Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Us inflation is now at 1.2% according to truflation

Source: Anthony Pompliano

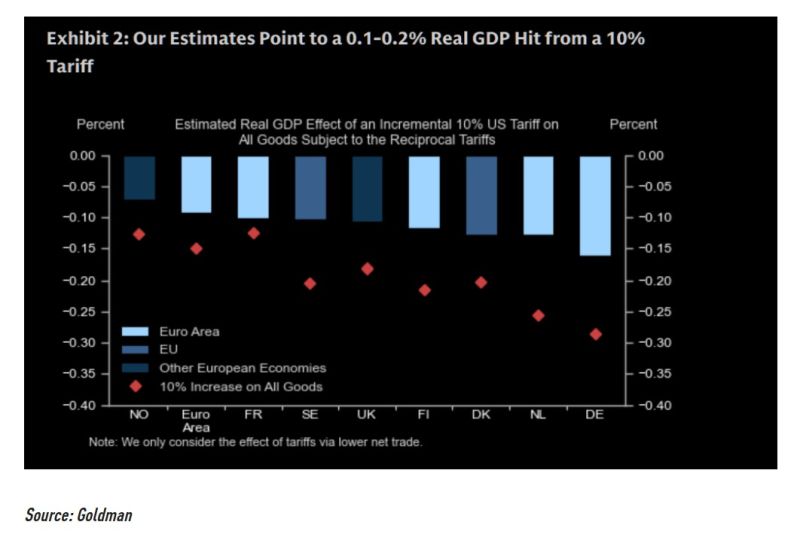

GS says very small effects of the 10% tariff on Europe

"While implementation is highly uncertain, we estimate that a 10% tariff would lower real GDP in the affected European countries by 0.1-0.2% via lower exports. The inflation effects would likely be very small and a Taylor rule would point to modestly lower policy rates, all else equal." Source: TME

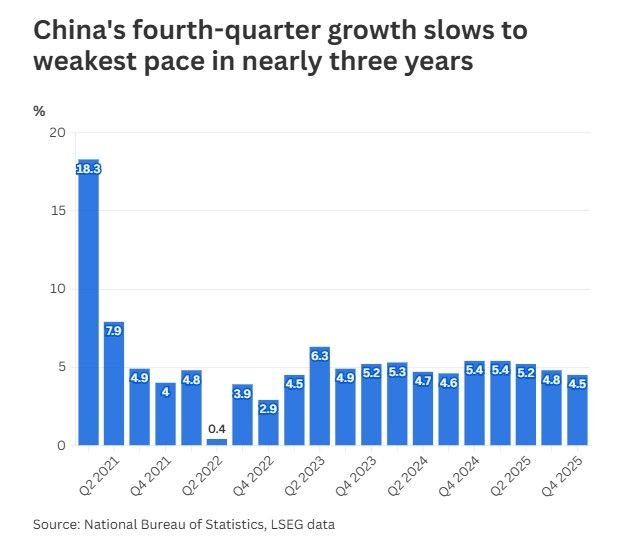

China’s GDP grew 4.5% in the October to December period, slowing from 4.8% in the third quarter, the weakest in nearly three years as consumption misses forecasts

Full-year economic output came in at 5%, meeting the official target of around 5%. Retail sales grew 0.9% in December from a year earlier, the slowest growth since late 2022. Industrial output climbed 5.2% in December, topping expectations for a 5% growth. Source: CNBC

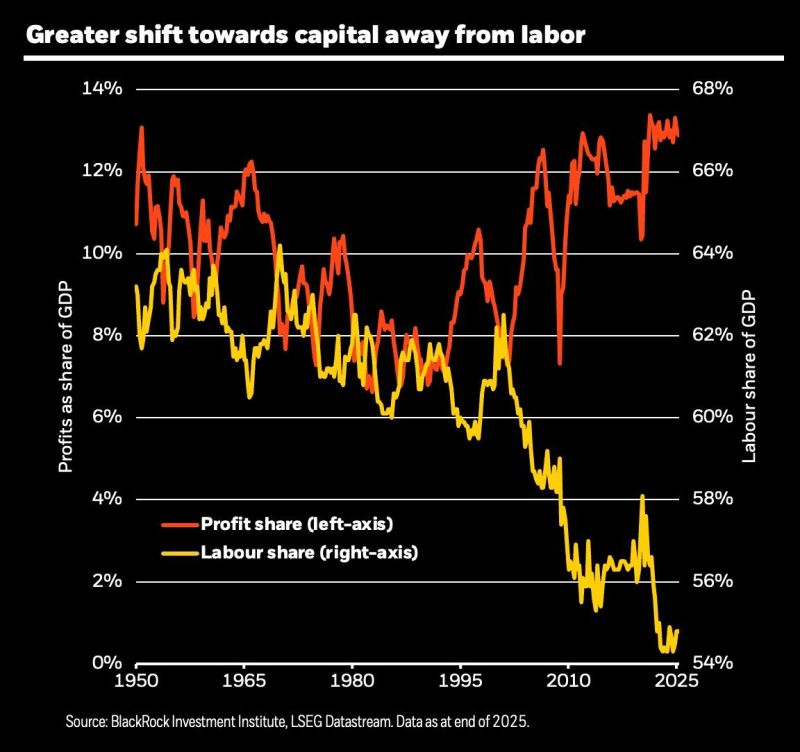

The K-shaped economy is becoming even more K-shaped...

The shift towards capital away from labor is one of the reason Source chart: Blackrock

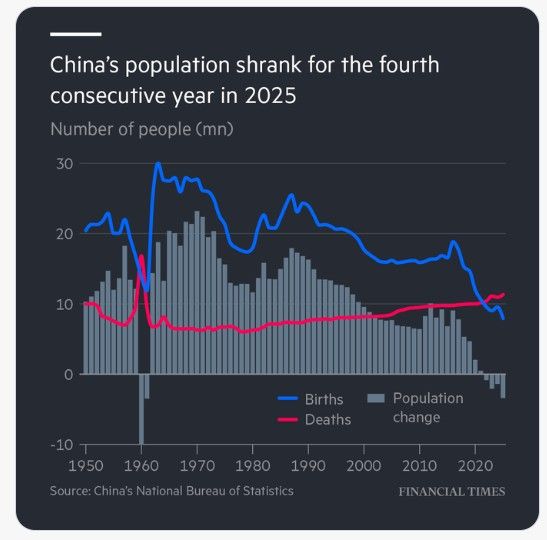

China last year registered the lowest number of births since records began

This marks the fourth consecutive year of population decline as policymakers grapple with a demographic crisis. Source: FT

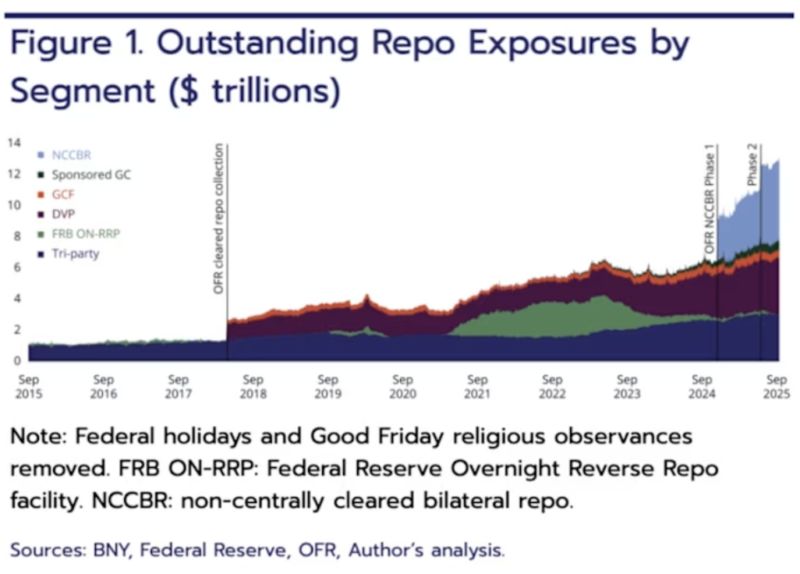

Total Repo Exposure has reached an all-time high of $12.6 Trillion

Source: barchart

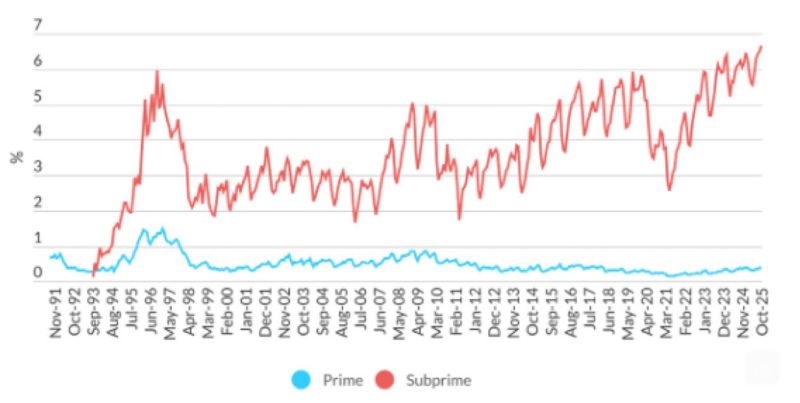

% of subprime auto loans that are 60 days or more overdue on their payments hit an all-time high of 6.65%

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks