Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

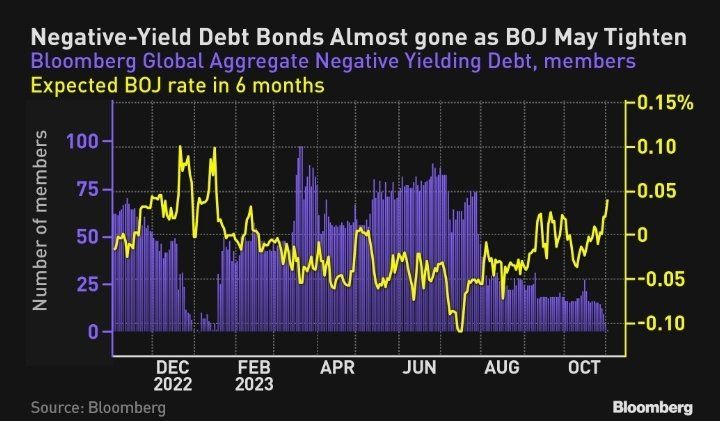

The negative bonds world is gone, with also a Japanese bond maturing in 24 trading at 0% yesterday

Source: From Macro to Micro

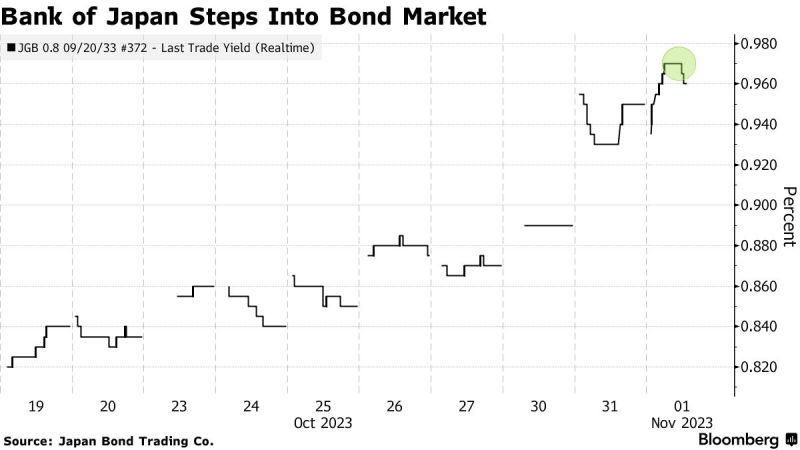

*BREAKING* BOJ Buys More Bonds to Slow Rising Yields a Day After Tweak Central bank acts after 10-year yield touches decade high - BLOOMBERG

The Bank of Japan stepped into the bond market unexpectedly Wednesday to curb the pace of gains in sovereign yields, just a day after announcing it was loosening its grip on debt prices. The central bank’s unscheduled purchase operation statement came as the benchmark 10-year bond yield touched 0.97% — a fresh decade-high but still below the 1% cap it removed in favor of a more flexible policy setting. There was very little immediate market reaction to the move, with traders trimming one basis point off the 10-year yield before it recovered half of that. Bond futures pared losses and the yen, which is sensitive to shifts in interest rates, shed a fraction of its advance versus the dollar.

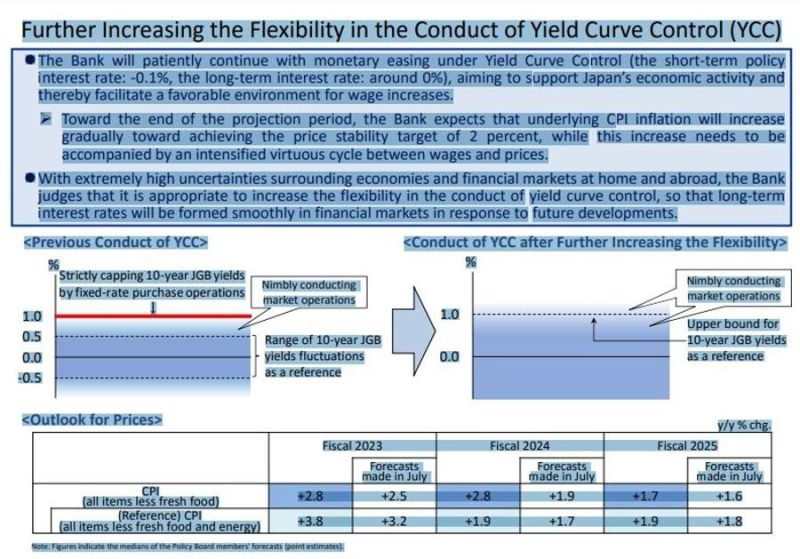

BREAKING: The yen falls near 150 after the Bank of Japan makes only modest tweaks to its yield control program, defying market expectations

Japan’s centralbank decided to make its yield curve control (YCC) policy more flexible, shifting the language used to describe the upper bound of the 10-year Japanese government bond yield. The BoJ said it will patiently continue monetary easing under YCC to support economic activities. BOJ makes the decisions on YCC by an 8-1 vote. The decision is sending the $USDJPY back to above 150.

Meta’s ad rebound gets huge assist from China even though its services are banned there

Meta may be banned from operating in China, but the company is counting on advertisers there to boost its growth. Finance chief Susan Li told analysts on Wednesday’s earnings call that Chinese companies played a major role this quarter. Online commerce and gaming “benefited from spend among advertisers in China reaching customers in other markets,” Li said. Source: CNBC

Here's a chart of gold in yen

Japan has been ahead of the curve when it comes to FIAT currency debasement and the way its currency is trading against gold is rather frightening with another huge ~10% new ATH move this month. Will other FIAT currencies follow the yen path? Source: Graddhy - Commodities TA+Cycles

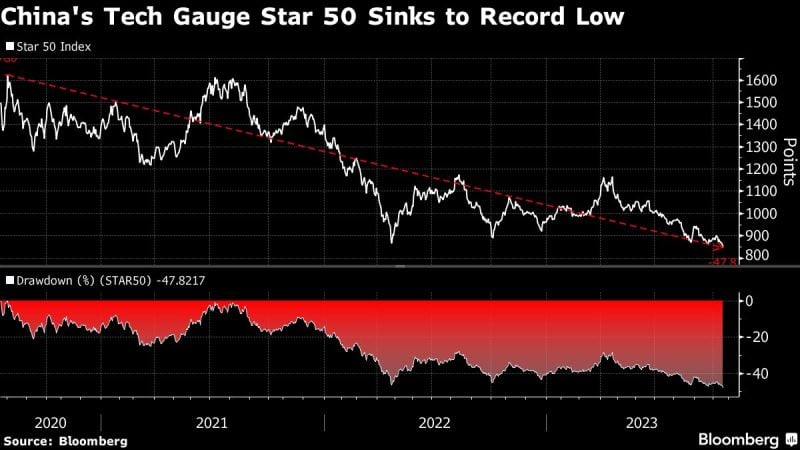

China’s Nasdaq-Style Index falls to record low:

Star 50 index, which tracks manufacturers, chipmakers & biggest comps on Star Board, falls to lowest since its inception >3yrs ago as investors’ confidence wanes. Set for 6 straight mths of decline. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks