Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

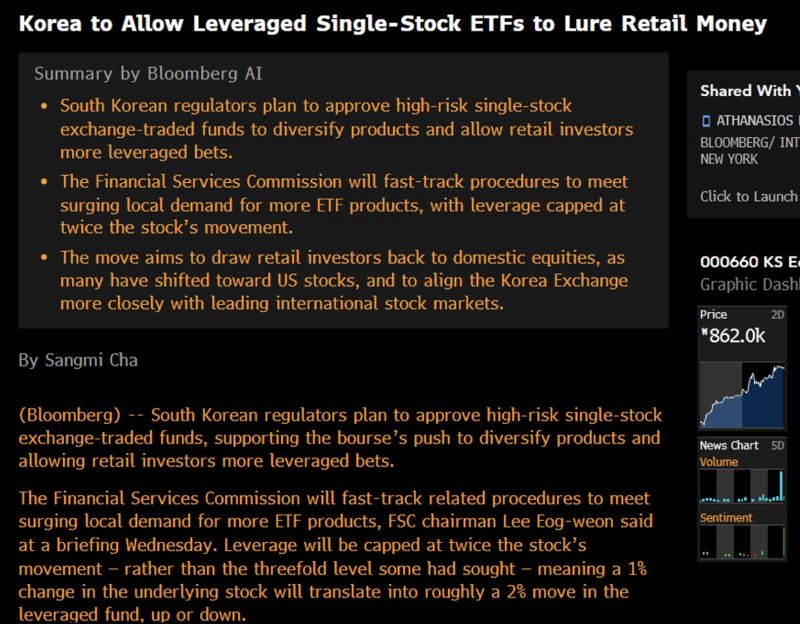

Markets in Asia are getting shredded on Monday.

Indonesia and Korea down over 5% each; commodities tossed out the window Source: David Ingles

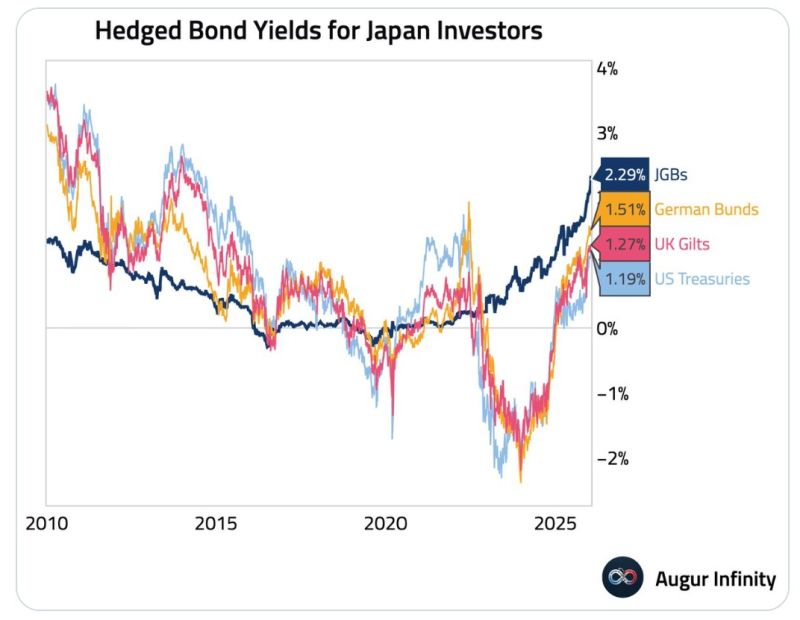

🇯🇵 For Japanese investors, domestic JGBs are now more attractive than hedged foreign bonds from a yield perspective.

Source: Augur Infinity @AugurInfinity on X

Japan’s 30y govt bond yield jumped 10bps to 3.50%, its highest level since at least the 1990s.

The move comes amid growing speculation that PM Sanae Takaichi may dissolve parliament as early as next month, following reports in local media. Source: Bloomberg, HolgerZ

In case you missed it...

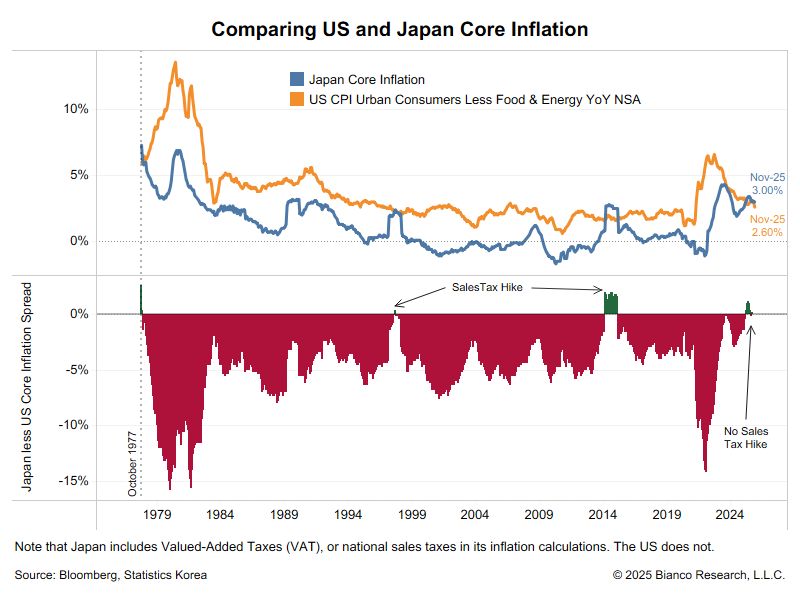

*JAPAN NOV. CORE CPI RISES 3.0% Y/Y; EST. +3.0% *US NOV. CORE CPI RISES 2.6% Y/Y; EST. +3.0% This is the first time since 1977 that Japan has a higher inflation rate than the US. (Japan includes taxes in its inflation measure. The US does not.) Source: Jim Bianco

The Bank of Japan just threaded the needle. 🧵

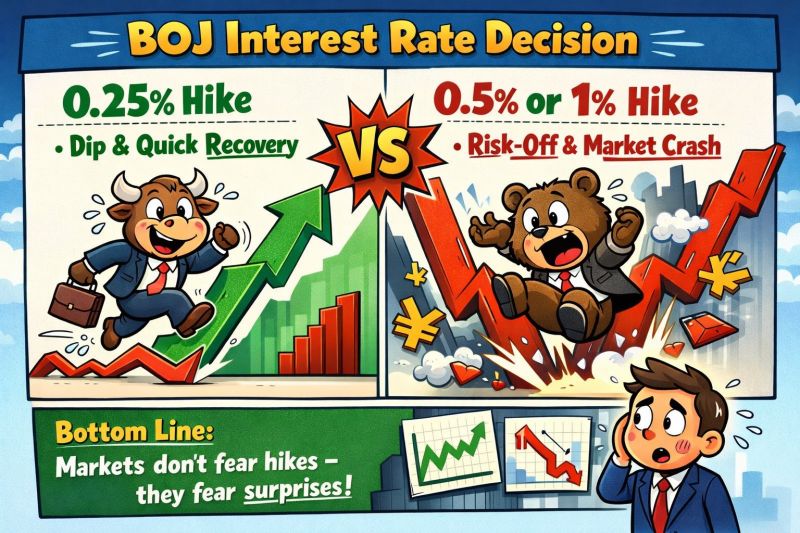

Rate hike? Yes. Market crash? No. In fact, it’s the exact opposite. Here is why the "Carry Trade Collapse" everyone feared just got cancelled (for now). The Headline: The BOJ raised rates by 25 bps to 0.75%. It was priced in, expected, and delivered with a heavy dose of "don't panic." Why the markets are rallying: The BoJ basically told the world: "We’re raising rates, but we aren't pulling the rug." Real Rates stay LOW: The BOJ explicitly stated that real interest rates will remain at significantly low levels. This is classic Financial Repression. Accommodative Stance: Even with the hike, the monetary environment remains "supportive." They are still cheering for the economy. The Stimulus Paradox: While the BOJ lifts rates, the Japanese government is simultaneously releasing a massive stimulus package. The "Risk-On" Reaction: Usually, a rate hike strengthens a currency. But today? The Yen is weakening. 📉 This is the "Green Light" for risk assets. If the Yen doesn't spike, the Yen Carry Trade doesn't unwind. The result: Equities: UP 📈 Bitcoin: UP 🚀 Bond Yields: UP 📊 (10 year ABOVE 2%) Yen: DOWN (156) The Takeaway: Governor Ueda is playing a dangerous game of balance, but for today, he’s the market's best friend. Liquidity is still flowing, the "cheap money" isn't disappearing overnight, and the global carry trade lives to see another day. Is this the "Goldilocks" scenario for the end of 2025, or is the market ignoring a looming Yen spike? Source: FinancialJuice @financialjuice SWING BLASTER 🥷🕉️🔱 @swing_blaster

Investing with intelligence

Our latest research, commentary and market outlooks