Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

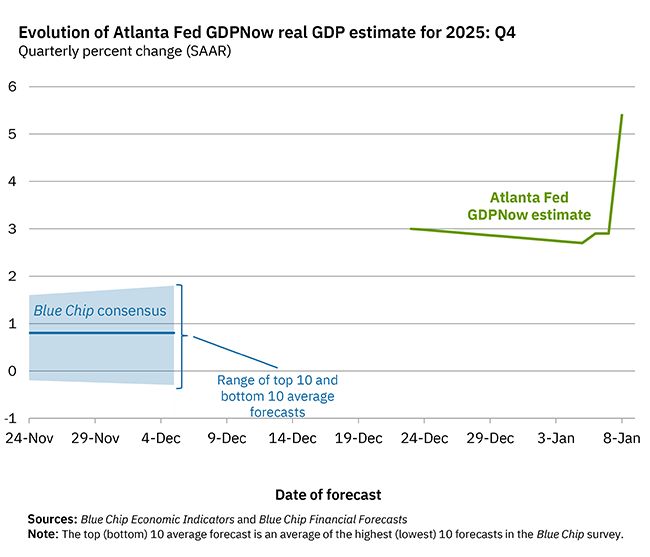

On January 8, the Atlanta Fed GDPNow model nowcast of real GDP growth in Q4 2025 is +5.4% from 2.7% previously.

That's a significant move upward. Yes you read it correctly +5.4% !!!! Real personal consumption expenditures growth increased from 2.4% to 3.0%. Net exports increased from -0.30% to 1.97%. Colling inflation, higher production, and higher GDP growth all seem very promising for the US economy. What comes next is $350B tax cut, Fed balance sheet expansion and maybe more Fed rate cuts... Source: Truflation, AtlantaFed

Is this the Goldilocks economy? 📈

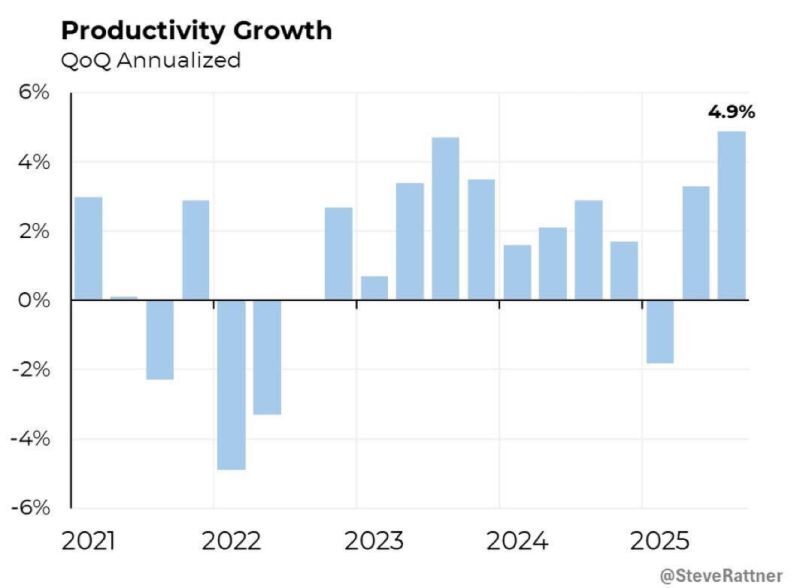

US Bureau of Labor Statistics (BLS) released yesterday preliminary Productivity and Costs data for Q3 2025 (July-September) and it’s a masterclass in efficiency. U.S. productivity just surged +4.9%—the strongest reading we’ve seen in nearly 6 years. The number is sharply above 3.3% consensus expectation, and higher than the previous 4.2% (revised up for Q2). But here is the real kicker: While output is soaring, labor costs actually fell -1.9%. In the world of economics, this is the Holy Grail. 🏆 The breakdown: Productivity: Jumped from ~3.3% ➡️ 4.9% Labor Costs: Flipped from +1% ➡️ -1.9% Indeed, Hourly compensation increased with figures varying around +4-5%. But Unit labor costs (compensation adjusted for productivity gains) declined or rose modestly, reflecting that productivity growth outpaced wage gains. Why does this matter to you? It means we are seeing massive growth without the inflationary "tax." This indicates accelerating economic efficiency, often driven by technology, innovation, or better processes. This is probably why the Atlanta Fed just hiked its Q4 GDP forecast to a staggering +5.4%. The Productivity and Costs report measures how efficiently the economy produces goods and services. This robust productivity growth is positive for the economy, as it helps contain wage-driven inflationary pressures and supports potential Fed rate cuts without overheating. This is bullish for markets, the economy, and risk assets. Source: Quantus Insights, Truflation

In case you missed it…

"German manufacturing orders for November surprised sharply to the upside, with the year-on-year figure rising +10.5%, versus expectations of +2.9%. Outside of the post-Covid rebound, this marks the strongest increase in almost 15 years. The data were boosted by large orders linked to government rearmament plans, but even stripping out such lumpy items, there has been a clear and gradual improvement in underlying momentum over recent months“ (Jim Reid, Deutsche Bank) Source: DB through Daniel D. Eckert @Tiefseher on X

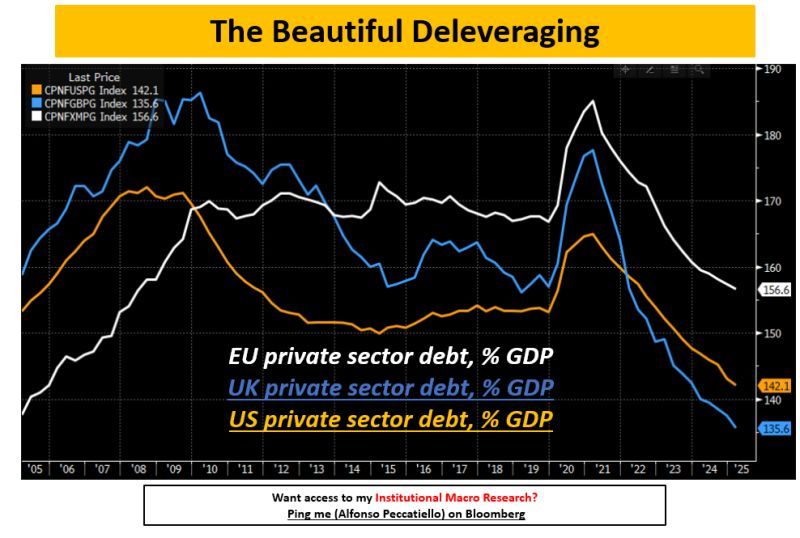

Stop worrying about the "debt mountain." You’re looking at the wrong mountain. 🏔️❌

High interest rates were supposed to "break" the economy by now. We all expected a collapse. So why are we still standing? It comes down to one massive shift that almost everyone is missing: The Great Private Sector De-leveraging. Here’s the breakdown: 1. Private Debt > Government Debt 🏦 Unlike the government, you and I can’t print money. If a household gets buried in debt, the pain is real and immediate. This is where economic "breaks" actually happen. 2. The 15-Year Cleanup 🧹 Since 2008, while we were focused on government deficits, the private sector (US, UK, EU) was quietly de-leveraging. Households and businesses have spent over a decade cleaning up their balance sheets. 3. The "Baton Pass" 🏃♂️💨 Governments took over the burden of money creation. Massive fiscal stimulus allowed the private sector to reduce its debt as a % of GDP. Essentially, the public sector took the hit so the private sector could heal. 4. The Result? Resilience. 💪 A lean private sector can handle 5% interest rates much better than an over-leveraged one. That’s why the "inevitable" crash hasn't arrived. The Big Question for 2026: How long can governments keep expanding deficits before they hit the wall of inflation and credibility? Can this "beautiful" de-leveraging continue forever? The baton has been passed... but is the runner running out of breath? 🏃♂️⛽ Source: Alfonso Peccatiello @ The Macro Compass - Institutional Macro

Financial conditions keep loosening as investors get excited about the potential for both fiscal and monetary stimulus this year.

Yields on junk bonds have fallen to the lowest since 2022, despite bankruptcies starting to creep higher. Source: Bloomberg, Lisa Abramowicz @lisaabramowicz1

In case you missed it... In Germany, inflation slowed more than expected at the end of last year.

Consumer prices rose 1.8% in Dec YoY, below the 2.1% forecast. The slowdown was driven mainly by falling energy prices and a sharp easing in food inflation, which dropped to just 0.8%. Core inflation also declined to 2.4%, although service inflation remains stubbornly high at 3.5%. Source: HolgerZ, Bloomberg

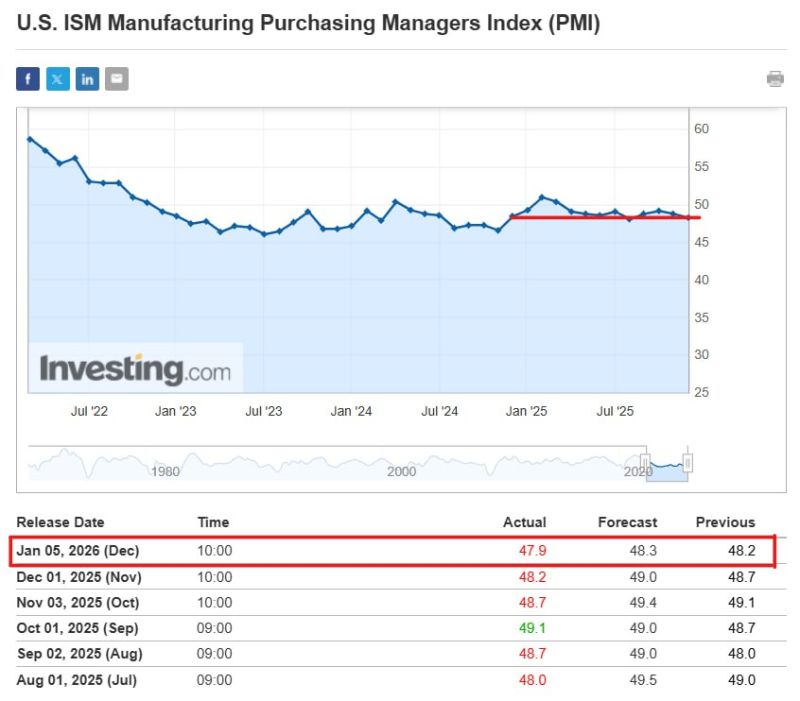

In case you missed it... US ISM Manufacturing PMI came in at a 14 month low of 47.9. while the expectation was 48.4.

The ISM Manufacturing is still trending lower, which means the US economy is still struggling. Source: www.investing.com, Bull Theory

🚨The U.S. is sitting on nearly $1 TRILLION worth of hidden liquidity that could be unlocked without QE.

The U.S. is sitting on a $1 TRILLION "hidden" asset that almost nobody is talking about. 🤫 Forget QE. Forget interest rate cuts. There is a lever the Treasury could pull that would inject massive liquidity into the system without issuing a single new bond. Here is the "Invisible Math" that could change everything: 1. The Accounting Time Warp 🕰️ The U.S. Treasury owns 261.5 million ounces of gold. On the official books, it’s valued at just $42.22 per ounce—a price frozen in 1973. Official Book Value: ~$11 Billion Real Market Value (at ~$4,500/oz): ~$1.17 Trillion 2. The $1.1 Trillion Gap 🕳️ While most countries value their gold at market prices, the U.S. is sitting on a massive unrealized gain. This isn't just a fun fact—it’s a strategic bazooka. 3. Why this matters NOW ⚠️ With U.S. debt crossing $37 trillion and interest costs exploding, the government is running out of moves: Raising taxes? Politically impossible. Cutting spending? Unrealistic. More debt? Pushes yields into the danger zone. 4. The "Stealth Liquidity" Play 🚀 If the U.S. revalues that gold to market prices, it instantly creates over $1 trillion in balance sheet capacity. No bonds, no debt—just "unlocked" value. What happens to your portfolio? Gold: Skyrockets, as it’s the primary asset being repriced. Risk Assets: Follow suit as "stealth liquidity" enters the system. Bitcoin: Becomes the ultimate signal. Gold revaluation is an admission that fiat purchasing power has eroded. Bitcoin is the only major asset that sits entirely outside that system. Will the US decides to revalue their gold holdings in 2026??? 🧐 Source: Bull Theory on X

Investing with intelligence

Our latest research, commentary and market outlooks