Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

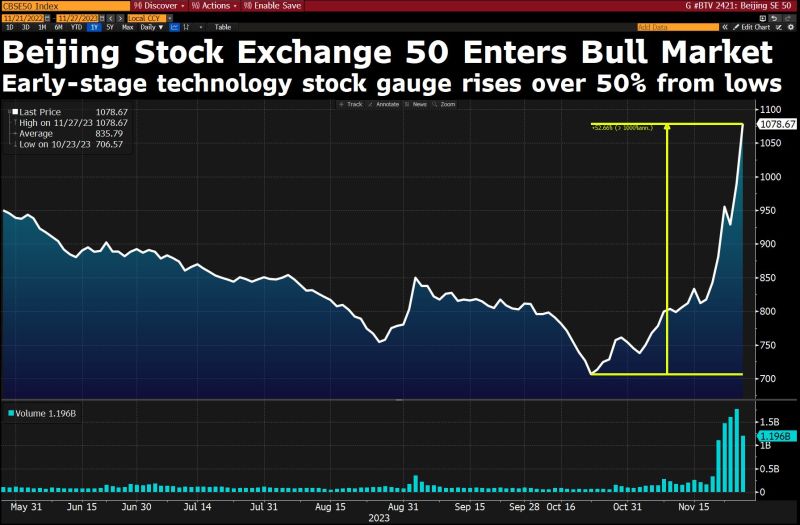

Up again today. Index is up 8%. This group of Chinese stocks is up over 50% in just a few weeks

Source: David Ingles, Bloomberg

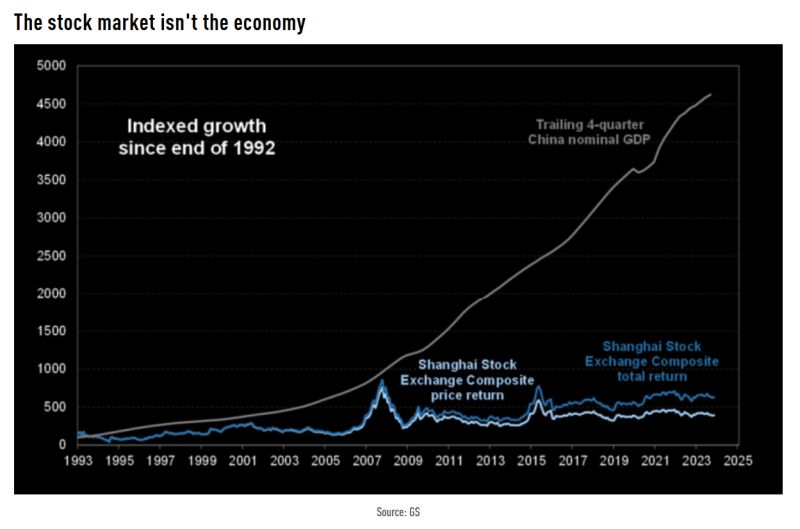

The stock market isn't the economy...The Chinese version...

Source: GS, TME

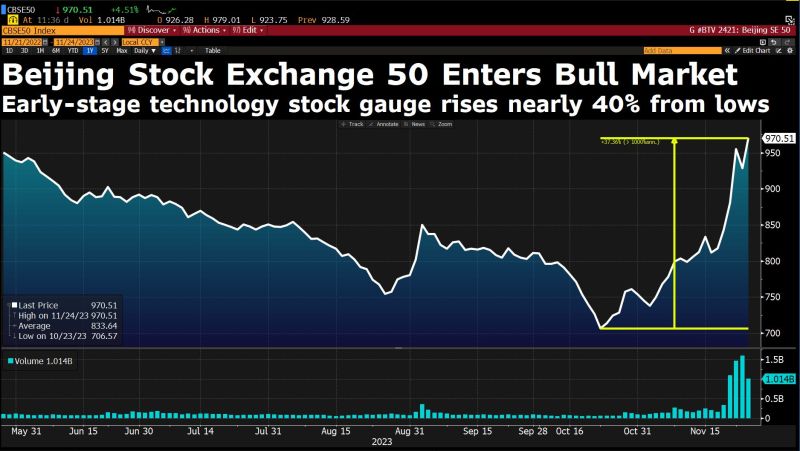

A gauge of early-stage small, mid-cap growth stocks in China has rallied 40% within just a few weeks

Source: David Ingles, Bloomberg

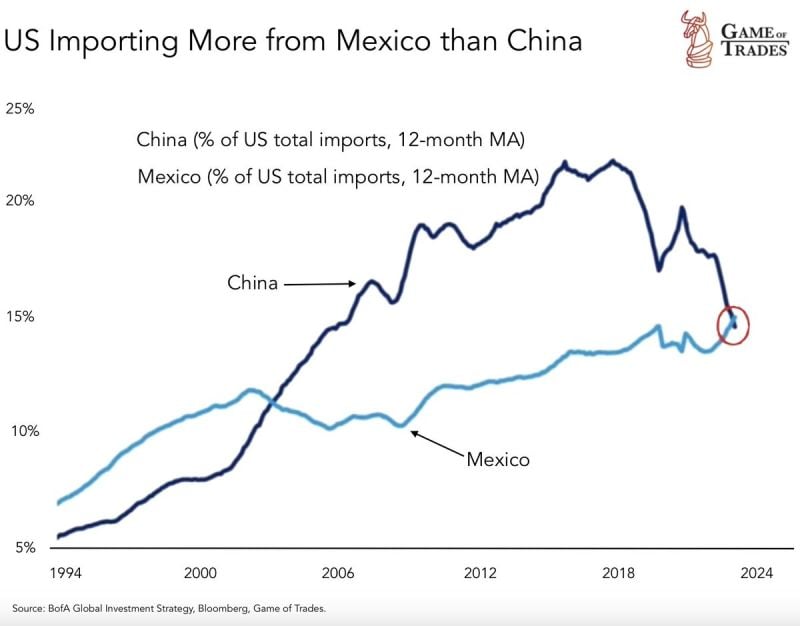

ALERT: US imports from Mexico have just surpassed those from China This has happened for the first time since in 2 decades

Source: Games of Trades

Nvidia indicated that the latest round of China restrictions will not have a meaningful impact on its business

It’s possible that this is because China frontloaded its GPU orders earlier this year in anticipation of these restrictions. It’s also possible that any lost revenue from China will be made up for by tremendous revenue growth in developed markets. Guidance for the January quarter might be indicative here. Source: Morningstar

[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability

After months of keeping money too tight to stabilize the FX, at the first sign of FX strength they eased... Source chart: The Daily Shot

President Joe Biden and China’s President Xi Jinping have their first in-person meeting in about a year

This is the first time since 2017 that Xi has stepped foot on American soil. Although the US-China relationship is breaking, experts and U.S. officials caution not to expect markedly improved relations post-meeting. Mrs Yellen might be rather in favor of some kind of cooperation... Source image: Michel A.Arouet

China on Wednesday reported better-than-expected retail sales and industrial data for October, while the real estate drag worsened

- Retail sales grew by 7.6% last month from a year ago, above the 7% growth forecast by a Reuters poll. Retail sales, sports and other leisure entertainment products saw sales surge by 25.7% in October from a year ago, the data showed. Catering, as well as alcohol and tobacco, saw sales surge by double digits. Auto-related sales rose by 11.4% from a year ago. - Industrial production rose by 4.6% year-on-year in October, faster than the 4.4% pace predicted by the Reuters poll. - Fixed asset investment for the first 10 months of the year grew by 2.9% from a year ago, missing expectations for a 3.1% increase. - Investment into real estate fell by 9.3% during that time, a steeper decline than the 9.1% drop reported for the first nine months of the year. - The urban unemployment rate was 5%, the National Bureau of Statistics said. That was unchanged from September. The bureau has suspended reports of the unemployment rate for young people since summer. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks

![[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability](https://blog.syzgroup.com/hubfs/1700087239074.jpg)