Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

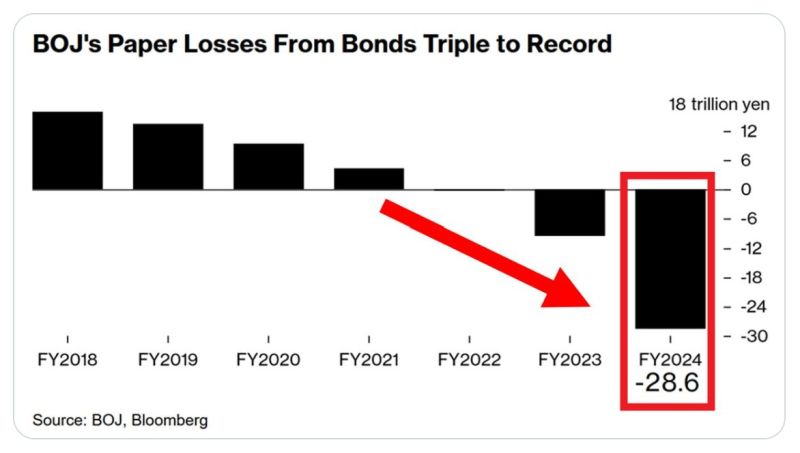

The Bank of Japan's unrealized losses hit a record ¥28.6 trillion ($198 billion) in Fiscal Year 2024 ending March 31, 2025.

Paper losses from Japanese government bonds TRIPLED from the last year. However, the BOJ's reported net income was ¥2.26 trillion ($16 billion). It can take years until these bonds mature. Source: Global Markets Investor, Bloomberg

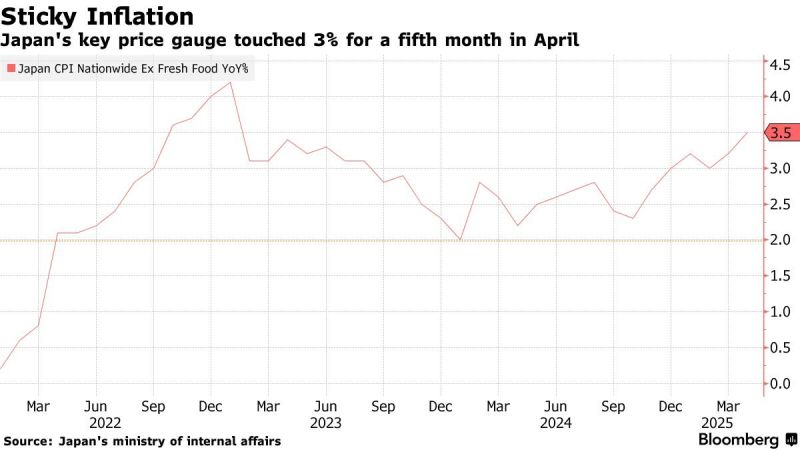

Japan’s CPI pickup, rice price surge raise pressure on Ishiba

Bloomberg

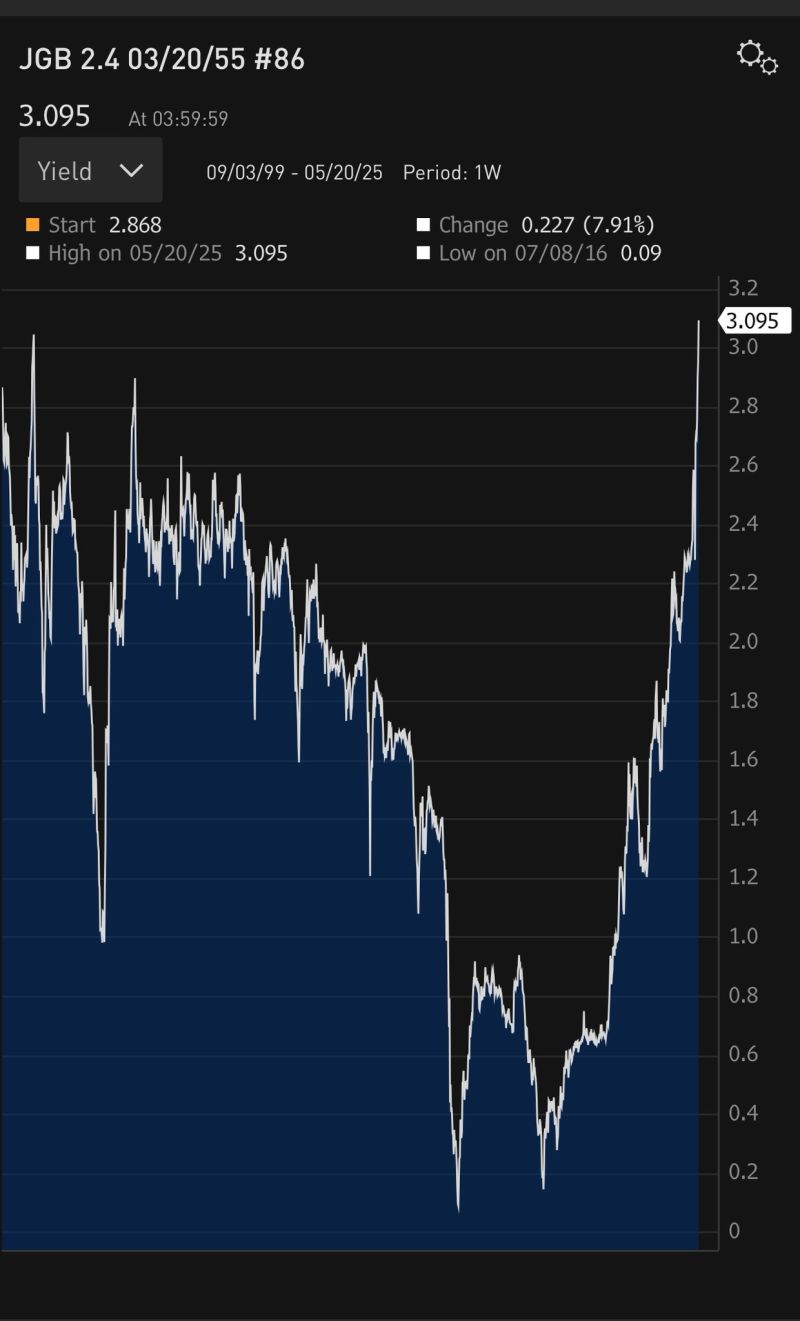

Japan’s 20-Year bond auction gets weakest demand since 2012 – Bloomberg

A slump in Japanese bonds worsened Tuesday after the weakest demand at a government debt auction in more than a decade highlighted worries over the central bank’s retreat from the market. The rout drove up the 20-year yield by about 15 basis points to the highest since 2000, while the yield on 30-year bonds climbed to the most since that maturity was first sold in 1999. Yields on the 40-year tenor rose to a record high in a sign of nervousness ahead of a sale of that debt next week. The surge in yields underscores structural challenges particular to Japan’s debt market, along with the concerns of bond investors globally about the risks posed by rising government spending. Key Japanese buyers like life insurers aren’t stepping in to fill the gap as the central bank scales back its purchases of the nation’s bonds. Meanwhile, the Prime Minister’s comparison of his own nation’s fiscal position to that of Greece this week sharpened the focus on Japan’s huge debt burden. The result is that Japan’s bond curve is the steepest among major economies, even as yields globally are being driven higher, including for US Treasuries.

JUST IN 🚨: Japan's 40-year bond yield just jumped to 3.47%, its highest level in 2 decades

Source: Barchart

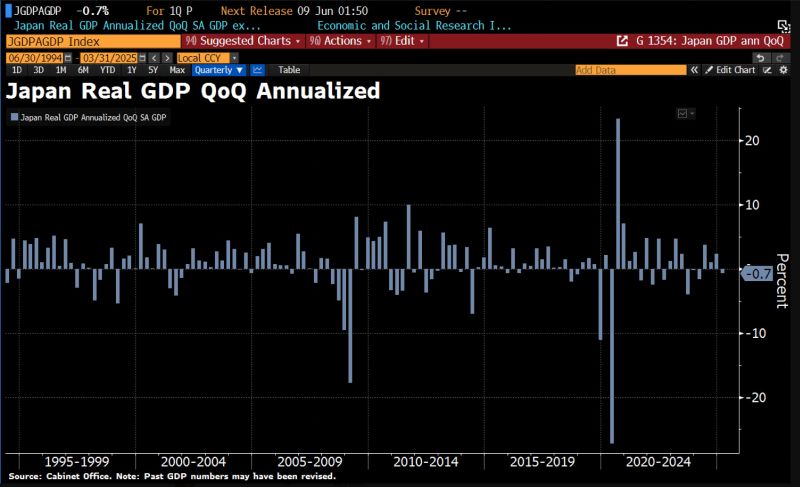

Japan’s economy shrank for 1st time in a year, highlighting how fragile it is—even before feeling full effects of Trump’s tariffs.

Japan’s inflation-adj GDP fell by 0.7% in Q1 annually. That’s worse than economists expected—they had predicted a smaller decline of 0.3%. Source: Bloomberg, HolgerZ

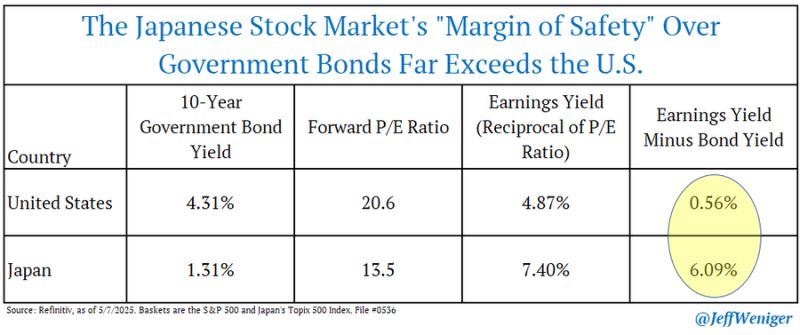

Japan is cheap...

Japan's forward P/E ratio is 13.5, or a 7.4% earnings yield. That is a 609bps premium to the 1.31% yield in 10-year Japanese government bonds. For context, the S&P 500 trades for 20.6 times forward earnings, for an earnings yield of 4.87%. That is just 0.56% over 10-yr T-Notes. Source: Jeff Weniger

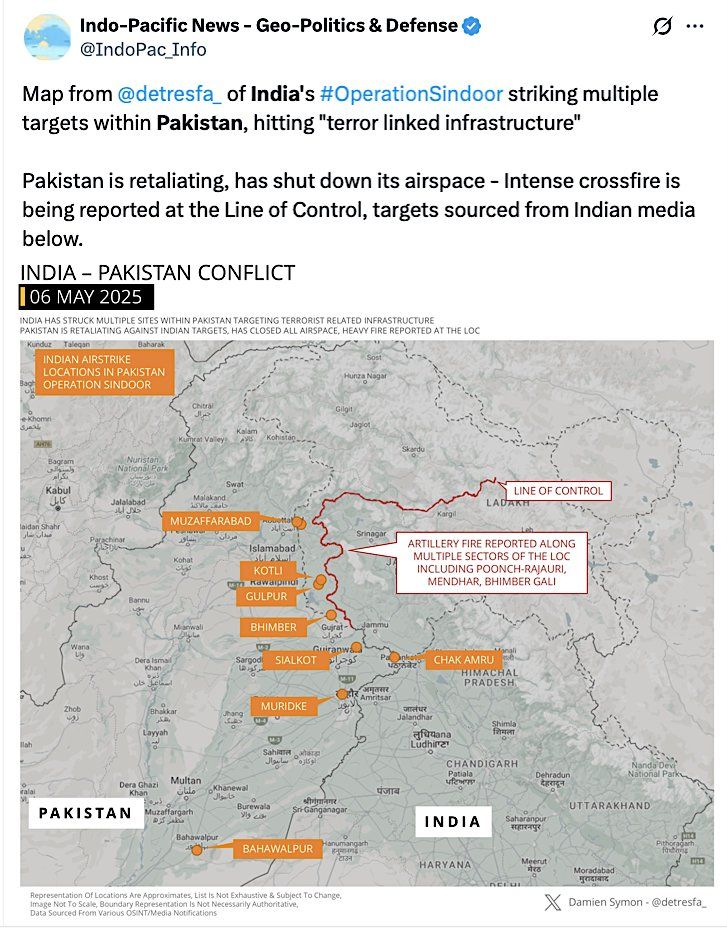

🚨Two nuclear powers are now at WAR, as Pakistan launches retaliatory strikes against India after India’s initial attack

➡️ India says it has targeted 9 Pakistani terror camps in Pak occupied Kashmir using standoff missile strikes as part of Operation Sindoor

Investing with intelligence

Our latest research, commentary and market outlooks