Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

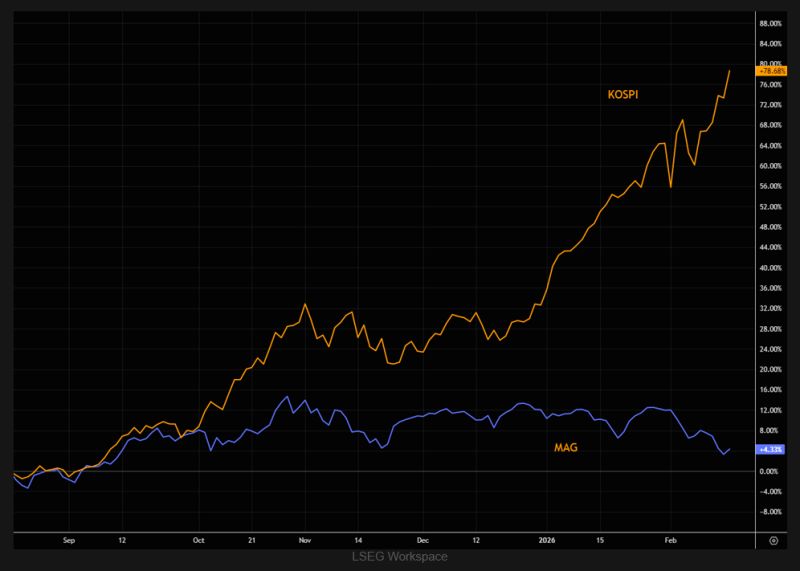

KOSPI vs MAG index performance over the past 6 months needs little commenting.

Source: TME

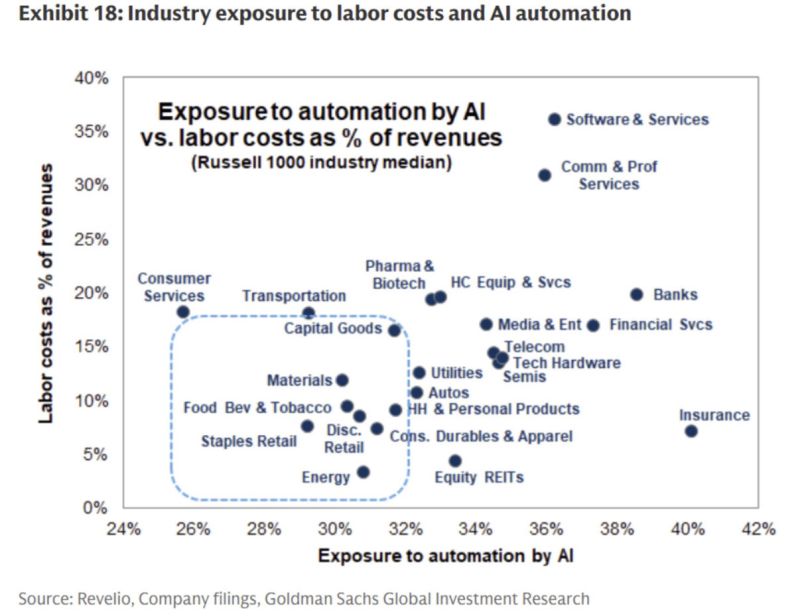

Perhaps the trade this year isn't so much "sell America"rather something like: "spend a lot more money everywhere else" -

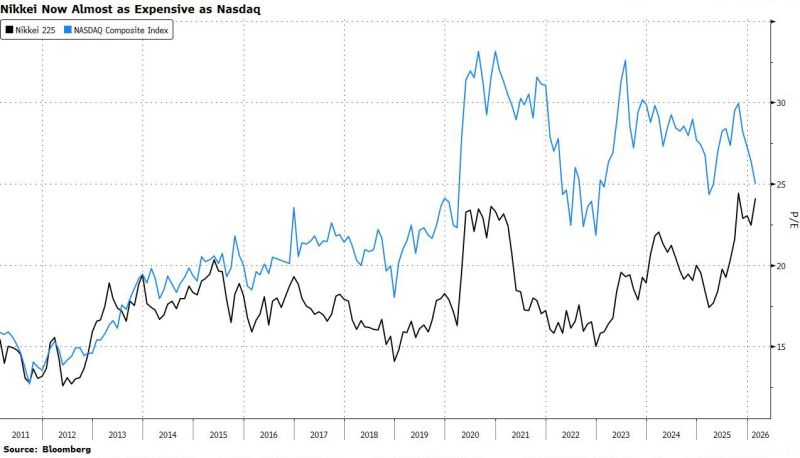

At least so far this year. For example, Asian stocks have made their best start over US equities since at least 2000: @TheTerminal Source: Lisa Abramowicz @lisaabramowicz1 Bloomberg

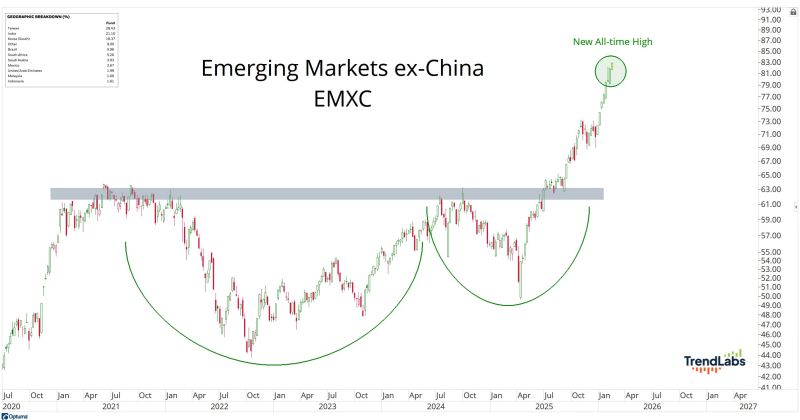

Emerging Markets Ex-China is up 50% in the past year and over 13% so far in 2026. New all-time highs again today.

Source: J.C. Parets @JC_ParetsX

A very important development for global markets ‼️

➡️ JGBs long-term bond yields are moving LOWER (see below the 30Y over the last month) while the Yen is firming against dollar (From nearly 158 on Sunday evening to roughly 155 this morning, it’s been a significant move in USDJPY). Takaichi landslide victory - which implies fiscal stimulus & tax cuts - hasn't trigger a bond or yen crash. Quite the contrary. Meanwhile, Japan equities continue to move upward. This is quite a compelling development overall for Japan macro & markets landscape.

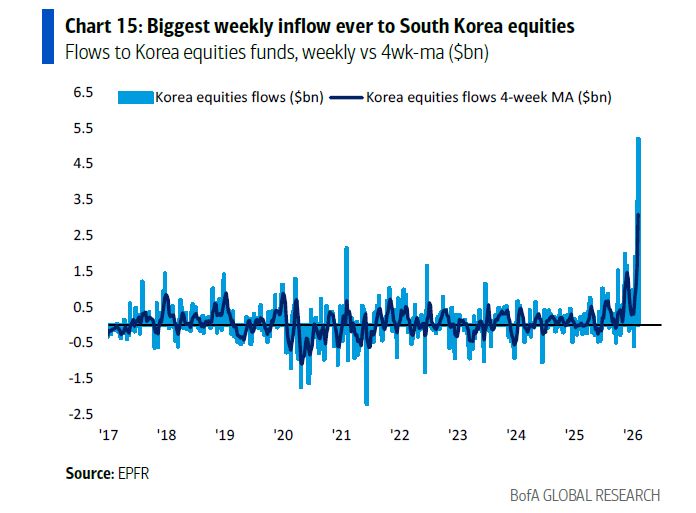

Massive inflows into Korean stocks have some cross-border ripple effects...

The Korean momentum kamikazes dumped bitcoin, dumped gold, dumped silver, dumped anything that did not have upward momentum and piled into Korean memory stocks at a record pace. Source: BofA, zerohedge

Japan’s prime minister Sanae Takaichi has led her party to a crushing victory in Japan’s snap general election on Sunday

Japan’s Prime Minister Sanae Takaichi won a landslide election, securing a two-thirds majority that enables major reforms. Her agenda includes strong economic stimulus, tax relief on food, increased tech investment, and possible constitutional change. Markets welcomed the political stability, pushing Japanese stocks to new highs.

Investing with intelligence

Our latest research, commentary and market outlooks