Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

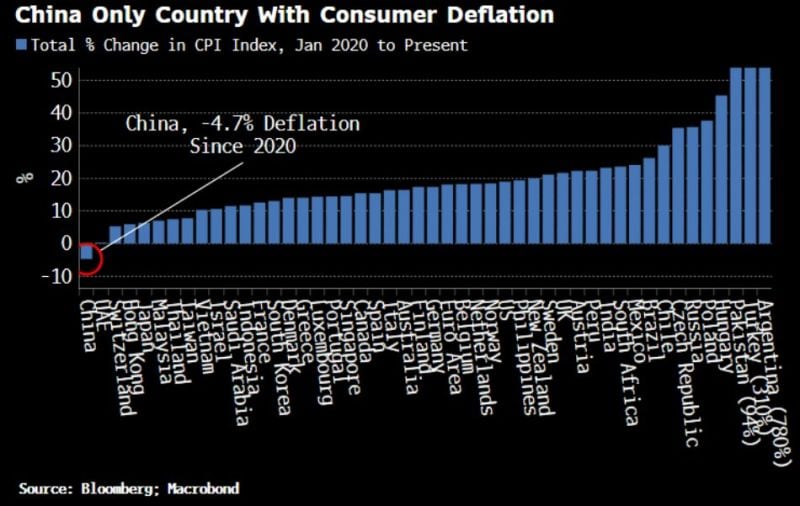

China is the only country experiencing deflation

CPI is down 4.7% since 2020 while every other country has experience inflation – some experiencing the highest in decades. Source: Genevieve Roch-Decter, CFA, Bloomberg, Macrobond

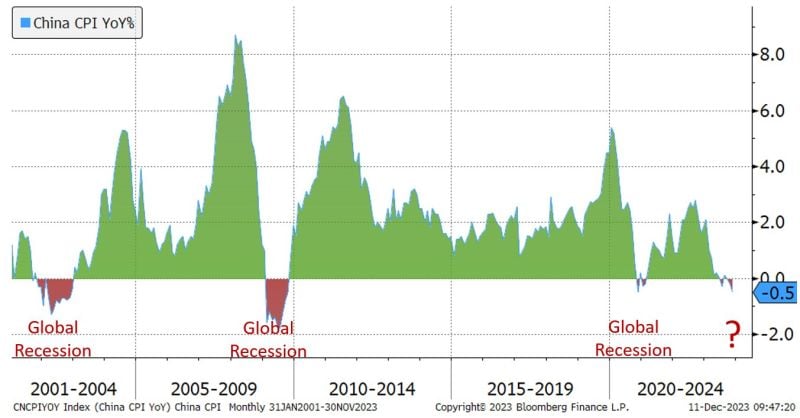

Each time inflation in China turned negative the global economy was in a recession: 2001, 2008-09, 2020... Is this time different?

Source: Jeffrey Kleintop, Bloomberg

Looming Threat to Japanese Bonds: A Setback for the Global Fixed-Income Rally?

Amidst the impressive year-end rally in the global fixed-income market, a significant development last night casts a shadow over this upward momentum. The yield on the Japanese 10-year bond surged by 12 basis points, driven by comments from BOJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino, instigating a belief that change might unfold sooner than anticipated. The probability of the BOJ ending its negative rates policy this month skyrocketed to nearly 45%, as Himino's speech was perceived as relatively hawkish, amplifying the significance of the BOJ's December meeting to a live event. Adding to the market tension, the Japan 30-Year Bond Sale recorded its lowest bid-cover since 2015. Notably, the sharp steepening of the Japanese curve, from 20 bps in March to 80 bps at the end of October, coincided with a significant increase in US Treasury yields over the same period... Source: Bloomberg

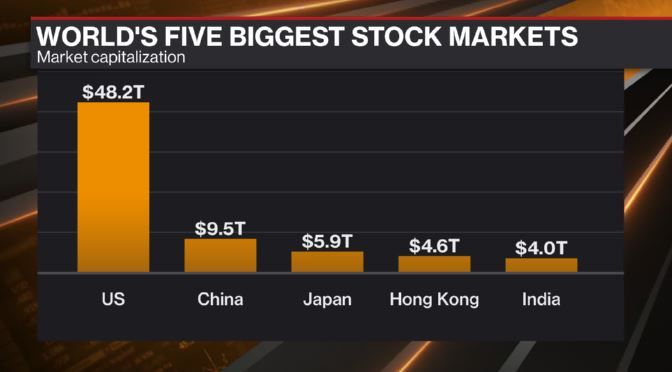

INDIA IN THE TOP 5!

India's stock market hit a milestone this week. It's now a $4 trillion market. Here's how that looks alongside the world's biggest. Source: David Ingles, Bloomberg

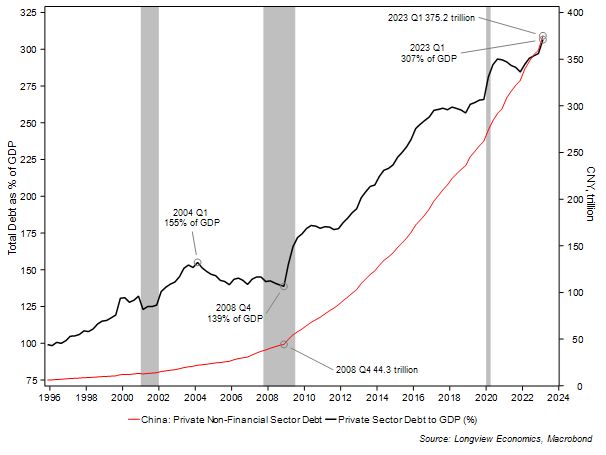

Chinese total private sector debt (level and relative to GDP). This helps explain why Moody's downgraded China's credit rating today...

Source: Longview Economics

BREAKING 🚨: Chinese Stocks have fallen to their lowest prices in 5 years

Source: barchart

Gold hit record high 2'135.39/oz in early trading hours

Gold surged to a new all-time high as growing expectations for US rate cuts early next year. This latest leg of gold's rally has been turbocharged by comments on Friday from Fed Chair Jerome Powell. Precious metal's strength has been underpinned buy other factors as purchases by governments and central banks as well as geopolitical uncertainty.

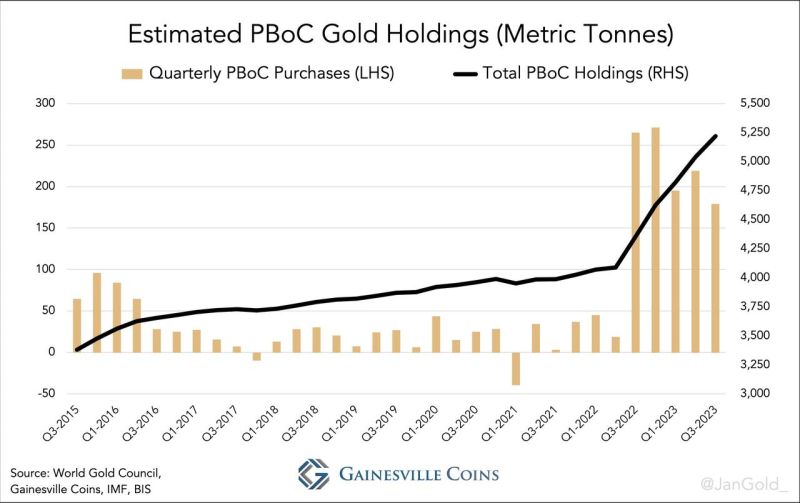

Is massive buying by China the main reason for the current gold rally?

Gold trading above $2,000 despite real fund rates above 2% and the strong dollar is one of the main surprises of 2023. One theory is that China's "Massive Accumulation Of Gold" is behind Gold resilience this year. Indeed, according to unofficial tallies - such as that kept by Gainesville Coins analyst Jan Nieuwenhuijs - total gold purchases by the Chinese central bank (reported and unreported) are significantly bigger than what has been officially disclosed, and in Q3 alone, China purchased 179 tonnes of physical; year-to-date the PBoC bought 593 tonnes, which is 80% more than what it bought in the first three quarters last year. As such, China's total estimated gold holdings are 5,220 tonnes, more than twice what’s officially disclosed at 2,192 tonnes... Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks