Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

President Donald Trump said Wednesday that the United States has struck a trade deal with Vietnam that includes a 20% tariff on the southeast Asian country’s imports to the U.S.

*ADP PRIVATE PAYROLLS: -33K vs 98K exp. First negative print since March 2023. Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy as investors believe as they bid the S&P 500 back up to record territory to end the month. Private payrolls lost 33,000 jobs in June, the ADP report showed, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May’s soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week. Source: Zerohedge, Bloomberg, CNBC

The Hong Kong Monetary Authority said it used HK$9.4bn ($1.2bn) of its reserves to buy Hong Kong dollars on the open market.

It acted after the local currency dropped past HK$7.85 per US dollar, the weak end of the band within which it is allowed to trade. The move will drain liquidity from the banking system and pushed up interbank lending rates on Thursday, potentially threatening a carry trade that has allowed investors to borrow cheaply in the city’s currency before investing in higher-yielding US debt securities. Source: FT https://lnkd.in/evksjsp9

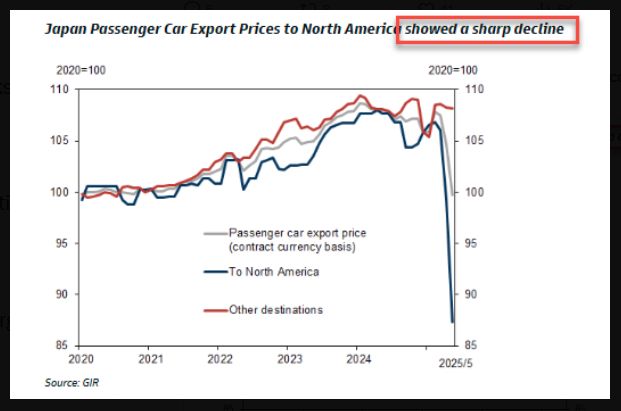

US Tariffs have massive negative consequences on Japan's car exports

Source: GIR, zerohedge

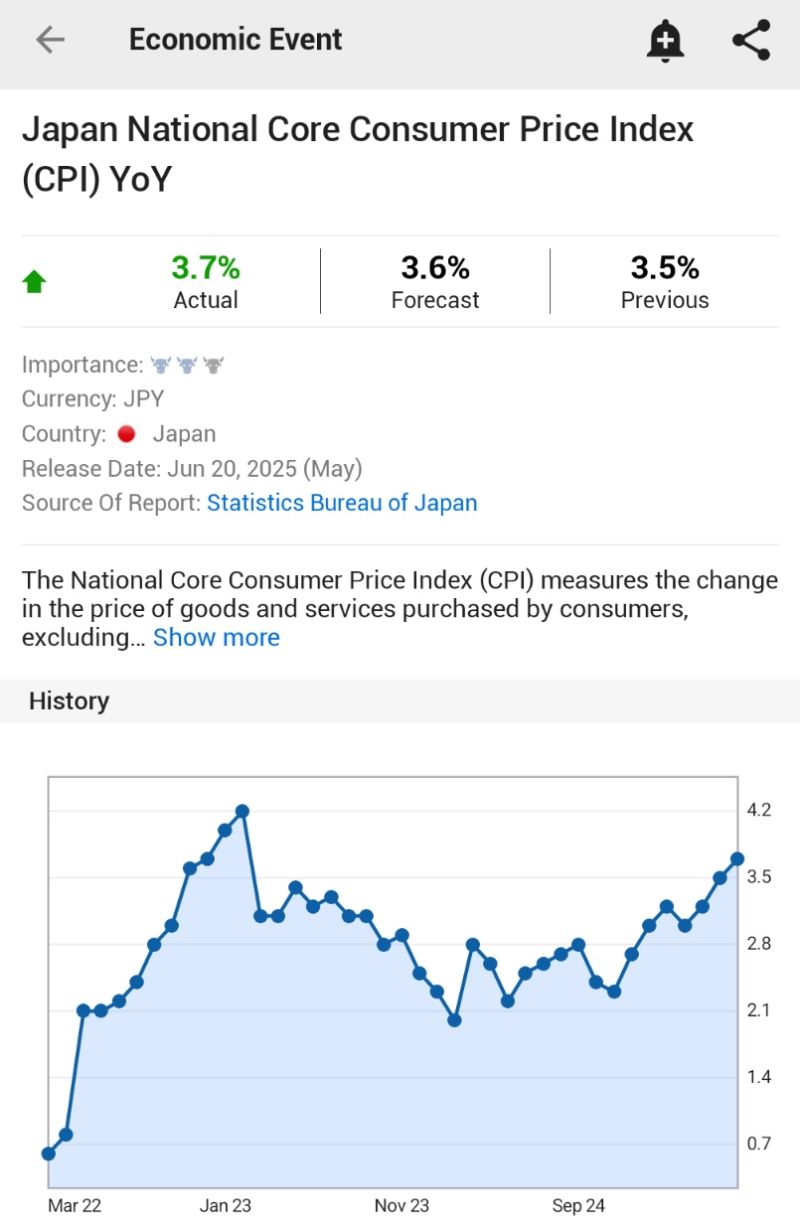

JAPAN MAY CORE CPI INFLATION RISES 3.7% Y/Y; EST. 3.6%; PREV. 3.5%

HIGHEST SINCE JANUARY 2023 $JPY Source: investing.com

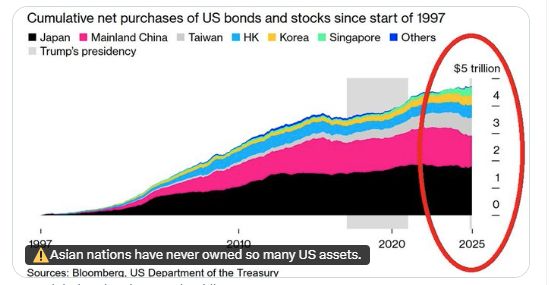

Asian nations have NEVER owned so many US assets:

The 11 largest Asian countries have accumulated $4.7 TRILLION of US stocks and bonds over the last 28 years. Their total investments in the US reached $7.5tn. ➡️ Will they bring the money back home? Source: Global Markets Investor, zerohedge, Bloomberg

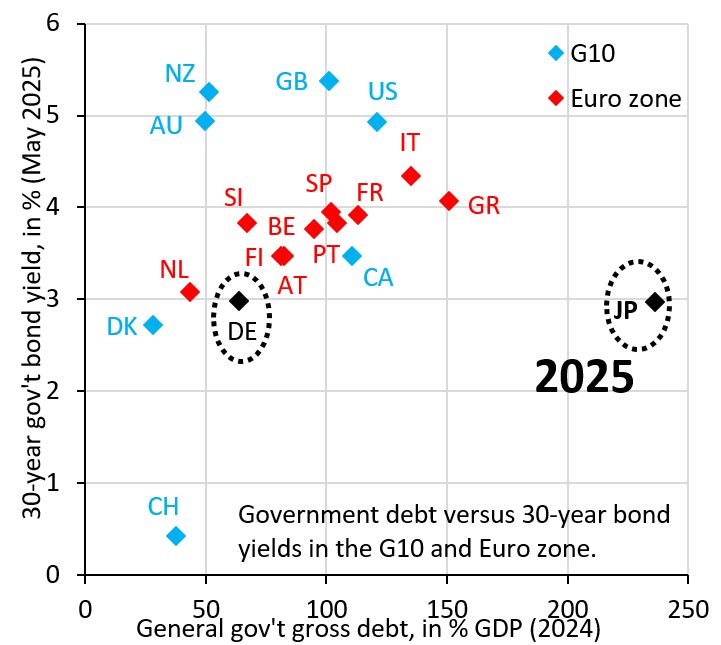

Japan's 30-year government bond yield has risen sharply in recent months and is now 3%.

That's the same yield level as Germany, but German government debt is 60% versus Japan's 240%. Japanese yields are still way too low given Japan's astronomically high level of government debt. Source: Robin Brooks @robin_j_brooks on X

And now watch Japanese inflation tumble...

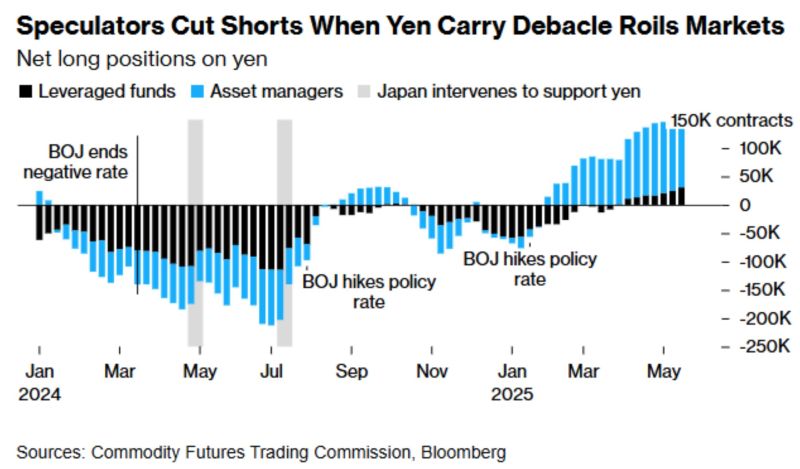

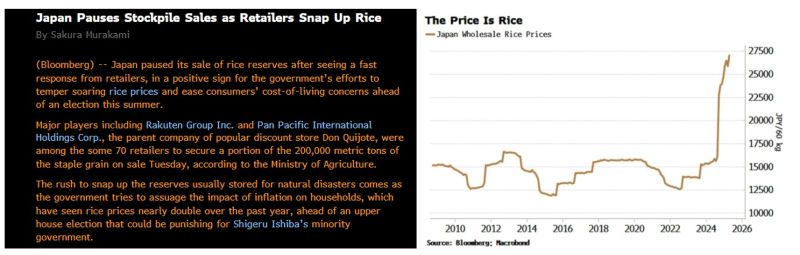

As highlighted by zerohedge, Japan does NOT actually have high CORE inflation; it does however have soaring rice prices which have skewed inflation expectations across the population as rice is a huge component of the overall CPI basket. Meanwhile the BOJ is scrambling to contain inflation - which has tumbled ex food with real wages near record lows - and is tightening conditions by raising rates even though it has zero control over food inflation. However, as a by product of its monetary policies and strong yen, the bond market is crashing every day now... This bond crash could eventually spread to Japan's banks and global markets, sparking a global crisis. They thus need to do something. Yesterday, Japan's Ministry of Finance (MOF) said they will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance... This was enough to trigger a big drop in bond yields and the yen, which both came as a relief for global markets. What is happening on rice (and its deflationary consequences) is anotehr positive development Source: zerohedge, Bloomberg, Macrobond

Investing with intelligence

Our latest research, commentary and market outlooks