Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

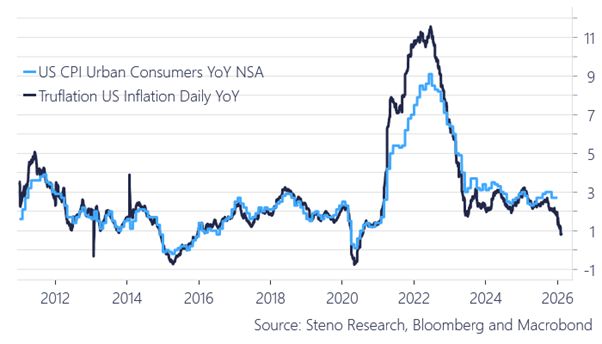

Will Truflation prove to be correct

Truflation is a digital, real-time alternative to government inflation numbers. Unlike the traditional CPI, which updates monthly and is based on a fixed “basket of goods,” Truflation tracks millions of prices daily from sources like Amazon, Zillow, and grocery stores. It’s faster, more reflective of actual spending, and transparent because it uses blockchain technology. This means you can see changes in prices almost immediately, giving a clearer picture of how your money’s value is changing in real time.

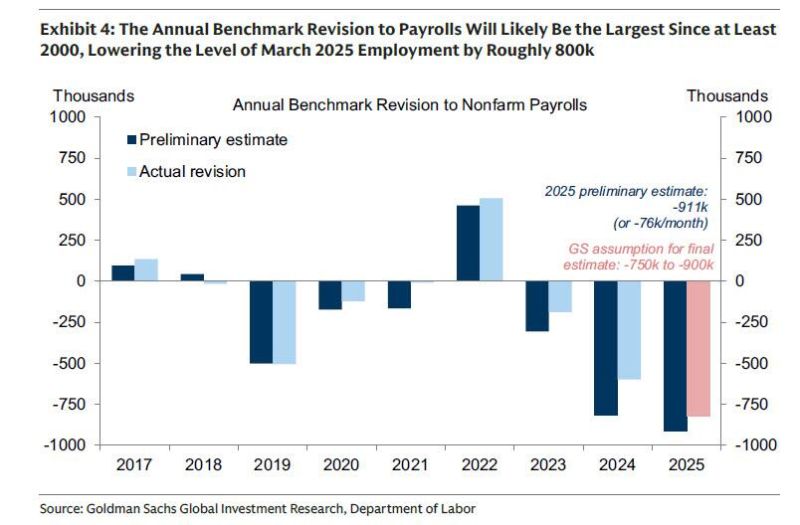

Brace yourselves: "One Shouldn't Panic" At How Bad The January Jobs

The real focus of Wednesday’s January jobs report is not the monthly headline figure but the major BLS revisions that could erase over one million previously reported jobs, revealing a much weaker labor market than believed. Economists are already preparing markets for softer data, with some suggesting that 50,000 monthly job gains may become the new benchmark amid a federal hiring freeze, productivity gains, and immigration shifts. The report may also appear weaker due to updates to the “birth-death” model, which could eliminate tens of thousands of previously estimated jobs each month. While unemployment is expected to hold around 4.4%, the Fed is closely watching signs that job growth has been overstated, marking a broader transition from labor hoarding to a cooling and more fragile economic environment.

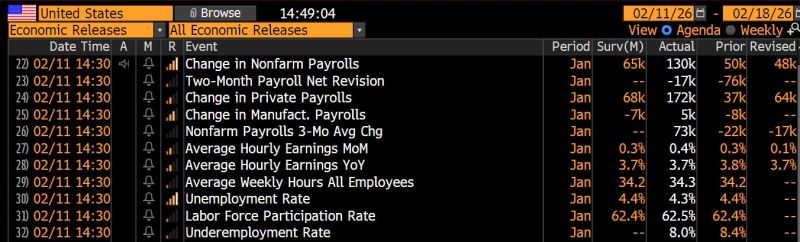

The January jobs report just SMASHED expectations.

Establishment Survey showed 130k new payrolls, well above 65k consensus estimate – and ahead of “whisper numbers” that were closer to 50k or even lower. This is the strongest number since April 2025... And here’s the kicker: -34,000 GOVERNMENT jobs. Private sector up. Government down ‼️ According to Household Survey, employment jumped by 528k in January, pushing the unemployment rate down to 4.3% from 4.4% in December. US Treasuries are selling off in response, with US 10y yield up 6bps. This better than expected report has caused odds of a rate cut in March to drop from around 20% to 6%. Source: Bloomberg, HolgerZ

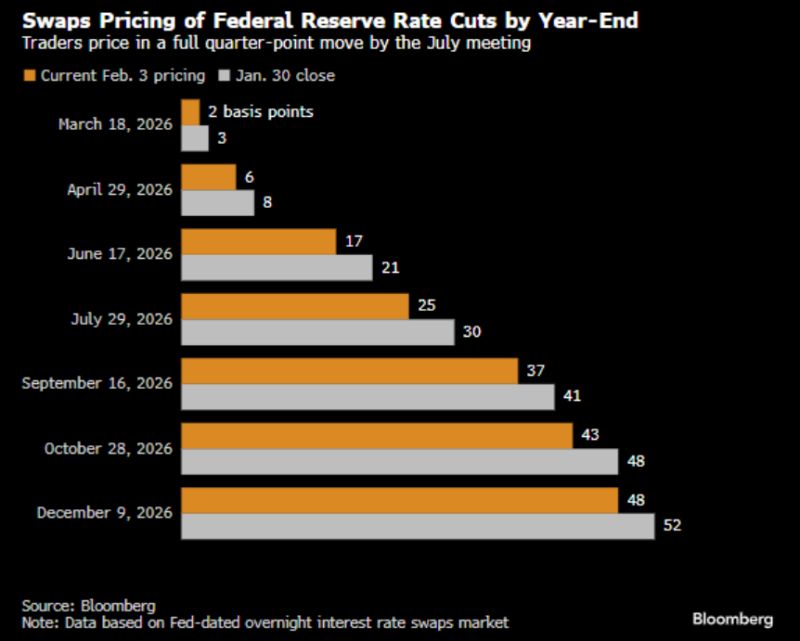

Rates Traders Target Dovish Policy Shift Under a Warsh-Led Fed

➡ Since Trump’s Friday announcement, flows in options linked to the Secured Overnight Financing Rate — which closely tracks the central bank’s path — have reflected bets on a more dovish tilt once Warsh takes his post in time for the Fed’s June meeting. Source: Christophe Barraud @C_Barraud on X, Bloomberg

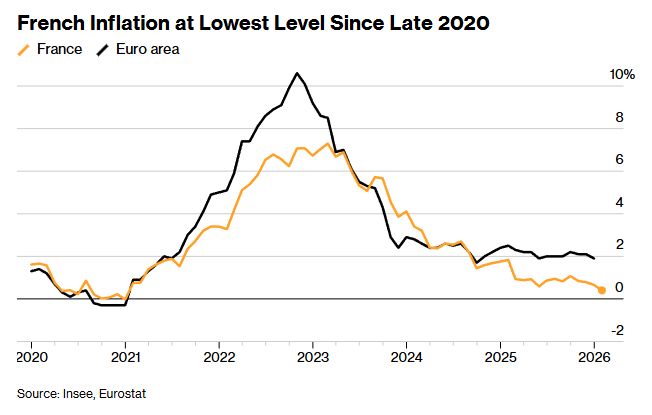

In case you missed it French Inflation Rate Unexpectedly Sinks to Five-Year Low

Source : Bloomberg

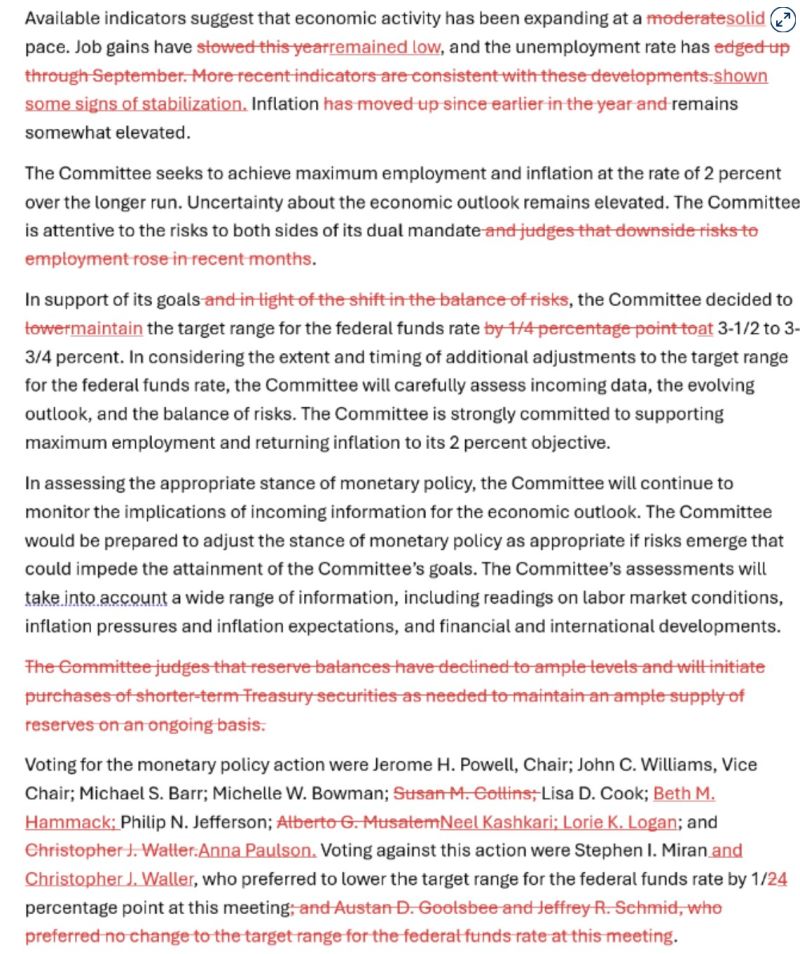

The Fed just hit the "Pause" button. 🛑

After three straight cuts, the FOMC is holding rates at 3.5%–3.75%. But the real story isn't the percentage—it’s the pressure. Here is what you need to know about the shift in DC today: 🔹 The "Labor Scare" is over: The Fed removed the language suggesting they're worried about the job market. They now see risks as "balanced." 🔹 Inflation is sticky: With growth tracking at a massive 5.4%, the Fed is worried about a second wave of price hikes. 🔹 A House Divided: Two Trump-appointed governors (Miran and Waller) dissented, pushing for more cuts despite the hold. 🔹 The End of an Era: Jerome Powell has only two meetings left. Between DOJ subpoenas over office renovations and a Supreme Court battle over firing governors, the Fed’s independence is being tested like never before. The big question for the markets: Who takes the wheel next? 🏎️ Prediction markets are currently betting on BlackRock’s Rick Rieder to succeed Powell. Below is the Fed statement with changes in red Source: CNBC

Might be a bit early to say if Truflation works but if it does, this looks pretty good. Here's why Truflation could the "anti-CPI" index disrupting economic forecasting

1. Goodbye Surveys, Hello Big Data 📡 The official CPI relies on manual surveys and "judgmental adjustments." Truflation uses 18 million+ data points in real-time. It scrapes e-commerce APIs, transit data, and housing aggregates every 24 hours. 2. The "45-Day Edge" 🏃💨 Traditional inflation data is a rearview mirror. Truflation acts as a leading indicator, often sniffing out price pivots 45 days before they hit government reports. 3. Censorship-Resistant Math ⛓️ Ever feel like the "official" numbers don't match your receipt? Truflation puts its data on-chain (via Chainlink). It’s immutable. No "seasonal adjustments" or political massaging—just pure, transparent code. 4. The Current Reality (Jan 2026) 📊 While headlines debate the latest "sticky" CPI prints, Truflation’s dashboard often shows a different story: Official CPI: Hovering around 2.3% Truflation: Currently tracking closer to 1.7% The Takeaway: In a world of high-frequency trading and instant supply chain shifts, "monthly" is the new "obsolete." By the way, hashtag#blockchain is the structural backbone of Truflation. While it collects data from traditional sources (like e-commerce sites and retailers), it uses blockchain to ensure that data is verifiable, transparent, and tamper-proof. The ecosystem has its own native token ($TRUF) which handles the "business" side of the data: - Staking: Node operators (the people running the computers that verify the data) must stake tokens as collateral to ensure they provide honest numbers. - Governance: Token holders can vote on things like which new data categories should be added or how the inflation formula should be weighted. - Payments: Users often pay in tokens to access premium, high-speed data streams Source chart: Bloomberg, RBC

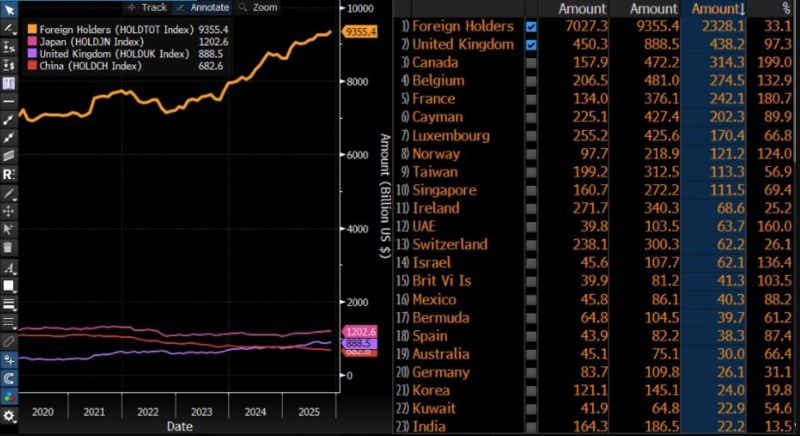

Foreign ownership of US debt rises to an all-time high.

Source: Daniel Lacalle @dlacalle_IA Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks