Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

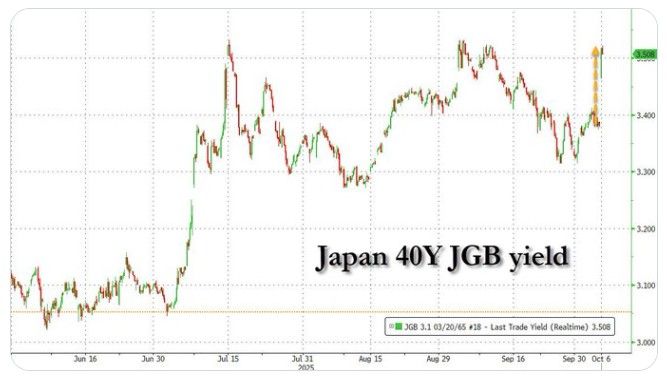

Japan 30-Year Bond Yield jumps to 3.29%, the highest level in history.

Source: Carl ₿ MENGER @CarlBMenger

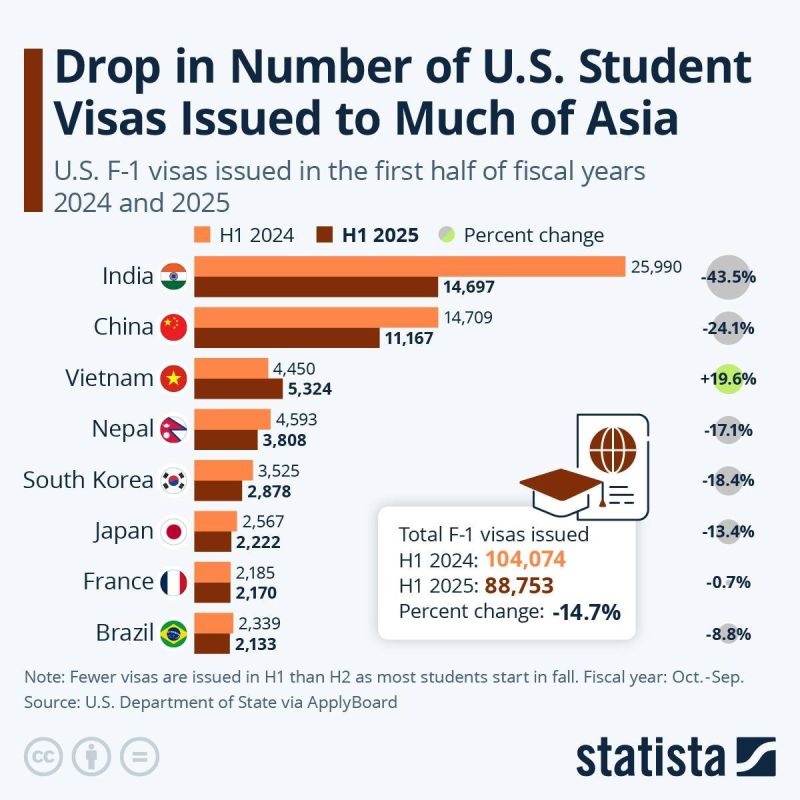

Big drop in U.S. student visas to Asia - India down 43.5%

New data shows a major decline in U.S. F-1 student visas issued in H1 2025, with total visas falling 14.7% year-over-year. India saw the steepest drop: down 43.5%. China fell 24.1%, Nepal 17.1%, and South Korea 18.4%. Vietnam was the only major country to increase, up 19.6%. Source: Statista, U.S. Department of State, ApplyBoard thru Mario Nawfal on X

BREAKING: The Bank of Japan announced that it will leave its benchmark interest rate on hold

The decision was widely expected amid political uncertainty stemming from the resignation of PM Shigeru Ishiba. BUT HERE'S THE BIG NEWS: The Bank of Japan has decided to begin SELLING its ETF holdings. The BOJ is the largest shareholder of ~70% of large listed stocks in Japan; if it really does this, it will put downside pressure on Japanese stocks. The planned pace of sales is based on an annual book value of ¥330 billion. As of June 2025, the BOJ’s ETF balance stood at a book value of ¥37.1861 trillion. The stock market is already asking the BOJ: “are you sure bro?” - see chart below. Best of luck to the BOJ plan to sell stocks when the BOJ IS THE MARKET.

‼️ JUST IN : Taiwan Semiconductor $TSMC’S REVENUE JUMPED OVER 33.8% YoY TO $11.09B IN AUGUST

👉 TSMC (TAIWAN SEMICONDUCTOR) MAKES ALL THE CHIPS FOR NVIDIA , APPLE , AMD AMONG OTHERS 👉So far in 2025 (Through August) TSMC has brought in total revenue of $80.33B up 37.1% YoY. Source: GURGAVIN

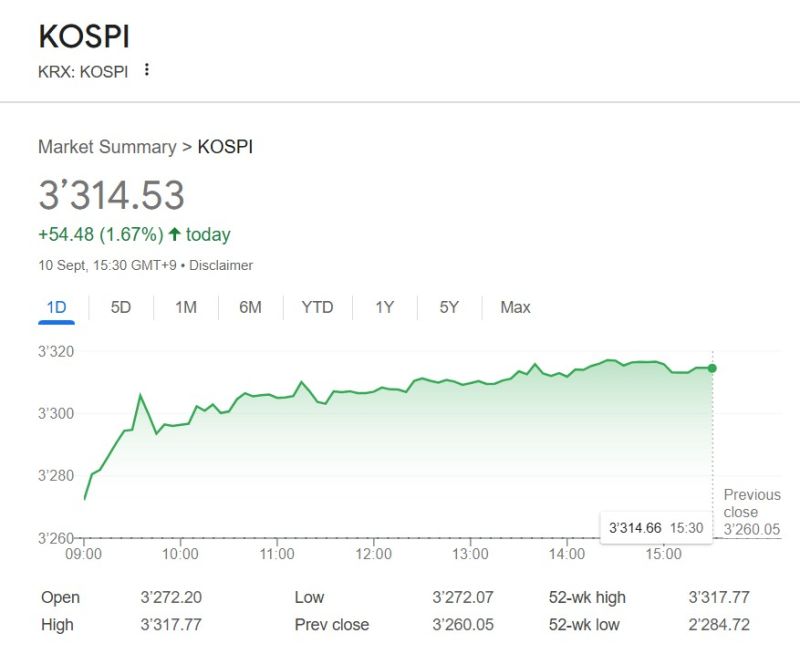

Korea's Kospi index at record high ‼️

👉 South Korea’s benchmark stock index Kospi surpassed the 3,300-point threshold for the first time in more than four years during early trading Wednesday. The global bull market is broadening.

Japan’s top trade negotiator Ryosei Akazawa canceled a trip to the United States on Thursday over issues related to the U.S.-Japan trade deal.

In a statement, Japan’s Chief Cabinet Secretary Yoshimasa Hayashi said that his trip would have involved the discussion of U.S. tariff measures. “However, during the coordination with the US, because it became apparent that certain points required further technical discussion, the trip was cancelled, and it was decided that discussions will continue at the administrative level,” Hayashi told reporters. Japanese media outlet Kyodo News said it has not been decided whether he will reschedule the trip, while Reuters said Akazawa could head to Washington as early next week after the outstanding issues are resolved, citing an anonymous government source. Hayashi said Tokyo will urge the U.S. to amend its presidential order on reciprocal tariffs as soon as possible, and ask Washington to issue a presidential order to lower tariffs on automobiles and auto parts. Source. CNBC

Investing with intelligence

Our latest research, commentary and market outlooks