Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

UAE PICKS AMERICA OVER CHINA IN THE GLOBAL AI ARMS RACE Abu Dhabi’s tech giant G42 is going all-in on the U.S.—not Beijing—as it races to become one of the world’s most powerful players in

With a $1.4 trillion investment plan aimed squarely at the U.S., the UAE is signaling a strategic pivot: America is its partner of choice for AI dominance. G42, backed by the oil-rich emirate and chaired by national security adviser Sheikh Tahnoon bin Zayed, has quietly launched “G42 USA” in Delaware and is expanding rapidly into American cloud services, chipmaking, and AI infrastructure. The company just pumped $335 million into U.S. chipmaker Cerebras, after cutting ties with Chinese suppliers like Huawei to meet U.S. national security demands. It already counts Microsoft, Silver Lake, and Ray Dalio’s firm among its investors. People familiar with the matter added that some of G42’s subsidiaries — which include AI applications, cloud computing and data centre companies — are expected to make announcements about US business plans in the coming months.

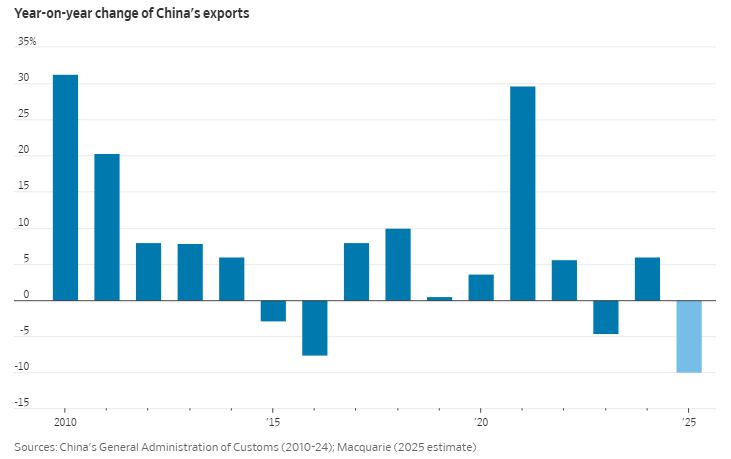

China's exports decline 10% year-over-year, the largest drop in AT LEAST 15 years

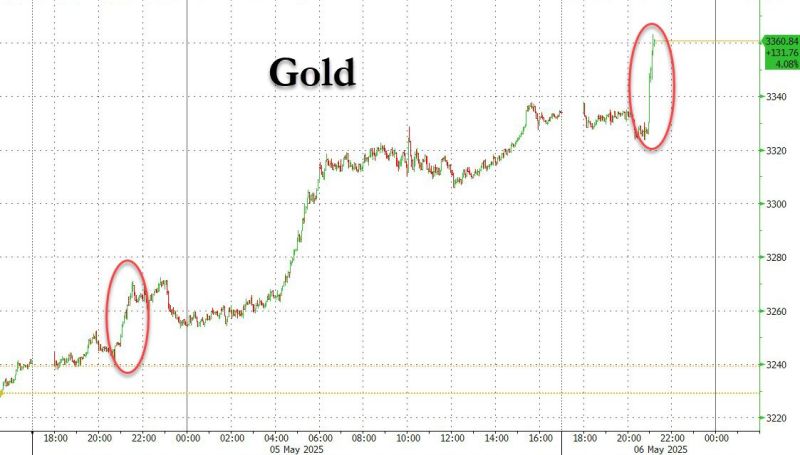

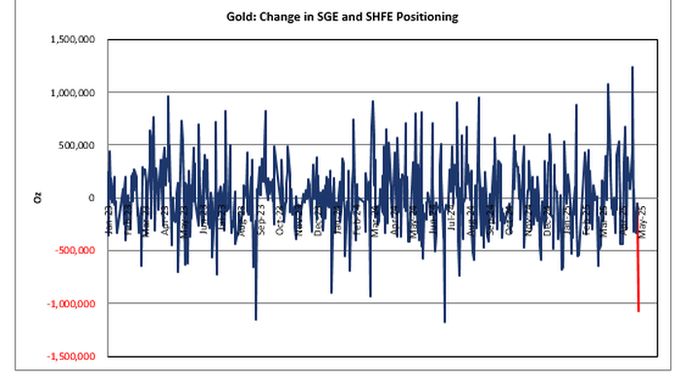

China said it is evaluating the possibility of starting trade negotiations with the U.S. Senior U.S. officials have reached out recently “through relevant parties multiple times,” hoping to start tariff negotiations, China’s commerce ministry said. Source: Barchart

🔴 Nvidia CEO Jensen Huang said Wednesday that China is “not behind” in artificial intelligence, and that Huawei is “one of the most formidable technology companies in the world.”

👉 Speaking to reporters at a tech conference in Washington, D.C., Huang said China may be “right behind” the U.S. for now, but it’s a narrow gap. “We are very close,” he said. “Remember this is a long-term, infinite race.” 👉 The Trump administration this month restricted the shipment of Nvidia’s H20 chips to China without a license. That technology, which is related to the Hopper chips used in the rest of the world, was developed to comply with previous U.S. export restrictions. Nvidia said it would take a $5.5 billion hit on the restriction. 👉 Huawei, which is on a U.S. trade blacklist, is reportedly working on an AI chip of its own for Chinese customers. “They’re incredible in computing and network technology, all these essential capabilities to advance AI,” Huang said. “They have made enormous progress in the last several years.”

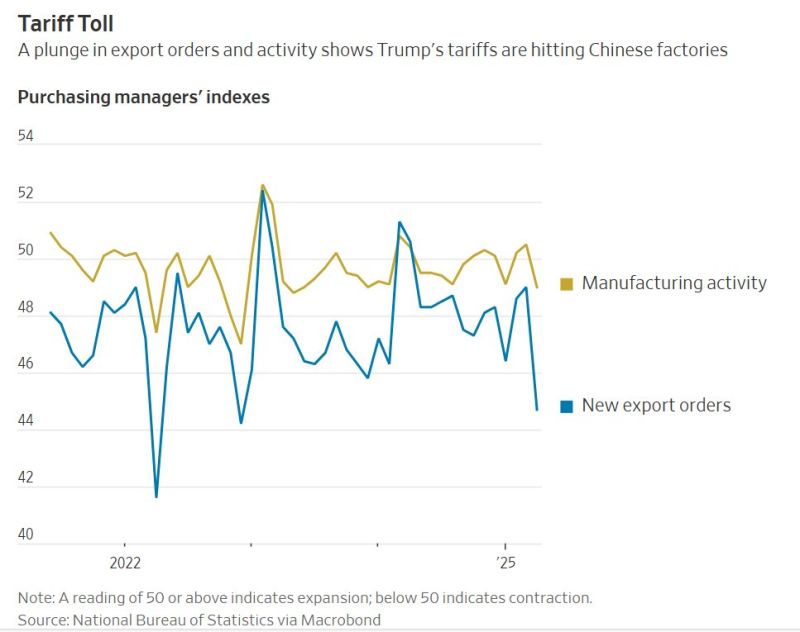

The Wall Street Journal on China's latest economic data:

"A gauge of new export orders fell in April to its lowest reading since Covid-19 was ravaging the country in 2022, while overall manufacturing activity in China was the weakest in more than a year." The sharp declines reflect both the "bring forward" to beat the US tariffs and the impact of these tariffs. Source: Mo El Erian on X, Macrobond

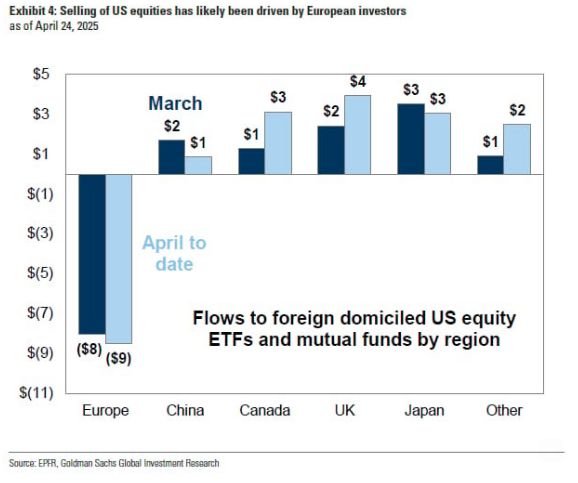

Only European Investors have been dumping U.S. Stocks 🚨

The rest of the world, including China, are buying 📈📈 Source: Barchart, Goldman Sachs, EPFR

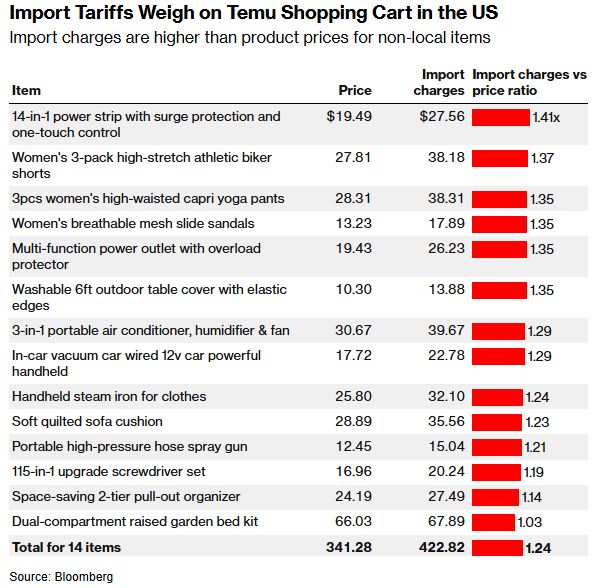

The import charges for many items on Temu (Chinese discount retailer) are higher than the cost of the products themselves.

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks