Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Investors expect European countries to purchase more military equipment from Asia after Donald Trump threatened to withdraw the US’s security umbrella.

Link >>> on.ft.com/4iC5Fby Source: FT, Bloomberg

Japan 40Y bond yield hits highest in history.

Eventually markets will remember that Japan has to roll over the world's biggest debt load ever assembled. Source: Bloomberg, www.zerohedge.com

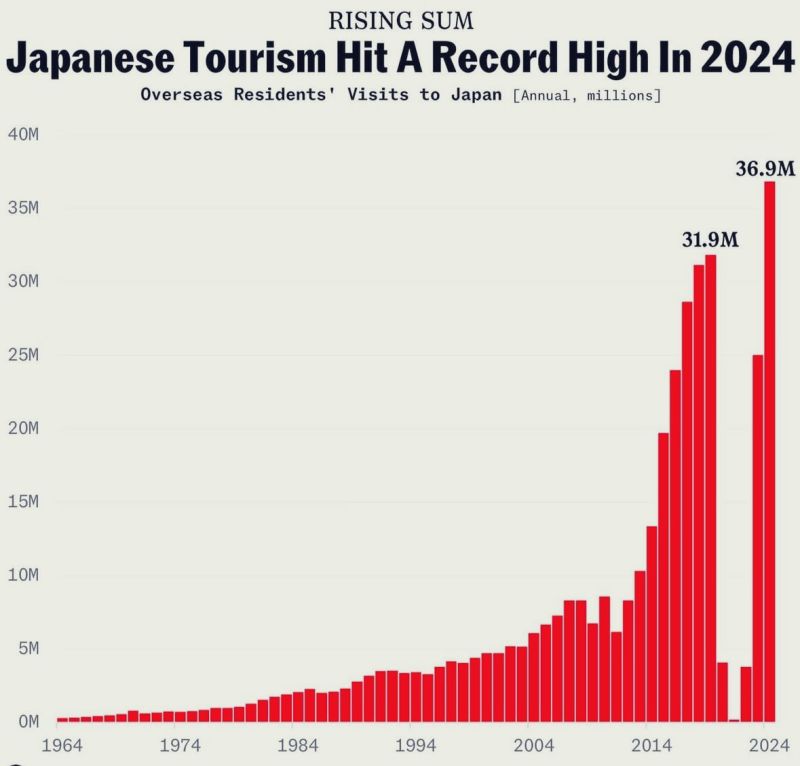

So many tourists flying to Japan

(The weak yen helps). It is an extraordinary country to visit by the way. Source: The long view on X

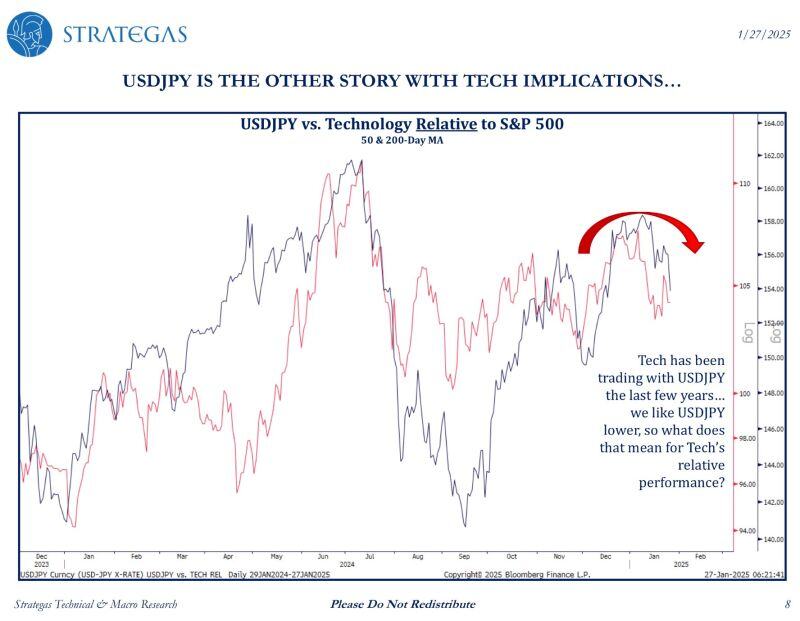

Is it DeepSeek or $USDJPY?

… a reminder that Tech’s relative performance peaked all the way back in July when Yen first strengthened. USDJPY < 155 today is important - perhaps more so than the unknowable impact of China AI Model. @StrategasRP

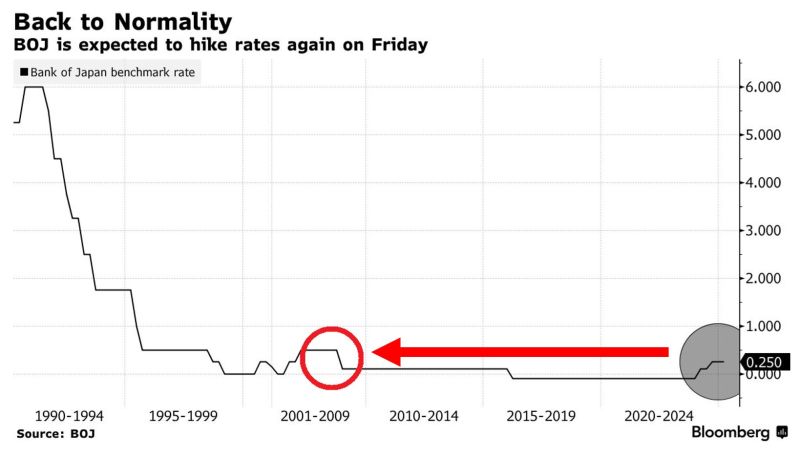

‼️The Bank of Japan is set to HIKE rates again on Friday:

The market is pricing a 90% chance that the BoJ will raise rates by 0.25% to 0.50% on Friday, the highest in 16 years. That would be the 3rd rate hike in less than 12 months, after 17 years without an increase. Source: The Kobeissi Letter, Bloomberg

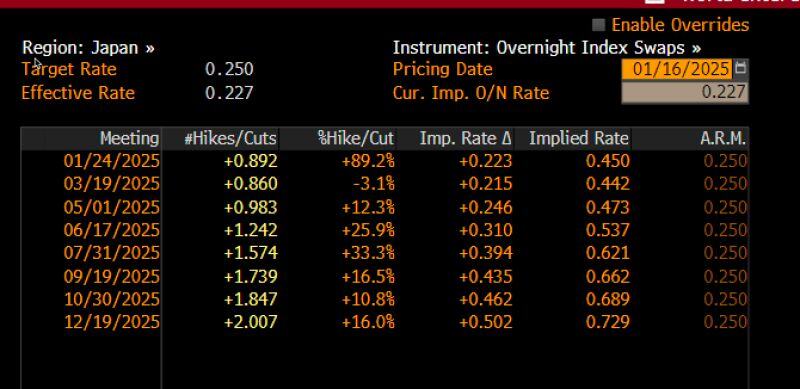

90% chance BOJ hikes next week.

Source: Michael J. Kramer @MichaelMOTTCM on X, Bloomberg

⚠️Bank of Japan is getting closer to deliver another rate hike:

Inflation has picked up while wages have jumped to the highest level in at least 3 DECADES. The market is pricing in about a 60% probability of a hike next week, and an 82% chance by March. Remember when in August 2024 the market flash crashed by suddenly waking up to BOJ's rate hikes? This is key to watch. Source: The Kobeissi Letter, The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks