Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

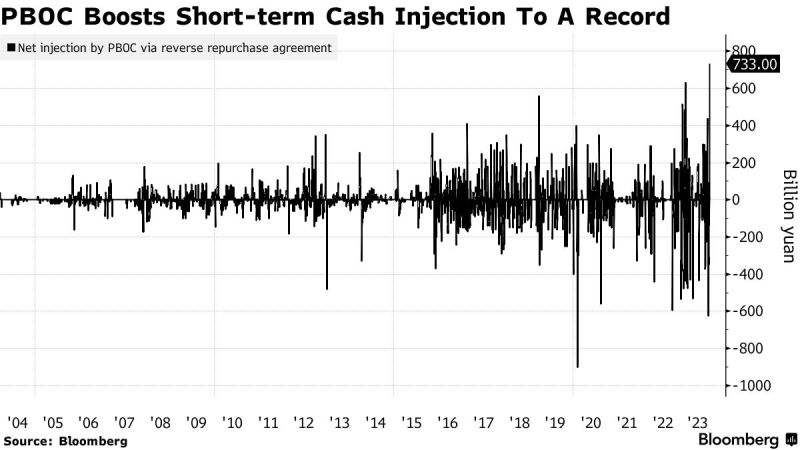

China Injects Most Short-Term Cash Into Banking System on Record - Bloomberg

China pumped the most liquidity into its financial system via short-term monetary tool on record, suggesting policymakers are keen to keep funding costs low to bolster the economy. The People’s Bank of China granted lenders a net 733 billion yuan ($100 billion) of cash with the so-called reverse repurchase contracts on Friday. That came after data released this week flashed signs of a pickup in the economy last month, when consumer spending and industrial production came in stronger-than-expected. Lenders keep one- and five-year loan prime rate unchanged. Source: Bloomberg

China has cut its holdings in US Treasuries to $805bn, the lowest level since 2009

Beijing has been selling $502bn in Treasuries in the past decade, & pace of Chinese selling has been accelerated recently. Source: Bloomberg, HolgerZ

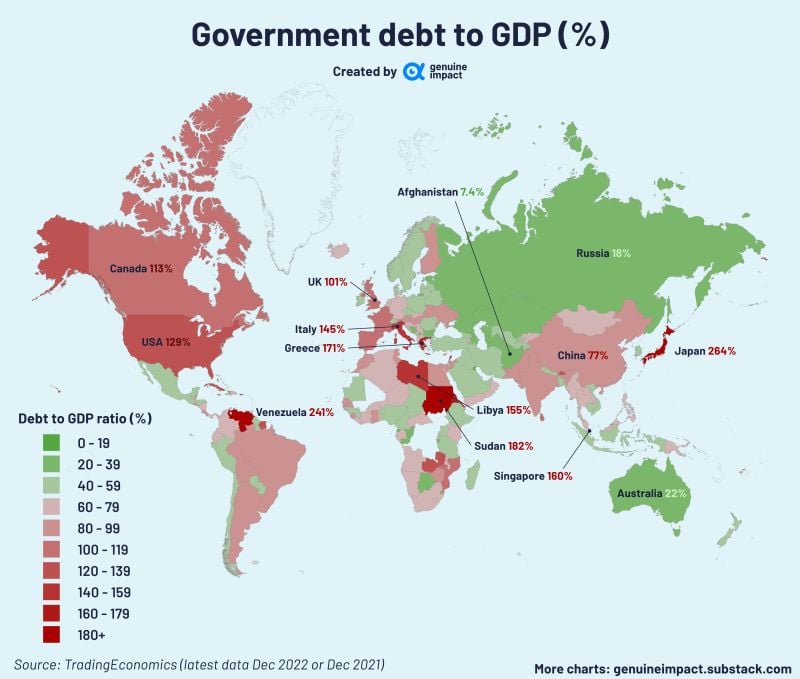

🌍Worldwide, many other countries have debt that is more than their GDP

Japan consistently ranks among the top nations with a debt-to-GDP ratio exceeding 200%. Source: Genuine Impact

China shows signs of stabilization after a long period of slowdown and disappoitning data over the spring

China’s Q3 growth exceeds forecast, buoyed by consumer spending and industrial production. China posted 4.9% growth in the July to September quarter from a year earlier, stronger than the median forecast for 4.6%. Quarter on quarter, China’s GDP grew 1.3% in the third quarter, helped by a downward revision for Q2 from +0.8% to 0.5%.

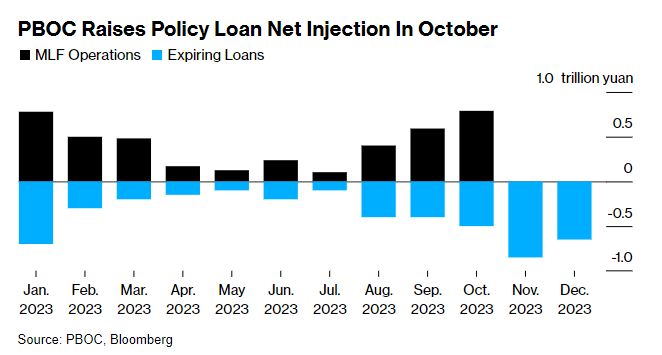

China | PBOC adds net 289 billion yuan via medium-term facility as Debt Sales Surge

The move adds to recent efforts to ensure hitting GDP target - Offers Most Cash Support Since 2020 - Bloomberg China’s central bank is making the biggest medium-term liquidity injection since 2020, stepping up efforts to support the nation’s economic recovery and debt sales. The People’s Bank of China added a net 289 billion yuan ($39.6 billion) into the financial system via a one-year policy loan on Monday, the most since Dec. 2020. At the same time, it drained a net 134 billion yuan of short-term liquidity through open-market operations.

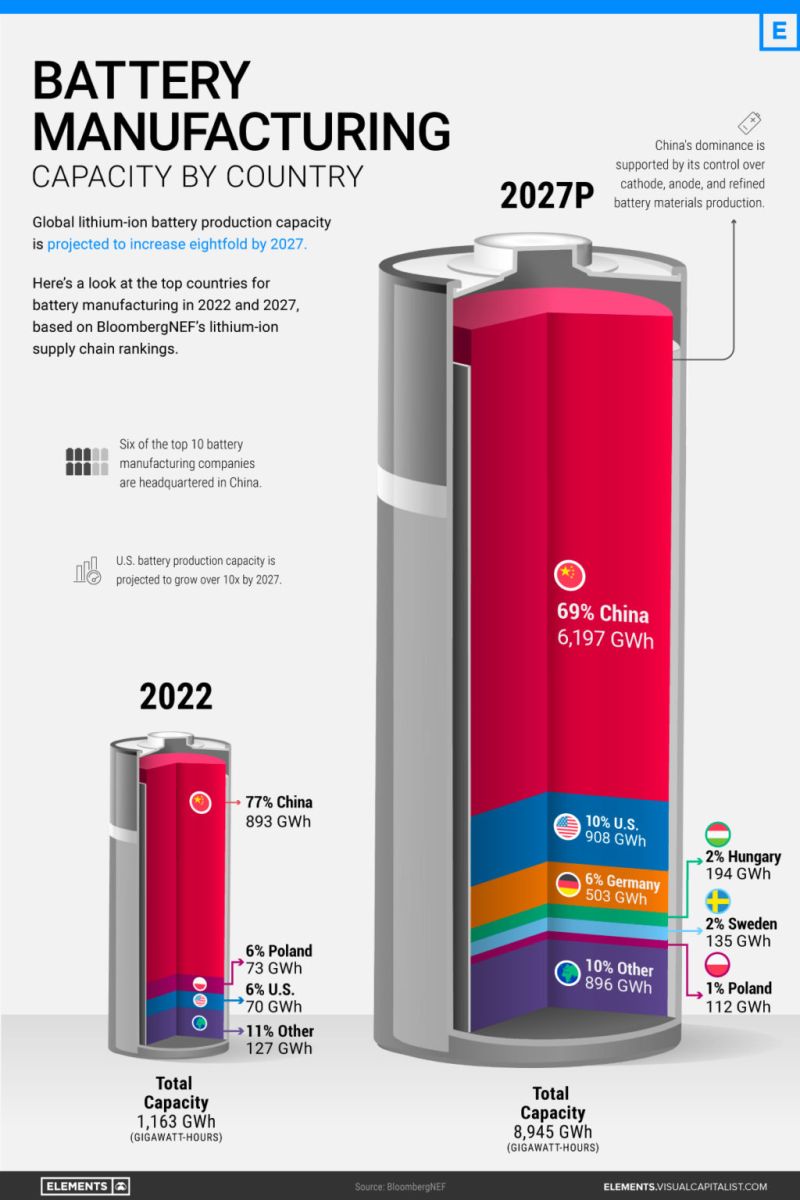

Visualizing China’s Dominance in Battery Manufacturing (2022-2027P)

by Elements / Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks