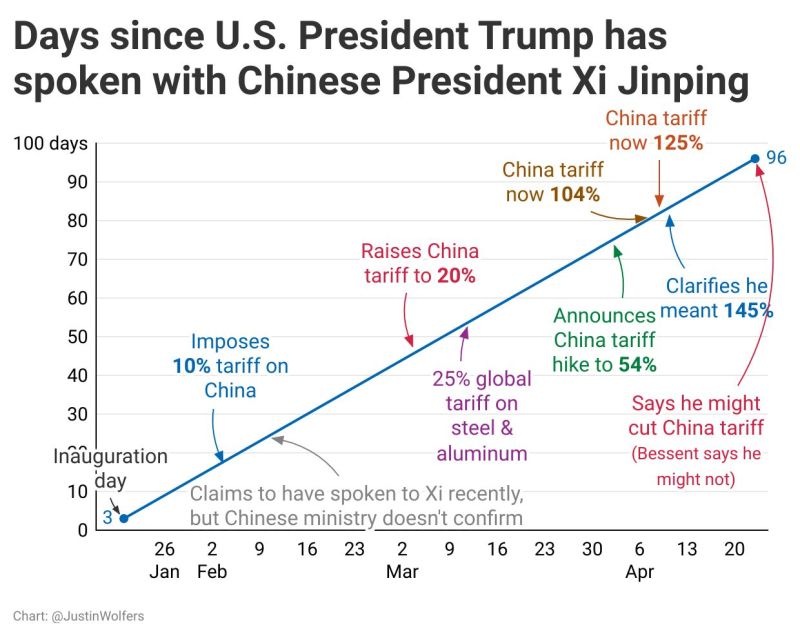

Trump - Xi Jinping summarized in one chart

Source: Justin Wolfers @JustinWolfers on X

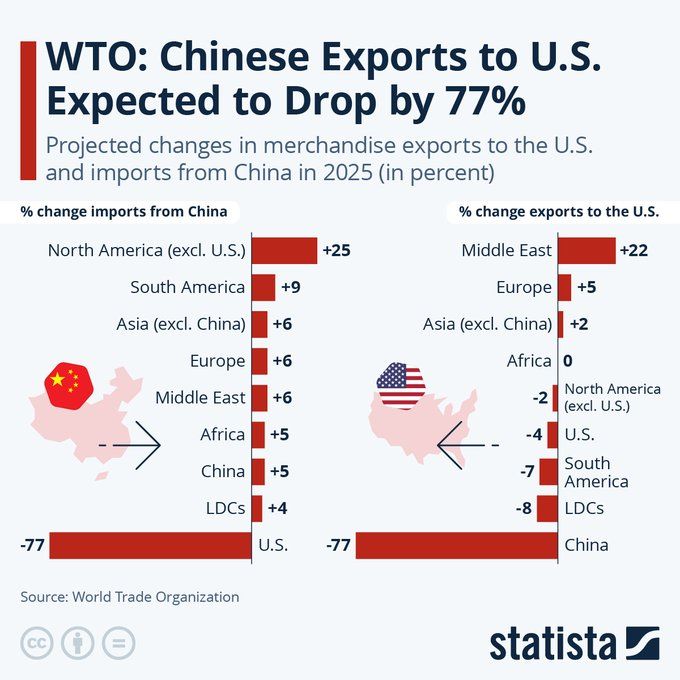

Chinese exports to the United States are expected to fall by 77 percent in 2025, according to World Trade Organization forecasts.

Meanwhile, Chinese imports are expected to increase to every other market, with the rest of North America predicted to see growth of 25 percent. Source: Statista @StatistaCharts

Global Markets Investor @GlobalMktObserv ‼️

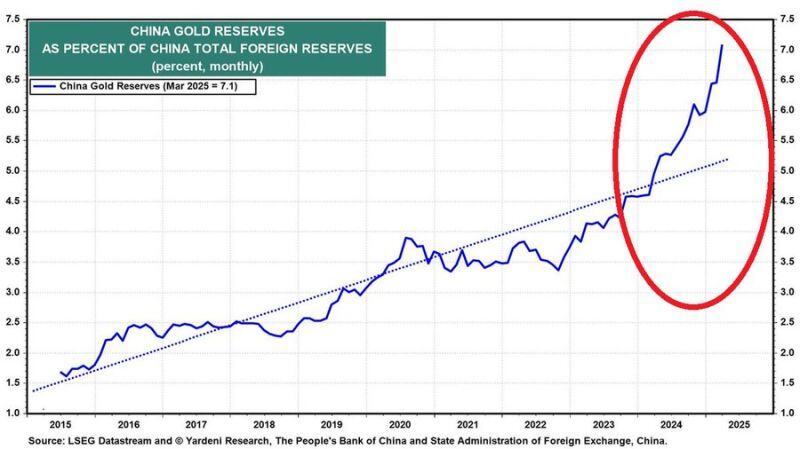

China's gold buying has been truly historic: China's gold reserves hit a RECORD 73.5 million troy ounces. China has bought a whopping 10 MILLION troy ounces of gold over the last 30 months. In effect, gold's share of China's total foreign reserves hit 7.1%, an all-time high. Source: Global Markets Investor

CHINA HITS BACK: RARE EARTH EXPORT CRACKDOWN RISKS GLOBAL CAR CRISIS

China’s hitting back at Trump’s 145% tariffs by choking off exports of rare earths — the weird metals your car, wind turbine, and fighter jet desperately need. That includes stuff like dysprosium and terbium which power the super-strong magnets in EV motors and defense tech. China’s latest export controls on rare earth minerals could cause shutdowns in automotive production, with stockpiles of essential magnets set to run out within months if Beijing fully chokes off exports. Beijing expanded its export restrictions to seven rare earth elements and magnets vital for electric vehicles, wind turbines and fighter jets in early April in retaliation for US President Donald Trump’s steep tariffs of 145 per cent on China. Government officials, traders and auto executives said that, with inventories estimated to last between three and six months, companies would be racing to stockpile more material and find alternative supplies to avoid major disruption. Jan Giese, a metals trader at Frankfurt-based Tradium, warned that customers had been caught off guard and most car groups and their suppliers appear to be holding only two to three months’ worth of magnets. “If we don’t see magnet deliveries to the EU or Japan in that time or at least close to that, then I think we will see genuine problems in the automotive supply chain,” said Giese. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks