Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is China to blame for the rise in US long rates?

China has cut its holdings in US Treasuries to $822bn, lowest level since 2009. Beijing has been selling $300bn in Treasuries since 2021, & pace of Chinese selling has been faster in recent months, Apollos's Slok has calculated. Source: HolgerZ, Bloomberg

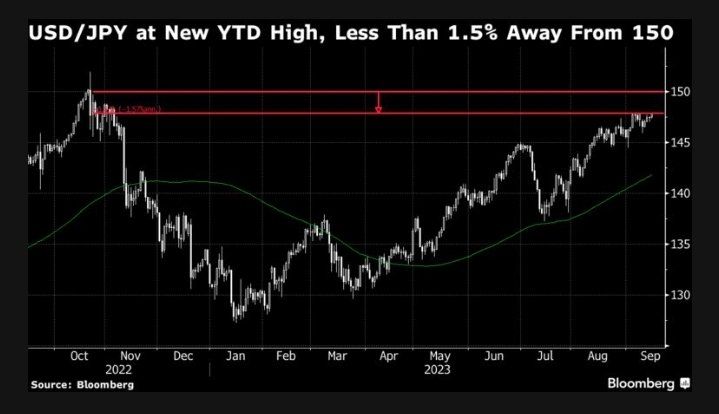

Japanese Yen falling to lowest levels against the U.S. Dollar since the BOJ intervened last year

150 level approaching fast 👀 Meanwhile, The Bank of Japan announced an extra bond-buying plan for this week as a global debt selloff forces policymakers into the market to curb sharp increases in yields. The BOJ will purchase extra amounts of 5-to-10-year debt on Wednesday as it strives to slow rising yields that are at the highest level in a decade. The benchmark 10-year maturity climbed to 0.775% Monday, a level last seen in 2013. Japan’s 20- and 30-year yields are at similar peaks while Treasury yields also keep moving higher. Japanese sovereign yields have risen as speculation grows the central bank will end its negative interest rate sooner rather than later, while the US Federal Reserve will also keep borrowing costs high. The BOJ has already conducted three unscheduled buying operations since late July to manage yields after adjusting policy to let them rise more. Source: Barchart, Bloomberg

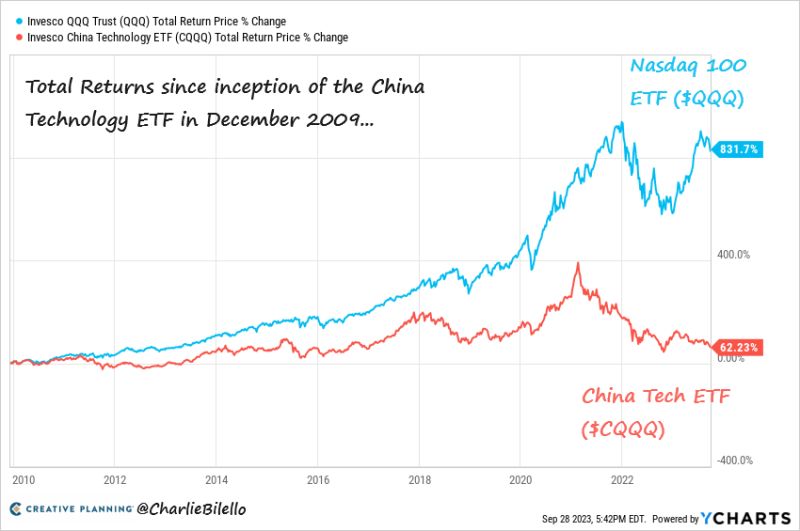

This is not the chart of an AI or crypo

It is the chart of India BSE small & medium IPO index Source: Amit Jeswani

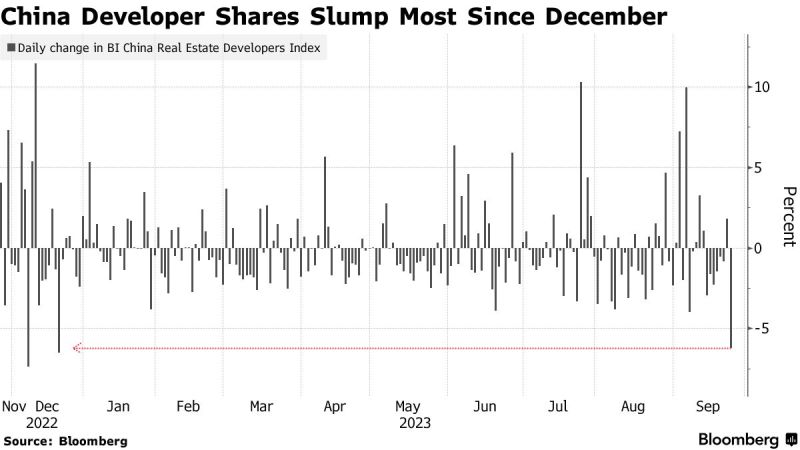

Chinese property stocks tumbled the most in nine months as concern over a possible China Evergrande Group liquidation added to fresh signs of stress across the industry

A Bloomberg Intelligence gauge of developer shares fell as much as 6.4% Monday, taking its loss in valuation this year to $55 billion. Evergrande, which scrapped key creditor meetings at the last minute and said it must revisit its restructuring plan, dived 25%. China Aoyuan Group Ltd. was the biggest drag on the gauge, slumping by a record 76% after shares resumed trading. Sentiment has worsened dramatically in recent days as investors brace for years of pain from the ailing sector, with policy support failing to resolve liquidity woes. While developers are pinning their hopes on the upcoming Golden Week holiday period to revive home sales, a rapid cooling of a late-August rally in property shares shows any relief may be short lived. Source: Bloomberg

Apple aims to scale up production over 5 times in India to USD 40 bn in 5 years

This is another very bullish news for #india economy! This will not only lead to lower imports/ higher exports ( leading to higher GDP) but also create more jobs (directly and indirectly). Extract from www.indiaexpress.com article iPhone maker Apple has plans to scale up production in India by over five-fold to around USD 40 billion (about 3.32 lakh crore) in the next 4-5 years, according to government sources. According to the official, who did not wish to be named, the company has crossed the USD 7 billion production mark in the last financial year.

BOJ Update

Japan | BOJ left its monetary settings unchanged and offered no clear sign of a shift in its policy stance, putting a damper on market speculation over the prospects for a near-term interest rate hike and adding pressure on the yen. The Bank of Japan kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg. It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it. Japan’s currency weakened as much as 0.4% after the decision to around the 148.20 mark against the dollar. This helped stocks, which trimmed about half of their losses for the day. The benchmark 10-year bond yield was down half a basis point from Thursday’s closing level at 0.74%. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks