Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

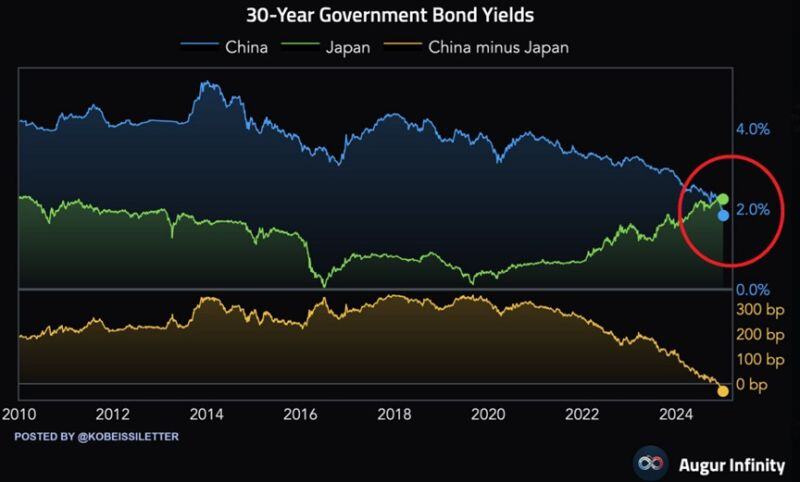

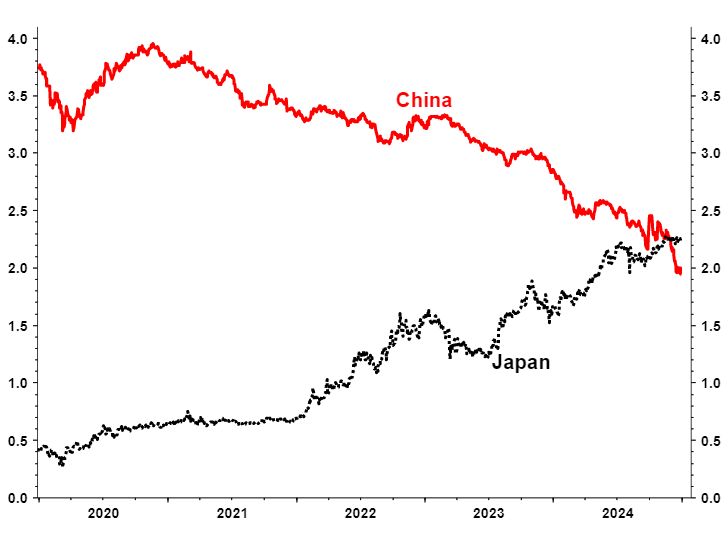

This is truly historic: China’s 30-year government bond yield has dropped below Japan’s 30-year yield for the first time ever.

Over the last 4 years, China’s bond yield has declined by a whopping 215 basis points. This comes as China’s economy has slowed and experienced 6 straight quarters of deflation, the longest streak since 1999. At the same time, Japan’s bond yield has risen 160 basis points as inflation has picked up in the country. In the past, Japan had seen 3 decades of economic stagnation and had suffered 25 years of deflation starting in the 1990s. Is China entering its own "japanification" economic phase? Source: The Kobeissi Letter, Augur Infinity

The Japanification of China: This has to be a contender for the chart of 2024 (30y bond yields).

Source: Albert Edwards

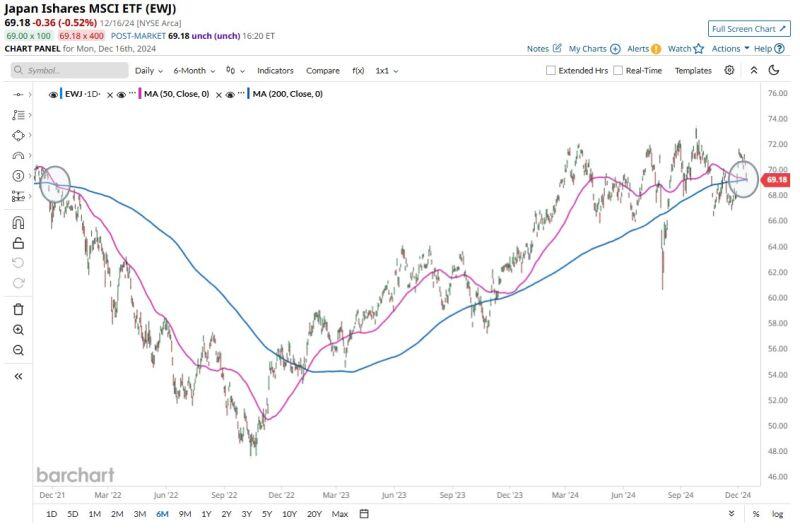

🔈 BANK OF JAPAN JUST MADE THEIR INTEREST RATE DECISION: THEY WILL NOT BE RAISING INTEREST RATES. This is a relief for markets 👍

🚨 If Japan hiked rates, the US Dollar would weaken against the Yen. Anyone who is short the Yen then would have to sell off US equities in order to cover their short, which could've caused a decline in stocks. Most of those stocks would have been tech stocks. It also could have caused a sell off in Bitcoin as many people have borrowed against the Yen to put money into crypto. Basically it would be another edition of the Yen Carry trade which still has trillions of dollars tied into it. 😊 On a day like today, bulls really needed Japan to NOT raise rates. USD/JPY after the decision, up 0.27% Source: @amitisinvesting

BREAKING 🚨: Japan

Japanese Stocks $EWJ formed a Death Cross for the first time since December 2021 ☠️ The last one saw stocks enter a bear market with a plunge of more than 30%. Source: Barchart

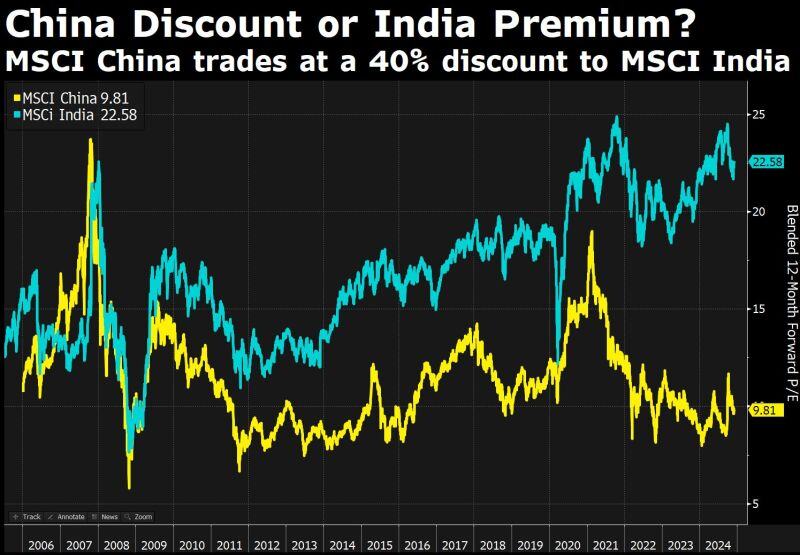

China trades at a 40% discount to India. Is this more a China discount or an Indian premium?

Source: Bloomberg, David Ingles

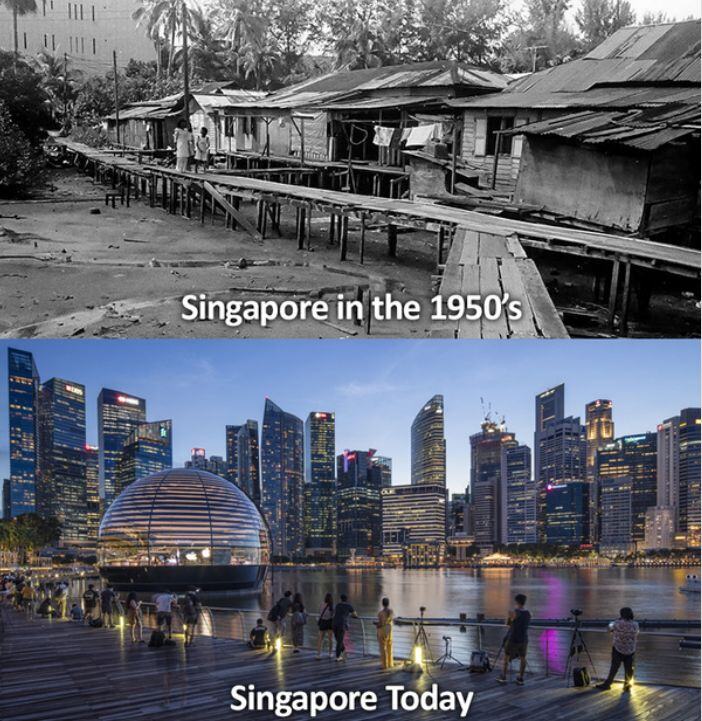

Vision is everything...

In 1965, Singapore was forced a tiny island of 2M people forced out of Malaysia. No army. No resources. No fresh water. Then ONE man's ruthless vision built modern Asia's greatest success... Source: Great post by Oscar Hoole on X

GDP growth does not always correlate with earnings and equities performance

Source: Michel A.Arouet

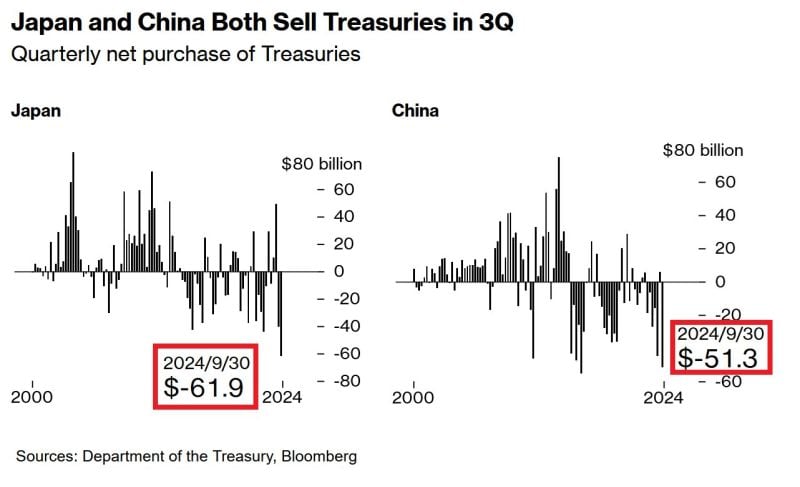

CHINA AND JAPAN ARE DUMPING US TREASURIES

Japanese investors sold $61.9 billion of Treasuries in Q3 2024, the most on RECORD. Chinese funds dumped $51.3 billion, the second largest on record. Japan and China are two world's biggest foreign holders of US government debt. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks