Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Saudi Arabia has removed all restrictions for foreigners to buy local stocks.

The decision allows non-residents to invest directly in the main market effective Feb. 1.

A $100B "Santa Rally" might have arrived via the UAE sovereign wealth funds

Here is the breakdown of what is going on: 1. The $100 Billion Life Raft 💰 OpenAI is reportedly looking to raise a staggering $100B (Source: WSJ). With a target valuation of $830B, this isn't just a fundraising round—it’s a geopolitical event. Sam Altman isn't just looking for "growth capital"; he’s securing a bridge to 2030 profitability. 2. From Debt to Equity 📉 Private credit markets (like Blue Owl) have been tightening the taps on AI infrastructure. OpenAI is pivoting from cheaper debt to massive equity dilution. Why? Because when you’re "incinerating" cash to build the future, you need a sovereign-sized safety net. 3. The Oracle "Survival" Surge 🚀 This isn't just about OpenAI. This cash flows directly into compute. Oracle and CoreWeave are the primary beneficiaries. This funding ensures OpenAI can pay its hyperscaler partners for years to come. The market is breathing a sigh of relief: Bankruptcy risks for AI infrastructure plays are evaporating. 4. The Credit Default Swap (CDS) Collapse 📉 Before tonight, Oracle’s CDS was at a 16-year high (~156bps). Investors were pricing in serious risk. Now? We expect a short-covering frenzy. The "AI winter" just got hit by a heatwave of Emirati capital. The Bottom Line: The world was waiting for the US to backstop the AI revolution. Instead, Abu Dhabi stepped up. This $100B injection doesn't just fund a chatbot; it stabilizes the entire AI ecosystem for the next 24 months. Is this the start of the 2025 bull run, or just a very expensive bridge to the unknown?

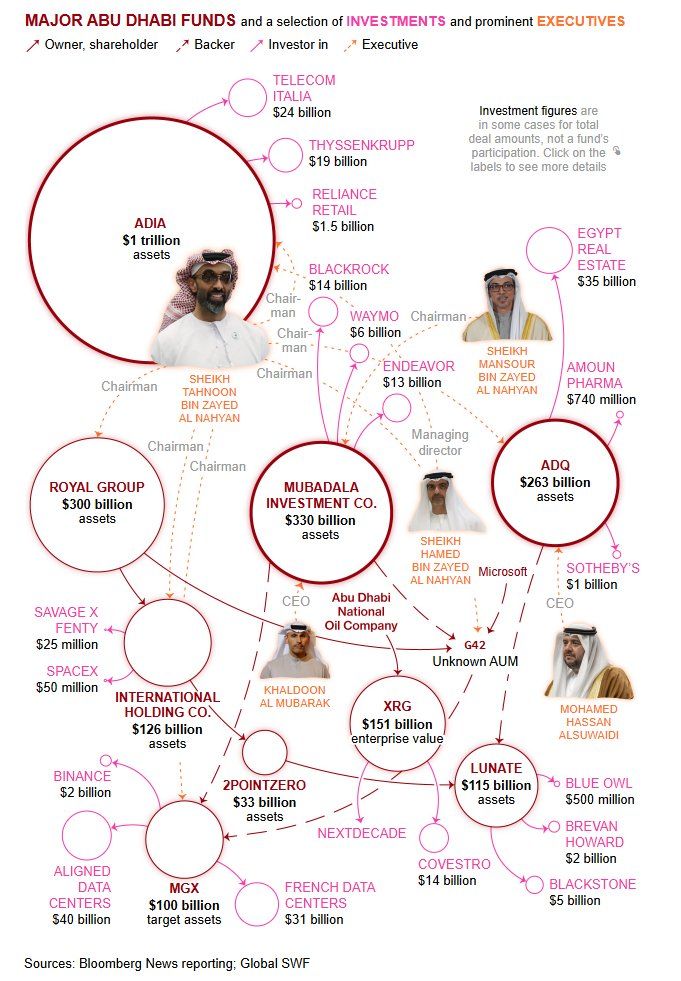

"It’s uncommon for a city to have even one sovereign wealth fund; the UAE’s capital has three"

This bloomberg article is a nice overview of how and where Abu Dhabi invests its wealth. Source: Ziad Daoud @ZiadMDaoud

Major Move from Saudi Arabia’s PIF — Right Before a White House Visit

Saudi Arabia’s Public Investment Fund (PIF) just made a big statement. In Q3, the near-$1 trillion sovereign wealth fund fully exited nine US-listed companies — including names like Visa and Pinterest — cutting its exposure to US equities by 18%. Yet PIF still holds $19.4B across six US-listed giants, including Uber and Take-Two Interactive. For context? Its US equity holdings once peaked at $56B in late 2021. And then there’s the gaming play. 🎮 PIF has kept its stake in Electronic Arts — but that will soon shift off the US-listed books once the $55B take-private mega-deal closes. It’s the largest leveraged buyout in history. PIF is leading the consortium alongside Silver Lake Capital and Jared Kushner, with PIF writing the biggest equity check — positioning it as EA’s majority owner. This is just the latest move in a fast-growing gaming investment spree driven by Crown Prince Mohammed bin Salman’s personal interest in the sector. All of this lands right before the crown prince’s highly anticipated visit to the White House on Tuesday, where he is expected to meet President Trump and sign a series of major defence and trade agreements. 💬 Big question: Is this a strategic portfolio rebalance? A geopolitical signal? Or the beginning of a new investment era focused on entertainment, gaming, and national digital transformation? What’s your read on this move? Source: FT https://lnkd.in/e69yETNc

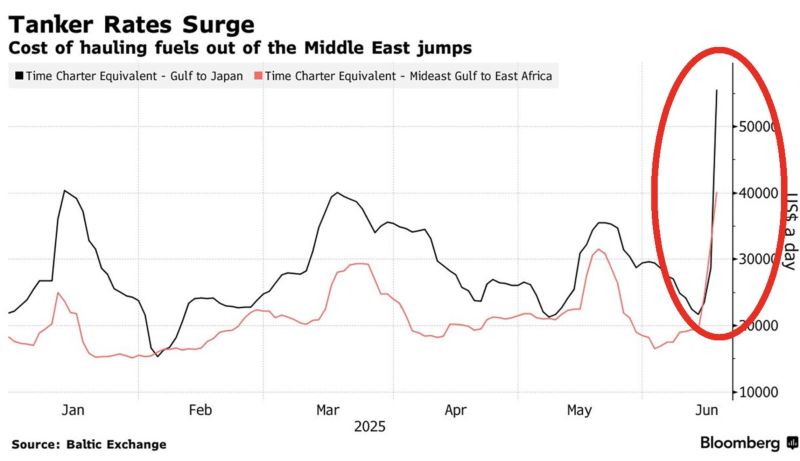

⚠️Middle East oil shipping costs are SPIKING:

Persian Gulf-Japan tanker rates hit $55k/day, the highest in over a year, while East Africa routes hit $40k, a multi-month peak. Costs doubled in 2 weeks amid the Israel-Iran conflict.

🟥 Crude Oil is now back above its 100 day moving average for the first time in more than 2 months.

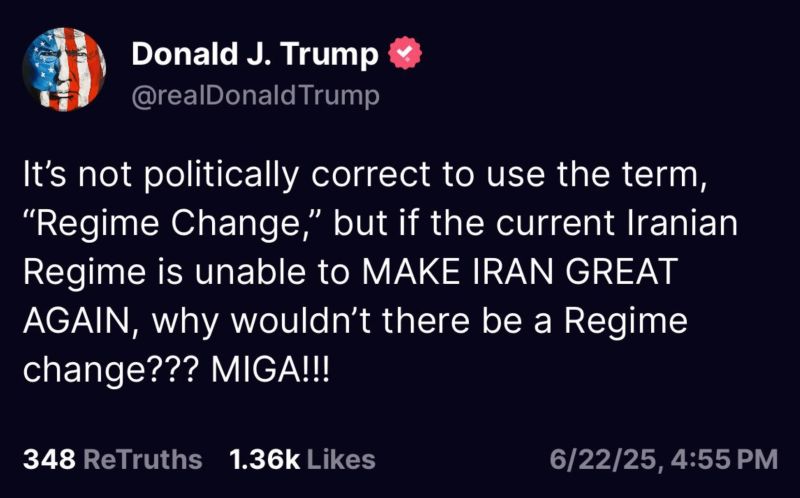

‼️ Oil prices edged higher on Thursday to their highest in more than two months, after U.S. President Donald Trump said U.S. personnel were being moved out of the Middle East, which raised fear that escalating tensions with Iran could disrupt supply. ➡️ Trump on Wednesday said U.S. personnel were being moved out of the Middle East because “it could be a dangerous place,” adding that the United States would not allow Iran to have a nuclear weapon. ⚠️ Reuters reported earlier on Wednesday that the U.S. is preparing a partial evacuation of its Iraqi embassy and will allow military dependents to leave locations around the Middle East due to heightened security risks in the region, according to U.S. and Iraqi sources.

Investing with intelligence

Our latest research, commentary and market outlooks