Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

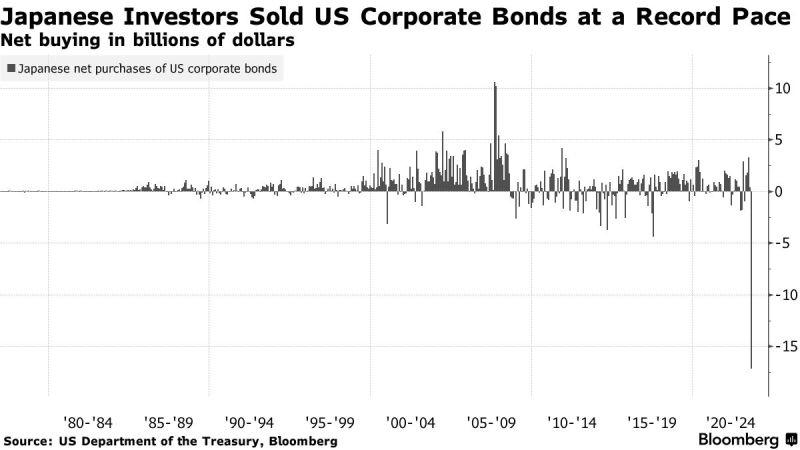

Japanese investors are selling US corporate debt at a record pace 👀

Source: Bloomberg

Did you know that the biggest e-Commerce app in Asia AND EUROPE trades at 10X earnings?!

$BABA Source: A.J. Button

Chart of global fish catch per country -> China will account for 37% of the global catch by 2030

Chinese boats have expanded their capacity to harvest staggering amounts of catch in a single voyage. China subsidizes the fuel cost for fishing boats. That's what makes it economical for them to roam the oceans. The Chinese Pacific fishing fleet has grown more than 500 per cent to 564,000 vessels. Source: Indo-Pacific News - Geo-Politics & Defense News

Retail Investors own 9.4% of the NSE-listed companies

Source: investywise

China reported a worse-than-expected drop in exports in October, while imports surprisingly rose for the month from a year ago

China’s customs agency said exports in U.S. dollar terms fell by 6.4% in October from a year ago. That’s worse than the 3.3% drop predicted by a Reuters poll. Overall, China’s exports have fallen on a year-on-year basis every month this year starting in May. The last positive print for imports on a year-on-year basis was in September last year. China’s exports to Southeast Asia and the European Union fell by double digits in October, according to CNBC calculations of official data. Exports to the U.S. dropped by more than 8%, the analysis showed. Imports rose by 3% in U.S. dollar terms in October from a year ago. That’s in contrast to the Reuters’ forecast for a 4.8% drop from a year ago. However, China’s imports from the U.S. were down by 3.7% in October versus the year ago period, CNBC calculations of customs data showed. China’s imports from the European Union rose by more than 5%, while those from the Association of Southeast Asian Nations grew by 10.2%, the analysis showed. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks